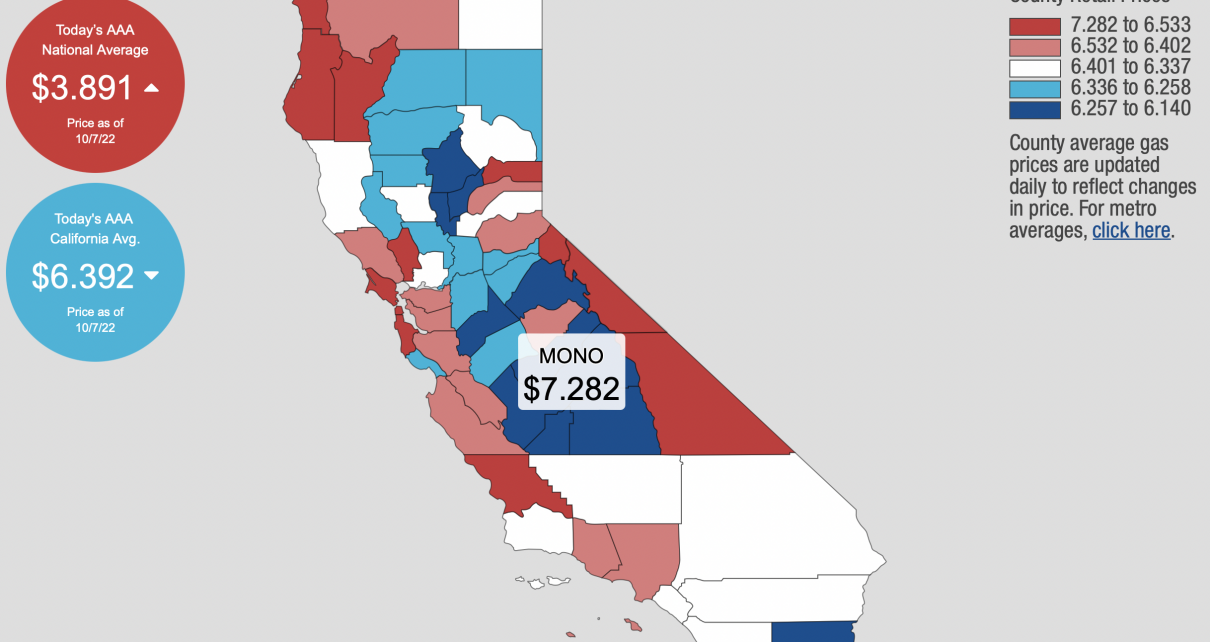

AAA gas prices, Oct. 7, 2022. (Photo: gas prices.aaa.com)

California ‘Windfall Gas Tax Profits:’ Gas Now $2.55 Above the National Average

‘Governor Newsom and Capitol Democrats are as dumb as they want to be’

By Katy Grimes, October 7, 2022 7:27 am

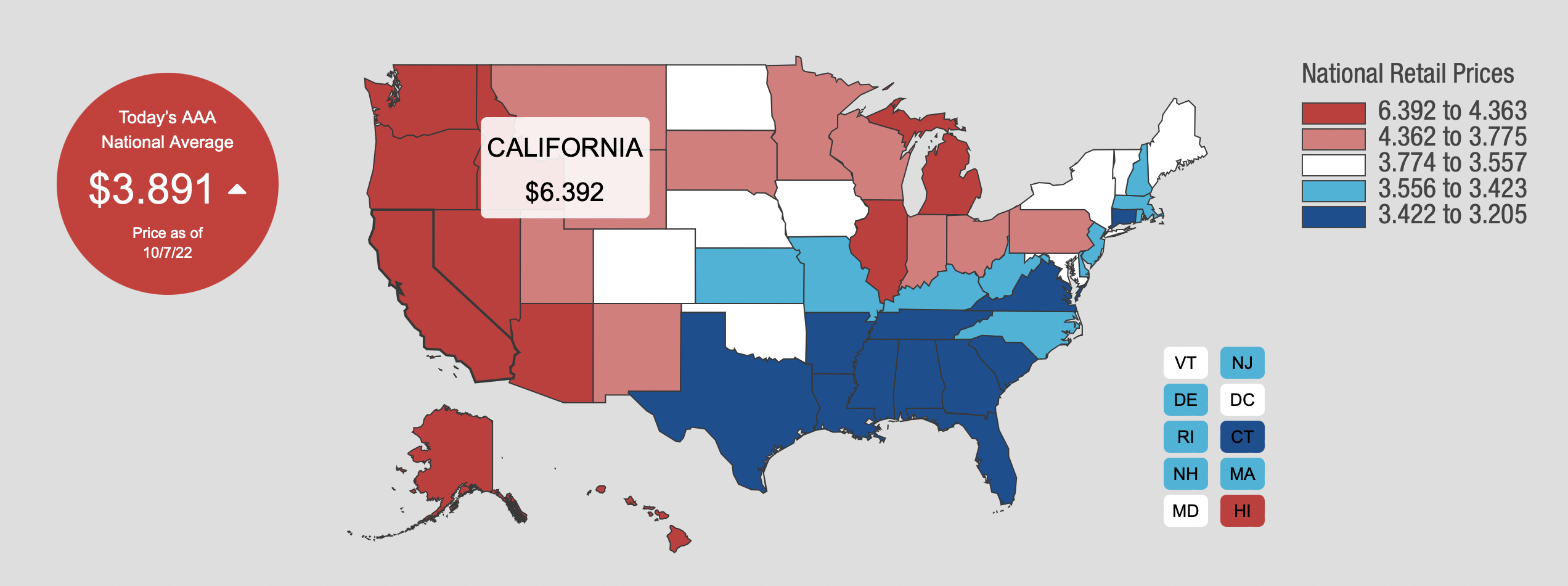

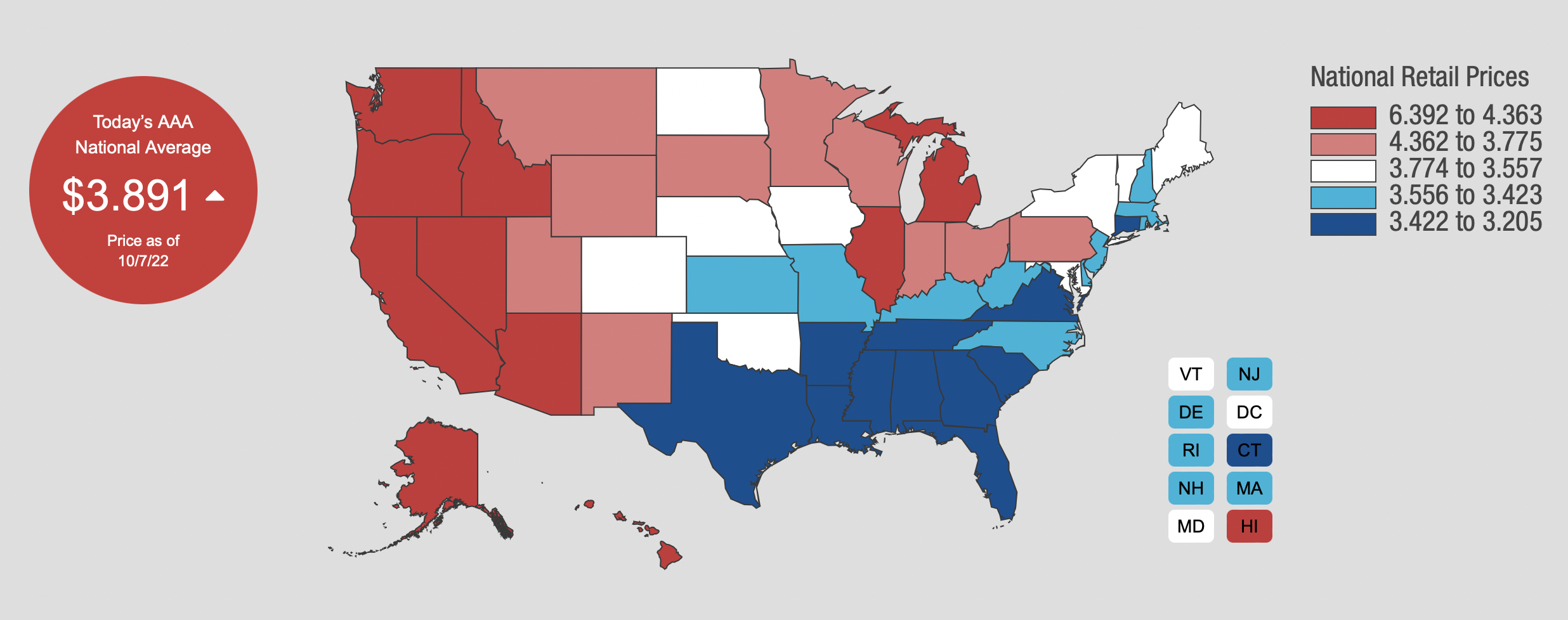

Californians are paying the highest gas prices in the entire nation thanks to the state’s “windfall gas tax profits.” The average price for a gallon of gas in the U.S. is $3.891 according to AAA. California’s average price for a gallon of gas is $6.392. This means Californians are paying a $2.55 premium on gas in many locations.

Gas in Mono county California is $7.82 per gallon.

The lowest gas is in Mississippi at $3.205 per gallon. Texas comes in at $3.232, Florida is $3.289, and Georgia is $3.207.

Notably, “It has now officially been 211 days since the Democrats promised action on soaring gas prices,” Assembly Republican Leader James Gallagher (R-Yuba City) said Thursday.

“Governor Newsom and Capitol Democrats are as dumb as they want to be. People have friends in other states who are paying around $3.50 a gallon. It’s laughable and Californians aren’t buying it,” Gallagher said. “Another dismal record the state set earlier this week shows that California has the worst maintained roads in the nation, even though most of the gas tax is intended for road maintenance.”

A new report found “44% of California’s roads analyzed were in poor condition. That’s the highest of any state, MoneyGeek said. Only 22% of the state’s roads were in good condition.”

Assemblyman Kevin Kiley (R-Granite Bay) also weighed in, and he addresses Gov. Newsom’s threat to call a special legislative session for the sole purpose of raising taxes. Again.

“Gavin Newsom is considering a Special Session of the Legislature for a single purpose: raising taxes. That is the last thing California needs,” Kiley said. “Newsom’s proposal, a new tax on suppliers, will inevitably make gas prices even higher. For those keeping score, prices in California are now $2.56 above the national average and our state budget has grown $100 billion since Newsom took office.”

“If Newsom does re-convene the Legislature, he’ll be sending the Supermajority into a trap. I’ll use the opportunity to force a new vote on suspending the gas tax, and we’ll see if they’re willing to oppose it again as ballots land in mailboxes.”

As for Gov. Newsom’s special session of the Legislature in response to rising gas prices, “We’re hoping to do more with this windfall profits tax to go after big oil,” he said Thursday at the climate change compact signing in San Francisco.

Newsom’s solution is to accuse oil companies of hoarding “windfall profits,” and to impose additional taxes. This isn’t a climate plan, but a tax plan.

Assemblyman Kevin Kiley had a solution to California’s highest-in-the-nation gas prices, but in March, Democrats on the Assembly Transportation Committee hijacked Kiley’s bill by passing amendments to gut the bill so they could not be accused of voting for the gas tax increase. Kiley proposed to suspend California’s .51 cent gas tax (CA gas tax is now .54 cents). At the hearing, Kiley noted that Maryland and Georgia had just reduced their gas taxes, and the people of those states saw immediate results. He said rebates are a good idea, especially with a substantial state surplus, and should be much larger, returning to overtaxed tax payers more of their own money.

Democrats diddled for 100 days to provide relief at the pump for the state’s drivers from the record high gas prices,” the Globe reported in June. California Democrats abandoned the opportunity for a gas tax holiday, and then announced they were forming a new committee to investigate gas price gouging to make it appear they were doing something.

Read more about Gov. Newsom’s new “windfall profits tax” on oil companies.

Here are some of the policies implemented in California that drive up the cost of gasoline:

- 51.1 cents – State gas tax (add an additional 3 cents starting July 1.)

- 25 cents – Cap and Trade (estimate)

- 22 cents – Low Carbon Fuel Standard (estimate)

- 2 cents – Underground Storage Fee

- 10-15 cents – California’s switch to summer-blend costs more to produce than other types of gasoline. Source.

- 14.4 cents – State sales tax (estimate based on 6/20 average price)

- California Elections Code Book Published - July 26, 2024

- California Supreme Court Ends Legal Snafu Over Gig Drivers – Upholds Prop. 22 - July 26, 2024

- Sen. Kamala Harris Claimed Ignorance Over Long-time Employee Sex Abuse Case - July 25, 2024

“This isn’t a climate plan, but a tax plan.” No kidding!

We’re rightly focused on gas prices (and taxes) now, but these duplicitous Dems have been getting away with this con job (and worsening roads and other infrastructure across the board, meanwhile) not just for gas but for all of our other energy and water needs. Whether they succeed or fail on taxing “windfall oil profits” it’s still a win-win for them —– and calling for taxes on windfall profits is nothing but a virtue-signaling and fake do-something show —– because higher gas prices or other energy prices will always result in higher taxes paid by consumers and thus “windfall tax revenues” collected by the state (and local) govts for THEIR coffers.

Go have a look at your latest electric/gas/water bill. Round about 2008 most CA municipal govts conned voters into voting to burden themselves with a Utility Users Tax, which enshrined cities’ ability to tax energy and water at a high rate. Thus as energy prices continually skyrocket, so do the UUT taxes on them, and thus the revenues that cities collect.

Same with gasoline. Gruesome and the Gang aren’t unhappy at all with rising gasoline prices here in CA. It just means more windfall revenues for the state coffers and thus more for them and their endless destructive slush funds and etc.

I like what Kevin Kiley said about a threatened “special session” of the legislature. Force a vote on gas taxes just as ballots arrive in voters’ mailboxes! Ha ha! We’re all paying attention now, even those who haven’t thus far been paying attention.

Rebates are great. But once again seniors who don’t file taxes are left out. We pay gas taxes like everyone else but get no help. We have paid taxes longer than everyone else. But, we don’t count. Guess they have to leave someone out so the governor and his wealthy friends can have fancy dinners. I can’t afford Big Macs twice a month

It is a Big Oil rip-off, because Kern County is over flowing with oil.

The issue really is that we as a state decided to treat energy (oil/gas, natural gas, and electricity) as a resource and not a commodity (to be used wisely). Energy is not a luxury item but a necessity, which makes treating it like a resource silly.

Step right up folks, lets play the gas tax shell game. Any gas tax rebates should be sent directly to registered vehicle owners, anything else is a Democrat bribe

We have to put the blame of high gas price on us. Why did we vote to increase to sales tax on gas. Why have we let this “special summer blend/special winter blend” B.S. This means that we are the only state that can’t by gasoline from any other state. They have us where they want us. Pay up or take public transportation. WE let this happen. Could be that oil companies are squeezing us but they are the only game in town. We have been suckered into this “green” B.S. and have no one to blame but us for electing this lame assholes.

Would be good to put your letter in the sacramento bee newspaper& all the rest cal’s lefty rags to educate, the sheep in this sanctuary state.anti- small business, anti- family, pro union, pro abortion, pro- dependant , pro- CCP Newsom

Is it me or is it a coincidence that Democratic lead states have higher prices than Republican lead states?

OR maybe it’s bad management or greedy management!!

Hey, look everyone —– even the L.A. Times took Gov Gav and CA’s Dem policies to task, not only for skyrocketing gas prices in the state NOW, but for as long as most of us can remember:

“L.A. Times: California policymakers have failed for decades on gas prices”

https://www.breitbart.com/politics/2022/10/09/l-a-times-california-policymakers-have-failed-for-decades-on-gas-prices/