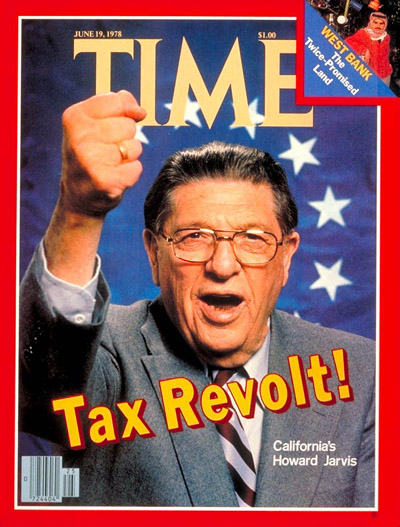

Assemblyman Mike A. Gipson. (Photo: Kevin Sanders for California Globe)

Excise Tax on CA Property Owners for Renting or Leasing Property in New Bill

The tax would also create the Homes for Families Fund

By Chris Micheli, February 19, 2021 6:54 am

On February 18, Assemblyman Mike Gipson (D-Carson) introduced Assembly Bill 1199, to impose an annual excise tax for the privilege of renting or leasing out qualified property. The bill would add Article 8 (commencing with Section 12280) to Chapter 3 of Part 2 of Division 3 of Title 2 of the Government Code, and to add Part 6.8 (commencing with Section 11951) to Division 2 of the Revenue and Taxation Code. The bill contains an urgency clause, which means the bill would need a 2/3 vote by each house of the Legislature and that it would take effect immediately upon being signed by the Governor.

Section One of the bill would add Article 8, which would be titled “Reporting Requirements for Qualified Entities.” Prior to February 1, 2023, and annually thereafter, a qualified entity that owns qualified property would be required to report specified information to the Secretary of State in the form and manner as required by the Secretary of State. The information would include:

- The identity of the beneficial owner of each qualified property owned by the qualified entity in the previous calendar year.

- The number of units for each qualified property owned by the qualified entity in the previous calendar year that were offered for rent or lease.

The Secretary of State would be required to create a searchable database, updated annually, on its internet website, with the information provided by qualified entities. A “qualified entity” is defined as a limited liability company or a limited partnership.

Section Two of the bill would add Part 6.8, which would be titled “Homes for Families and Corporate Monopoly Transparency Excise Tax.” The bill defines numerous terms such as “affordable housing unit,” “multifamily dwelling,” “persons and families of low or moderate income,” “qualified property,” and “qualified taxpayer.”

The bill would impose an annual excise tax upon a qualified taxpayer for the privilege of renting or leasing out qualified property in this state at a rate of ___ percent of the gross receipts of the qualified taxpayer that are derived from rental income. Moreover, it states that it is “the intent of the Legislature to enact legislation that would increase the rate specified if the qualified taxpayer receives a certain number of code violations issued by the building department or health department of a city or county.”

The California Department of Tax and Fee Administration would administer and collect the excise tax and would be able to adopt regulations to implement this law. The bill also specified that this excise cannot be passed through to tenants by way of higher rents. The measure would also create in the State Treasury “The Homes for Families Fund.” Monies deposited in this fund would be appropriated for specified purpose.

AB 1199 contains an urgency clause that is deemed necessary “in order to discourage landlords from raising rents and displacing tenants, to provide relief to tenants facing evictions, and to provide support for home ownership during a health and economic crisis. The bill would get its first hearing in March.

- Enforcement of Judgments in California - December 13, 2025

- General Provisions Related to Family Law Support - December 13, 2025

- Petitions for Forming Harbor Districts in California - December 12, 2025

So now we are imposing taxes on “the privilege of owning a rental property.” And adding on more rent control?? I am not real savvy on reading some of these bills but this was my outtake, am I right or wrong?

It sounds like another way to keep Californians from making a living so they must rely on the government. Whats mine is yours? Help me out here Showandtell, educate me on this one.

Stacy, you give me WAY too much credit. 🙂 But for what it’s worth I’m taking away from this what you are. Dem legislature hates landlords, thinks they should be punished, adds more burdens on them through taxes and regulations, the end result of which will be fewer landlords willing to put up with this nonsense, thus fewer rentals in the state. Less available housing is of course the exact opposite of what these Dems SAY they want. The usual upside-down B.S. thinking. Right?

I agree with everything you said, Showandtell, except I would change two words:

“…the end result of which will be NO PRIVATE landlords willing to put up with this nonsense,”

Furthermore, change the word ‘fewe’r to:

“…thus NOT ONE DECENT LIVABLE rental(s) in the state.”

Ask every tenant – who would you prefer running your building – your current landlord or Government?

I’d bet everything on the answer to that survey.

Moe, these apartments will soon become projects. Small ghettos that will sadly spill crime and violence to the nearest community. Unfortunately, the Government and city are the largest Slum-lords. Look at all their government-owned and run properties. Some are completely abandoned, creating such eye-sores and creating ghettos, with no real oversight. But yet they want to control and run all housing.

And less available housing means available housing will be much more expensive. Also the exact opposite of what Democrats want. But they fought for the livable $15/hour minimum wage so we should all be good……????????♀️

They are idiots I have rentals In 2 different cities and both charge me a business was license – $175 & $165 Started few years ago considered 2 or more Motel business license . I also report Income maybe time we sell Do THEY realize renters need places to live ? I bought with my money my income wasn’t fairly told no evictions

“The Secretary of State would be required to create a searchable database, updated annually, on its internet website, with the information provided by qualified entities. A “qualified entity” is defined as a limited liability company or a limited partnership.”

Quick question: How can/are they going to update annually when State & local government can’t even update voter registration it seems?

Great point!

That was my thought exactly!!!! I guess if its for their benefit than they can make it happen.????

Excellent point. T would prefer they spent time updating voters registration over taxing us more money to try and increase our living. If you’re a senior owning a home and want to help increase a lousy social security pit-tins, they want to punish you for trying to improve your income. In doing that they are discouraging you from making available shelter gor someone in need. What are they thinking? I know. They have to make up revenue for all those large companies that have gone to TEXAS.

forgiving the payment of rent for the past year, now they want to add more tax to the property owners. this should glut the market with sales further reducing housing for renters and reduce the property values for us all.

landlords will sell their properties and the rent is going to skyrocket!!!

I believe people who provide rental property have already been taxed at 100% given the eviction moratoria in place for the last year.

If this goes into law, people will sell or abandon their rental properties – or move back into them for two years then sell them as primary residences thus avoiding capital gains and the ridiculous tax on the privilege of providing rental housing.

Geez are these legislators truly this tone deaf?!

I was thinking the same thing. I have a rental property and I’m going to sell my home and move into the rental until I can leave this state. The governor has made it his mission to utterly destroy this state

https://recallgavin2020.com/petition/

This appears to be aimed narrowly at limited liability corporations engaged in renting residential properties, primarily to low income tenants. I suspect that this is really about closing a loophole, or pandering to a specific campaign donor at the expense of other business interests. Either way, it’s always the ordinary working citizen who’ll end up paying. I hope that the Globe will follow up with a more in depth analysis.

Excellent point

don’t those that rent out property already pay proper taxes, utilities, etc… Gee, wonder why people are leaving California and why there isn’t any affordable housing? Also, the fund would just be gobbled up from all the increase “construction fee/permits”

Yes, please follow up on this. Is it a publicity stunt by a legislator? Unfortunately probably not.

I spoke with someone in San Francisco who said with the virus rents are down about 25% but they are put in the terrible position for both them and potential rental customers of leaving units vacant as rents some years can only be increased 1 %. If they rent out a vacant unit at 25% less they are forever then tied to increases based on the temporary lower priced rental market. Unintended consequences that are bad for everyone. I have left rents lower for existing tenants for years, especially single parents. Legislators, do not take away that flexibility. Legislators are FORCING some rent increases. I have lived on $225 a month after paying mortgage, taxes, and insurance before owning any rentals, and try to work with tenants.

Private property rights are America’s foundation. Why are they trying to say renting out property is a privilege? It is a RIGHT!

“Why are they trying to say renting out property is a privilege? It is a RIGHT!”

Simple answer, because communists don’t believe in private property.

I have a choice to be a landlord, and this B.S. guarantees that I will not be a landlord in California. Ca. Is becoming a good place to be from, not a good place to reside.

This is bullshit

As a landlord, I could go on all day and never make the same point twice. For now, I call your attention to the second paragraph under Section Two, where the word “privilege” is used. Renting your property is a PRIVILEGE now? I fully understand anyone who becomes violent and seeks to harm or kill elected officials. I don’t practice or condone these actions, but I sure as hell understand them…100%!

I am sure that the Democrats think this is a great idea to increase affordable housing, right? Increase the cost of having rental property, load down more regulations and take away more private property rights. And renters will benefit with more slum lords, higher rents and less rental property available. Oh, this also means more high priced bureaucrats. Yep, this is a great idea.

Let me guess. Taxing rentals will make more rentals available and it will lower rents. I guess if we tax rentals enough they eventually will be free? I plan on selling my rentals which means the rental market it going to get smaller – reality, what a concept.

I am so thankful that I’ve sold all but one of my rental properties in CA, and that one is being purchased by the tenant soon. I am replacing them with properties in states more favorable to the property OWNER, not the state or tenant!! This will result in fewer rental properties, not more, but we can’t expect these bumbling idiots in Sacramento to understand that!

Where did you buy your new rentals? Interested ????

This is Bullshit, people are in need of rental housing and now they are going to add another tax on the business rentals, which will get passed on to the renter, everyone loses!

This whole agenda is by design for people to either lose their properties or abandon them. Newsome passed a bill in Jan. that will give the state of ca first rights to swoop up any foreclosures, citing he won’t allow hedge funds to take over like time. So, he’s putting more pressure on home owners to accomplish that.

Exactly.

Shameful taxing landlords more to add insult to injury. Landlords have had to endure months of losses during Covid and now you want to take even more of there money. Rentals are the only means of income for seniors who have worked hard for years at minimum wage jobs. They saved money and sacrificed to purchase these investments to help them survive their golden years. Social security is not adequate to live on.

So please tell me why you feel landlords are privileged?? I pray this tax never happens it will destroy many seniors livelihood and will hurt tenants.

Actually this may be good news. Many conservative Californians are on the brink of moving out of this once-awesome state (libs, stay here and enjoy what YOU destroyed!). I’ve got two great SFR rentals and long-term tenants, and this would push me over the edge regarding staying in CA. All three of my properties, and my family, will be gone. Both tenants will suddenly be looking for new homes at a higher rent. Good job you CA ASSemblymen and gov!! Again, maybe good news for me. Other than the weather there are better, and yes more-conservative, states to live in. If there was only a way to keep the liberals from moving out of CA and taking their politics with them. Hmm, maybe I could start a bill on this and get it thru the state assembly. If you haven’t already signed to recall Newsom, please DO IT by end of Feb.

https://recallgavin2020.com/petition/

Sigh. 5th generation Californian, but I don’t think I can hang on anymore. By the time my youngest finishes high school, I plan to have 1031’d my 30 doors to a different state. Too bad.

If you were a state and you wanted to destroy the middle class, what would you do differently?

Right now you:

-Don’t let people work

-You pay public sector employees not to work, including generous benefits & pensions

-Lockdown businesses indefinitely

-Raise minimum wage

-Find ways to raise taxes

-Try to eliminate Prop 13 protections, in part or whole

-Keep the next generation uneducated

-Implement “climate” and “environmentalist” agenda resulting in higher energy costs

-Invite illegals in and reward them with free stuff

-Keep eviction moratorium indefinitely

uumm…… NOTHING.

Because voter registration is the critical element for keeping the corrupt in power and above the financial curve of the top middle-class. It imposes financial penalty to the top middle class to offset the frivolous spending of the Democrats. Pelosi and her “Nephew” live off these ingenious bills to further their legacy’s!

I can’t think of a better way of legislating away the middle and upper middle class. Tax them to death (and not just rental property owners)! Do you really want to see the income gap between the rich and poor widen? The middle class is the upward pathway out of poverty. Is that really what the liberals want to preserve?

All this will do is hurt the renters that will have to move. Owners will sell, leaving less rentals. California is out of control with all the regylations

We currently are in the process of selling 4 single-family homes we have as rentals. That means 4 fewer rental units on the market for people looking for a place to live. The reason is the laws in Ca. that just screw owners of rental units. BTW we are going to Arizona with the money and will not have to pay Ca. income tax on the rental income from now on. California will soon be a third world state.

So you are a 74-year-old widow living in CA. You have your $2100 a month in SS payments and the rental income from the home you own free and clear to pay for the assisted living community you are in. And for the privilege of making mortgage payments on your own property for 30 years, Mike Gibson thinks you should create a fund to pay for someone else’s family to have a place to live?

This idea is wrong in so many ways.

First it will force landlords to raise rents. They now can raise rent 5% plus inflation . The small guy will pay.

Second it will discourage development of multi family in California further exasperating the housing shortage and making it more affordable

Third it taxes a small percentage of voters making it easier to pass. This is similar to prop. 15

Which the voters rejected in November .

Landlords already pay state income tax, property tax, local business license taxes.

Newsome is cringing because business is leaving

( and he wants to raise their taxes ????

Hey Mike! Are you really that dumb? We will just pass this cost on to our renters>>>>>>>

Sales Tax is collected from the consumer, so should be an Excise Tax

The bill also specified that this excise CANNOT be passed through to tenants by way of higher rents.

Plus it says “the intent of the Legislature to enact legislation that would increase the rate specified if the qualified taxpayer receives a certain number of code violations issued by the building department or health department of a city or county.”

The Government will have not restrictions to continue to harass property owners with violations in order to

impose rate increases….meaning it will NEVER end. It’s shameful, mind boggling and scary!

RECALL NEWSOM

This is also a major Property Tax Grab. As Landlords sell their rentals, those homes get Re-assessed at Market Value. The corrupt & greedy Leftist bureaucrats are creating ways to force long time family owned properties to Sell. As everyone, including the Tenants get hurt in the process. If you sell, the State Gov. temporarily wins. If you keep your real estate , the Landlord loses. Either way they gotcha if you are coming or going. When they use the word “Equality”, they mean they want us all Equally Poor. You can cut & run to another State or stay and fight for Our Rights. As California goes, so goes the Nation. This will eventually catch up to you or your kids generation in your new State. If the Soviet or Chinese Communist physically attacked CA would you cut & run like a coward? Or fight like hell to preserve our Nation? We can blame the Left, and I do, but we Conservatives have to take responsibility for not being involved the past 30 years. Not enough Small Gov. minded people are running for Schools Boards, City Council, County Supervisors Seats, Water District, volunteering at election poles, etc…The power is in the local races. It’s the breeding ground for future leaders. And we leave these seats wide open for Leftist. If your are playing football and leave the goal wide open, what do you expect? We handed the Left our State by not participating. All of us helped create this mess by being politically lazy. Voting isn’t enough anymore. You must be involved, speak up, Vet Out and support true patriots and if you lose a political battle, keep coming back in a smarter & harder way. If you leave CA, don’t go to that new State and just chill. All of our States are vulnerable to Leftism. It’s just a matter of time. It’s uncool to leave your fellow countryman to do the dirty work for you. It’s better to Contain and destroy Leftism in CA. There are still enough of us in CA. We must take back the Republican Party in CA to take back the State. You can’t have a Party if you don’t show up. Show up and work your tail off to clean up our Party. Push out the mushy Republican and replace them with all of you in this thread. These Dems may have bad policies, but they are not stupid, they will follow you to your new State. In fact, they are already there running for School Boards. and City Councils. They sounds like Republicans in their Campaigns and vote for Leftist policies once in. Quit getting duped. My Republican majority city gets fooled every time by these closet Leftist. Just because they say they are Republicans and sound Conservative and you met them does not mean they are on your side. You must attend Council & Board Meeting to see how they vote. Then you know the real deal the next election fight hard to keep the phonies out. One last thing, stop sending your kids to these Leftist Universities. Again, we allowed this Leftist Tax Grabbing mess you happen. It’s our job to clean it up. Not cool to leave it to the next generation. Our Founding Fathers fought for our Freedom and paid a big price. Don’t chicken out and walk away. If you Sell that property, the Left wins again.

The Next Best Step is to start a Recall on the Carson Assemblyman, Mike A. Gipson. Homemade Recall signs need to go up immediately in his Assembly District in the Carson area. The attention of RECALL signs could be enough to scare him to retract the Bill? These Leftist Tax Grabbing Control Freaks need to feel the strength of Homeowners & Tenants United. Sample Signage;

– STOP House Harming bill AB-1199.

– STOP Mike A. Gipson from hurting Property Rights & Tenants.

– RECALL MIke A. Gipson – Protect Property Rights & Tenants NOW. STOP AB-1199.

Take all your anger in the comments above and be a true Patriot and take Action Now. Don’t quit & sell your home. Strategically & Peacefully Fight Hard for your Rights. Be the Political Sherriff in your town. Don’t wait for others. One person can do a lot. But join a community of Property Right ActIvist or create one. The excuse that you have to work is bogus. I work too. Our Founding Fathers had families to support too with no safety net except Church. If you have to stay up for 3 days straight to make stuff happen, do it. Our Soldiers have to go All In during Hot Wars. The Left is engaging in a detrimental Cold War on all of us. If you don’t do anything to help, YOU ARE THE PROBLEM. Yes, all of us are the problem if we allow ourselves to be dictated by an Assemblyman.

I’m 60 miles away from Carson. If I have to come help I will. But there should be enough Patriots in the Carson and surrounding area to stand up for yourselves. Again, don’t sell your homes. If you sell, you are playing into the Leftist hands. Newsome’s machine will get the win fall of your home being reassessed at market value. They want to drive you out. Don’t give them what they want. Stay and Peacefully fight hard for our Right to not be unfairly Taxed & Regulated. Now go and fight the good fight!

I’m not paying any more taxes for the privilege of being a landlord/concierge service to my tenants. I will leave California like half of the rest of the state has done because of your outrageous taxes!