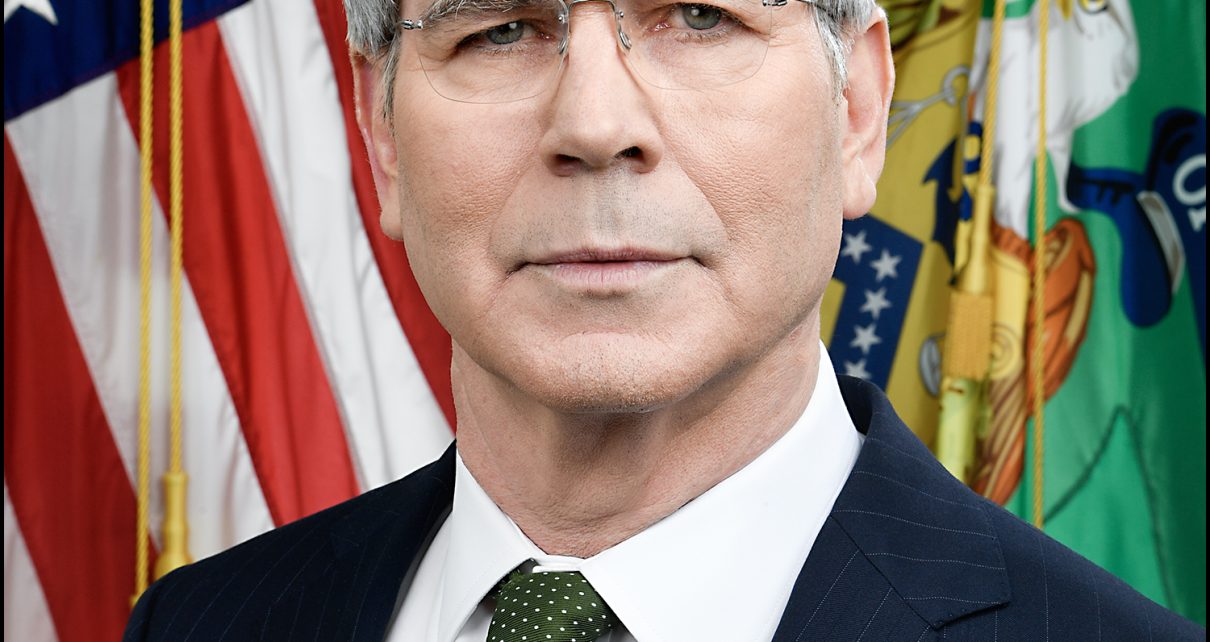

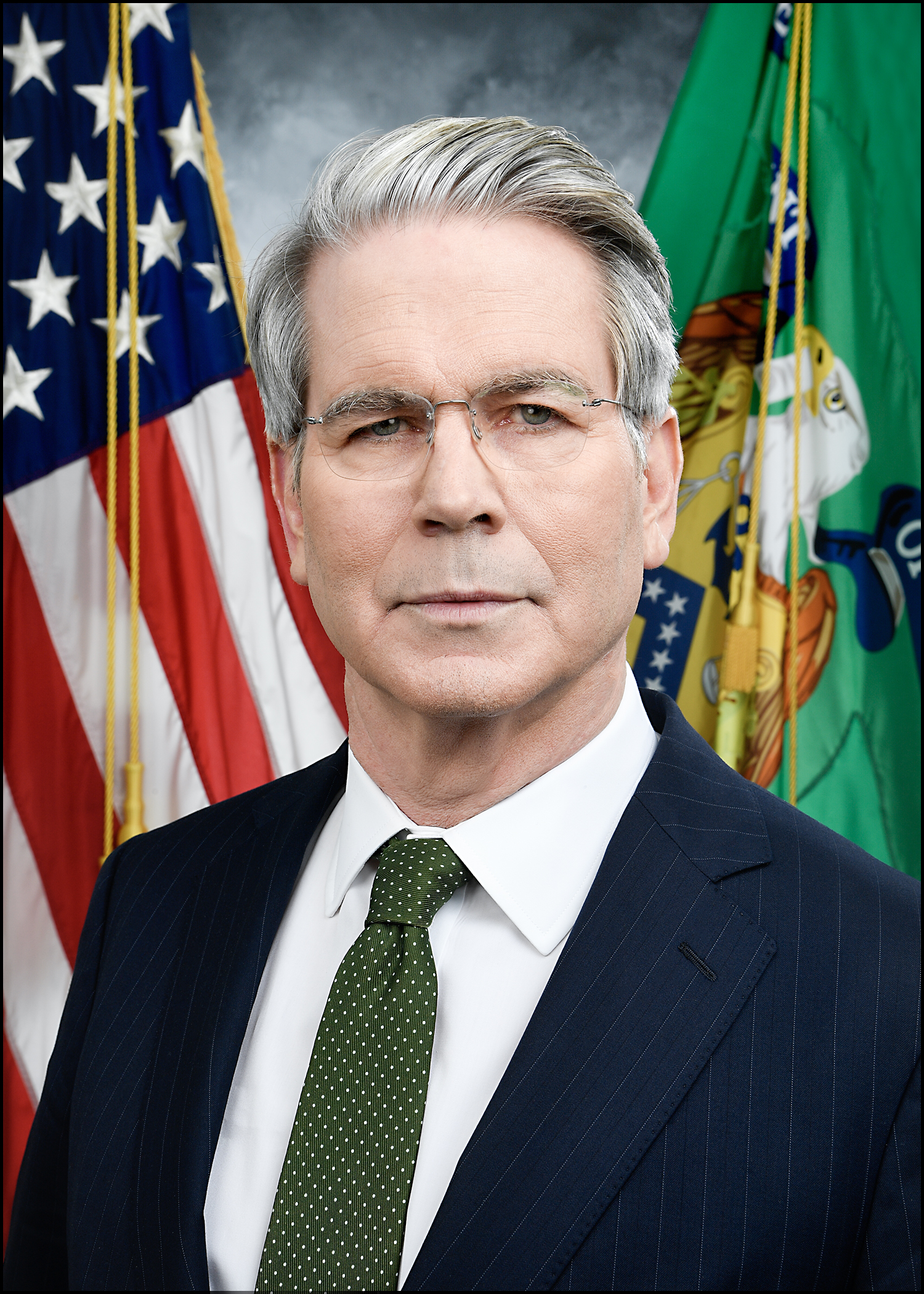

Treasury Secretary Bessent Says Great Economic Growth Ahead in 2026

Rather than the Biden plan for immigration, interest rates, and inflation, Trump’s plan is investment, innovation, and income

By Katy Grimes, January 9, 2026 11:54 am

In addition to pulling out of the United Nations Green Climate Fund, U.S. Treasury Secretary Scott Bessent announced this week that there is important growth ahead in 2026.

The U.S. Department of the Treasury notified the Green Climate Fund (GCF) that the United States is withdrawing from the Fund and stepping down from its seat on the GCF Board, effective immediately, Bessent announced this week. “Our nation will no longer fund radical organizations like the GCF whose goals run contrary to the fact that affordable, reliable energy is fundamental to economic growth and poverty reduction.”

Thursday, Bessent spoke before the Economic Club of Minnesota. Here are some excerpts of his talk:

In 2025, the President laid the foundation for powerful economic growth with: the historic passage of the One Big Beautiful Bill, which is actually the Working Families Tax Cut Act; trade deals that rewrote decades of global misalignment; and an ambitious deregulation agenda that empowered American entrepreneurs and businesses. Now, in 2026, we will reap the rewards of President Trump’s America First agenda.

He said “the Biden Administration made life impossibly expensive through a toxic mix of what I call the three I’s: immigration, interest rates, and inflation. Hardworking families in this great state and across the country experienced the burden of Biden’s America Last economic policies, suffering from higher rents, higher prices, higher borrowing costs, suppressed wages, and elevated crime.

Through the three I’s of immigration, interest rates, and inflation, President Biden inflicted tremendous harm on our economy. But President Trump is creating prosperity and long-term opportunity for all Americans through three I’s of his own: investment, innovation, and income.

President Trump led a 12-month transformation of our economy, which delivered roughly 4% GDP growth in his first two full quarters in office and nearly 3% GDP growth in the fourth quarter, even amid a Democrat-led government shutdown. This growth is just a harbinger of what’s to come.

Bessent then explained the President’s strategic use of tariffs:

The use of tariffs has encouraged corporations, both at home and abroad, to invest directly in the United States. His message is simple: Hire your workers here. Build your factories here. Make your products here. And business leaders are answering the call.

The Biden administration displayed outright hostility to America’s innovators and entrepreneurs. An endless string of regulations increased compliance costs, and heavy taxes made it more expensive than ever to do business. But President Trump has fixed that.

On the tax front, the Working Families Tax Cut encourages heavy investments in innovation by restoring immediate expensing of R&D costs. Businesses can now fully deduct domestic research and developmental outlays in the year incurred, instead of having to spread these costs over several years. This new tax provision empowers companies to secure larger tax benefits sooner, allowing them to invest more of their capital into R&D. It also encourages the buildout of high-precision manufacturing here at home, which will lead to high-paying construction jobs and factory jobs.

Incomes shrunk sharply under President Biden. Real weekly wages decreased by 2% during his presidency. All the while, embedded inflation made it almost impossible for Americans to catch up. But President Trump is fixing that too.

Thanks to the President’s pro-worker, pro-growth policies, real wages have climbed more than 1% since he took office, with blue-collar wages increasing at one of the fastest rates in decades. This is just step one in the President’s plan to raise incomes for all Americans.

The President’s bill prevented a $4.5 trillion tax hike, allowing the average American to keep up to $7,200 more in annual real wages and the average family of four to keep up to $10,900 more in take-home pay. For millions of families, such savings are the difference between making a mortgage payment, buying a car, or sending a child to college.

The President’s bill raised and made permanent the Working Families Child Tax Credit. It delivers for seniors by giving 88% of retired Americans a new deduction that eliminates tax on Social Security benefits. And it codifies no tax on tips and no tax on overtime pay so Main Street workers can keep more of their hard-earned income—something the Grinch who stole prosperity in the Governor’s Mansion has not done in the Minnesota tax code.

“The upshot of President Trump’s trade agenda is trillions of dollars in new investment across a broad cross-section of industries—from automotive manufacturing and semiconductors to tech and pharmaceuticals,” Bessent said.

Treasury Secretary Bessent concluded:

Taken together, President Trump’s policies have delivered a historic economic comeback in record time. Where the previous administration created stagnation and privation, this President has unleashed investment, innovation, and rising incomes. The result is an American economy that is stronger, more resilient, and more affordable for working families.

With capital flowing, productivity surging, and prices easing, the stage is set for robust, non-inflationary growth in 2026. The Trump economy is back—and its best days are still ahead.

Read his entire speech for more detail on how your life will get better in 2026.

- SMUD CEO Announces ‘Retirement’ Following Globe Exposé on $1M Salary - January 9, 2026

- Treasury Secretary Bessent Says Great Economic Growth Ahead in 2026 - January 9, 2026

- California Governor Gavin Newsom’s Fairytale State of the State - January 8, 2026

GREAT news!

Bessent used to work for George Soros.

https://www.newsweek.com/scott-bessent-connection-george-soros-trump-treasury-secretary-1984669

Gee, I guess he’s had a significant shift in his thinking and philosophy since then as many many many of us have. I’ll take it.