CalPERS logo. (Photo: CalPERS)

Post-Coronapocalypse Pension Reform Checklist for California

The new reality of public sector pensions in California: It is quite possible that CalPERS will collect a lot more from taxpayers

By Edward Ring, April 1, 2020 2:10 am

Pensions for state and local government employees in California are literally three to five times as costly as Social Security, and at least twice as costly as the Federal Retirement System.

In a perfect world, California’s state and local public employees would receive exactly the same retirement benefits as federal employees. They would receive a modest defined benefit, a contributory 401K, and they would participate in Social Security.

Unfortunately, in California, while some state and local public employees are offered 401Ks, and many participate in Social Security, all of them rely inordinately on a defined benefit pension. Far from being modest, even the most minimal examples of defined benefit plans for California’s state and local government workers provide roughly twice the value of the typical defined benefit offered federal workers. And where there’s twice the value, there’s twice the cost.

In reality, however, twice the cost would be a bargain. It’s much worse than that, and very little has been done. In 2013, the PEPRA (Public Employee Pension Reform Act) legislation lowered pension benefit formulas in an attempt to restore financial sustainability to California’s public employee pensions. But these revisions, which resulted in defined benefit formulas only about twice as generous as the federal formulas, only applied to new employees.

California’s Pension Systems Were Crashing Before the Coronapocalypse

Two years ago, and after more than eight years of a bull market in the stock market indexes, CalPERS, which is by far the largest pension system in California, had already announced that contributions from participating agencies were going to roughly double. They posted “Public Agency Actuarial Valuation Reports” that disclosed the details per agency.

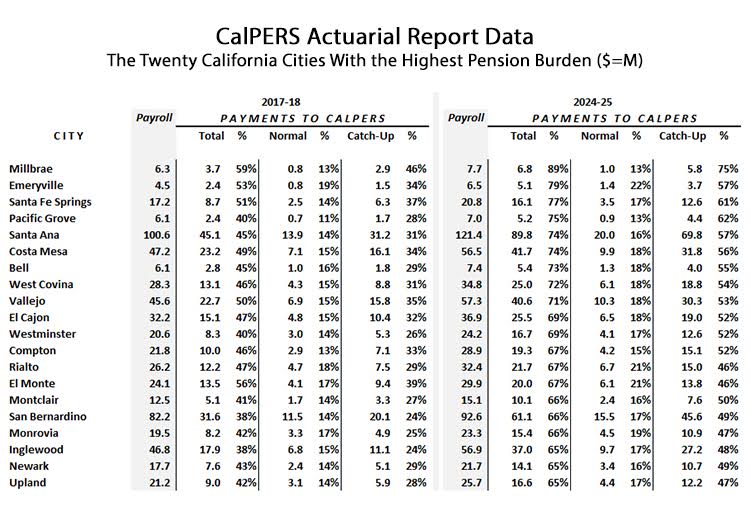

At the time, in partnership with researchers at the Reason Foundation, the California Policy Center used these reports from CalPERS to summarize the impact on 427 cities and 36 counties (download full spreadsheet). As shown on the table below, two sets of numbers are presented – payments to CalPERS for the 2017-2018 fiscal year, and officially estimated payments to CalPERS in the 2024-25 fiscal year.

The most important distinction one should make when reviewing the above data is the difference between the “normal” and the “catch-up” payments. The so-called “normal contribution” is the amount the employer has to contribute each year to maintain an already fully funded pension system. The “catch-up” or “unfunded contribution” is the additional amount necessary to pay down the unfunded liability of an underfunded pension system.

As can be seen in the example of Millbrae (top row, right), by 2024, the “catch-up” contribution will be nearly six times the amount of the normal contribution. But in the PEPRA reforms, new employees are only required to contribute via payroll withholding to 50 percent of the “normal” contribution.

A separate California Policy Center analysis, also published two years ago, attempted to estimate how much total payments statewide would increase if all of the major pension systems serving California’s state and local public employees were to require similar levels of payment increases. The analysis extrapolated from the consolidated CalPERS projections for their participating cities and counties and estimated that in sum, California’s state and local government employers would have paid $31 billion into the 87 various pension systems in 2018, and by 2024 this payment would rise to $59.1 billion.

As noted at the time, and now more than ever, this was a best case scenario.

A Financial Snapshot of CalPERS Today

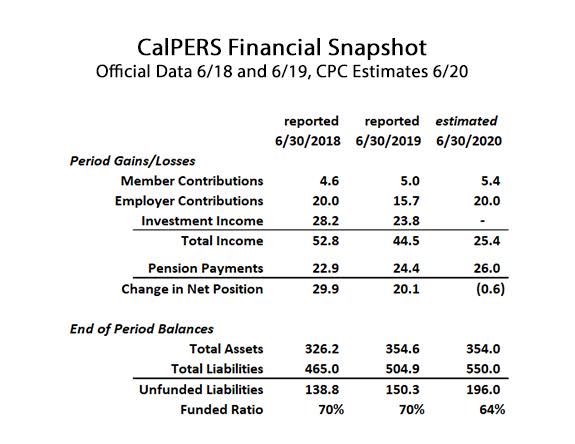

The next chart, below, depicts financial highlights for CalPERS – either officially reported or projected – in a format which ought to be publicly disclosed, every quarter, in this format, from every state and local public pension system in California. The first two columns depict data as reported by CalPERS for their most recent two fiscal years, ended 6/30/2018 and 6/30/2019. The final column, which consists of CPC estimates (not provided by CalPERS), shows how their financial condition could appear three months from now.

The first thing to note from the above chart is the fact that CalPERS was only 70 percent funded (“funded ratio,” bottom line) in June of 2019. The next thing to note, and this is crucial, is that the actuarial estimates of the total pension liability lags behind one year. That is, the $504.9 billion reported “actuarial accrued liability” is reported as of 6/30/2018, even though that figure is used to report the funded ratio as of 6/30/2019.

Take a deep breath, because the significance of this delay requires further discussion. From page 122 of CalPERS most recent CAFR, here are the trends for the actuarial accrued liability: 6/30/2009 = $294B, 2010 = $308B, 2011 = $328B, 2012 = $340B, 2013 = $375B, 2014 = $394B, 2015 = 413B, 2016 = 436B, 2017 = $465B, and 6/30/2018 = $504B. Based purely on the trend, is there any reason to believe this liability will not exceed $550 billion by June 30, 2020, two years later? Why isn’t that estimate being made?

There’s more. Why are actuaries permitted to have an entire extra year to complete their estimate of the total pension system liability, when changing single variables will cause the estimate to massively fluctuate? Sure, it is a complex exercise, and at some point an official calculation, based on all known data, should be reported that amends a preliminary estimate. But if, for example, you vary the earnings projection downwards from 7.0 percent to 6.0 percent – which needs to be done sooner not later – using calculations provided by Moody’s Investor Services, the amount of the CalPERS liability soars from $550 billion to $621 billion. You don’t split hairs when you’re being scalped.

And what about the employer contribution (second row of data)? Why did it go down from $20 billion in 2018 to $15 billion in 2019? From the “Basic Financial Statements” in the CalPERS CAFRs for the last few years, here are the totals for payments by employers: 2015 = $10.2B, 2016 (page 38-39) = $11.0B, 2017 = $12.4B, 2018 (page 40-41) = $20.0B. With the payment for FYE 6/30/2019 back down to $15.7B, the trends suggest that the large payment of $20.0 billion in 2018 was an anomaly. But assume that much money will come again from employers in 2020. But based on historical trends, probably not more than that. Yet.

Where does this put CalPERS?

All of this discussion is to explain the reasoning behind the figures in column three on the above chart. What might be materially different? What estimate isn’t best case? Does anyone believe CalPERS will actually break even in the return on their invested assets between 6/30/2019 and 6/30/2020? Does anyone believe the most accurate estimate of the total liability belongs anywhere south of $550 billion, particularly when they’re still using a discount rate that’s too high? And yet this puts CalPERS in what is arguably the worst shape it’s ever been, at 64 percent funded as of this June.

This paints a very grim big picture. CalPERS is on track to collect over $20 billion from taxpayers in the current fiscal year, and CalPERS, while the biggest pension system, only manages just over 40 percent of the state and local government pension assets in California. This suggests that the total taxpayer contribution to California’s state and local government pension systems in 2020 is already up to around $50 billion. And it isn’t nearly enough.

Steps to Reform CalPERS and all of California’s pension systems

1 – Admit the long-term rate of return projection is too high for calculating the value of pension liabilities. Move it down to 6 percent. Increase the required “normal contribution” accordingly, and, in turn, increase the share required from active employees via withholding.

2 – Once a more reasonable long term rate of return projection is adopted by the pensions systems, the goal of pension reform should be to stabilize pension system payments at some maximum percent of total personnel costs. With cooperation from union leadership, agree on what that maximum percent should be, then determine how to spread benefit reductions in an equitable manner between new hires, current employees, and retirees.

3 – For all state and local government employee pension plans in California, start providing consolidated quarterly financial summaries (without gimmicks), using the above chart as an example. Include a footnote indicating how much of the total employer contribution is for the unfunded liability vs the normal contribution.

4 – If a pension system falls below 80 percent funded, agree on an escalating series of remedies to be implemented to bring the funded ratio back up. They would include suspension of COLA, prospective further lowering of the annual multiplier for active workers, retroactive lowering of the annual multiplier for active workers, reduction of the retiree pension payment, and increasing the required payment to the pension plan by active workers via withholding.

5 – Pressure the California State Supreme Court to swiftly hear and rule on the cases Alameda County Deputy Sheriff’s Ass’n. v. Alameda County Employees Retirement Ass’n (filed 1/8/2018), and Marin Ass’n of Pub. Employees v. Marin Cnty. Employees Retirement Ass’n (filed 8/17/2016). These cases may provide clarity on the “California Rule,” which currently is interpreted as prohibiting lower pension benefit accruals, even for future work.

6 – With or without a decisive ruling (or any ruling) on the California Rule, work with government union leadership to revise pension benefits. If union leadership is uncooperative and the courts fail to offer an enabling ruling, than as a last resort, to bring the unions back to the negotiating table, lower salaries, current benefits, and OPEB benefits.

7 – In the long run, move towards a system modeled after the federal system. This would be a logical next step, following in the footsteps of PEPRA. It would create three basic tiers of public sector workers in California, the pre-PEPRA workers (who may submit to lower benefit accruals for future work), the post-2013 hires who are subject to the PEPRA reforms, and new hires starting in, for example, 2021, who would enjoy retirement benefits similar to what Federal employees receive.

The Ripple Effect of Unreformed Pensions

There are two problems with a bullish outlook today. First of all, the great returns of the past few years may have been unsustainable, a super bubble. And then that super bubble was not popped by a pin, but rather by a wreaking ball, the Coronapocalypse. There are tough economic times ahead.

In a severe downturn it is conceivable that annual taxpayer contributions to California’s public employee pensions systems will not merely soar from around $50 billion in 2020 to $60 or $70 billion within a few years. They could go even higher. For example, over the total three year period through June 2020, it is quite possible that CalPERS will collect more from taxpayers – $65 billion – than it will have earned in investment returns – $52 billion.

This is the new reality of public sector pensions in California. And because taxpayers have been increasingly on the hook to bailout these pensions, taxes have increased, services have been cut, and there has been a gradual wearing away of trust by citizens in their local governments. This is why, for the first time in decades, more local taxes and bonds were rejected by voters in March 2020 than were approved. Absent pension reform, this backlash has just begun.

So-called “crowding out” of other public services in order to pay for pensions doesn’t just impel an insatiable drive for higher taxes. It also works its way into higher fees, building fees in particular. Infrastructure investments such as connector roads and parks for new housing subdivisions used to come largely out of municipal operating budgets. It was a fair trade – the city builds the roads, the builders sell the homes, and the new residents pay taxes. But now, all of those costs are paid for by the builders and passed on to the home buyers. The rising cost of pensions can be directly tied to the unaffordable cost of homes.

Pensions for state and local government employees in California are literally three to five times as costly as Social Security, and at least twice as costly as the Federal Retirement System. Ultimately, this disparity divides Americans and undermines what it means to be an American citizen. Why should public employees care if Social Security is inadequate, if they don’t depend on it? Why should they care if all public benefits offered private taxpayers is diluted, or if citizenship itself becomes less meaningful, if their membership within the public sector is the primary source of their security?

America is entering difficult economic times. Maybe one good thing to come out of this will be a willingness on the part of public sector union leadership to make common cause with all of California’s workers, and agree to reasonable concessions on pensions that will help everyone living in this great state.

- Ringside: The Potential of Waste-to-Energy in California - April 17, 2024

- Ringside: How Much Water Will $30 Billion Buy? - April 10, 2024

- Ringside: Sacramento’s War on Water and Energy - April 4, 2024

A good article as usual. You are the most level headed individual writing about pension reform. Over the last ~10 years, you are one of the few that I have actually found worth reading. I agree with your solutions, but as a retired state employee, I think there are a few things that could be added and ‘safety’ employees need to be addressed separately.

First, again – I agree with your solutions, but I would add: 1) No pension (safety or otherwise) would exceed the average California household income. 2) Pension COLAs would be adjusted based on a combination of CPI and the average CA household income. 3) A reduction in percentage accumulation going forward for all active employees (earned years would be left in place). Adjusting employees that were in the system prior to Jerry Brown’s changes to the system to the new percentages would be adequate.

Regarding safety employees: We obviously don’t want 70 year old cops, prison guards, and so on. Some jobs just can’t be done at that age by most people. The safety jobs should not be in social security, as these people need to retire prior to that for the safety of all of us. Would still apply the same rules: Pension no higher than average household income & COLA formula.

So, if the average pension could not be higher than the average CA household income, what happens to the rest of the $ that goes in to CALPERS? In the near term, it gets the fund to 100% and there could be matching 401k style plans like in the private sector. Once CALPERS is funded, then there is a savings to the tax payer.

Is this going overboard?

@BOPRN I just wanted to chime in and say that I appreciate your comment here — it’s so refreshingly sane, fair-minded, and level-headed, compared with what I usually come across comments-wise from public employee pensioners.

My story is this: I’m a multi-generational native Californian (family roots here going back to the mid- to late-1800s), and have been a small business owner all my life. I’m also one of those “small business owners leaving California” that you keep reading about. Public employee pensions are a VERY significant part of the reason why. Apart from California’s infamous and ever-increasing hostility to small business (which absolutely, painfully real), I’ve also had enough of bearing the cost of SO much more than my own share of retirement risk. The unions are literally killing the goose that lays the golden egg. Or, perhaps more accurately, they are actively driving many golden-egg-laying geese right on out of the state.

Anyway… thanks for adding some sanity to the conversation, from your side of the table. It’s appreciated.

For what it’s worth…

Great article! What I have not heard or read much about is the earlier (Stockton or San Bernardino) federal judge opinion that City/County Calpers agreements are subject to federal bankruptcy and are not “special” state expenses that the cannot be disturbed due to the California rule. In affect are we not heading down to massive city/county bankruptcy (rising cost, lower revenue) whereby CALPERS may have to face a massive changes to their revenue streams. Why are taxes (city-state) mentioned, but not the federal issue which may trump unending cost. Cities cannot support fire/police existing rising cost and pay previous employees – at some hear point based on your figures cities may face a reality many individuals have done – restructure you debt to survive.

Ed, nice article,

A few observations………

(1) looking at your first chart above, it’s not at all surprising that the unfunded liability has grown so large, because the %-of-pay figures shown as the Normal Cost are absurdly too low for the VERY generous level of promised benefits ……. perhaps by a fact of FIVE !

(2) Showing a picture of the dollar bill (as the source-split for each dollar of revenue) with 59 cents in investment income, 28 cents from the employer (i.e., the Taxpayers) and 13 cents from the workers ……… while “technically correct” …….. is a disservice to Taxpayers, and a common Union ploy (to incorrectly say that Public Sector pensions don’t really cost Taxpayers much).

The are really only TWO “real” sources of revenue, the Taxpayers and the workers. Investment income arises only FROM those two “real” sources, and in the absence of the need to make those original contributions, wouldn’t that investment income have stayed in the pockets of the original constrictors? Assuming the %-split stayed level over the years, the Taxpayers are really contributing (in cents) (28 + 59x(28/(28+13))) = 69.29 cents and the workers are contributing (13 + 59x(13/(28+13))) = 31.71 cents.

And even that (the corrected) 69.29 cents and 31.71 cents split doesn’t PROPERLY reflect Taxpayer costs. That problem results from the MUCH too-low Normal Costs, which will ALWAYS result in MORE under-funding that falls 100% on the backs of the Taxpayers.

It’s not hard to determine the lump sum needed upon retirement for any individual worker. One way is to look at online annuity purchase rate ……. although these will be high due to the annuity-writer’s use of a low interest rate assumption and the need to cover expenses, risk charges, and and expected profit. A more net-cost type lump sum is easily available by using your “Pension Analysis for Everyone” EXCEL spreadsheet that you posted in one of your comments years ago, and can still be found here (embedded as the blue link labeled “pension_Analysis_Model”):

https://californiapolicycenter.org/a-pension-analysis-tool-for-everyone/

One you have a lump sum cost of the promised pensions as of the date of retirement, the Taxpayers are responsible for everything EXCEPT the accumulated value of th worker’s own actual contributions. When one dose so, it becomes clear that RARELY do worker contributions (including all the investment earning thereon) accumulated to the date of retirement, pay for more than 10% to 20% of the Total Cost of their promised pensions ……. with taxpayer contributions (including the investment earnings thereon ) responsible for the 80% to 90% balance.

In my above comment, at the end of my number (1), I stated …..”perhaps by a factor of FIVE”.

FOUR to FIVE would be about right for CA’s 3%@50 Safety worker pensions which (when valued using the SAME assumptions and methodology required by the US Gov’t in the valuation of Single-employer Private Sector DB pension Plans) have a level annual Normal Cost of about 50% to 60% of pay. A factor of THREE is about for Non-Safety workers Plans which have a level annual Normal Cost of about 30% to 40% of pay.

THere is no way, no how, no chance that the CALPERS scheme does not end up in some sort of effective default. Whether the collapse of the U$D is the killshot, or just the taxpayers in CA deciding to leave (taking their future earnings with them) will not matter much to the retiree or the citizen who pays taxes and gets no services. At some point it falls apart, because no one currently benefiting from the current scheme is wiling to budge, and the courts will not help at all.

So there, you Californians. At some point, unless you are VERY wealthy (north of 100M$), you are either going to have to leave or get shorn in a haircut of epic proportions. You better have more than a cheap gate at the end of your street then, as there won’t be any cops to protect you.

” In a perfect world, California’s state and local public employees would receive exactly the same retirement benefits as federal employees.”

In a perfect world, would California public workers receive exactly the same salaries also? Because every study I have seen shows that total compensation at the federal level is much higher.

That’s true, studies do show higher Federal THAN STATE total compensation (wages + pensions + benefits).

But similar studies ALSO show much higher STATE (and LOCAL) PUBLIC Sector total compensation than what comparable PRIVATE Sector workers get. And with State and Local Taxpayers responsible for most of the total cost of PUBLIC Sector pensions, the PROPER comparison is to the total compensation of the payees ….. the PRIVATE Sector.

My problem with cutting retirees’ pensions is that many have retired based on the assumed agreement made with state government to pay the pension. Many would have worked longer if they knew the state would reneg on their promise. The main problem with CalPERS is police and fire retirement formulas. Reduce those.

Well …………. Greed HAS consequences.

And ALL Public Sector pensions are excessive, ALWAYS being MULTIPLES greater in value (and hence cost) than the retirement security contributions typically provided Private Sector workers by their employers.

And who but Public Sector workers get free or heavily-subsidized retiree healthcare benefits today …… a VERY VERY VERY rare benefit in the Private Sector today.

We could start by destroying the so-called “California Rule” (which is not a law, but rather an interpretation of law). That at least would allow us to reasonably alter the trajectory of the not-yet-retired employee base. It’s currently a situation of being completely hamstrung by a one-way ratchet, which is a bit like being in a car headed for a concrete wall, while not being allowed to even ease off the gas, much less hit the brakes.

If we don’t at least do that (negotiating **future, currently-unearned** benefits), then I don’t see how reneging in some form won’t be forced into the conversation.

The people yelling the LOUDEST about this mess *ought* to be the currently-retired pensioners. They need to somehow get their union leaders to quit walking in dangerous economic denial.

The Law of Eminent Domain can solve the pension crisis as the Supreme Court has affirmed that it doesn’t only apply to land but to all properties. Government only needs a compelling interest that serves the need of the public and complies with the 5th (or 14th) Amendment requirement that private property cannot be taken without “just” compensation: i.e., not a required dollar-for-dollar settlement. Eminent Domain, an extraordinary process placed in the Constitution to resolve dilemmas, can provide the big stick to compel the amending of these outrageous and exorbitant pensions and bringing them back to reality before government at all levels goes bankrupt. When factoring in retirement benefits, public employees on average are paid and receive benefits 78% higher than private employees performing comparable work. There is a lot of room for negotiations when determining “just” compensation. Retirement is a government granted property right that can be amended through Eminent Domain, which will provide a permanent settlement better than bankruptcy.

Retirees and their unions must yield to the sovereignty of Government when it evokes the power of Eminent Domain when a compelling public interest arises, and the Eminent Domain process does not impair a contractual labor obligation but rather “takes” a portion of the fruit derived from it. Elected officials have a duty to retirees and taxpayers alike and must fix this process, since taxpayers are not a bottomless pit of money.

Another option is the power of the state to levy taxes. It has been estimated that the California pension dilemma could be averted by simply imposing a 50 percent surtax on all retirement income in excess of $40,000, but public employees and their unions have grown accustomed to the idea that taxpayers alone should pay for everything. Therefore, no politician would dare contemplate this simple solution since union money keeps them in office.

F*ck you

“Special Interests” ?

” The broadest classification of political donors separates them into business, labor, or ideological interests. Whatever slice you look at, business interests dominate, with an overall advantage over organized labor of about 16-to-1. Even among PACs – the favored means of delivering funds by labor unions – business has a close to 7-to-1 fundraising advantage.”

Opensecrets.org

” When factoring in retirement benefits, public employees on average are paid and receive benefits 78% higher than private employees performing comparable work.”

Nope. Not even close.

You are correct. On a total Compensation basis (wages + pensions accruals + benefits), CA’s Public Sector worker Total Compensation isn’t 78% greater (for the entire group taken together). But per Dr, Andrew Biggs AEI State-specific Public/Private Sector compensation study THEY ARE 23%-of-pay greater (33% including the value of the MUCH greater Public Sector job security). My source for that is figures 6 and 13 in the AEI Study than can be found here:

https://www.aei.org/wp-content/uploads/2014/04/-biggs-overpaid-or-underpaid-a-statebystate-ranking-of-public-employee-compensation_112536583046.pdf

Think about how much MORE Private Sector Taxpayer would have for THEIR retirement security needs, if THEY had an additional 23%-of-pay to save and invest in every year of their career ……… an extra $500K, $1 Million, more ?

Well, reversing the direction, those figures are then not unreasonable estimates of how much Private Sector taxpayers are over-compensating the AVERAGE full-career Public Sector worker.

Look before you leap. Then don’t leap. Proceed with caution.

Studies are all over the map. Federal workers are overpaid. Federal workers are underpaid. State workers earn 45 percent more than private workers. When accounting for education and other factors, public workers earn about the same as private workers… Even when accounting for higher pensions and benefits. (California’s Government Workers Make TWICE As Much as Private Sector Workers. By Edward Ring January 24, 2017) Pick your study.

Here’s the fact. Lower educated, unskilled public workers make roughly the same wages as equivalent private workers. But when their benefits are added in, they make much more. (Maybe even TWICE as much in the extreme cases.)

Professionals, PhD s, and the like earn much less in wages than equivalent private workers. Even their higher pensions and OPEB s are not sufficient to make up for the lower salaries.

Between those two are a cohort of public workers who are roughly equal to the private sector. Their higher pensions balance out the lower wages.

It’s not an exact science. There are too many variables to reach a consensus. If your idea of pension “reform” is pension reduction, because “pensions are too generous”, you will logically have to start your cuts at the lowest levels because, as Willie Sutton says, “That’s where the (excess) money is.

Even with pensions and benefits, the “average” California state worker is compensated very close to market rates. He/she does receive a larger portion of his compensation in the form of benefits than does the private sector worker; Deferred Compensation. And the pensions have been horribly managed.

Quoting …………… “When accounting for education and other factors, public workers earn about the same as private workers…”

That’s NOT accurate.

The AEI Study that I referenced (and linked) in my comment to which you are replying, VERY clearly shows that in California, for ALL education groups taken together …. which is indeed what financially impacts the Taxpayers …… Public Sector workers have a 23%-of-pay (and 33%-of-pay with their greater job security) ADVANTAGE.

Splits by income category (as noted in your 2-nd paragraph), while interesting, does NOT change the fact that the financial impact on Taxpayers arises from the income-specific-differentials summed across ALL income groups.

————————————-

Quoting …………..

“Even with pensions and benefits, the “average” California state worker is compensated very close to market rates. He/she does receive a larger portion of his compensation in the form of benefits than does the private sector worker; Deferred Compensation.”

The 1-st sentence above is FALSE ………. the 23% PUBLIC Sector Public Sector advantage noted above makes that untrue. They may be “market rate” when compared to other also over-compensated PUBLIC Sector workers, but certainly NOT when compared to comparable workers in the PRIVATE Sector ….. and with the PRIVATE Sector encompassing 85% of all workers, and Private Sector Taxpayers responsible for a VERY major share of the Total Cost of Public Sector pensions, it is THAT group (the PRIVATE Sector) to which Public Sector compensation should rightfully be compared.

The 2nd sentence, while true, dose NOT eliminate the overall 23%-of-pay Pubic Sector Total Compensation advantage in California. It just speaks of how that Total Compensation is split between wages and deferred compensation. The 23% of pay ADVANTAGE remains.

Quoting …………… “When accounting for education and other factors, public workers earn about the same as private workers…”

That’s NOT accurate.

“Studies are all over the map. Federal workers are overpaid. Federal workers are underpaid. State workers earn 45 percent more than private workers. When accounting for education and other factors, public workers earn about the same as private workers… Even when accounting for higher pensions and benefits. (California’s Government Workers Make TWICE As Much as Private Sector Workers. By Edward Ring January 24, 2017) Pick your study.”

Stephen,

It’s NOT accurate. You have told us you are a retired CA Public Sector worker, so we understand where your alliances are, but TRY reading with an open mind ………….

The AEI Study that I referenced (and linked) in my comment to which you are replying, VERY clearly shows that in California, for ALL education groups taken together …. which is indeed what financially impacts the Taxpayers …… Public Sector workers have a 23%-of-pay (and 33%-of-pay with their greater job security) ADVANTAGE.

Splits by income category, while interesting, does NOT change the fact that the FINANCIAL IMPACT on Taxpayers arises from PUBLIC/PRIVATE Sector income-specific-differentials summed across ALL income groups.

“… but TRY reading with an open mind ………….”

“Studies are all over the map.”

One twelve year old study is not definitive. Even the author of the study says so. Read the whole study, not just one page. He will even tell you why public sector wage compression is important. Expand your horizons. Start with this…

CHANGES IN THE WAGE STRUCTURE AND EARNINGS

INEQUALITY

LAWRENCE F. KATZ*

Harvard University and NBER

Take your time, and don’t call me Shirley.

Yes Stephen, Dr. Biggs does acknowledge that the published %-conclusions in that study are only the best estimates within a reasonable rage (down or UP). There is no reason to believe it would be materially different today than when published in 2014. Those versed in statistical analysis understand that “big data” (and his study is indeed based on a great deal of data) move VERY VERY slowly.

But keep typing. Perhaps some readers will believe you (a retired CA worker who changed light bulbs as part of his job responsibilities) vs Dr. Biggs a PHD from the London School of Economics.

With all due respect, the horse is dead.

Go read a book.

You need some fresh air ……… but 6 ft from anyone else please.

Safe six,

just do it.

Great article. The number one issue for the state of California is to keep the pensions rolling in to retired government workers. And continue giving cost of living increases. Why shouldn’t cops and firemen be able to retire in their early fifties? The taxpayers who will have to pay more and more will just have to tighten their belt. After all the taxpayers who are now struggling are just servants to the government workers.

You have a better chance of persuading Mexican drug cartels to give up smuggling drugs and people than you have of persuading government employee unions of giving up any pension benefits.