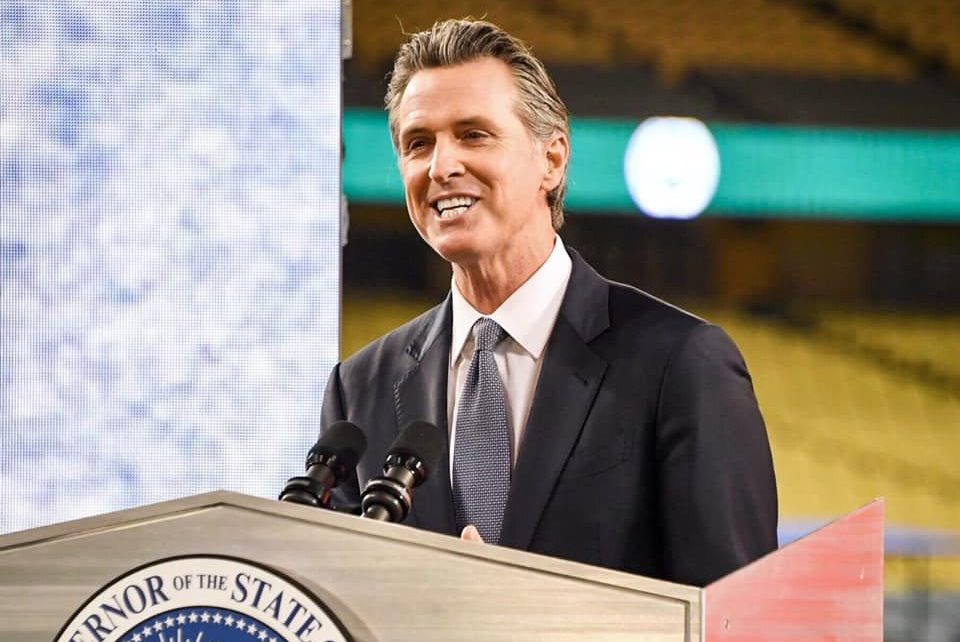

California Gov. Gavin Newsom State of the State 2021 speech at Dodger Stadium. (Photo: gov.ca.gov)

Gov. Newsom Made $1.7 Million Last Year According To Tax Returns

Income up by $500,000, compared to 2018 returns, gains made largely through the Newsoms’ blind trusts

By Evan Symon, May 18, 2021 11:05 am

Governor Gavin Newsom released his 2019 tax returns on Monday, showing that he made $1.7 million during his first year as Governor.

His returns, which were briefly unveiled to the press to look at but not photograph or film, also indicated that both Newsom and his wife, Jennifer Siebel Newsom, paid $712,000 in state and federal taxes.

Newsom made $175,000 as Governor in 2019, as well as $39,000 from writing a children’s book about dyslexia, while his wife made $151,000 through her non-profit organization The Representation Project, $50,000 through her Girls Club Entertainment production company, and around $1,000 in residuals from previous acting jobs.

However, most of their income was made through the couples numerous trusts and businesses. According to their 2019 returns, the couple made over $1.3 million in income from these passive sources, going up around $500,000 from their 2018 returns. While his taxes made it impossible to know what was or wasn’t losing money, it is known that his largest business, the winery and restaurant-based PlumpJack Group currently run by relatives and close friends in a blind trust due to his Governorship position, likely played a part in his income rise.

Due to their move to Sacramento in 2019, the Newsom’s also reported $140,000 in renting out their old Marin County home, but reported a $250,000 loss on the property due to the house going up for sale for $6 million in 2019 with no one buying it. Newsom also made $79,000 on the sale of a Napa County property and $3,000 from a property in the state of Hawaii.

The Newsom’s also reported $100,000 given to charity in 2019, paying $288,000 in employee wages in their home, and paying $69,000 in household employment taxes.

Future 2020 tax record concerns for Newsom, Recall candidates also likely to release tax returns

A spokesman for Gavin Newsom noted on Monday that, due to the Newsom’s getting a tax extension, they won’t be filing their 2020 taxes until October. This means that their income during the pandemic won’t be known for quite some time, despite a recall election happening later this year.

“The pandemic shut down a lot of businesses this year,” explained Les Galpin, a New York-based tax consultant who mainly works for clients who own food and beverage-related businesses, to the Globe on Tuesday. “Governor Newsom, logically speaking, is likely to have lost money on his main businesses due to the lockdowns and California restaurant restrictions last year. This covers PlumpJack and all those wineries and restaurants. But he also probably lost money elsewhere, like on rental properties.”

“And it also might show that he made out better than most too. He got several hundred thousand in waivable loans for Plumpjack in 2020, not to mention what other federal programs or state businesses programs they came in under that we aren’t seeing. And then there’s the fact that in California last year, wineries and restaurants couldn’t reopen last year in most counties, with Napa, where PlumpJack is, being the county of exception.

“I’m not sure that I would go so far as to call it an abuse of power, as Napa holds many other wineries and is kind of the lifeblood industry up there. I mean, so many up there were hurting, so that exception helped out many. It’s like giving tax breaks to the entertainment industry in LA or breaks to farmers in rural counties. It’s what they are known for and what is needed economically, with Napa being a much more niche example with wine. But it doesn’t look great that he was directly benefiting from one of his orders either. If it does turn out that it saved him from major losses, or helped his company in any way when compared to the tax records of similar companies, then it will hurt him. If not during the recall this year, then definitely in the 2022 election. If you track politics, this is definitely a future issue to look out for.”

A state law previously passed by Newsom may require his recall opponents to release their tax returns before the election this year. As of Tuesday, all 4 major candidates indicated that they would likely comply. 2018 GOP Gubernatorial candidate John Cox noted that he is currently reviewing the new state law requirements, with Entertainer and former Olympian Caitlyn Jenner, former San Diego Mayor Kevin Faulconer, and former Congressman Doug Ose saying that they will release their tax records to fulfill the requirements to run.

“I will disclose my tax returns once the election is set and I complete the paperwork to run,” said Ose on Monday. “Such disclosure should apply to every state legislative and constitutional office candidate, as well as their Chiefs of Staff.”

The candidates returns, as well as the returns of every other major candidate who will join in the recall election, are expected to release their returns soon.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

If he had 288,000 in household employee wages last year, I guess he was not quarantining in his home with only his family bubble as he mandated the rest of us do! Guess he wasn’t scared of COVID, he was afraid they might have to cook, clean or babysit their own kids. Once again, do as I say not as I do.

Did he pay his property taxes yet??????