Petition To Increase Property Taxes For Commercial And Industrial Property Underway In California

The proposed Proposition would reassess properties to their market values as high as wanted by the state.

By Evan Symon, October 30, 2019 6:04 am

Signature gathering began Sunday for a proposition that would increase taxes for commercial and industrial properties in California.

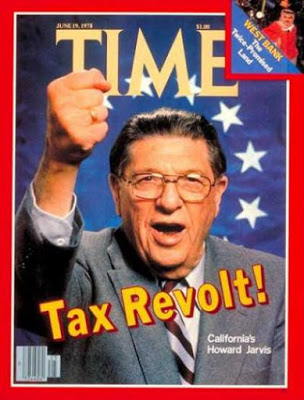

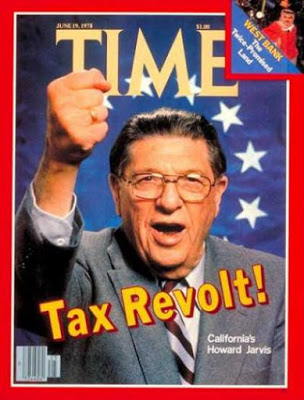

Currently state law follows the language of Proposition 13, a 1978 law that can only raise the value of a property by 2% a year, unless the property sold or if there was new construction on the site. It essentially works like rent control, except in this case it’s property values that are factored in to how much in taxes the owner has to pay, which according to law, can be no more than 1% of the value of the property.

The planned proposition would remove having the property value being reassessed once per year for a max of 2% and instead remove the limit. While the total tax can still only be 1% of the total value, the value can go as high as needed. Small businesses with a value of $3 million or less would be exempt from the proposition, as would any property that has residential units or agriculture on them.

“There’s a lot of criminally undertaxed properties in places that are being taxed very little for where they are or what they make,” said Andrea D’Amico, a real estate lawyer, “Think about now gigantic tech companies that own valuable real estate and buildings in places where their building hasn’t gone up more than 2% in years. Decades. Think of San Francisco and Silicon Valley. Think of parts of Los Angeles. There’s a lot of older buildings unchanged for years that businesses are paying low taxes on. This changes it.”

According to state projections, should the proposition pass, property taxes would go up from $7.5 billion a year to $12 billion a year. 40% of the projected revenue would go to schools and education in California while 60% would go to city and county governments.

According to the California Secretary of State, 997,139 signatures, or 8% of the total number of voters in California, are needed by April 14 for the proposition to be added to the 2020 ballot.

Supporters have said that this would give long overdue funds to Californian schools and cities.

“We’ve screwed our schools for long enough,” exclaimed Pedro Ortega, a custodian for a school in Southern California, as well as supporter of the proposed proposition. “There’s a lot of expensive buildings with rich companies who are paying taxes that are, quite frankly, insultingly low. They’re part of our neighborhoods too, and they should start contributing to them.”

“‘Schools and Communities First’ means exactly what it says,” said Ortega, referring to the name of the proposition supporters have given it.

Meanwhile, detractors say there can be a lot of negative consequences.

“Look at our older buildings,” said Dom Lombardy, a commercial landlord in Los Angeles. “If we are suddenly reassessed without a limit, we may have to pay double or triple that, depending on how old the building is and where the building is. A lot of businesses can only pay the rent because the property tax is low for the area. Remove that, and you’ll be seeing a lot of small businesses close down.”

“[Supporters of the proposition] only think that big companies are going to be affected. But there’s a lot of landlords who bought out there in the 90’s or earlier when things were much cheaper, or they had buildings in bad neighborhoods that are now really wealthy. Like hipster neighborhoods or where yuppies are at now. You raise rent on them, maybe some in better neighborhoods can afford, but many won’t. The higher taxes will need to come from tenants whose profits won’t be able to cover rent so they’ll move out.”

“Any affordable place for small businesses over that $3 million threshold are doomed. This will kill malls off for good. This will kill any small business that is unfortunate enough to be priced in an expensive old building, like indie theaters. It will kill any area trying to stave off over-priced gentrification.”

Land and property owners across the state have been generally against such a proposition, as have many community and neighborhood organizations who don’t want higher taxes to hurt them or any businesses in the area. Watchdog groups have also pointed out that the 60% earmarked to local usage would most likely go to pension programs and other programs that need more cash with an aging population.

Support has come from teachers organizations and teacher unions who want the billions of dollars that it would bring to public schools. Other unions have been in support of such a proposition, as have some community groups and Facebook founder Mark Zuckerberg’s Chan Zuckerberg Advocacy.The Service Employees International Union (SEIU) alone has already donated over $500,000 towards the campaign.

The movement has just over 5 months to get the nearly 1 million signatures they need.

- San Diego Country Supervisor Jim Desmond Calls San Diego New Epicenter Of Illegal Crossings By Migrants - April 27, 2024

- Oracle Moving Headquarters Out Of Austin Only 4 Years After Moving Out Of California - April 26, 2024

- Congressman Adam Schiff Robbed of his Luggage in San Francisco Car Break In - April 26, 2024

The democratic party controlled government in california continues to shoot itself in the foot at every chance they get. Apparently nobody on the payroll actually understands how the economy works.

As if prices of everything aren’t high enough, Newsom wants to increase the tax burden on businesses stuck with rent increases passed down in prices hikes.

Obviously, this is the beginning step to go after the remaining source of wealth of middle class: their houses.