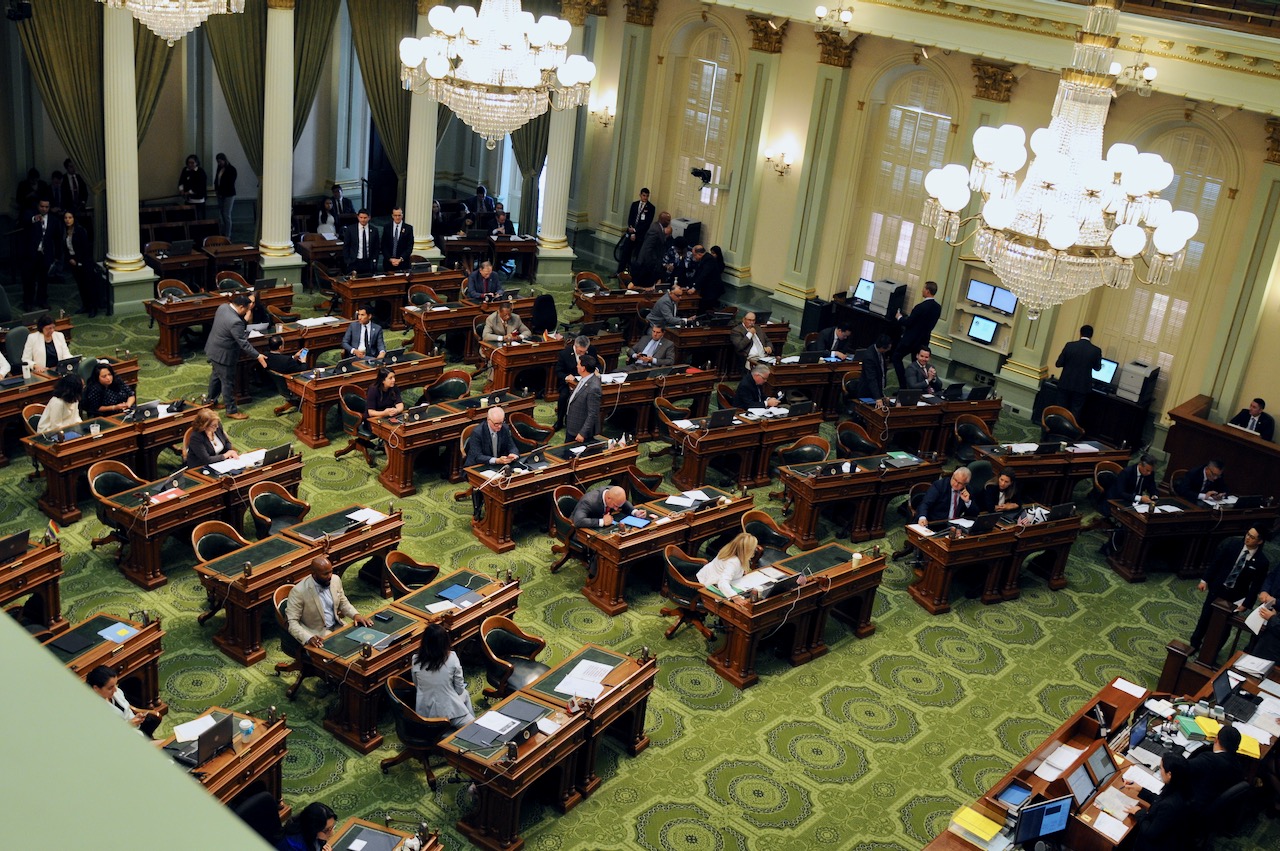

State Capitol Building. (Photo: Kevin Sanders for California Globe)

Required Financial Disclosure of California Public Officials

Every person who is appointed or nominated to an office is required to file a statement within 30 days of assuming office

By Chris Micheli, January 18, 2022 3:03 pm

As part of California’s conflict of interest laws, certain disclosure must be made. They are contained in Government Code Title 9, Chapter 7, Article 2, which contains Sections 87200 to 97210. Section 87200 provides that Article 2 is applicable to the following officials:

- Elected state officers

- Judges and commissioners of courts of the judicial branch of government

- Members of the Public Utilities Commission

- Members of the State Energy Resources Conservation and Development Commission

- Members of the Fair Political Practices Commission

- Members of the California Coastal Commission

- Members of the High-Speed Rail Authority

- Members of planning commissions

- Members of the board of supervisors

- District attorneys

- County counsels

- County treasurers

- Chief administrative officers of counties

- Mayors

- City managers

- City attorneys

- City treasurers

- Chief administrative officers and members of city councils of cities

- Other public officials who manage public investments

- Candidates for any of these offices at any election

Section 87201 requires every candidate for an office, other than a justice of an appellate court or the Supreme Court, to file no later than the final filing date of a declaration of candidacy, a statement disclosing the candidate’s investments, the candidate’s interests in real property, and any income received during the immediately preceding 12 months.

Section 87202 requires every person who is elected to an office, within 30 days after assuming the office, to file a statement disclosing the person’s investments and the person’s interests in real property held on the date of assuming office, as well as income received during the 12 months before assuming office.

In addition, every person who is appointed or nominated to an office is required to file a statement not more than 30 days after assuming office. Every elected state officer who assumes office during the month of December or January is required to file a statement under another section. The time period covered for reporting investments and interests in real property begins on the date the person filed the person’s declaration of candidacy. The period covered for reporting income begins 12 months prior to the date the person assumed office.

Section 87203 requires every person holding an office to file a statement annually disclosing the person’s investments, interests in real property, and income during the period since the previous statement filed. Section 87204 requires every person who leaves an office, within thirty days after leaving the office, to file a statement disclosing the person’s investments, interests in real property, and income during the period since the previous statement filed.

Section 87205 provides that a person who completes a term of an office and within 45 days begins a term of the same office or another such office of the same jurisdiction is deemed not to assume office or leave office. Section 87206 requires a statement that discloses an investment or an interest in real property to contain the following:

- A statement of the nature of the investment or interest.

- The name of the business entity in which each investment is held, and a general description of the business activity in which the business entity is engaged.

- The address or other precise location of the real property.

- A statement whether the fair market value of the investment or interest in real property equals or exceeds $2,000 but does not exceed $10,000, $100,000, or $1,000,000.

- If the investment or interest in real property was partially or wholly acquired or disposed of during the period covered by the statement, the date of acquisition or disposal.

- This does not include the principal residence of the filer or any other property which the filer utilizes exclusively as the personal residence of the filer.

Section 87206.5 requires an official disclosing a leasehold interest to do the following:

- Identify the interest as a leasehold interest.

- Disclose the number of years remaining on the lease.

- Provide the leased property’s address or other precise location.

- Provide the exact date the lease became effective or terminated if the lease became effective or terminated during the period covered by the statement.

- Disclose the value of the leasehold interest.

Section 87207 specifies that a statement disclosing income must contain the following:

- The name and street address of each source of income aggregating $500 or more in value, or $50 or more in value if the income was a gift, and a general description of the business activity, if any, of each source.

- A statement whether the aggregate value of income from each source, or in the case of a loan, the highest amount owed to each source, was at least $500 but did not exceed $1,000, $10,000, or $100,000.

- A description of the consideration, if any, for which the income was received.

- In the case of a gift, the amount and the date on which the gift was received, and the travel destination for purposes of a gift that is a travel payment, advance, or reimbursement.

- In the case of a loan, the annual interest rate, the security, if any, given for the loan, and the term of the loan.

In addition, there are specified rules if the filer’s pro rata share of income to a business entity, including income to a sole proprietorship, is required to be reported.

Section 87208 allows investments and interests in real property which have been disclosed on a statement of economic interests filed in the same jurisdiction within the previous 60 days to be incorporated by reference. Section 87209 requires disclosure of any business positions held by that person.

Section 87210 prohibits a person from making a gift totaling $50 or more in a calendar year to a person on behalf of another, or while acting as the intermediary or agent of another, without disclosing to the recipient of the gift both the intermediary or agent’s own full name, street address, and business activity, if any, and the full name, street address, and business activity, if any, of the actual donor. The recipient of the gift is required to include in the recipient’s Statement of Economic Interests the full name, street address, and business activity, if any, of the intermediary or agent and the actual donor.

- California Appellate Court Facilities - November 4, 2024

- Temporary and Permanent Legislative Officers and Employees - November 4, 2024

- Administrative Adjudications in California: General Provisions - November 3, 2024