Calif. Assembly Chambers. (Photo: Kevin Sanders for California Globe)

California Per Capita Spending Doubles – Where Is It Going?

Are the schools better? Are the roads improved? Is crime and homelessness down?

By Edward Ring, February 3, 2023 9:22 am

California’s state government is spending twice as much as it did a decade ago, and by every metric that matters to ordinary Californians, things have only gotten worse.

Even without further analysis, this is an incredible fact. California’s state government, in constant dollars, is spending nearly twice as much per resident as it did a decade ago, and what do they have to show for it? Are the schools better? Are the roads improved? Is crime and homelessness down? The answer to these and similar questions is no.

According to reports downloaded from the California Legislative Analyst’s Office (LAO), and after adjusting for inflation and for population growth, the state’s general fund budget is up 84 percent compared to just ten years ago. Put another way, the state’s per capita general fund spending in the current fiscal year is just under $6,000 per California resident, and ten years ago — in 2022 dollars — it was just over $3,000 per resident.

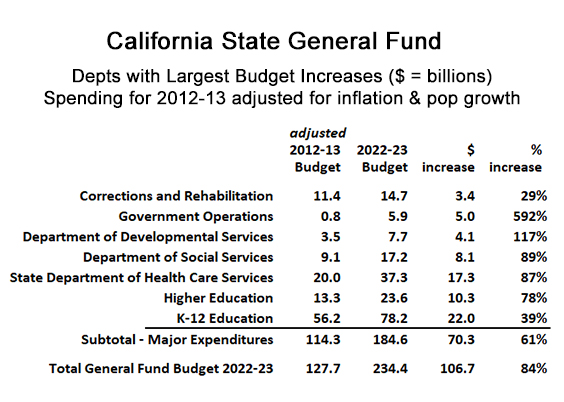

Digging into what drove this tremendous increase doesn’t reveal much, because the increase is across the board. As the table below indicates, the seven departments that logged the biggest dollar increases in spending were, in most cases, increasing their budget by a lower percentage than the 84 percent by which overall spending increased. Still, some of these multibillion dollar increases bear examination.

The state prison system, for example, increased spending (all figures are in 2022 dollars) by $3.4 billion over the last ten years, a 29 percent increase. But the inmate population in state prisons dropped during the same period, from 168,000 in 2009 to 96,000 in 2022. This fiscal year, California’s state prison system is now spending an estimated $159,000 per prisoner.

How is it possible that inflation-adjusted spending is up 29 percent when the inmate population is down by 45 percent?

Similar questions arise with every element of the state budget. The basic LAO report reduces the general fund budget to 12 categories: (1) Business, Consumer Services, and Housing, (2) Corrections and Rehabilitation, (3) Environmental Protection, (4) General Government, (5) Government Operations, (6) Health and Human Services, (7) Higher Education, (8) K-12 Education, (9) Labor and Workforce Development, (10) Legislative, Judicial, and Executive, (11) Natural Resources, and (12) Transportation. But each of these categories can be expanded; viewing all subcategories will reveal 302 separate line items.

For this reason, “Government Operations” rising from $800 million ten years ago to over $5.0 billion today, only begins to become explicable if you wade through its 66 line items. The biggest line, accounting for nearly half the increase? “Health & Dental Benefits for Annuitants,” otherwise known as OPEB (Other Post-Employment Benefits), that costly benefit afforded to state retirees that constitutes the unseen but nearly as financially voracious cousin to pension benefits.

The next three lines are all subcategories falling within the category “Health and Human Services.” These are big numbers. The “Dept. of Social Services” nearly doubled its spending (remember, all these calculations are after adjusting for inflation). So what’s costing another $8.1 billion a year? It turns out most of this is for so-called SNAP benefits (Supplemental Nutrition Assistance Program), once known as food stamps. Factors influencing this rise would include $6 billion per year of recently allocated “emergency allotment benefits,” part of the state’s response to the COVID pandemic. Another reason for the rise in spending is the decision of the state to award SNAP benefits to undocumented immigrants, but there is no publicly available data on how many of California’s undocumented residents are recipients.

The eligibility of undocumented immigrants is also a factor in the biggest single line item increase in the state budget over the past ten years, that of Health Care Services. Nonetheless, most of this increase, $17.3 billion, is the result of the expansion of Medi-Cal under the Affordable Care Act. By 2015, so-called Obamacare in California had grown to cover 12.7 million people, a nearly 60 percent growth in under two years. By 2018 there were an estimated 13.5 million Californians covered by Medi-Cal. By 2022, enrollment grew to nearly 14 million. Because most of the costs to cover Med-iCal recipients qualifying under the Affordable Care Act are covered by the Federal Government, however, it remains unclear just how much of this cost increase is due to higher enrollment, and how much is attributable to higher costs per insured, the extension of benefits to the undocumented, and more bureaucracy.

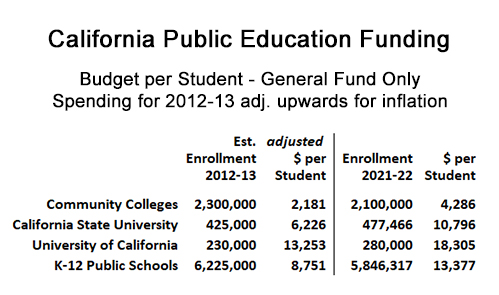

When it comes to the primary recipients of general fund spending for education, there is almost no case to be made that the population served has increased. As shown on the next chart, compared to 10 years ago the total enrollment is actually down at community colleges and in K-12 public schools. In the California State University system, enrollment is up 12 percent compared to a decade ago; enrollment at the University of California is up a bit more, at 22 percent compared to a decade ago.

But these enrollment trends, at most up by 2 percent per year, do not begin to keep pace with overall spending increases in every case. Per student spending in just the last ten years increased (again, after adjusting for inflation) by 97 percent at the community colleges, 73 percent in the Cal State system, 38 percent for the UC System, and 53 percent in the K-12 public schools.

The most egregious of these examples has to be the K-12 schools. They receive approximately 38 percent of the state general fund every year, no matter how swollen the budget gets. Imagine the perverse incentive this creates. The powerful teachers unions will push for anything that increases the state budget, because no matter what the expenditure is for, they will get 38 cents out of every dollar increase. But all this money has not improved educational outcomes.

Before moving on it’s important to note that the $13,377 per pupil spending reported by the LAO is nowhere near the actual amount Californians pay for K-12 education. That is just the general fund’s share. When spending from all other sources are considered, the per pupil expenditure rises to over $20,000. That is a spectacularly high amount of money, reminiscent of the apocryphal $600 hammer once uncovered in a defense budget audit. But at least the hammer hammered. Are California’s children learning?

The big remedies are as obvious as they are anathema to the government unions that run Sacramento.

Tens of billions every year could be saved by scrapping defined benefit pensions and OPEB benefits, and instead giving public employees the same state-funded retirement package that every taxpaying citizen is entitled to, i.e., Social Security and Medicare. That would not only restore solvency to every local government in California and eliminate the looming state budget deficit, but it would reestablish a badly needed sense of shared fate between public servants and the citizens they serve.

Such reforms might also stimulate a more meaningful dialogue in the state Legislature as to what realistic limits might be placed on taxpayer supported benefits to undocumented Californians. If the weight of undocumented beneficiaries threatens to sink the budgets and hence the systems that state workers also depend on along with their fellow citizens, maybe a more appropriate balance will be struck between policies that are compassionate and policies that are sustainable.

Another way to save would be by implementing school choice, where parents would have the ability to direct the public funds allocable to their child into whatever accredited school they wished. Tens of billions in education establishment bloat could be saved with better educational outcomes.

To truly restore solvency in the state government, California could also enact common sense policies that would lower the cost of living and stimulate genuine economic growth: deregulate the housing market, loosen building code restrictions, abandon the policies of urban containment to free up land for housing, end the assault on natural gas drilling and distribution, keep natural gas generating plants open, invest in water infrastructure to lower the cost of food and housing, bring back the timber industry to create jobs, and enable access to low-cost lumber, and create a business climate that is friendly instead of hostile.

Instead of pursuing practical measures, and making tough decisions, California’s state legislators are exclusively committed to simply spending more money. A lot more money, as the past decade clearly indicates. If lawmakers would balance their penchant for spending with a commitment to eliminate inequitable and failed — and very expensive — programs, it would help everyone living here, instead of just the special interests.

- Ringside: Finding Water for the San Joaquin Valley - December 5, 2024

- Ringside: Californian Energy Use Compared to the USA and the World - November 29, 2024

- Ringside: The Numbers Driving California vs. Washington on Energy, Water & Forestry - November 21, 2024

Democrats MO – talk about fixing problem, Tax, spend, never actually solution it, use issue as campaign promise that will never fulfill only to use again

Not only is their goal NOT to find a solution, it’s to make it worse!! That way they can demand more money to line their pockets!

Good read! This idea sounds like a good place to start… Wyoming Senate Passed a Bill to Fund Students Instead of Systems (SF143: Wyoming Freedom Scholarship Act) Families will take their education dollars to the school of their choosing. Another area that needs to be scrutinized is CPS, to see if they’re incentivized to

adopt foster children out of their homes vs assisting families. Why the increase in Developmental Services

isn’t that for people with disabilities? (something we should know?). Govt operations 592% increase?, better to

shut it down and save us all alot of grief while Newsom’s afoot. I don’t believe it will be much longer until

he is ‘Perp walked’ out, God has already won!

One thing is DEFINITELY a lot better! The Democrat politicians bank accounts!

I forget who it was on this forum that mentioned Bonhoeffer’s “Theory of Stupidity” but it is an apropos description of our state legislature and the sheep who continue to vote for them. (https://bigthink.com/thinking/bonhoeffers-theory-stupidity-evil/)

Mr. Ring, let’s get one thing straight; they are illegal aliens, not ‘undocumented immigrants’. Stop letting the ‘woke’ Left define the debate.

The simple answer is that more and more is being spent on head count (new hires), higher salaries, and higher pension costs. In short, bigger bureaucracy. Go to Transparent California and search any department or job title and you will go page after page of state employees making over $250,000 per year with salary, “other” pay, and pension.

On public employees making over $250,000/year, in 2021 there were 408,000 such employees with total compensation over $250K.

The Communists in Sacramento either have no common sense whatever, or they are deliberately sending CA to the ash heap of history. Once a truly Golden State, now a third-world disaster.

Many conservatives have the wrong idea about government. It’s NOT the purpose of CA government to provide public safety, or to educate our children, or to take care of the roads.

The purpose of CA state and local government is to enrich “public servants” — and to provide freebies to people who will in turn vote for the politicians.

Using that standard, I must admit that CA governments work spectacularly well.

Collectively, we get what we pay for.

For those who think the answer to everything is “more money for government”, you are obviously wrong. Our government has enough money, what they don’t have is a clue on how to spend it in ways that benefit the People.

Or, maybe they do and choose to ignore that in favor of spending on themselves?

According to latest Transparent California data, California now has 7.5 million public employees with total compensation greater than $100,000/year.

408,000 of those have total comp greater than $250,000/year.

14,000 are over $500,000 and almost 1,000 over $1 million.

Yes, our “poorly paid public servants” are perhaps not so poorly paid after all?