California Teachers Association building, Sacramento, CA. (Photo: Katy Grimes for California Globe)

Teachers Union Promotes Property Tax Increase

‘End the shady tax breaks for corporations and wealthy investors’

By Edward Ring, February 3, 2020 5:43 pm

Last week what is arguably California’s most powerful political special interest, the California Teachers Association (CTA), or teachers union, held its quarterly State Council of Education meeting at the plush Westin Bonaventure Hotel in downtown Los Angeles.

The CTA reported revenues of $209 million on their most recent IRS Form 990 (results through 8/31/2018), and their total assets increased from $296 million to $334 million. The CTA’s “savings and temporary cash investments” increased from $56 million to $79 million during their most recent year of operations.

Even here in California, these are astonishing sums of money. Moreover, the CTA, operating statewide, only wields about half of the teachers union’s financial firepower deployed in California. Additional financial resources come from the CTA’s national affiliate, the National Education Association, as well as from the dozens of major local affiliates, such as the United Teachers of Los Angeles.

Getting Rid of Proposition 13 Protection for Commercial Properties

A helpful mole inside the CTA’s recent meeting has provided five examples of what is one of the top priorities for the CTA these days, which is to strip commercial properties of the protections they have enjoyed under Prop. 13. To that end, they have endorsed and are major contributors to the “Schools & Communities First” state ballot initiative, likely to face voters in November 2020.

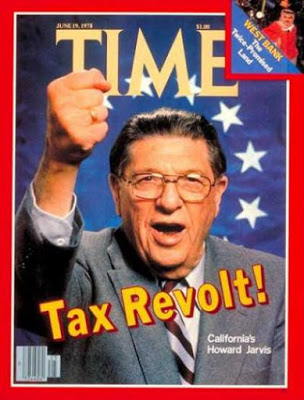

Since 1978, Prop. 13 has limited property assessments to a maximum of 2 percent increases per year when calculating the base on which to impose property taxes. The only time the taxable base value is reset is when a property is sold. If a business property is inherited, to purposes of property taxation the descendants inherit the base value without reassessment.

Let’s be clear, Prop. 13 protection constitutes one of the last, if not the last, advantage businesses have when trying to operate in California. As this first flyer shows, that last bit of relief businesses get in what is the most inhospitable state in America is not as important as putting “Schools & Communities First.”

A very long time ago, presidential candidate Ronald Reagan famously had this to say about business taxes:

“Some say shift the tax burden to business and industry, but business doesn’t pay taxes. Oh, don’t get the wrong idea. Business is being taxed, so much so that we’re being priced out of the world market. But business must pass its costs of operations–and that includes taxes–on to the customer in the price of the product. Only people pay taxes, all the taxes. Government just uses businesses in a kind of sneaky way to help collect the taxes. They’re hidden in the price; we aren’t aware of how much tax we actually pay.”

In reality, it’s worse than that, because the corporations that will be able to pass on higher costs to the consumer will be the major multinational corporations, the franchises, the chains, whatever outposts of big business that haven’t already pulled out of California.

The victims, that will not be able to pass on higher costs to the consumer when their property taxes suddenly go sky high are the small family owned businesses. Many of these small businesses are multi-generational, and the only reason they have been able to stay in business is because their property taxes are manageable. But have a look at this next flyer.

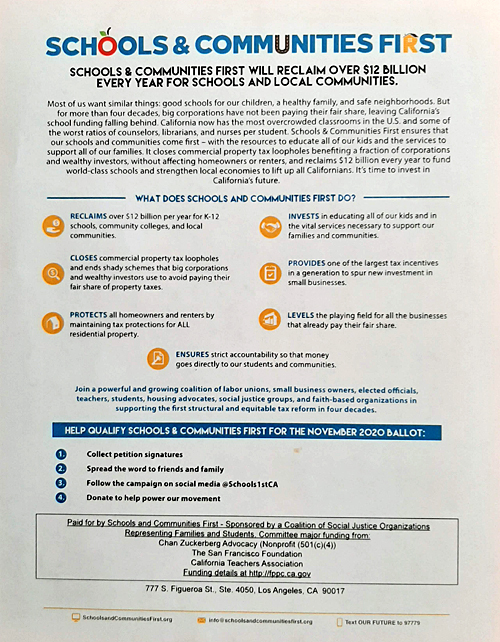

According to the CTA, the “Schools and Communities First” Act will “level the playing field for all the businesses that already pay their fair share.” Wrong. It will tilt the playing field in favor of the mega-corporations, taking away the last advantage of the little guys.

The dirty secret that the CTA in particular and California’s one-party political establishment in general don’t want voters to know is that over-regulation helps big business. The biggest, most financially secure businesses use regulations to consolidate their position at the top, while the smaller competitors die off because they can’t to afford to comply.

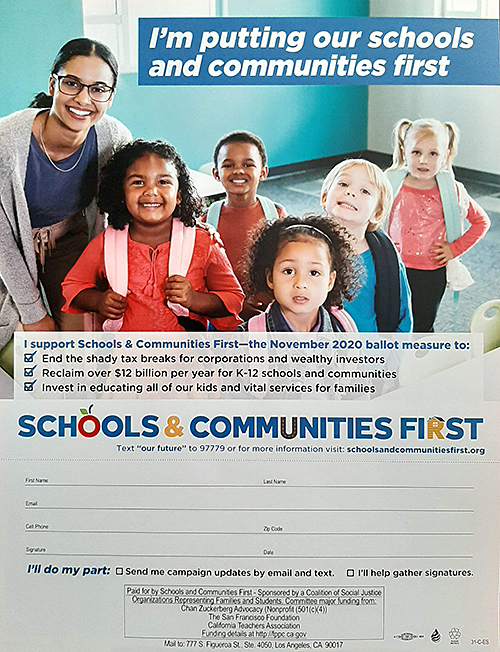

If you’re wondering how the CTA intends to get the “Schools & Communities First” Act onto the ballot, have a look at this next flyer. There’s big money behind gathering signatures, but in Los Angeles last week the CTA was making sure every available activist had a chance to get personally involved.

How could anyone refuse this pitch? Look at the boxes that are prechecked: “End the shady tax breaks for corporations and wealthy investors.” Too bad the biggest ones are the least harmed by this change in the law, while the mom and pop businesses are going to drop like flies.

As for “Reclaim over $12 billion per year for K-12 schools and communities,” well, that’s right, the estimated annual proceeds of $12 billion – 100 percent of which will be passed on to consumers in the form of higher prices – will be thrown into the maw of California’s public education budget.

The problem with this is simple: The educational policies supported by the CTA are not going to improve education. In fact one might say it is the educational policies supported by the CTA that have grossly undermined the quality of K-12 public education in California. So we’ll give them more money with no change in these policies?

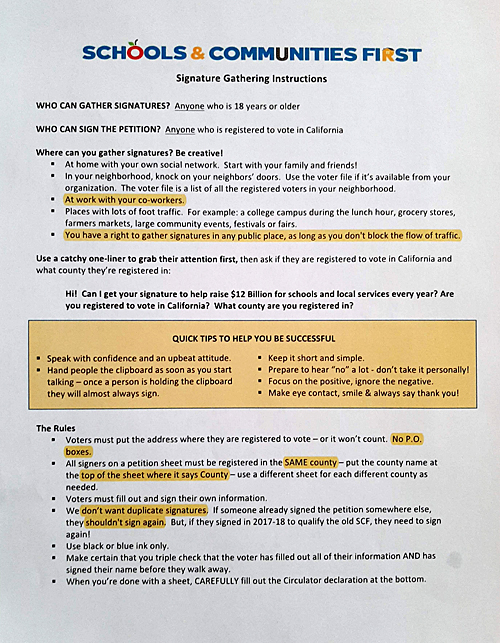

This next flyer shows the reach of the CTA, enlisting an army of teachers and other school employees to actively solicit signatures for the “Schools & Communities First” Act. But it’s important to note that the CTA, and the PAC it supports, does not need volunteer assistance.

According to the California Fair Political Practices Commission, the “top aggregated contributions” for the “Schools & Communities First” Act, Measure # 1864, already has collected $11.5 million, which even these days should be sufficient to pay professionals to gather the requisite signatures.

What Ought to be Preconditions for Increasing School Funding?

The problem with opposing measures like this are rooted in the very human and very virtuous urge most people feel to do the right thing. Who opposes something that will “help the children learn?” Who doesn’t want teachers to receive a “living wage?” The answer, of course, is that nobody apart from the most hardened misanthropes would ever oppose these things. The problem is that the educational policies the CTA pushes are not going to help the children learn, and the pay increases they want to give the teachers will not reward the best teachers.

For example, whether or not all public school teachers are underpaid is debatable, but clearly the finest teachers are underpaid, because the union work rules do not sufficiently reward the finest teachers. The Vergara case, not even heard by the California Supreme Court based on a technicality, offers compelling evidence of the damage caused by these work rules.

In the case, which challenged statutes governing layoff, dismissal, and tenure policies, the plaintiffs argued that by favoring seniority over merit in layoffs, by making it extremely difficult to fire incompetent teachers, and by awarding tenure after barely a 1.5 years of classroom observation, students were denied quality education. Moreover, the negative impact of these statutes had a disproportionate impact in low income communities. Watch the plaintiff’s closing arguments, made six years ago in a Los Angeles courtroom, to see how persuasive those arguments were and also to realize how much California’s students lost when that case died.

California’s teachers should be paid more when California’s teachers are truly held accountable for their performance and when incompetent teachers are fired.

One may argue endlessly about the effectiveness of union work rules, just like one may argue about Common Core and a host of other curricula that are, depending on who you ask, either necessary preparation for life in the 21st century or divisive and destructive indoctrination. But it wouldn’t matter if parents had a choice about where they send their children to school.

And this brings us to the other big issue, school choice. The CTA opposes expansion of charter schools, making the dubious claim that charter schools take money away from traditional public schools. The problem with that claim is that if the charter schools were defunded, returning that money to the traditional public schools, the charter school students would also return to traditional public schools, making crowded classrooms even more crowded. For much more on the fallacy that charter schools damage the finances of traditional public schools, read “Modest Strike Settlement Nonetheless Puts LAUSD in Even Worse Financial Shape.”

Moreover, why should charter schools, which compete for students, permit diverse educational strategies, and leave power in the hands of fully accountable principals to hire and fire teachers, be the only solution? Why are school vouchers considered a third rail by education reformers as much as by the opponents of vouchers? Why? Why not allow parents to receive vouchers that they can use to pay for their children to go to any accredited school they want, whether it’s public, private, charter, parochial, or home schooling? Why should parents whose children could never thrive in a traditional public school pay taxes to support those schools, then also have to pay tuition for private schools?

The bottom line with the California Teachers Association is that it does not want teachers or schools to be held accountable for their performance, much less to compete for students. They just want more money.

- Ringside: The Potential of Waste-to-Energy in California - April 17, 2024

- Ringside: How Much Water Will $30 Billion Buy? - April 10, 2024

- Ringside: Sacramento’s War on Water and Energy - April 4, 2024

Divide and conquer. First the business owner and then the homeowner. Pro 30:15 The leech has two daughters—Give andGive!

If this passes, assured there will be referendums, recalls, massive commercial property vacancies, hundreds of thousands of property tax appeals, incredible appraisal and court delays, many foreclosures and bankruptcies, some banks may go under.

And we haven’t considered resulting unemployment, social costs, drop in all property values etc etc.

And word has it commercial property owners will immediately charge hefty parking fees, “resort fees”, “for the kids fees”, sustainability fees, enviro fees, etc etc.

Imagine a day with six errands or doctor visits plus shopping stops.

Just might cost you at least 30 bucks……has your life changed!

And don’t choke on that $18.00 plant based burger……

The ambulance driver doesn’t carry cash or equivalents to pay to park and save you.

Seems passage is preordained, given the measure’s Orwellian name and propaganda.

Let’s cross our fingers on this one because voters DO seem to be catching on in spite of the relentless “it’s for the children” lies and other deceptions. LAUSD parcel tax Measure EEE was voted down 54% to 45% in June 2019, much to the shock of the usual suspects who promoted it and actually seemed to take it for granted that it would pass, even by the 2/3 needed. But it didn’t come close:

https://www.dailynews.com/2019/06/04/election-2019-in-early-results-measure-ee-tax-hike-for-la-schools-looks-to-have-missed-the-mark/

The CTA is a major democrat fundraiser and should have a label on the doc’s that say.. DNC Affiliate. If the Kaly dunces pass this … you know that next is the Homeowners and goodbye to being able to afford an already un-affordable house in Kaly… The counties and cities will increase property taxes every year like they did and older folks were taxed out of their homes. Stop voting democrat folks. Your very home depends on it.

Wyoming here I come…

9 months and counting…

NO MORE SCHOOL BONDS UNTIL THE STATE IS AUDITED AND ALL PAST FUNDS FULLY ACCOUNTED FOR. WHEN THE STATE REFUSES TO HAVE AN AUDIT THEN THERES NO GROUNDS FOR APPROVAL OF FURTHER FUNDS

1975 Economics 101 Junior High, Walnut Creek School District. Lesson learned, corporations DO NOT PAY TAXES! Any taxes are simply passed on to the customer in the form of higher cost for goods, or the burden is transferred to the corporation employees either through lower wages, delayed pay raises or layoffs which force remaining employees to work harder for the same pay level. If these options are not available the corporation can relocate to a location with lower taxes, move high cost processes off shore, or simply take down their signs and shutter their doors.

Do not pay taxes? Do you drive on roads? Enjoy security by a police department? Who will come if your house is on fire? Pay will tab for private school? Who keeps the common land tidy in your city? Great idea… no taxes… then we can go back to the middle ages!!!

Here we go again that it is going to help our kids, different wording just the same politicians saying the same thing over and over, just like the lottery was to help our schools and our teachers with less students in a classroom, wake up and see the pictures on the wall, teachers are even spending their own money to help their students to buy paper and pencils for the classrooms, no way should this be happening and in the end here in California the kids aren’t learning like most of the private school because they have small classroom and teachers can have the one on one learning. This prop 13 will be paid by us middle class people, one way or another. And we will be paying higher taxes if this goes though.

Public schools are going down the drain because successful parents/families are more and more taking their kids out of public schools and putting them into private schools, leaving a higher concentration of kids from struggling families. Like the concept of “concentrated poverty” concerning housing, there is a growing concentration of lower achieving kids in the public schools (speaking generally here).

Let everyone live where they can afford live; build government housing projects in unused areas and then have city buses available to get the low income workers to and from where they need to go. Sneak just a small handful of kids from impoverished homes into wealthy schools to help broaden those kids’ opportunities; but dump bus loads of kids from impoverished homes, and best believe me, parents with means will rip their kids out of those schools quicker than a presidential tweet.

Also… I’m not exactly sure that either Glendale or Burbank has the kinds of impoverished areas as I’ve spoken about (above), and I’m not at all familiar with Glendale, as I have my eyes set on Burbank at this time. Just more or less exploring the political landscape, taxes, real estate, schools and other things before I make the leap. I was actually talking about my observations in the Washington DC area where I presently live. I coined this that I have observed, “achievement flight”. Just another perspective, who really knows.

However, based on the article from the link in showandtell’s post, the tax increase aka Measure EE was in fact intended to “help pay for a labor contract agreement reached with striking teachers and ease its financial burden due to ballooning pension costs and declining student enrollment.” So maybe there is something to be said about the declining student enrollment thing I was eluding to. Absolutely no amount of money will fix the achievement gap between kids from families with either the financial means or organizational/planning skills to obtain private or charter schools, and the kids from families that really, really struggle.

You can put a sufficiently capable kid from a high-functioning family in a wooden shack with nothing more than a text book, pencil and paper, and even a half-witted teacher, and that kid will still be able to master the materials enough to pass the state exam, come hell or high water if he/she has the right support at home. My two cents, as my own history has allowed me to observe close up and personal different economic groups and families.