Assemblywoman Luz Rivas. (Photo: Kevin Sanders for California Globe)

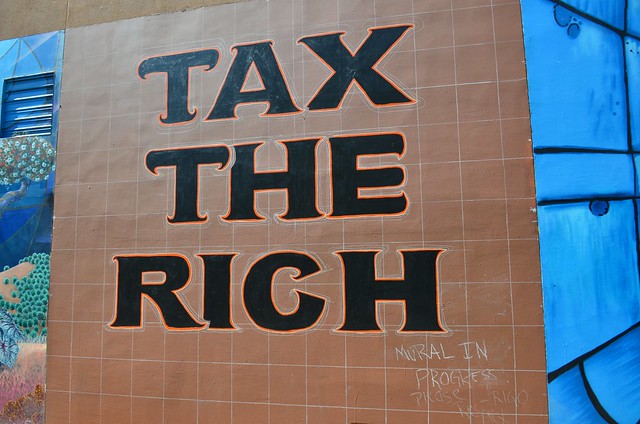

Deja Vu: Another Wealth Tax Bill Introduced in Assembly to Combat Homelessness

As more businesses and residents flee the state, this bill would increase corporate taxes, incomes of people who make over $ 1 million a year

By Evan Symon, December 11, 2020 2:38 pm

A new bill was introduced in the Assembly this week that would simultaneously increase corporate taxes, raise income taxes on citizens making over $1 million a year, and eliminate corporate tax “loopholes.”

Assembly Bill 71, jointly authored by Assembly members Luz Rivas (D-Arleta) and David Chiu (D-San Francisco), aims to create a homelessness solutions fund dubbed the “Bring California Home Fund.”

To fund the program with at least $2.4 million, AB 71 would specifically increase the corporate income tax to historical high rates to create a more “progressive” corporate income tax, would increase the personal income tax for anyone in California making more than $1 million, eliminate or limit corporate tax loopholes including the water’s edge election, and would “mark to market” unrealized capital gains and repeal step-up in basis inherited assets, raising the amount generated from capital gains.

Assemblywoman Rivas and Assemblyman Chiu wrote the the bill primarily to combat homelessness. In AB 71, they point out that homelessness is a crisis in California, as over 150,000 people in the state have experienced homelessness in the past year. Increases in homelessness in 2021 are also expected due to COVID-19 and eviction protection measures expiring. The bill also notes that those who are homeless face a greater chance of contracting the virus.

The Assembly Members argue that the new program is needed to halt the growing homelessness trend and that a tax on wealthier citizens and entities in the state is the best solution.

“Hundreds of thousands of Californians are either experiencing homelessness or experiencing housing insecurity. While California has implemented short-term, piecemeal solutions to address homelessness, the ultimate solution is to invest in an ongoing, permanent source of funding to tackle this crisis,” explained Assemblyman Chiu in a statement on Thursday.

Growing discontent against AB 71

However, AB 71 has received a growing amount of scrutiny this week, with many comparing it to the failed AB 2088 earlier this year. AB 2088, authored by Assemblyman Rob Bonta (D-Oakland), would have created one of the largest wealth taxes in the world. The bill, designed to raise as much as $7.5 billion for the state, would have raised taxes for wealthy residents by as much as 16.8% and would have followed people even if they had moved out of state for up to 10 years. Despite much interest, AB 2088 fizzled out in August largely due to the backlash against it.

“It’s absolutely crazy,” Los Angeles-based financial consultant Richard Ritz told the Globe. “We’ve been seeing wealthier people leave the state for years because of high taxes, including, most recently, Elon Musk. Especially the Bay Area.”

“A lot of wealthy people had that wealth tax proposal earlier this year as the trigger to move, and now many who stayed after it was defeated are looking at this one for being a trigger. Not so much in SoCal, but clients up in the Bay Area sure are.”

“That’s the thing about wealth taxes. For as much as people celebrate them, they’re flawed from the beginning. You estimate the generated income based on current levels, but if a lot of wealthy people leave, that estimated income falls way down. So you wind up with an underfunded program, a smaller group of wealthy people to tax, and doom the state to a smaller overall budget the next year.”

“If this was a state with lower taxes and the proposed program was for something like parks, beaches, or something for all the public, maybe it would be acceptable. Maybe. But right now, it’s just seen as an unnecessary tax for a program that won’t directly do anything by many.”

More details on AB 71 are expected in the next month. AB 71 will likely go to committee in the next few weeks.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

Reject any and all legislation proposed by any Bay Area politician!!!

Chiu, Bonta and Weiner are all mentally unstable and are mentally incompetent to draft legislation affecting fully functional citizens…

Go back to being your community organizers and president of the HOA and leave us alone, you FREAKS!!!

Im kool now with weath taxes on the silicon valley con artists and thugs. Make them PAY for their fraudulent election..

This is the first step towards euthanasia of homeless, then we’re next.

You should be able to see this by now. Its getting clearer everyday.

Is there no end to the stupidity of some Democrats in the California legislature? Proposing raising taxes during a time when businesses and individuals are struggling financially to survive due to Newsom’s tighter, scientifically unfounded, dictatorial, and get even ( lawsuit banning his creating any further illegal laws) Covid rules? Time for everyone to get back to life and business under Newsom’s allowed peaceful demonstrations. We are all peacefully demonstrating by supporting our businesses and enjoying our lives while distancing and masking by choice.

Im kool now with weath taxes on the silicon valley con artists and thugs. Make them PAY for their fraudulent election..

Even more problematic than the higher taxes is that it follows you for 10 years if you leave the state. If this becomes a trend, a lot of people may leave the state in anticipation of this happening some day.

Comrades

They know best how to spend your money……ha ha ha , you gloat….tax the rich….just a warm up before they grab your Denny’s coupons and your meager pensions,,,, how cruel.

CA Politicians always try to hide behind a cause especially when they know its bogus. This homeless cause only states portion could be (.0001%) and they will dip it into “general fund” so its hand grabbed by the vultures at the capital.

This tax will be the breaking point to “ADD” more TAXES at lower incomes levels….because its for the kids…type stuff.

That’s less than $16 per homeless person. One meal.

I suspect Dems actually want to drive out all the businesses in the state. Their plan is Calizuela and they are well on their way to “success”.

This is an income tax proposal, not a wealth tax. Entirely different and should be identified as such. A wealth tax sounds like a property tax, which would be very difficult on farm, pasture based livestock ranches, dairy, and tree farms that may have a high house site value near population centers. They just don’t provide much income. Tree farms may go many years between harvests.

Seems stupid to drive out high income tax payers if more tax revenue is wanted. But these are Democrat proposals which so often lack logic.