Potholes filled with sandbags in Compton (Photo: youtube)

Are California Roads Still a Mess Even When Cities and Counties are Receiving Millions From Gas Tax?

‘I find it fascinating how quiet they are about the amount of money they are raking in’

By Katy Grimes, March 12, 2020 2:15 am

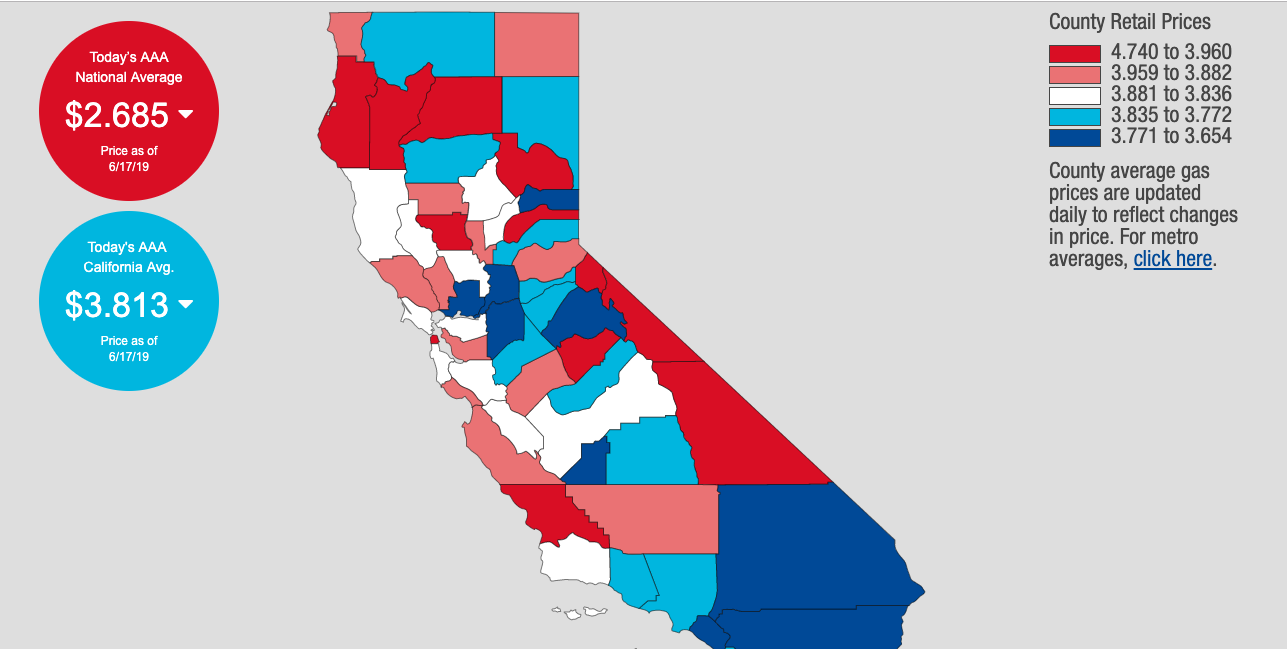

California has the highest gas taxes in the country, and some of the worst roads and highways.

Californians were promised that if voters refused to repeal Senate Bill 1, the gas tax, as Proposition 6 on the ballot in 2018, roads throughout the state in terrible disrepair would be finally improved and a regular maintenance schedule would once again take place.

Prop. 6 was an 2018 initiative that would have repealed SB 1 – the gas/diesel and vehicle registration tax hikes.

Representatives and elected officials from California’s cities and counties opposed the Prop. 6, SB 1 gas tax repeal, claiming that they would not be able to fund repaving and road maintenance projects without it.

SB 1 imposed a massive tax increase on auto fuel of an additional 12 cents per gallon on gas, an additional 20 cents per gallon on diesel fuel, and a significant increase in vehicle registration costs.

When Proposition 6 was voted down in 2018, voters essentially approved more future gas tax increases. A YES vote would have repealed the gas tax imposed by the California Legislature in 2017. A NO vote approved more gas tax increases.

Few voters realized that 20% of the gas tax was allocated for High Speed Rail and mass transit, and $100 million annually allocated for more bike lanes, pedestrian crosswalks and sidewalks.

Proposition 6 also would have created voter approval (via ballot propositions), along with legislative passage and the governor’s signature, to impose, increase, or extend fuel taxes or vehicle fees.

The Howard Jarvis Taxpayers Association reminded us that 30 years ago, in 1990 voters approved in Proposition 111, a 9-cents-a-gallon tax increase combined with a 55 percent increase in truck weight fees, promising road repairs and ongoing maintenance.

Californians have been paying for decades, extra taxes specifically for road maintenance that never happened.

Flash forward to SB 1’s hefty gas taxes and vehicle registration fees, and voters want to know just how much money California cities and counties are receiving from the gas tax, and if roads are being repaired.

What Voters Were Promised

Voters were promised passage of SB 1 was the chance to get back to a better cycle of repairs. City leaders claimed they have not been funding road maintenance at an adequate level. But there was no discussion of where the 1990 gas taxes went.

The Sacramento region was promised around $55 million for roads and transportation the first year.

How much gas tax funding has Sacramento County received, and is the money going toward road repairs and maintenance?

SB1 Revenue by County, according to the State Controller’s Office in the Road Maintenance and Rehabilitation Account (RMRA), just for January 21-February 21, 2020 – one month:

- Sacramento County – $2,001,963.54

- Los Angeles County – $9,653,595.94

- San Diego County – $3,738,592.57

- San Francisco County – $736,000.11

- Santa Clara County – $2,009,723.64

- Ventura County – $1,019,938.99

- Orange County – $3,287,576.38

- Fresno County – $1,651,429.62

Total for all California cities, the State Controller reports, for Collection Period January 01, 2020 – January 31, 2020, Streets & Highways Code section 2032(h)(2), Road Maintenance a total of $52,178,704.13 was sent to cities. Just for January.

The year-to-date for all California counties, Sept, 2019 through February 2020 is $315,236,029.47 – that’s $315 million.

- Sacramento County received $12 million and some change. Just since September. Notably, Sacramento County wants to double the transportation sales tax again.

- Los Angeles County received more than $58 million in SB 1 gas tax money just since September.

- San Diego County received $22.6 million.

- Santa Clara County received $12 million.

- Riverside County received more than $16 million – just since September.

- Orange County received nearly $20 million.

- Alameda County received $9.6 million – all just since September.

- Citrus Heights $832,000.

- Folsom $742,000.

- Galt $250,000.

- Elk Grove $1,600,000..

- City of Sacramento $4,800,000

- Isleton $8,000.

SB 1 was predicted to raise $4.4 billion in 2018, and up to $5 billion a year every year, with the promise it would be used for the decades long statewide road maintenance backlog.

We know what has been sent to the cities and counties. Now we need to know how the money is being spent and why some counties are talking about more transportation taxes in the next election.

“I find it fascinating how quiet they (cities/counties) are about the amount of money they are raking in,” one local taxpayer advocate said.

You can look this up for yourself on the State Controller’s website.

Next: California Globe will contact Caltrans and a few of the cities and counties regarding what/if road work is being done, and if the money is going into the general fund or is set aside in a special “roads” account.

- Step Over the Delirious Drug Addict to See Sacramento’s Urban Dreams Art - August 12, 2025

- Gavin Newsom Sends Strongly Worded Letter to President Trump re: Redistricting - August 11, 2025

- Californians Choosing Between Gas or Groceries, Utility Bills or Rent - August 11, 2025

Roads and bridges, roads and bridges. Oh, and the children. Don’t forget the children!

This particular money theft from taxpayers by CA govt “leaders” for their slush funds is so unconscionable that there can be no trust or peace about it until the day there is real action to hold these people solidly accountable for what they’ve done and continue to do. At the moment they don’t give a damn because they’ve seen they don’t HAVE TO give a damn. About anyone or anything except their own sorry selves.

This is a very important story. Local governments in Sacramento county are now collecting about $60 million more each year In transportation funding from the gas tax/registration fee hikes of SB 1. That’s over 55% of what they would have collected had their failed 2016 failed attempt to double the Sac County transportation sales tax been approved by voters. Now they are AGAIN seeking to double the transportation sales tax in November, from the current 1/2% to 1%. If approved by voters, Sacramento local governments will pocket 155% MORE in transportation funding than what they sought from their failed 2016 sales tax hike – $175 million more each year ($8.4 billion more over the term of the tax hike). This is sheer government greed.

To put this in perspective, their proposed doubling of the transportation sales tax would cost the typical Sacramento family about $17,750 over the life span of the tax hike – that’s on top of the recent 1/2% sales tax hike on City of Sacramento residents.

It would push the sales tax rate on Sac city residents up from 8.25% to 8.75% – 1.5% HIGHER than the current sales tax rate charged in ultra high-cost San Francisco. This would be a punishing rate of taxation on everybody, but particularly for working families, seniors on fixed incomes and the poor who’re already struggling to cope with California’s sky high cost of housing.

I drive to Fresno on Hwy 99 and Hwy 41 most days, passing the boondoggle “high speed” rail construction. All the way, I try to dodge the large potholes, while fuming that the state doesn’t maintain the roads and highways after paying so much in taxes that are SUPPOSED to repair our roads and add much needed lanes. Our small town of Dinuba also has potholes that aren’t fixed, or if they are, are repaired so poorly that they are still rough. BTW, I worked very hard to help Prop 6 be defeated, but with the deceptive wording, people thought they were voting AGAINST the tax, not FOR it.

You’re so right… Without Atty General Becerra and his ilk’s contempt for the voter and thus their willingness to engage in lies and trickery, what do they have to offer? Nothing, that’s what.

What do you expect when electing democrat , after democrat, after democrat? For things to get better?

the people of each City/ County need to form a whistle blowing committee to keep the gas tax money that the officials regulate in check for what it’s meant for if not then take the appropriate actions to make it so