Zuckerberg San Francisco General Hospital. (Photo: psych.ucsf.edu)

Prop. 15: Messy Title, Feud With Signer, and Ironic Zuckerberg Contributions

Zuckerbergs contributed $1.9 million to ballot initiative signed by SF nurse who feuded with them

By Katy Grimes, July 27, 2020 12:51 pm

Proposition 15, given the clever yet disingenuous ballot title, “the Schools and Local Communities Funding Act,” is also known as the controversial Proposition 13 split-roll initiative.

The initiative itself is controversial enough without adding drama to it.

One of the signers for the Yes on Prop 15 argument is Sasha Cuttler, a San Francisco public health nurse, who led the protest against re-naming San Francisco General Hospital after Mark Zuckerberg. Sasha Cuttler even wrote an open letter to the Zuckerbergs, inviting them to a “drag brunch,” and asking them to remove their name from the hospital.

Yet ironically, the Chan Zuckerberg Initiative has contributed $1,905,000 and is a top three funder of the “Yes on Prop. 15” side.

It certainly is rather odd that the “Yes” side would choose someone who so openly feuded with Zuckerberg to be a signer on the initiative.

Cuttler has also accused Zuckerberg SF General Hospital of retaliation after his public push removing their name from the hospital. “The hospital was renamed the Priscilla Chan and Mark Zuckerberg San Francisco General Hospital and Trauma Center in 2015 after Chan and Zuckerberg gave $75 million to the hospital’s foundation — the single largest contribution by private individuals in support of a public hospital in the United States,” the SF Examiner reported.

Attorney General contorts the English language to avoid using the word ‘tax’

Prop. 15 is on the November ballot as a constitutional amendment, which will eliminate the ceiling on commercial property taxes and require all commercial property taxes to be immediately re-assessed to 2021 market values.

The split-roll property tax measure will also remove Prop 13’s protections for California farmers, triggering annual reassessments at market value for all agriculture-related facilities and improvements.

The ballot summary says Prop. 15 will “increase funding” sources for schools… by changing tax assessments and sticking it to commercial property owners, tenants and consumers.

California Attorney General Xavier Becerra has once again written a biased ballot Title and Summary, which deliberately misleads voters about Prop. 15, the initiative that will remove Prop. 13’s property tax protections for commercial property and institute the largest property tax increase in California history.

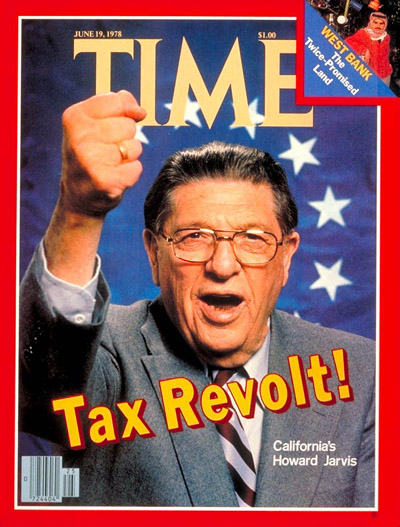

Currently, under the 1978 Proposition 13, property tax rates could not exceed 1 percent of the property’s market value and valuations couldn’t grow by more than 2% per annum unless the property was sold, according to the Howard Jarvis Taxpayers Association.

While claiming the anticipated $12 billion annually from Prop. 15 will go to schools and California cities desperate for bailouts, proponents are not addressing the snowball effect the initiative will have on property owners, small businesses, and consumers.

Property taxes will double and even triple for many commercial property owners, and those costs will be passed on to the small businesses renting space, and eventually to consumers.

“The attorney general contorts the English language to avoid using the word ‘tax.’ Unfortunately, he can’t call Prop 15 a revenue increase, since, as the nonpartisan Legislative Analyst’s Office says, some rural governments could lose money if Prop 15 passes.

The No on Prop 15 campaign released the following statement:

“We are not surprised that Attorney General Xavier Becerra, who has once again written a biased Title and Summary, would deliberately mislead voters about Prop 15, the initiative that would undo much of Prop 13’s property tax protections and institute the largest property tax increase in California history.”

“Left with limited ways to disguise the largest property tax increase in state history, the attorney general falsely claims the measure ‘increases funding sources,’ deceiving voters into thinking these ‘sources’—small businesses, farmers, ranchers, and day care centers—aren’t already paying property taxes. Ultimately, every Californian will pay for the $11.5 billion-a-year property tax hike through higher costs for the goods and services they buy every day.”

Just imagine the property tax bill Zuckerberg San Francisco General Hospital pays annually.

Here is how this new “revenue stream” is expected to be dispersed:

1) About $1 billion comes right off the top and goes to counties to pay for administrative costs and paying back the state for loss of income tax revenue, according to the LAO analysis.

2) About 60% goes to unspecified local government services. The legislature can divert the new local government revenues for other purposes, just like they did with the gas tax, the lottery and other revenue streams intended for local government.

3) Lastly, 40% goes to schools with no guarantee that the money makes it to the classroom. There are no reforms and no requirements that the money be spent in the classroom.

Is it any wonder the initiative is not called “The largest property tax increase in California history?”

- Nationwide Gas Prices Jump 11 Cents; California Still Leads with the Highest Gas Prices - March 3, 2026

- Gov. Newsom to Spend Another $1 Billion on Homeless - March 3, 2026

- U.S. Supreme Court Smacks Down California’s Law Prohibiting Schools from Notifying Parents of Child Transgenderism - March 2, 2026

Bottom Line it will be a small business killer! It will be the death knell for any business that survives the Wuhan Virus shut down and the destruction caused by the rioting and looting!

Also, the smokers tax should be added to the revenue diversion scam. The smokers tax that was to be used for California Medi-Cal programs for the disadvantaged has been cut in the current budget!

Please read up on this awful proposition that will not end up doing what they claim. It is only meant as a stepping stone to end the benefits to long time property owners gained from Proposition 13.

It should be outlawed to give it an innocuous name such as “The schools and community funding act. The uninformed low iq voter will be duped!

You are absolutely correct! This will be the death to any property owner and business that is left after the virus.

Liberal mayors have made it clear that business owners are “legitimate” targets for BLM and Antifa terrorists. Now they will tax the remaining EMPLOYERS out of the state. Leave while you can and avoid the rush! Find a home and job while there are opportunities in other states.

the same snowball effect as in “minimum hourly income” the worker gets more money, the store raises its cost, the delivery raises its cost and so on. Now who ends paying for this? THE COMSUMER.

Ironically the lowest income Californians will vote in favor of this in order to stick it to “rich” people. Yet these ignorant people are almost always renters, many of whom will be living on properties taxed as “commercial” properties. So they will be voting to give themselves a tax increase, while the so-called “rich” people living in non-commercial residences will not see property tax increases on their homes.

Only people who pay a net positive amount of taxes should be allowed to vote.

My untruths in this article! Prop15 exempts farms, farm land and building and equipment ; it has protections so the money cannot be diverted,, and currently the money saved under this 40 year tax break goes…??? Where ever the wealthy property owner want, we have no idea.

Get the facts

https://www.yes15.org/debunk