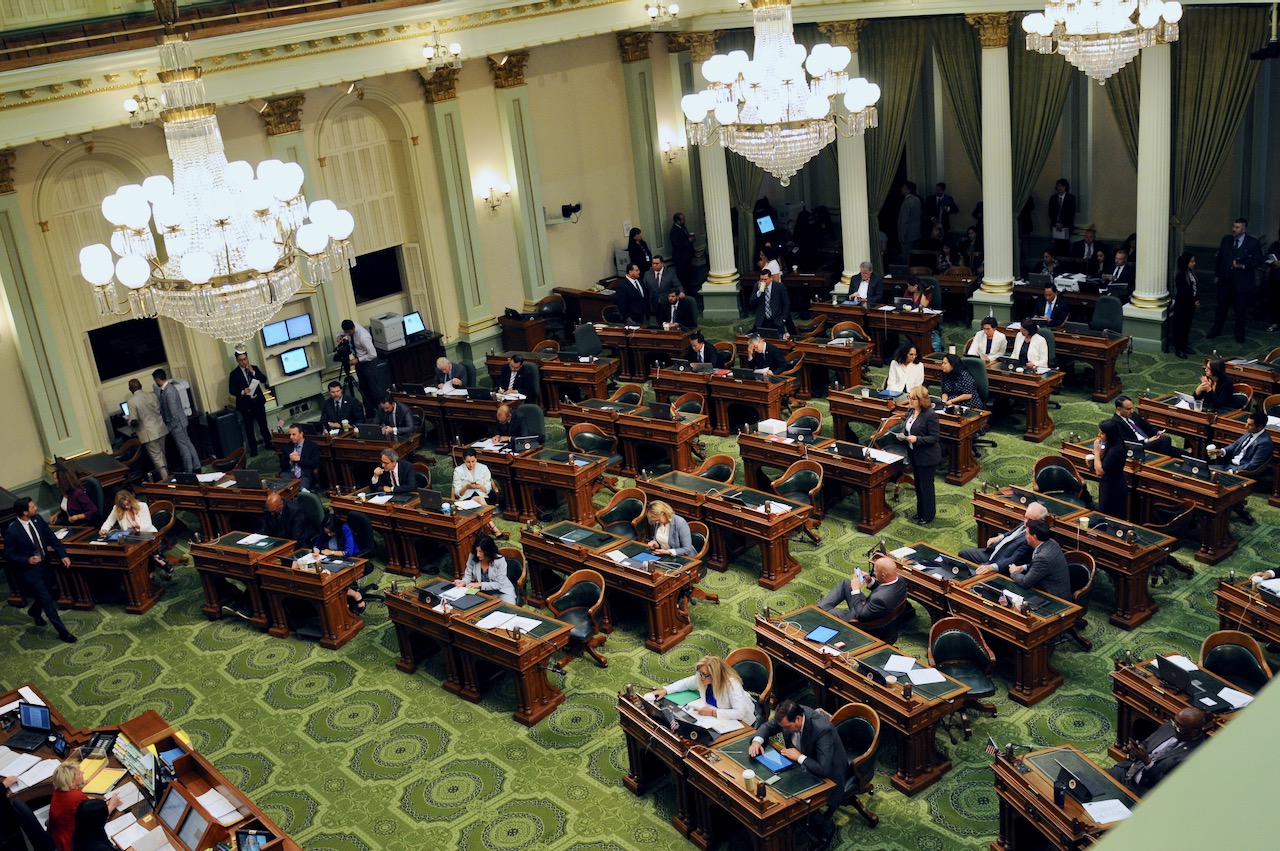

California State Capitol. (Photo: Kevin Sanders for California Globe)

Loyalty of California State Personnel

California Government Code prohibits a person from being employed who advocates or abets sabotage, force and violence, sedition, or treason

By Chris Micheli, November 25, 2022 7:55 am

Chapter 3 of Part 1 of Division 5 of Title 2 of the California Government Code concerns “loyalty.” Government Code Section 18200 prohibits a person from being knowingly employed by any state agency or court directly or indirectly carries on, advocates, teaches, justifies, aids, or abets a program of sabotage, force and violence, sedition, or treason against the Government of the United States or of California.

In addition, any person employed by any state agency or court must be immediately discharged from his or her employment when it becomes known to the appointing power that the person has, during the period of employment, committed any such act. In addition, money appropriated from the treasury cannot be expended to compensate any person whose employment is forbidden by this section.

- Liability for a Deceased Spouse’s Debt - March 4, 2026

- Wildlife Management Areas - March 3, 2026

- County Revenues for Fish and Game - March 3, 2026

In a more um, “innocent” time, this made sense, but with the seemingly apparent Communist Chinese takeover of many of our governmental officials (Swalwell, Feinstein, Pelosi(?), Biden), this takes on a more draconian overtone…

The real “disloyalty” abuse committed by state employees is taking their fat California taxpayer funded pensions and immediately moving to low tax states, the minute they retire.

We taxpayers lose out on those life long public pension dollars of getting recycled back into our own state’s economy. Much like illegals getting taxpayer funded benefits and free K-12 for their kids, but sending large amounts of earned but untaxed US dollars back to their home countries – via money wire services, and not USPS.

Too much money leaks out of the pipeline from taxpayer to scofflaw recipients. Clean this up, Newsom. A hefty tax on remittences leaving this state, in order to fund “free” K-12 education is in first order. Then to fund all social services and “free” medical care.

Good to know you think of state employees as property, to be under state control for the rest of their lives. Good to know.

Jaye

those fat taxpayer funded pensions you refer to don’t exist for most working people. 7 percent of my salary was withheld automatically for well over 20 years and as part of our “total compensation package” the district matched our 7 percent most of that time. You also seem to have forgotten that between Dukemejian and Wilson declaring well over a billion dollars (believe Wilson alone declared over a billion) in PERS as surplus funds and transfered said funds to the general fund and That under Davis school districts at least did not have to pay their 7 percent for several years. Had politicians kept their hands off of PERS it would be more than adequately funded today. So the taxpayers might well have to repay what the politicians stole from PERS.

You forget other workers pay out of their salaries for social security, as well as funding their own retirement savings and/or participate in a 401K type —defined contribution– pension plan. Private sector workers fund their retirements.

State workers on the other hand are guaranteed a —defined-benefit pensions— – which well exceeds anything offered in the private sector. That is your fat cat pension as a government employee, and we taxpayers are forced to fund every cent whether enough money has been set aside or not.

Your unions and the union backed lackies you manage to keep electing have long avoided recognizing the true costs keeping the growing numbers of public sector employees afloat. So this growing public pension funding gap keeps getting kicked down the road too.

Your immediate agency “employer” does not fund it, nor do you fund your pensions.

Taxpayers alone fund your pension promises, and taxpayers alone are forced to make up any unfunded differences between what you were promised and what your unions failed to secure in investments upfront. Never knowing what games will be played in your final years compensation formula, that sets your lifetime pension. Your unions managed to get taxpayers to write you a blank check – and that is the sheer horror of still owing your a defined-benefit pension – the end point is never known even if savings and investments were prudent.

The cost to taxpayers for your total, public sector union bargained contract, is what we state taxpayers are forced pay – you pay nothing. You just take. The fact your unions learned to manipulate elections to put your union friends on both sides of the collective bargaining table created this most worst pension abuse that has ever befallen this state. While your party legislators continue to create one of the most unfriendly business climates in the states – something finally has to give.

You can laugh about being able to take your California pension to antlers lower cost, lower tax state. But who is going to laugh when the major players who fund nearly 50% of the state funds also leave due to strings of egregious anti-business Democrat legislation and attitude.

From RINO Schwarzenegge onwards, the year 2000 forward is when this public pension disaster really took off. After learning to game the election system, between the locked-in Democrat super majority and under-funded public pensions the state is now in fiscal free fall. As more “billionaires” leave this state, the private sector small businesses and other private sector persons are stuck with funding more and more of this unholy public pension disaster. It won’t be long before the free-fall tipping point has been reached. You are doing nothing to build your independent economic base; only growing the public sector demands on remaining tax payers.

But hey, please tell younger people to worry instead about “climate change” and ignore the tax bills now pushed on the in your name. it is a given taxpayers now will have to pay trillions to make up for the games played that guaranteed you a defined benefit pension.

But I didn’t hear any government employees rejecting those defined benefit pensions when they were offered, and exposed by the Grace Commission investigation at the time to be exactly as ruinous in 20 years as we are now learning today. If you want to save this state, instead of raiding it blind you will need to covert ALL public pensions to defined-contribution pensions now – no matter what your vesting.

Courts protected you from being forced to do this; but reality requires you do this anyway. Who among your government employee unions will be the first to bend their knee for real pension reform in this state for the good of everyone? You demanded tax payers give you a blank check. Now taxpayers are voting with their feet. What do you owe them now?

Absolutely right, Jaye. Good summary. A defined contribution plan is an anachronism – a dinosaur, a legacy of the past. When the collapse of CALPERS/CALSTRS happens, and it will, I don’t want to be living in California. You mention the loss of the tax base in California – businesses (large and small) and billionaires leaving the state. The people left holding the bag in California will be the individual property owners who can’t afford to or don’t want to leave for one reason or another. Imo, this is why Proposition 13 remains under continuous attack during each election cycle. Logically, who else would the state go after to fund their obligations?

P.S. Sorry, typo…..”A defined BENEFIT plan is an anachronism…..”

Nice try, Harvard. You miss the point. Just exposing what a rotten ROI we make transferring vast amounts of our tax dollars to any government employee. We get little in return during their active work years, and even less after they suck off their “defined benefit” pensions for the rest of their lives. Not a good investment over all. Let’s stop doing it.

No more lousy work product like #50 rankings for our massive K-12 system in exchange for a guaranteed Prop 98 50% of all state general funds dedicated to public education. No more elimination of community college placement exams in English and Math, which served to independently underscore how badly K-12 was preparing our students for college level work.

No more raid the treasury and hire the relatives expansion of the government deep state union memberships rolls. We are running a full employment racket in this state – I only wish we had more control as the price of “choosing” to work for the state taxpayers. You best hope Newsom finds a way to stop the current bleeding of state tax revenues after spending so much time making this state rank at the bottom of business-friendly states. Otherwise, this state is eating its seed corn.

“Can California Tax My Pension if I Move out of State? Thankfully, no. A Federal law (PL 104-95) passed in 1996 supersedes the state’s tax interests and prohibits any state from taxing pension income of non-residents, even if the pension was earned within the state.Nov 24, 2020”

Yet did not Newsom threaten he would tax any high tax revenue-producing California business that left the state? Yet courts reasonably concluded there can be no similar strings on state employee pension recipients who choose to flee this high tax-high cost state.

What was Newsom even thinking when he treated the long arm of California law would punish any former state revenue-producer from leaving this state? Or do revenue-takers operate under a different legal ethic. State loses money both ways.

Hard to discern the governor’s politically cynical throught processes.