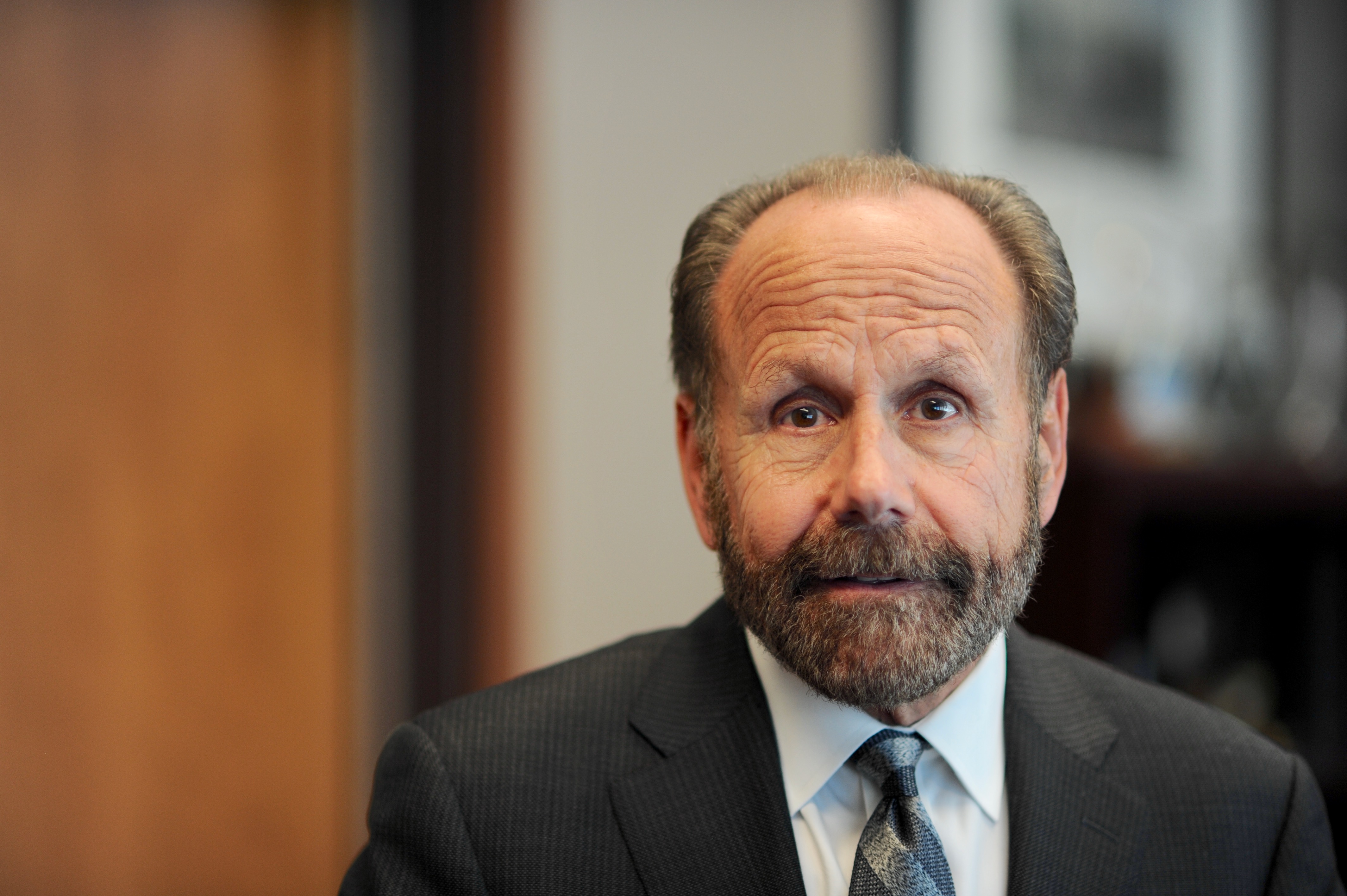

Governor Gavin Newsom. (Photo: Kevin Sanders for California Globe)

Gov. Newsom Doubles Down on State Takeover of PG&E, Says Utility ‘No Longer Exists’

The real goal appears to be controlling the state’s energy and renewable energy mandates

By Katy Grimes, February 4, 2020 2:17 pm

“Exactly one year after PG&E Corp. filed for bankruptcy, Gov. Gavin Newsom said PG&E ‘no longer exists’ and doubled down on a state takeover if the utility doesn’t shape up by June 30,” the San Francisco Chronicle reported.

The California mega-utility Pacific Gas & Electric filed for Chapter 11 Bankruptcy reorganization one year ago on January 29, 2019, which makes it curious how Governor Gavin Newsom continues to publicly threaten that if PG&E doesn’t do what he wants, the state may just take over the utility.

Newsom has told the company repeatedly, if PG&E didn’t work to get itself out of bankruptcy, that the state might take over the entire company as early as June, California Globe reported.

But the state cannot just take over the private utility without federal Bankruptcy court approval. And PG&E just won court approval of a settlement with bondholders that had threatened to derail its bankruptcy strategy, the Wall Street Journal reported Tuesday. “The ruling Tuesday from Judge Dennis Montali keeps the California utility on course to exit bankruptcy by the end of June, in time to qualify for a statewide fund designed to cushion utilities against the rising risk of wildfires.”

State Takeover of PG&E

The real goal of the PG&E takeover appears to be to control the state’s mandated renewable energy goals so PG&E’s bankruptcy does not sell off or shut down the utility’s renewables division. While PG&E is in Chapter 11 bankruptcy, the court has to examine where the financial drains to the company come from (renewables division) and where the profits are. The Bankruptcy court is the one place PG&E could divest itself of the state’s renewables mandates… and California’s Democrats can’t have that.

California Globe asked Tom Tanton, Director of Science and Technology for the Energy and Environment Legal Institute, to weigh in on the governor’s threat to take over the giant utility.

“Governor Newsom has floated the idea of state takeover of Pacific Gas and Electric in response to the Company’s bankruptcy and consumer outrage in light of Public Safety Power Shutoffs,” Tanton said. “I trust the Governor recalls what happened to Grey Davis when HE tried government control of the essential service of electricity. While some conditions are different today, the similarities are eerie as well. There were folks involved in the 2000 energy debacle that actually thought, after things went south with skyrocketing prices and blackouts, that state takeover would be ideal. Remember the California Power Authority? They signed long term (and short term) contracts way above market, leading to higher ultimate costs…to the tune of $30 billion. Some also forget that government utilities (primarily large municipals in Southern California) were equally culpable as the Investor Owned Utilities and independent generators and marketers in driving the nascent market over the cliff. Government failure is just as likely as market failure.”

“PG&E currently is faced with massive debt, maybe $18-20 billion, to compensate for wild fire losses. That is largely why they’re in bankruptcy court. So, what happens to that debt if the state takes over PG&E? The state will have to assume that debt. Maybe another bond would cover that, but coupled with financing the taking of assets, is not likely to lower rates paid by consumers. And what would happen to the current contracts with independent generators to supply electricity?”

“Much of the problems facing PG&E and its customers is the result of too much government ‘oversight’ rather than too little. Mandates for specified types of resources, whose performance is lacking, drives prices higher and reliability lower. Government restrictions on removing dead and dying shrubs under power lines leads to disastrous conflagrations such as we’ve seen. PG&E is not without responsibility for the mess we’re in as consumers, but the State has some too. Increasing the State role is not the answer, much less total state takeover.”

As California Globe reported, a new bill was introduced in the Senate on Monday by Senator Scott Wiener (D-San Francisco), in which current shareholders of PG&E would be forced by California to sell their shares to the state, assuming control via eminent domain. Municipal bonds would be used to initially pay for everything surrounding the takeover. A state power authority run by Governor-picked members would lead the company temporarily before transitioning into a seven member municipal board. Each member would represent an area of PG&E’s coverage area within the state based on an equal population ratio.

But Wiener is ignoring history as Tanton explained, allowing his personal disdain of the Investor Owned Utility to dominate.

“PG&E is a failed company. It is an irresponsibly run company,” said Senator Wiener. “It has allowed its infrastructure to completely deteriorate to the point that it is causing wildfires. It has just allowed its system to spiral out of control.”

“It is more beholden to Wall Street and the shareholders than maintaining its system and providing safe and reliable service. PG&E operates a monopoly as a privilege granted by the state of California, and that privilege can be revoked. I support public ownership of PG&E.”

As Tom Tanton and I have reported in the past, as PG&E was closing down the Diablo Canyon Nuclear Power plant, “removing it could create profitable business opportunities for solar, wind, battery, bioenergy and natural gas companies.”

That’s the real goal… not only taking over the state’s energy, but propping up the state’s mandated renewable energy goals. PG&E and all utilities are not allowed to make a move without approval from the California Public Utilities Commission.

False claims about the success of California’s green economy have been front-page headlines for several years. Green tech groups, green energy investors, stakeholders and even green tech media claim California has a “thriving clean energy economy.”

This green economy “push” is coming from billionaire oligarchs like Tom Steyer, who are heavily invested in green energy and stand to make billions more in their portfolios, control the energy market, and control the masses, and are doing this through influence peddling California’s elected politicians.

Notably, Steyer made his fortune investing in the energy sector, through his hedge fund company, the Farallon Capital Management fund, which Steyer managed until 2012. Farrallon invested in coal mines in Australia and Indonesia, as well as in tar-sands oil, which is strip mined, processed to extract the oil-rich bitumen, which is then refined into oil. It’s an interesting career change and about-face, but one based on a business opportunity, and not altruism.

As for state takeover of PG&E, this is reminiscent of Venezuela’s takeover of its oil industry in 1998, when Hugo Chávez was elected president of Venezuela. Within two to three years, Chávez fired nearly 20,000 employees of the formerly private oil company, Petróleos de Venezuela, and replaced them with employees loyal to his government.

- Leaving California: Public Storage Relocates HQ from California to Texas - February 25, 2026

- California Democrats Propose Government Takeover of Healthcare, Banning Private Insurance - February 24, 2026

- Gov. Newsom Facing Calls to Resign Over Release of ‘Monster’ Convicted Serial Child Abuser - February 24, 2026

Katie,

My belief is that their long range goal is a systematic destruction of California as we know it.

The reining politburo is in this for life due to the woefully and collosally ignorant and begging masses that vote them in.

IMHO

Thank you, thank you, thank you, Katy, for reporting what is really going on here with this attempt to have the state take over PG&E, for reminding us that they are unable to do it as they threaten to do without Federal bankruptcy court approval, and for spelling out what the state’s real goal is: flogging unaffordable and unreliable renewable energy, which they fear might be cut from PG&E’s portfolio. A must-read article.

The AG could simply withdraw its charter under corporations code section 1801