CA Gov. Gavin Newsom presenting 2024-25 budget. (Photo: gov.ca.gov)

Gov. Gavin Newsom and the Democrat Supermajority are Coming for Your $$$

And they won’t stop at the billionaires…

By Katy Grimes, April 30, 2024 3:00 pm

California Governor Gavin Newsom has a gaping $73 Billion budget deficit.

Gov. Newsom and the Democrat supermajority Legislature will be searching in every crevice and corner of the Capitol, under every couch cushion, and coat pocket in order to backfill the $73 billion budget deficit. And they won’t stop at the billionaires.

The State of California also owes the federal government more than $21 Billion after borrowing billions to pay unemployment benefits during the Covid pandemic. And while California already has paid more than $650 million in interest on the loan, there is another $550 million due Sept. 30, 2024, the Los Angeles Times reported.

Adding to the pain, The California Employment Development Department admits that $55 billion was lost in the pandemic, the Globe reported.

Gov. Newsom didn’t have to borrow the money from the feds – California could have used federal American Rescue Plan Act funds to pay the debt. Instead, Newsom sent stimulus checks to California residents, and spent the relief money on new projects.

The LA Times reports:

Data also show that jobless workers in California stay on unemployment significantly longer than the national average, which adds to the total payout amount. And California workers claim unemployment benefits in disproportionately high numbers.

The state accounts for about 20% of the nation’s jobless claims, far in excess of its 11% share of the labor force population. That partly reflects the state’s higher unemployment and accompanying increases in layoffs and jobless claims in the tech industry and other sectors, but also its comparatively easier eligibility rules and low re-employment rate.

“Businesses are going to continue to see the slow boil eating into their margins,” said Robert Moutrie, senior policy advocate for the California Chamber of Commerce, Yahoo Finance reported. “Higher taxes will hit small and midsize companies in sectors such as restaurants and tourism especially hard,” he said. “It just adds to the burden and the costs of operating here and makes companies look at operating elsewhere,” Moutrie said.

What can employers, faced with huge unemployment taxes do?

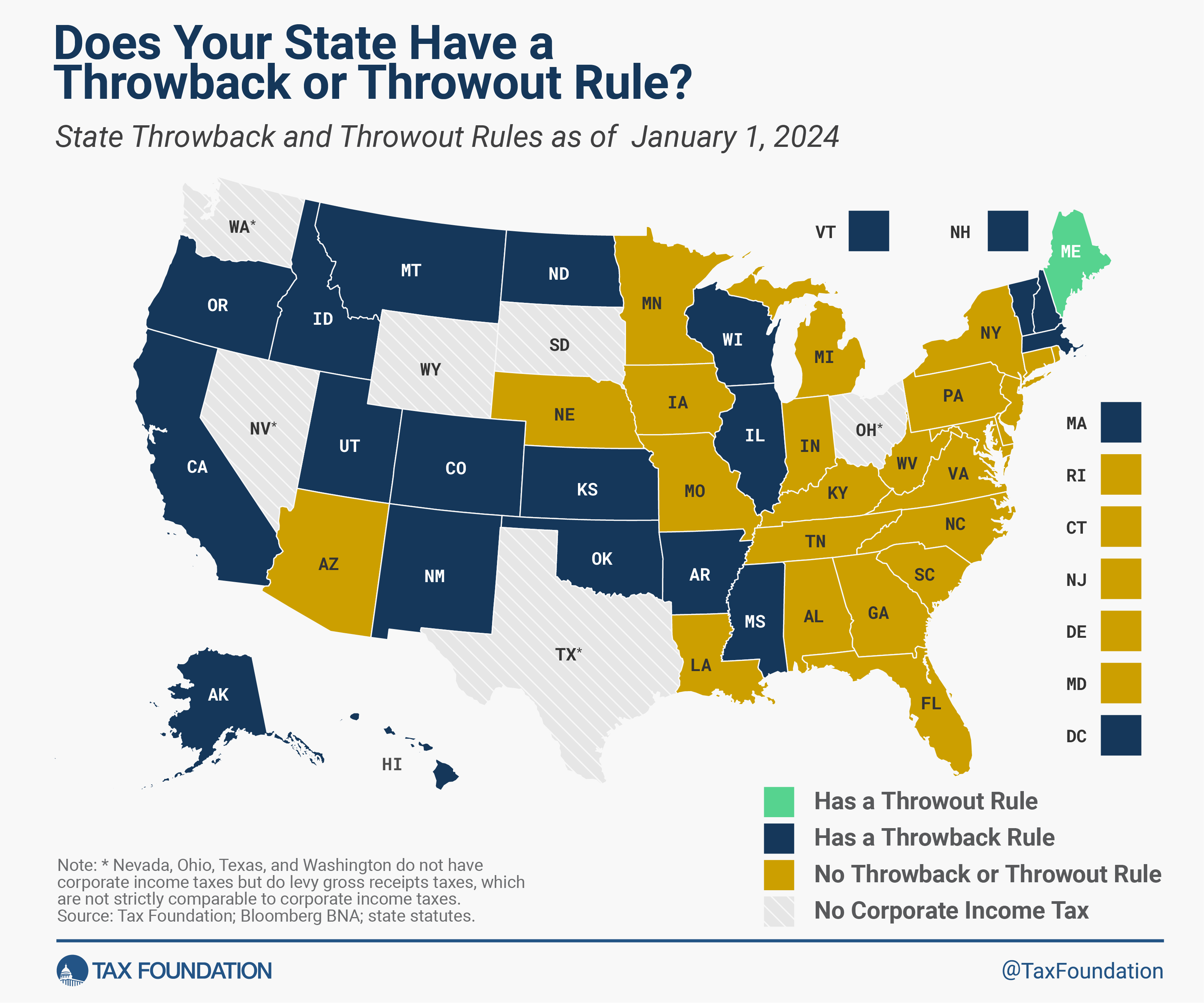

Some have left the state. Others are planning an exit. However that is problematic as well, as California is a “throwback state,” the Tax Foundation reports.

“Under throwback rules, sales of tangible property that are not taxable in the destination state are ‘thrown back’ into the state where the sale originated, even though that is not where the income was earned. This means that if a company located in State A sells into State B, where the company lacks economic nexus, State A can require the company to ‘throw back‘ this income into its sales factor.”

The Tax Foundation explains:

“Throwback and throwout rules can substantially increase corporations’ tax liability and influence business decision-making. Throwback rules have multiple negative effects on state business activity, including reduced new corporate investment and lower rates of economic efficiency. Throwback rules and throwout rules erode the competitiveness of states that impose them by incentivizing firms to relocate to non-throwback and throwout states to avoid higher corporate income tax burdens.

Throwback rules are a case of the wrong tax, at the wrong rate, in the wrong state. They cause businesses to be taxed at potentially many multiples of the income they have in the state imposing the throwback rule, motivating these businesses—or at least certain aspects of their business—to locate elsewhere. This effect is so robust that studies find throwback rules actually decrease tax revenue over time, since they do more to drive out business activity than they do to tax the nowhere income from remaining businesses with exposure to the provision.”

California even has lawmakers again proposing an Exit tax “on the wealthy;” a wealth tax on billionaires to recover anticipated lost revenue on stock earnings by existing residents or residents moving out of the state.

However, this is unconstitutional under interstate commerce laws, as well as due process clauses, as the Globe has reported. Berkeley’s Hastings Law School Scoca Blog reports that the exit tax violates the right to travel, violates the federal Commerce clause, and Due Process clauses.

And, a “wealth tax” is a secondary tax on wealth already taxed at the point of acquisition, consumption, or on income already made. The reason a wealth tax ends up not impacting the wealthy is because it gets passed down to the consumers. This double or triple taxation should be illegal.

In 2020, Democrats proposed an exit wealth tax, AB 2088, and one which would follow any and all businesses leaving California for greener economic pastures.

The bill’s author, then-Assemblyman Rob Bonta (D-Contra Costa), now California’s radical Attorney General, blamed coronavirus for creating “inequality” in California, and not on Democrats’ legislation, policies, and their lockdowns, the Globe reported. “Families are hurting right now. COVID-19 has only made matters worse,” Bonta said. “In times of crisis, all Californians must step up and contribute their fair share. Asking these well-resourced Californians to give a little more to keep our people working and support our most vulnerable is the right thing to do.”

This first-in-the-nation net worth tax was estimated to generate $7.5 billion per year in new “revenues” to the state coffers.

But that proposal took a lot of direct hits and Gov. Gavin Newsom discovered it wasn’t good for his national optics. He assured California business owners that the wealth tax was dead-on-arrival.

However, another “wealth tax” was proposed in January 2023. Assembly Constitutional Amendment 3 by Assemblyman Alex Lee (D-Palo Alto) begins with six WHEREAS clauses including that California has long-term needs that are not being met by existing revenue sources.

The Globe reported that ACA 3 would make three big changes:

The first change that ACA 3 would make is to amend Article XIII, Section 2 to provide that the Legislature may provide for the taxation of all forms of personal property or wealth, tangible or intangible and classify personal property or wealth for differential taxation or for exemption.

The second change that ACA 3 would make is to amend Article XIII B, Section 1 to modify the Gann Limit or the State Appropriations Limit (SAL).

The third would determine that California is no longer among the top 10 states with the highest percentage of households whose costs are in excess of 50% of household income.

Financial Advisor Magazine covered this exit tax:

“California is basically looking for unrecognized capital gains for wealthy persons leaving the state,” said Mary Kay Foss, a CPA in Carlsbad, Calif. “Gains on California real estate are taxed here in any case, so the tax would be imposed either on unrecognized gains on other assets or wealth other than real estate. It doesn’t smell constitutional to me.”

Exit taxes seem to be connected to wealth taxes. Seven states—New York, California, Connecticut, Hawaii, Illinois, Maryland and Washington—have some sort of wealth tax, said Miklos Ringbauer, CPA and founder of MiklosCPA in Los Angeles.

“It’s not legal for states to implement a real exit tax on their citizens simply as a result of moving to another state,” Ringbauer said. But “states like New York, Massachusetts and California have implemented robust exit-tax audit techniques such as automated programs to track a citizen’s activities—cellphone use, the location of credit card charges, use of toll roads and so on—to help determine whether the taxpayer actually moved out of the state or has spent sufficient number of days in the state and is now subject to state income taxes.”

ACA 3 has been stalled in the Assembly Revenue and Tax Committee – the bill has not been killed, which means the Governor and Democrats are keeping this one in their back pocket. Expect to see it suddenly shoved through committees quickly, or reappear as language in a spot bill, or shoved through by the budget committee’s budget bill, if they think they can.

- Why California Has an Oil and Gas Crisis… and China’s Involvement - March 11, 2026

- Yamaha Leaving California for Business-Friendly, Crime-Free Kennesaw Georgia - March 10, 2026

- Marathon, Chevron, PBF Warn Governor Newsom of Widespread Refinery Shutdowns, Fuel shortages, Economic Collapse - March 10, 2026

Katy Grimes has turned clairvoyant because my husband and I were just wondering this morning by exactly what diabolical method CA residents would be fleeced as a result of that pinhead Gov of ours recklessly shoving us all into a $73 BILLION dollar state deficit hole with extra BILLIONS in other debt sprinkled on top. Will be keeping an eye out, on the off-chance anything can be done about this, and especially keeping an eye out for the Return of the Abominable ACA 3.

“Taxing citizens when they leave” is what the Nazis did to the Jews who had to give up their wealth to emigrate from Germany as Hitler came to power.

Time for Governor Newsom to take a giant bite of that financial $hit sandwich he constructed by failing to pay back the federal loans to cover the EDD losses (Every other state has paid it back) and generally mismanaging the state.

Democrats that control California taxing citizens when they leave is something that Nazis and other oppressive, authoritarian, totalitarian and dictatorial regimes have done throughout history?

It’s time that California taxpayers revolt against the unjust and unfair taxation being imposed by the criminal Democrat mafia that controls the state?

There will be no revolt. More than half the Californians are living off the system; in other words living off of you and I. Therefore the majority has everything to gain and we have everything to lose: No revolt in the offing.

BTW some self-proclaimed genius sociologist is recommending giving each homeless person a grand a month.

There too has to be an assault on prop. 13 in the works; they’ll find a way.

https://www.latimes.com/california/story/2024-04-30/monthly-payments-of-1-000-could-get-thousands-of-homeless-people-off-the-streets-researchers-say

I guess I won’t hold my breath for the $150 tax refund that I am waiting on from the state. In all seriousness the state doesn’t have a revenue problem it has a spending/governing problem. Trickledown taxation does not work. Study after study has shown the best way for government to reduce the revenue coming into its coffers is to increase taxes. But with this crowd it’s really not about the money it’s about power/control. History has shown the easiest way to enslave the people is to increase their taxes and decrease their economic freedom. This is the exactly the place where we find ourselves based upon the policies that “Newsom and the Supermajority” want to implement. They want to make us slaves of the state trapped by a loss of economic freedom. The 2024 election is shaping up to be the most consequential in our state’s history. The question boils down to freedom. Do we want the God given freedom to live our lives in a relatively free society or do we want to live in the clutches of a tyrannical government. It’s a simple question with profound consequences.

Gavin Newsom was made a WEF “Young Global Leader” by Klaus Schwab in Davos in 2008. http://www.maloneinstitute.org He is following his buddy, Justin Trudeau, into making the U.S a Totalitarian State. Newsom will be running for President after Biden is out next month. WEF Plan.

CAPTION OF THE ABOVE PICTURE : “THIS is how I will break them economically!!!”

AND – per Rob (“I’m a dumbass and so is my wife”) Bonta : “Families are hurting right now. COVID-19 has only made matters worse,” Bonta said. “In times of crisis, all Californians must step up and contribute their fair share. Asking these well-resourced Californians to give a little more to keep our people working and support our most vulnerable is the right thing to do.”

Good luck with that Bonta – your Gubernatorial chances of being (s)elected by your wealthy Democrat donors just dropped PRECIPITOUSLY with that pearl of wisdom… and of course, YOU and your Democrat pals are the smartest people in the room and able to discern what exactly constitutes someone’s “FAIR SHARE”… (in Demo-speak, that’s EVERYTHING…)

What a bunch of CLOWNS are making legislation in Excremento… who knew that the Insane Clown Posse would describe California pols….

Maybe it would just be simpler for the Dem stalinist regime in Excremento to set up exit stations at all the roads and airports leading out of the state. Californians fleeing tyranny would have to hand over deeds to any assets still remaining in the state and their vehicles seized.

The victims then be subjected to shaker machines which would grab the victims by the ankles, turn them upside down and violently shake them to remove any remaining coins, car keys, wallets or valuables.

Only then could an inmate to gulag California be permitted to leave.

Under Newsom and the Democrat supermajority, taxes and living costs are skyrocketing and soon some of us won’t be able to afford the internet and complain about it online. But that’s OK, we’ll still complain to each other while standing in the bread line after work.

It is bad out on the streets of California especially Southern California! We just arrived back from a trip to L.A. and San Diego, we did a lot of driving in the general Los Angeles area and the filth and homeless problem is everywhere. What did Sacramento accomplish with all the wasted taxpayer funds?

*Less water storage

*More crime

*more people living on the streets

*potholed narrow surface streets and freeway lanes

*overburdened local government agencies

*unhappy, stressed citizenry

Yes they will come for our money well before they reduce spending and abandon progressive failed policies hurting Californians.

I ache for the people of this state who have no clue why their quality of life SUCKS so bad.

If people do not get out and vote for change, this state is finished. It is unsustainable. They might as well just hold a 24/7 televised flushathon in Sacramento. Flushing our hard earned money down the toilet leads to the same result. Nothing to show for our taxes!

Yes, they will find a way to take more!

Add THIS rich piece of TRUTH to Newsom’s complete life of utter boolsheet….

https://www.ocregister.com/2024/04/04/gavin-newsom-says-baseball-saved-him-but-the-legend-of-his-career-doesnt-always-match-the-reality/

with THIS cherry on top :

https://www.dailynews.com/2024/05/01/ucla-survey-quality-of-life-rating-is-the-lowest-ever-for-la-county-residents/

Gavin Newsom is a PATHOLOGICAL LIAR and 100% responsible for the misery being experienced by California residents….

Thanks for the article @CriticalD!

It confirms what I witnessed.

“We have two societies here in L.A.,” said Zev Yaroslavsky, director of the study at UCLA. “We have an incredible income gap.”

It is very apparent.

I came back home somewhat depressed. It did not help that my hotel was directly across the street from a Step Up facility.

Every night a homeless man screamed at the top of his lungs.

What does the future hold for the average Californian trying to make a living?

Too much money is made in the homeless industry for real solutions to be desired by those profiting. Housing vouchers, with landlord protections for damages, is a much better solution that a dollar handout to homeless.