Senator Mike McGuire. (Photo: Kevin Sanders for California Globe)

Proposed Bill To Require State Pension Funds to Divest Completely From Russian Investments

Legislation would divest at least $1.7 billion from Russian assets

By Evan Symon, March 1, 2022 11:56 am

A bipartisan-backed bill to require the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS) state pension funds to divest completely from any Russian assets was announced on Monday, with the intention of being formally introduced as soon as possible.

The bill, to be authored by Senator Mike McGuire (D-Healdsburg) and co-authored by a mix of Democrats and Republicans, would have both state pension funds, as well as all state agencies divest of financial holdings associated with Russian assets. In addition, the bill would strongly urge all Californian companies to follow suit, with the state also halting the awarding of state contracts to companies which do business with Russia. An urgency clause attached to the bill also means that the bill will be fast tracked through both houses, with Newsom signing and propelling the new law into effect in a matter of weeks rather than months.

According to CalPERS spokeswoman Megan White, the pension fund fluctuates on Russian holdings based on the market, with the amount usually between $900 million and $1.1 billion of the total $485 billion fund amount. CalSTRS meanwhile only has around $500 million invested in Russian assets out of the $320 billion total. While both funds hold only a very small amount of Russian debt when combined, investments in Russian companies such as state-owned energy company Gazprom and Russian banks Sberbank and VTB would be done away with as a result of the bill.

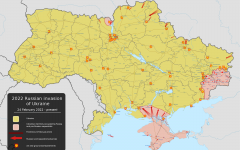

McGuire is writing the bill as a direct consequence of Russia’s invasion of Ukraine, which began on February 24th. While Russian investment only counts for less than 1% of both funds total investments, lawmakers believe that dispossessing the $1.7 billion in investments, as well as more divestitures through state agencies and Californian companies, will add to the national and international pressure on Russia.

“We must stand strong for the people of Ukraine,” said Senator McGuire in a statement on Monday. “The world is watching the atrocities taking place in Ukraine. It’s sickening. California has unique and remarkable economic power in this circumstance. As the fifth-largest economy in the world, we must use this power for good. We can help stop this autocratic thug, Putin, by advancing this critical legislation and enacting our own financial divestments.”

Support for the proposed bill was swift on Monday and Tuesday, with lawmakers on both sides of the aisle quickly supporting it.

“Russia’s unprovoked and unjustified invasion of Ukraine is a threat to democratic freedoms and global stability,” noted Senator Susan Eggman (D-Stockton). “The loss of life to satisfy the ego of a fragile tyrant is unconscionable and there must be consequences. This legislation builds upon the strong economic sanctions being pursued by the Biden Administration and our allies.”

Assemblyman Jordan Cunningham (R-Templeton) added that “An unprovoked and illegal invasion of a sovereign nation is grounds for divestment. California must stand with the people of Ukraine.”

McGuire’s bill to be introduced soon

In an unusual move, both Gov. Newsom and state pension fund leadership indicated support for the bills ahead of introduction. In Newsom’s case, he has rarely given early committal to bills in the past, making his early support for the as-of-yet unnumbered bill all the more surprising.

“California stands against the unprovoked aggression against the people of Ukraine, and we continue to evaluate potential actions or policies related to the developing circumstances,” said Newsom’s office in response to the bill.

With no opposition to the bill expected to be formed, and other lawmakers calling on even more divestment from Russia through county and other funds, political commenters on Tuesday said that the bill would almost certainly go through.

“This is an election year,” Mary Simmons, a New York-based financial tracker looking at state responses to the war, told the Globe on Tuesday. “If anyone opposes the Californian bill, that would be election suicide. It makes you look like you are on Russia’s side on this.”

“California’s divestment, if passed, won’t be all that much to the trillions of worth and worldwide investments of Russian companies, but it nevertheless is something and pretty much what the state can do in this situation. All states doing things like this for that matter. A billion here, half a billion there and it adds up to something pretty quick when combined.”

“Putin knew that Western countries would do this and really hurt Russia’s financial situation, but they are also trying everything they can to keep Western companies from leaving right now too, indicating that the West’s response was greater than they thought it would be. California is adding to that dog pile with this bill.”

Senator McGuire’s bill is expected to be formally introduced soon, with passage also being hoped to be fast tracked to being signed into law as well.

- San Diego Country Supervisor Jim Desmond Calls San Diego New Epicenter Of Illegal Crossings By Migrants - April 27, 2024

- Oracle Moving Headquarters Out Of Austin Only 4 Years After Moving Out Of California - April 26, 2024

- Congressman Adam Schiff Robbed of his Luggage in San Francisco Car Break In - April 26, 2024

Good going Democrats – buy HIGH, sell LOW…..

Any of you numbnuts EVER taken a Finance or Economics class??? Or were you too busy in your Social Studies and Community Organizer electives???

*any losses are made up by taxation.

Wish my 401k and other investments had that loss option too.

Not their only problem… Fed Chair Powell: Possible to have more than one Reserve Currency

???? No more SSN, Disability, State and Federal Pensions, 401k, IRA, SNAP, Medicare, Medicaid… Because our printer will be off. ??????