Downtown San Diego Sunset. (Photo: Dancestrokes/Shutterstock)

San Diego City Council Eyes Sales Tax Increase to 8.75%

Initiative would compete with a similar 0.5% increase proposition already on the ballot for November in SD

By Evan Symon, March 15, 2024 2:45 am

Momentum is growing both for and against a proposed sales tax increase in San Diego by 1% from 7.75% to 8.75%. The San Diego City Council rules committee is due to make their decision on the proposal next week.

Currently, San Diego has a city sales tax of 7.75%. With San Diego making more through tourism and other special taxes, the sales tax is one of the lowest in California amongst larger cities, with San Francisco having an 8.63% sales tax, Los Angeles having a 9.5%, Long Beach 10.25%, Sacramento 8.75%, and Oakland 10.25%. San Diego also has one of the lowest sales taxes within the county, with nearby cities such as Chula Vista having 8.75%.

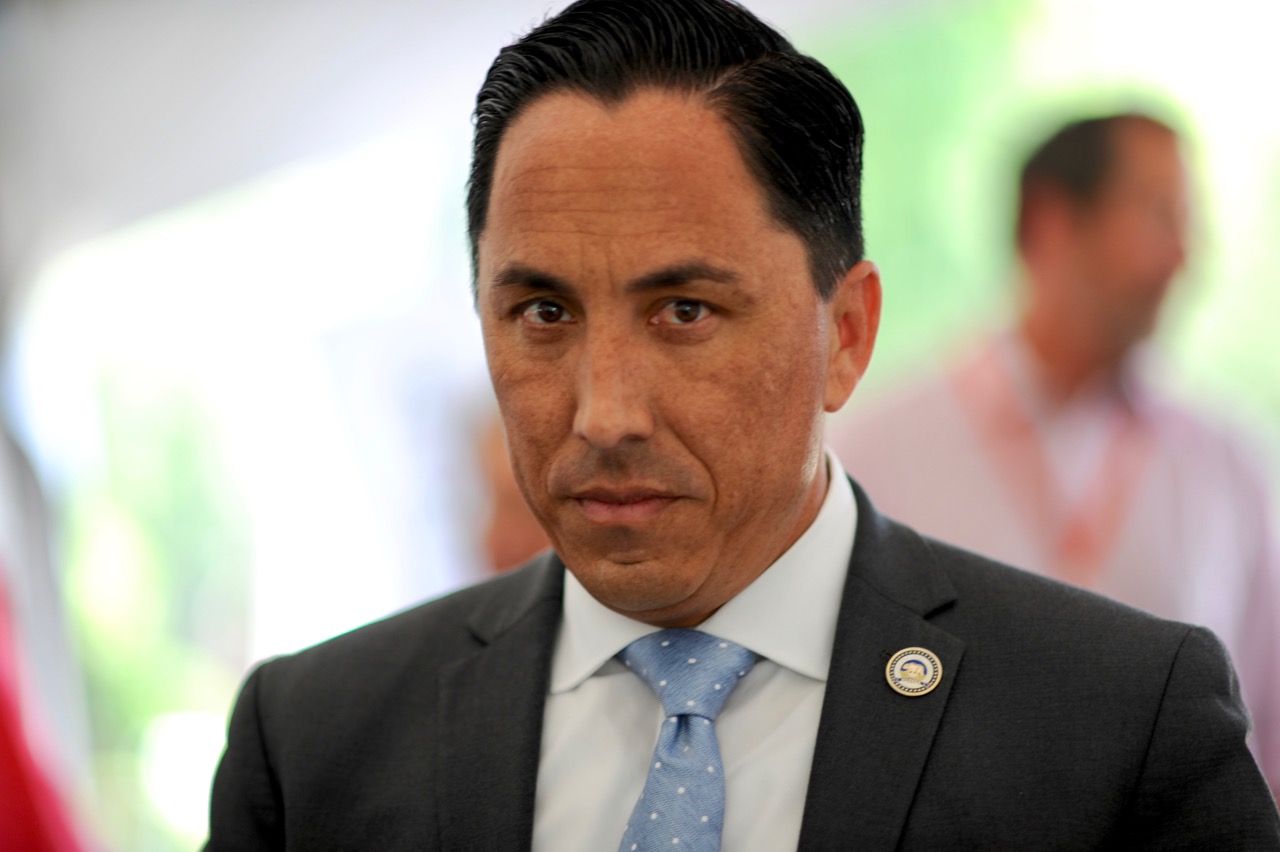

However, for the past few years, San Diego lawmakers have considered putting a raise to the citywide sales tax to a vote. Both San Diego City Councilman Raul Campillo and Mayor Todd Gloria in particular have pushed for a 1% increase. While vague at first, both of them have in recent weeks focused on how that money would go to the general fund. They have also specified that infrastructure repairs and improvements would benefit from the increase, especially roads.

“If San Diegans want to see progress, this is the most effective way I can see for us to fix the damn roads, repair our storm water systems and make the other necessary investments,” said Gloria. “We are still going to fall far short. In fact, we have $9.2 billion worth of infrastructure needs over the next number of years that far exceeds our city’s resources. This would help in rebuilding the city.”

Campillo added that “This is not just one time funding. This is money with a plan. The plan would send the additional money to the city’s general fund, with a plan to improve the roads, and maintain them. Which is the part of our budget that is most under pressure. Other cities in the county of San Diego where people go shop, go have fun, they have a higher sales tax than us right now. They have that extra cent, that extra penny. We’re asking voters to step up for us right now so we can invest for their families going forward in the future.”

The 1% sales tax initiative, dubbed “Penny for Progress” is set to go before the San Diego City Council rules committee on Wednesday. Should it pass, the entire Council will vote on it. Should it pass again, the initiative will be made into a proposition for a November vote where, because of it being for the city general fund, it would need a simple majority of voters approval.

However, there is also a major issue to the 1% proposal in that there is already a .5% sales tax increase proposition on the ballot for November in San Diego. A ballot initiative to fund transit projects across the county backed by transit group Let’s Go! San Diego and the San Diego Association of Governments (SANDAG) received enough signatures in January to qualify for the ballot.

With two potential large increases now looking likely for San Diego, experts have said that voters would likely either reject both or only vote for one because of the overall cost and high prices affecting many citizens.

“Both combined would bring the sales tax to LA levels. Above San Francisco levels,” Southern California tax advisor Lara Cartwright told the Globe Thursday. “That is a lot to be asking for people at a time with high costs. All these pennies they’re talking about. They really add up fast on even an individual level.”

“People will be voting with their wallet. Any year with high prices they do. Gloria will have to make a really hard case for this to even go on the ballot and be clear why it is needed. Similarity, the transit tax proposal will need to convince a lot of voters too. Tax increases will be hard to justify this year even for needed things by cities. People will say to get the money elsewhere or cut back on other programs. They need to prepare for that pushback, because it is coming. If both pass, sales tax would be 9.25%. That’s a big jump.”

The San Diego City Council rules committee is due to make their decision on if the proposal will go to a City Council vote this coming Wednesday.

- San Diego Country Supervisor Jim Desmond Calls San Diego New Epicenter Of Illegal Crossings By Migrants - April 27, 2024

- Oracle Moving Headquarters Out Of Austin Only 4 Years After Moving Out Of California - April 26, 2024

- Congressman Adam Schiff Robbed of his Luggage in San Francisco Car Break In - April 26, 2024

San Diego voters will likely vote no on the sales tax increases but the criminal Democrat mafia that now controls San Diego will probably create the votes through voter fraud and rigged voting machines to pass the sales tax increases?