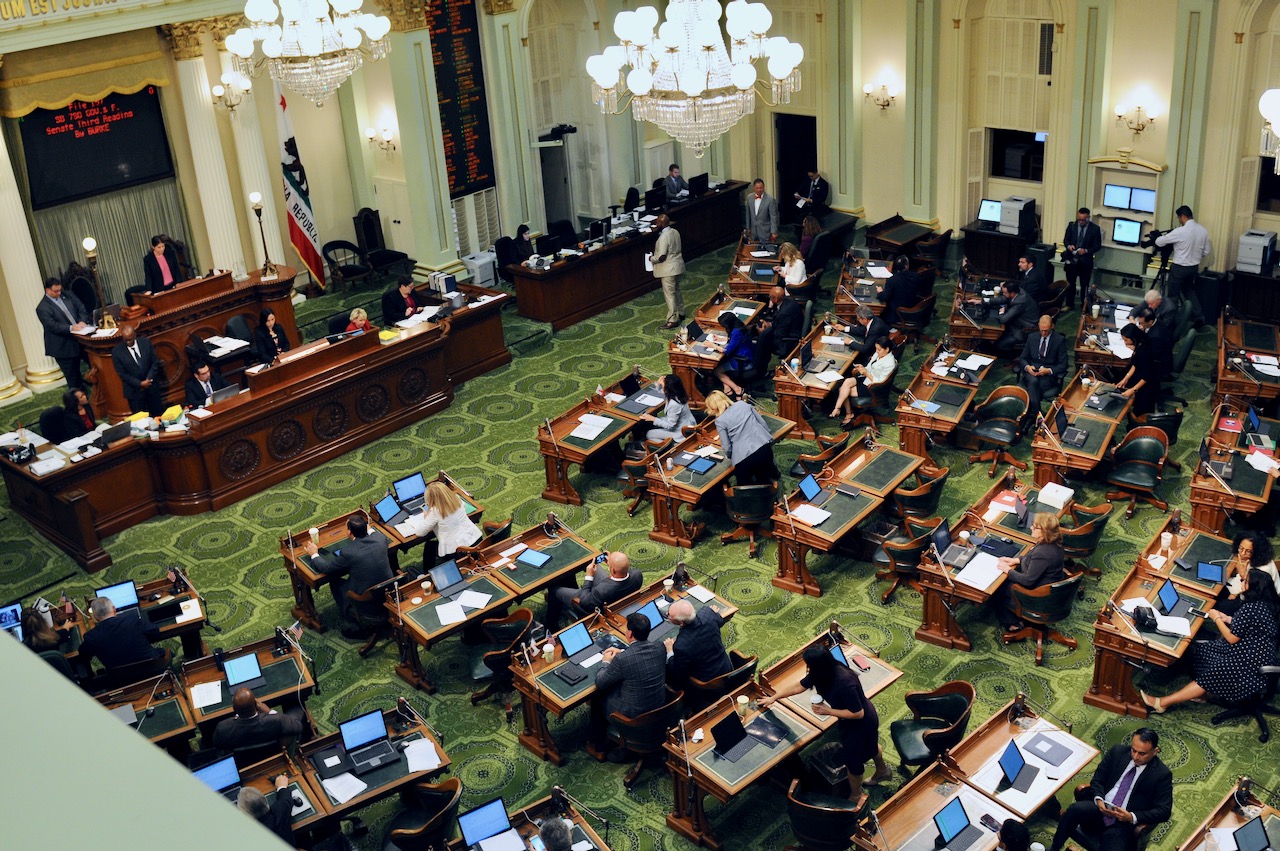

California State Capitol. (Photo: Kevin Sanders for California Globe)

Frequently Asked Questions about Gifts and Honoraria and California Legislators

What happens if someone violates state law for making or accepting an honorarium?

By Katy Grimes, July 2, 2024 2:30 am

What does the state Constitution say about gifts and honoraria for legislators? The California Constitution, in Article IV, Section 5, prohibits any honorarium being paid and limits gifts being made to state legislators. Government Code Title 9 (Political Reform), Chapter 9.5 (Ethics) deals with both topics as well.

Are honoraria allowed under the state Constitution? Article IV, Section 5(b) specifies: “No Member of the Legislature may accept any honorarium. The Legislature shall enact laws that implement this subdivision.” Article 1 of Chapter 9.5 of Title 9 of the Government Code deals with Honoraria in Sections 89501 and 89502.

How is honorarium defined in state law? Government Code Section 89501(a) defines an honorarium as “any payment made in consideration for any speech given, article published, or attendance at any public or private conference, convention, meeting, social event, meal, or like gathering.”

What is not an honorarium under state law? Government Code Section 89501(b) specifies that honorarium does not include (1) earned income for personal services which are customarily provided in connection with the practice of a bona fide business, trade, or profession, and (2) any honorarium which is not used and returned to the donor within 30 days or delivered to the Controller as a donation to the General Fund.

Does the honorarium ban apply to all officials? Section 89502(a) prohibits any elected state officer or elected officer of a local government agency from accepting any honorarium.

Does the honorarium ban apply to candidates for public office? Section 89502(b) prohibits a candidate for elective state office, judicial office, or local government agency office from accepting any honorarium.

Does the honorarium ban apply to public employees? Section 89502(c) prohibits any member of a state board or commission, as well as designated employees of a state or local government agency, from accepting an honorarium.

To whom does the honorarium ban not apply? Section 89502(d) specifies that this code section does not apply to a person in his or her capacity as a judge.

What happens if someone violates state law for making or accepting an honorarium? Government Code Section 89521 provides any person who makes or receives an honorarium in violation of the law in liable in a civil action brought by the FPPC for an amount of up to three times the amount of the unlawful honorarium.

Are gifts allowed under the state Constitution? Article IV, Section 5(c) specifies: “The Legislature shall enact laws that ban or strictly limit the acceptance of a gift by a Member of the Legislature from any source if the acceptance of the gift might create a conflict of interest.” Article 2 of Chapter 9.5 of Title 9 of the Government Code deals with Gifts in Sections 89503 and 89503.5.

How is a gift defined in state law? The word “gift” is defined in Government Code Section 82028(a) to mean “any payment that confers a personal benefit on the recipient, to the extent that consideration of equal or greater value is not received and includes a rebate or discount in the price of anything of value unless the rebate or discount is made in the regular course of business to members of the public without regard to official status.”

Which items are not considered a gift under state law? Government Code Section 82028(b) specifies that the term “gift” does not include:

- Informational material such as books, reports, pamphlets, calendars, or periodicals.

- Gifts which are not used and which, within 30 days after receipt, are either returned to the donor or delivered to a nonprofit entity exempt from taxation without being claimed as a charitable contribution for tax purposes.

- Gifts from an individual’s spouse, child, parent, grandparent, grandchild, brother, sister, parent-in-law, brother-in-law, sister-in-law, nephew, niece, aunt, uncle, or first cousin or the spouse of any such person.

- Campaign contributions required to be reported.

- Any devise or inheritance.

- Personalized plaques and trophies with an individual value of less than $250.

What is the gift limit for public officials in this state? Section 89503(a) prohibits any elected state officer, elected officer of a local government agency, or other specified individuals from accepting gifts from any single source in any calendar year with a total value of more than $250, adjusted for inflation.

Does the gift limitation apply to candidates for public office? Section 89503(b) prohibits any candidate for elective state office, for judicial office, or for elective office in a local government agency from accepting gifts from any single source in any calendar year with a total value of more than $250, adjusted for inflation.

Does the gift limitation apply to public employees? Section 89503(c) prohibits any member of a state board or commission or designated employee of a state or local government agency from accepting gifts from any single source in any calendar year with a total value of more than $250, adjusted for inflation.

To whom does the gift limitation in state law not apply? Section 89503(d) specifies that this code section does not apply to a person in his or her capacity as a judge.

What is not prohibited under state law’s gift limitation? Section 89503(e) specifies that this code section does not prohibit or limit (1) payments, advances, or reimbursements for travel and related lodging and subsistence that is otherwise permitted, or (2) wedding gifts and gifts exchanged between individuals on birthdays, holidays, and other similar occasions, provided that the gifts exchanged are not substantially disproportionate in value.

What happens if an individual violates the gift limitation in state law? Government Code Section 89521 provides any person who makes or receives a gift in violation of the law is liable in a civil action brought by the FPPC for an amount of up to three times the amount of the unlawful gift.

- Trump State of the Union: Democrats Showed They’re Not On the Side of The American People - February 25, 2026

- Leaving California: Public Storage Relocates HQ from California to Texas - February 25, 2026

- California Democrats Propose Government Takeover of Healthcare, Banning Private Insurance - February 24, 2026