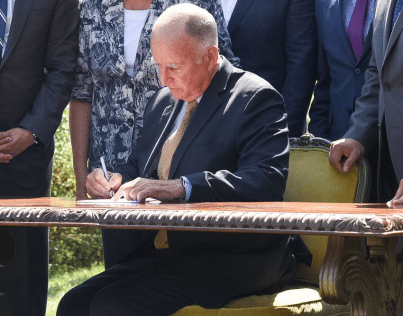

Assemblyman Miguel Santiago (Photo: Kevin Sanders for California Globe)

Bill That Would Establish a California Run “I-Bank” Polarizes State Lawmakers

Aside from the fact that a state-run bank is something out of 1984, this is a very dangerous precedent

By Evan Symon, July 10, 2020 3:51 pm

A new bill in the Assembly would create a publicly owned state bank that would give loans to city governments and small businesses, has gained traction during the extended legislative recess and has become poised to be one of the “hot button” bills this session.

The I-Bank

Assembly Bill 310, authored by Assemblyman Miguel Santiago (D-Los Angeles), would establish the California Infrastructure and Economic Development Bank, or I-Bank for short. The bank would be run out of Governor Gavin Newsom’s Office of Business and Economic Development. An executive director chosen by the Governor would lead the I-Bank, along with a board of directors that would be picked by the Infrastructure and Economic Development Bank Commission. The Commission itself would be comprised of the Governor, state Treasurer, and the state Controller.

Under the bill, the I-Bank would be allowed to accept deposits and join both the Federal Reserve System and the Federal Home Loan Bank System. The bank would act like a credit union for local governments and small businesses, with around $9.9 billion being funded into the I-Bank from California’s Pooled Money Investment Account to allow for loans and credit.

Supporters push for bill to allow for more direct, local relief

AB 310, also known as the Bergeson-Peace Infrastructure and Economic Development Bank Act, had begun life last year as a jury selection bill where it fizzled out after being passed by the Assembly. After AB 857 was passed last year allowing for the establishment of public banks in California, a state bank became a possibility. While only cities such as Los Angeles started state banks beginning in October of 2019, the COVID-19 pandemic and ensuing economic crisis financially hurt local governments and small businesses.

Assemblyman Santiago, as well as other supporters, used the crisis as a way to create the I-Bank to assist them with state funds that would have otherwise been difficult to divest from the state’s general fund to struggling local governments and small businesses.

“Let’s take 10% of the money that California already holds in its checking account, and let’s help Main Street,” said Assemblyman Santiago in a press conference. “We can structure a bank that actually is accountable to the people and does what the people want it to do.”

His office continued in a follow-up announcement that the bank would help those hurt in the current crisis “by lending to small businesses at reasonable rates and provide local governments with a stable source of financing.”

The lack of federal assistance coming in was also noted by supporters.

“You can’t count on the federal government to come and rescue us so the state must do its part to save our cities and save our small businesses,” noted Assemblyman Ash Kalra (D-San Jose).

However, the bill has brought in substantial opposition from state lawmakers as well.

Opponents to AB 310 note state run issues, Governor having large amounts of control over I-Bank

Those who oppose AB 310 note that a state run bank bypasses critical stages in the legislative process when funding is decided on in budgets and through bills.

“Aside from the fact that a state-run bank is something out of 1984, this is a very dangerous precedent,” noted financial expert David Wilson in an interview with the Globe. “Just look at it. The Governor essentially picks everyone involved who decides what loans and lines of credit can be given and to whom.”

“On top of that, these financial decisions aren’t going through the Senate or Assembly or through proper channels to make sure it’s all on the up and up. Instead, they’re going through a bank. A bank run by the state that can approve whoever much more quickly and with much less digging.”

“This bill is only up because small businesses are hurting and a lot of places are facing budget crunches due to less tax money coming in and higher health budgets. And yes, schools and other places hurt by this do need money. But both the federal government and the state have been working on loans themselves, or have fixed budgets that have school systems taking out short-term loans in between funding gaps. We’ve been finding solutions by and large.”

“But a state run bank, that’s going far. They’re using the crisis as a means to get something they’ve wanted to have for awhile. If it’s passed, yes, it might help some people out, but in the long term, when the economy gets better, it would just be an extension of state funding. And it would be state funding decided on not by two houses and an executive branch, but by solely the state executive branch and their personal picks on who oversees it. Read the bill. They have a hand in picking everyone involved with little oversight.”

“This is what would happen if Congress legalized and funded everything the Harding administration did in the 20’s. It’s giving way too much behind the curtain of the crisis going on.”

AB 310 is expected to go before the Senate Governance and Finance Committee when the session resumes later this month.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

Total, 100% corruption. Newsom will use this to favor his cronies that in turn favor him with cash. He will use the leverage to take over local governments and impose the left wing agenda on business owners. This is right out of Obama’s playbook.

Sounds to me like a slush fund from the taxpayers to Democrat buddies.

Yes, this pos called gov is a liability to this State, he is out of touch with reality. What a panzi

Yes, this so called gov is a liability to this State, he is out of touch with reality. What a panzi

CW and JF: You’re both absolutely right. We don’t want Tom Steyer & Co., never mind Newsom, anywhere near something like this. It’s a nightmare.

A bank with no responsibility for losses, doling out money “for doing the right thing”. And what exactly will be the, the…. You know. The Thing?

We need to defund the year around legislature so they don’t have time for all of this nonsense.

Another way to screw the citizens of California. They have no shame. You know where the money is going…..straight into their pockets. Thank God that I am almost retired and will be moving to another state.

Stand your ground and join NCS51.com to form a new 51st California state with our US Constitution modeling after W. Virginia in 1861.

This proposal for a government retail bank is like a chapter out of Robert Caro’s book The Power Broker about how Robert Moses, the Parks Commissioner of New York in the 1930’s to 1960’s, created his own slush fund by holding a dinner every year at Christmas time for wealthy people. These wealthy people could buy influence by giving money to Moses that did not have to go through the democratic process of a city council and public hearings. You don’t hear environmentalists screaming about this do you? This could create a slush fund that could go around CEQA and other environmental laws. We’re shifting to a Fascist like government where there is only symbolic separation between government and business.

Defund Newsome & his cronies! Better yet, Recall Newsome & his cronies!

The bank will be linked to Bill Gates’ microchip (patent # 060606) which is linked to something like the COVI-PASS which will prevent you from buying or selling anything if you are not covid-compliant. Does this sound like a familiar story? Oh yeah, and just to make this even scarier-because-actually-happening, have you noticed the signs about no cash accepted because of a “national coin shortage”.

Prediction. Once this bank is established Democrats will give other banks the PG&E treatment and eventually force them out of business. Their only option will be to surrender control to the state or close.