Map of California

Leaving California: Interviews With Californians Who Moved To Greener Pastures, Part III

Idaho Legislature: ‘They aren’t in the news everyday saying something idiotic’

By Katy Grimes, July 20, 2019 8:05 am

Everyone is piling on California these days, and for many valid reasons. California is always ranked as one of the worst states in the country in which to run a business, while many other states are ranked at the top of the chart. California is always ranked as one of the worst states in the country in which to run a business, while Texas always ranks as one of the best. Chief Executive rankings show Texas in first place and California in an embarrassing last place at 50th.

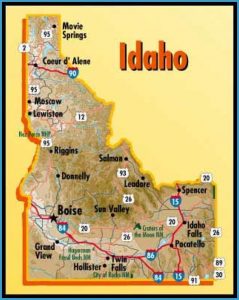

Idaho is now the fastest-growing state in the nation according to Chief Executive. “Idaho has been fairly successful but we have more to do in taking back the authority that the federal government over the years has taken, whether it’s in the area of education, transportation, healthcare, public lands management and all the areas of regulation,” said Gov. Brad Little.

Jim and his wife, California residents since 1989, saw the handwriting on the wall many years ago when Gov. Gray Davis was elected. However, they did not decide to leave until retirement as Jim’s wife had a thriving therapy and counseling practice.

Two years ago they sold their house in Carmichael, a suburb of Sacramento, bought a lot and built a home in Avimor, just outside of Boise, Idaho.

Jim said there were no hassles building the home at all with permits or outlandish fees. And the property taxes are only $3,000 annually.

The Tax Foundation ranks Idaho at 23rd in the nation for combined taxes. Idaho has an income tax rate which ranges from 1.125 percent to 7.4 percent. Individual income tax is graduated so higher earnings are taxed at a higher rate. The scale initially seems silly, but this scale shows that everyone is paying taxes, and not just those above a certain income level.

- 1.6% on the first $1,451 of taxable income.

- 3.6% on taxable income between $1,452 and $2,903.

- 4.1% on taxable income between $2,904 and $4,355.

- 5.1% on taxable income between $4,356 and $5,807.

- 6.1% on taxable income between $5,808 and $7,259.

- 7.1% on taxable income between $7,260 and $10,889.

- 7.4% on taxable income of $10,890 and above.

Idaho’s state sales tax is 6 percent. Idaho also imposes a use tax, which is the same rate as the general sales tax, Bankrate reports. Use tax is collected on the consumption, use or storage of goods in Idaho if sales tax wasn’t paid on the purchase of the goods.

There is no inheritance tax in Idaho.

The statewide average urban property tax rate is 1.511 percent; the rural rate is 0.994 percent. Idaho also has a homeowner’s exemption equal to the lesser of 50 percent of the assessed value or $100,000 for owner-occupied homes and manufactured homes that are primary dwellings. The exemption applies to your home and up to one acre of land.

Jim said Avimor, Idaho is located on an old sheep ranch which encompasses three counties. He and his wife found Boise a bit too much like what they just left, and opted to move into the foothills outside of Boise instead.

There is a current building boon in Idaho and Jim said it is difficult to land contractors or subcontractors. A gallon of gas is $2.85. The median home value in Idaho is $266,400 – California’s median home value is over $600,000.

Jim told the story of while still living in Carmichael, his old water heater died and he had to get a new one. However, while in the process he discovered Sacramento County requires a permit for new installations or replacement water heaters. The list of miscellaneous permits required in Sacramento County for homes is long and extremely invasive.

After they built their new home in Avimor, which is located in Boise County, Jim said the new water heater was a lemon. He had to replace it – no permit required. Boise County building permits are fairly basic and non-invasive.

As for politics, “I don’t know what they are doing, and that’s good,” Jim said of the Idaho Legislature. “They aren’t in the news everyday saying something idiotic.”

“The garbage gets picked up, criminals get arrested, when you turn the water faucet on, water comes out,” Jim said. “That’s how government is supposed to work. We had a brush fire here last year and the fire department took care of it.”

“It’s such a pleasure here,” Jim added. He noted one of the things he first realized when they moved to Idaho is he wasn’t angry, and he wasn’t talking about politics much any more. “And the people are nice.”

“We rarely go to Boise – the Mayor is a dork,” Jim said. “You have your perpetual weirdos there – it’s more like Sacramento.”

Jim said Idaho is also a one-party state, however, “the Republicans do not oppress the Democrats at all.”

It is notable that the Idaho Legislature calls itself “Idaho’s Citizen Legislature,” and says, “The Idaho Legislature is responsible for translating the public will into policy for the state, levying taxes, appropriating public funds, and overseeing the administration of state agencies. These responsibilities are carried out through the legislative process – laws passed by elected representatives of the people, legislators.”

- Trump Responds, Issues Global 10% Tariff on all Countries - February 21, 2026

- What is Trump’s Plan B After Supreme Court Strikes Down Tariffs? - February 20, 2026

- New BLS Data Shows Union Membership Drives Falling Flat - February 19, 2026

I bought a house 1 1/2 year ago in Boise. People are so nice and very young demographic. I’ll move from San Diego when I retire.

My 26yo son lives in Meridian Idaho, a suburb of Boise. He graduated from Boise State Univ. Even as a nonresident, BSU tuition was less expensive than all 4-year California school. Meridian is similar to Roseville.

He bought a condo in Meridian for $110K. My son said he will never return to California to live.

Leaving California is an attractive idea. With my career field I could probably easily find work elsewhere. Leaving here is going to be hellaciously expensive. Checked UHaul prices lately? Plus I have 2 cars to bring with me as well.

I lived in Bay area from 1984-2015. I live in Idaho now, City of Eagle. It’s a no brainer

You’ll pay for that UHaul in the first year of tax and utility savings.

No brainer? Stay in your stupid state. You voted all this officials in office. Don’t come here to screw up another state. Californians are not welcome by many.

People leaving California did NOT vote our current leftist officials into office. That’s why we (conservatives) are fleeing to Idaho… for conservative values! Do you really think liberals would leave California for Idaho??

I am a native born Californian and at 73 I can’t afford to stay. The state government has been lost to a group of coastal elites lead by a tin pot dictator named Gavin Newsom. I wish the citizens of Calif who I leave behind nothing but the best. My wife and I leave for Sparks, NV in 8ctiber.