California Bear Flag. (Photo: ca.gov)

Sacramento Taxpayers President Warns of Prop. 13 Bait and Switch

Read the petitions and understand what you are signing

By Katy Grimes, November 6, 2019 7:41 am

Debra Desrosiers, President of the Sacramento Taxpayers Association, walked out of Sam’s Club in Yuba City Saturday and saw a guy at a table collecting signatures for ballot initiatives. “Read the signs… who wouldn’t sign what is on the table? It looks great, right?” Debra said.

“But do you really know what those petitions say? I asked the guy if he was a paid signature gatherer, he said he was a volunteer – a lie. I asked him if he normally just hangs out volunteering to raise taxes on consumers for fun, oh and by the way, he lives in Florida, he doesn’t care.”

“I asked him which one of the petitions would protect Proposition 13, he couldn’t answer – he said I’d have to read them. I already have.”

Debra identified each sign (in bold).

“Mega Corps Pay Their Property Taxes” – “This I assume is referring to the Split Roll – Initiative 19-0008A – Removing commercial and industrial properties from Proposition 13, and reassessing them at market value every year,” Debra said. “But it’s being sold as ‘Increasing Funding for Public Schools, Community Colleges, Local Government Services,’ which it may, but did you see what they are doing with our gas tax? Can you imagine the swings in taxes this will cause for businesses and school budgets trying to calculate revenue? Have you thought about who will pay these tax increases? It’s you and me. When property taxes increase the burden is pushed down hill, the tenants’ rents are increased and the cost of their goods and services increase and we pay more. We end up paying the property tax increase as consumers.”

“When the local gas station gets reassessed, who will pay those property taxes?” Debra asked. “You. When your grocery store gets reassessed, who will pay? You.”

Debra posted a video on youtube of her interaction.

She says, “Ask the petition gatherer this, ‘So, you’re in front of a business that will have increased property taxes and who do you think will pay those taxes?’ I actually heard a petition gatherer tell people that commercial property owners don’t pay anything towards school funding. My head almost exploded as the uninformed petition signers said things like, ‘Ya, get it from the deep pockets.’ I’m not kidding.”

“Property Tax Break” – This is referring to Initiative 19-0003, being sold as “Closing Special Loopholes.” “This would allow ‘portability’ of the tax base for property owners 55+, severely disabled, victims of natural disaster and victims of hazardous waste contamination to move to any county in California and transfer their tax base, which sounds great,” Debra said. “But did you know that we already passed Propositions 60 and 90 that allow that – if a county chooses to participate, only 10 counties choose to participate. To be clear though, this would remove the requirement to buy at equal or lesser value to qualify for the tax base transfer – but if you actually do the math, it is still a huge tax base increase. The other ‘loophole’ is the parent/grandparent to child/grandchild tax base transfer already in effect through Propositions 58 and 193, but listen to this… this would force the heir to physically move into their deceased loved ones home to transfer the tax base. Think about that.”

“Ask the petition gatherer this, ‘You realize that we can already transfer the tax base to a participating county? How about if we get more counties to participate in that “loophole?’”

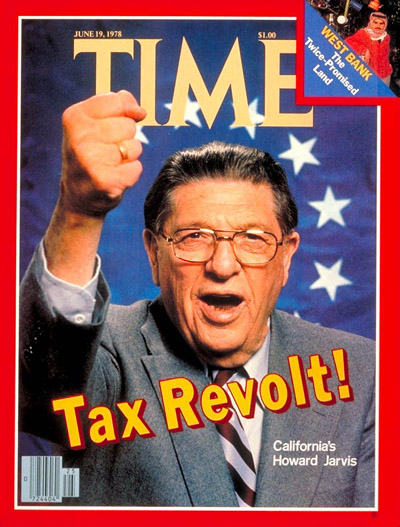

“Save Prop 13” – “I really have no idea what this is about because every petition related to property taxes on those petition tables is a flat out attack on Proposition 13 and all of the other Propositions passed by voters since 1978 that enhance Proposition 13 for property owners.”

Debra says, “Ask the petition gatherer this, ‘Which one of these petitions will save Prop 13?’ See what they say and let me know, because the real answer is ‘NONE.'”

“The Recall Newsom petition is the bait, it’s on the top of the petition clipboard, under that petition are all the others and I watched people mindlessly sign petition after petition not reading a single word and believing every word the PAID petition gatherer said,” she said. “Be careful, know what you are signing. Please pass the word to your friends.”

Most importantly, “If you think you signed a petition by mistake and are interested in signing a rescission to remove your signature, please let me know,” Debra said. “We can get you to the site that will do that. It’s OK, you didn’t know, but let’s fix it.”

“I’m not telling you what to sign or not sign, but please read the petitions and understand what you are signing. Everything that is circulating right now is on the Secretary of State’s website.”

Double check all ballot initiatives at this link: Initiatives Cleared for Circulation.

- California Elections Code Book Published - July 26, 2024

- California Supreme Court Ends Legal Snafu Over Gig Drivers – Upholds Prop. 22 - July 26, 2024

- Sen. Kamala Harris Claimed Ignorance Over Long-time Employee Sex Abuse Case - July 25, 2024

Democrat doublespeak again…

And again….

And again….

Another scam by the blue Democratic Party to impose additional taxes. Remember the businesses that rent from those spaces if this passed their will face horrendous rent increases which of course will be passed on to the consumer. Or some of these businesses will just close up shop and got out of business because they may not have large enought profit margins to sustain such rental increases. The tax happy crowd is at it again. As has been said they never met a tax they didn’t like.

Just watched democratic debates

Trump is two term President of the United States

What’s new? Every since Jerry MOONBEAM COCKROACH BROWN. We’ve taking it in the AZZ. We have millions of ignorant SPICS taking over who cant read nor speak English. All they do is drag race, rape our woman and children, sterl catalytic converters and sell drugs. Tell me why we need filth like this in Calimexice, Newbitch and your pet spic Basura!

If we as homeowners don’t support the business community in opposing “split roll,” don’t expect the business community to support us homeowners when in a couple years WE are on the progressive Prop 13 chopping block.

United we (hopefully) stand. Divided we SURELY fall.

You make a lot of sense, but confuse issues too easily in the defense of “Old Prop 13” and “New Prop 13”, which is a General Bond issue, not a Property Tax Issue. The truly onerous of these two is the one involving “Split Role”, which doesn’t have a number yet, as a competing proposition is still gathereing signatures. It taxes commercial at a higher rate is realllllly bad policy.

Portability, however, is good policy, not bad, because it allows most EXISTING home owners to move around the state without fear of higher costs……Why should just a few of the next generation get a break earned by the previous one, at the expense of their peers, for decades from now…..Portability allows for increased choice by the baby boom generation without creating unequal contributions for services by younger gens….and I’m a boomer.

If you wanted to vote against the gas tax- they made you vote YES . Very deceptive the way they word the props.

ATTY’S are TRAITORS PERIOD!!! TRAITORS ATTY’S have taken the JUSTICE SYSTEM to be EVOLVED into ^^^^ GREED OVER GOD— GREED OVER JUSTICE— GREED OVER LIFE —- PERIOD !!! TREASON FOR BLOOD TAX DOLLARS PERIOD

Everybody hates lawyer – until they need one.

Nobody “made them” They didn’t care or take the time to READ.

It appears our rights have been overwritten by executive order. that is why the people are pissed. no one should have that much power and not see the dangers

The signature gather is doing it illegally. You have to be a registered voter in California to gather signatures for a petition. Every signature they got needs to be disqualified.

And since when does the powers that be in Cali care if it’s illegal or not??

You are not correct. One does not have to be a registered voter to collect signatures in the state of CA, either vollenteer or paid. They only need to sign the declaration under penalty of perjury that they personally witnessed the signatures being signed and are required to not allow duplicate signatures and make sure all necessary voter information is provided to verify that they are in fact a registered voter signer.

It is not uncommon for professional circulators to travel from state to state to work on issues they choose to work. Every state that participates in the initiative process has their own state laws and requirements but I know very well, as a pro petition circulator residing in California, what the laws of this state is.

Just like prop. 47, The Safe Neighborhoods and Schools Act. The poorly named initiative that lowered some crimes from felonies to misdemeanors. People, don’t sign anything unless you understand it.

You should study the English language and grammar rules before attempting to sway opinions.

????

wtf

Signatures were illegally obtained.

Turn him in as voter fraud!

What is that website to go to if we signed? I know people that already signed mistakenly and I would like to push out this website.

The City has received multiple inquiries as to “How do I remove my name from a petition?”

As a result we have researched the Elections Code and we reference those with such

inquiry to Election Code Section 9602; stated below:

Elections Code 9602

A voter who has signed an initiative or referendum petition, and who subsequently wishes

his or her name withdrawn, may do so by filing a written request for the withdrawal with the

appropriate elections official. This request shall be filed in the elections official’s office prior

to the date the petition is filed. A written request made under this section shall not constitute

a petition or paper for purposes of Section 104.

Go to the Howard Jarvis website.

I speak as a petition signature gatherer… it is my job as a PAID signature gatherer to obtain signatures to put these issues onto the ballot. I am neither FOR nor AGAINST the issue themselves. I am for democracy and the ability to have people vote for issues that may, or may not, help society. I’ve been told, “You should be ashamed of yourself!” (Like they know my morals and values as a person beyond me getting signatures) to which I responded, “Have a good day”. I explain the petition as quickly and accurately as I can. Is there misleading text on it? Probably. However, it’s not my job to educate America on the government’s language on petitions. Again, I dont stand for or against the issues so I don’t put my personal opinion out there, it’s not my job to debate with people. It’s my job to get signatures. I tell people that if you don’t agree with it, then vote “No” on the ballot.

J.G.,

You are actually “FOR” something if you are gathering signatures to bring it forward and put it on the ballot. Don’t kid yourself, by thinking you don’t have a hand in whatever it is you are promoting as a signature gatherer. Keep your head up high on the things you support and don’t gather signatures for the things you don’t. Just my 2 cents. – R.

Impeach Trump the Racist TRAITOR,

LMaq, you’re an idiot. This is the demonic Democrats bill, it has nothing to do with Trump. Try not regressing on the evolutionary continuum.

You are an idiot!

You sir are a moron do yourself

And the rest of us Patriotic Americans a service. Sew your mouth shut and commence to bang your head on the nearest brick or block wall until you open your eyes. I guess you can’t fix stupid!

So glad you wrote such a clear msg re: the prop 13 issue…..I have been screaming about it for 2 years to those who refuse to see the truth…so my husband and I (both in our 70’s, retired and native Californians) are leaving. In 1976, I was a 2 yr bride and a new mama and the tax assessor called and said we owed $600…we didn’t have $600 I had to go to my parents, I will never forget the feeling of being kicked in the gut! We worked hard all our lives to raise our kids, made good moves and now have a nice(really too big) house. My taxes based on the PURCHASE price are $6k, under the new prop 13 based on the VALUE of my taxes will go to $25K. IF they go split roll all that you said is right, but, also thousands of small businesses will be forced to close…there goes jobs. I was up at 5 am last week, and they gave a short blurb that LA County is wanting to hire 25,000 real estate appraisers……remember, last year after Christmas that teacher union went out on strike…but, then it just went away…why????? Because they were promised a piece of the tax action to come. WHAT I WANT TO KNOW IS WHERE IS ALL THE LOTTERY MONEY AND OUR STREETS AND BRIDGES SHOULD BE MADE OF GOLD. IF ANY OF THIS GARBAGE PASSES, FLUSH THE TOILET THE CALIFORNIA I GREW UP IN IS GONE…..GOOD BYE, WE WILL BE LONG GONE.

Very well said Sue. I am 53 years old, born and raised in California. I inherited my family home after the passing of my parents. My home is a 1954 home, originally owned by my grandparents. I am on prop 13 as well. I was tricked into signing these petitions the other day! I was misinformed it was to protect prop 13! California is changing for the worse and we may eventually have to relocate out of California. This has always been home to me. It is sad as I can’t imagine living anywhere else. I feel for my kids. It us scary times. Prayers!

So, where can you go to “ UN-sign “ ?!

the HJTA website has a flashing red button at the top of their website which takes you to a page to withdraw your signature: https://www.hjta.org/

https://www.hjta.org/withdraw-your-signature-forms/

Katherine you can go to the Howard Jarvis website to remove your signature on that trick petition

So many are leaving. And I don’t blame them. We may too one day.

there is a remedy for all this nonsense. Vote Republican. Hold your nose if you have to but do it.

Who pays the paid signature gatherer? That should be posted. If you don’t have the time to be informed, maybe you shouldn’t sign. An old saying, “Believe none of what you hear, and half of what you see.” I personally believe that applies more now than before. Just my opinion.

That is right, everything that is being circulated is published on the secretary of states website.

For those that wish to read the full context of the bill before signing a petition, it is readily available in its entirety.

I take issue with a couple of points in this article.

1) The Split roll initiative. This initiative seeks to right a wrong and correct an inbalance of fairness that occurred under the original prop 13 bill. Proponents of the original bill, a real estate group, publicized the bill as helping elderly and severely disabled to receive a stay on their tax assessments to help relieve a burden and allow that their tax rate would not increase at a higher rate for as long as they owned their home. That is true. A later bill allows them to tranfer that tax credit if they decide to sell their home and buy a home of equal or lesser value and allows for family members to retain that savings as long as it stays in the family. What wasn’t widely publicised is that businesses and corporations, not just mom and pop, also received that benefit. It wasnt the tax break to the elderly and disabled that caused the problem, it was the unjust tax break to buissness and corporations that robbed schools, infrastructure, and emergency services of fair revenue. They have enjoyed this windfall for too long. This bill seeks to put right an injustice. You may want to call it raising their taxes but in reality, it is asking them to pay tax on fair market value! As they should have been paying all along!

2) I am deeply offended by the tone and intention of the author of this article. She assumes that all paid, and yes some are actually vollenteer, petition circulators are out to do you dirty! These men and women are doing a public service. They are offering the public an opportunity to directly participate in putting a petition, referendum or recall on the ballot. Although yes, a circulator should be well informed and capable of answering any questions, the truth is, the signature only helps to qualify it to the ballot. It is not your vote! If and when it does make it to the ballot, all information and arguments pro and con are provided in your voter information pamphlet. An informed voter has all information at their fingertips. A person who signs a petition can still vote no!

Furthermore, in this climate, where our lawmakers are beholden to their wealthy donors and not to the people that voted them into office, this is the one place where the voter has the opportunity to directly make a difference. If you dont trust the knowledge of that particular circulator, dont sign if your not comfortable, but not every circulator is uninformed..and again, its not your vote, its getting it on the ballot! The informed voter will read their voter information material!

What is my stake in this? I am an activist. I have worked both paid and 100% VOLUNTEER to collect signatures to qualify ballot initiatives, recalls and referendums that I care about because I do believe in direct democracy and personal responsibility! There have been alot of good bills that have been very favorably passed by the vote of the people due to the hard work these men and women to get them qualified to the ballot. If it bothers you that a person is paid to work their butt off to provide that opportunity to the voting public, how would you prefer they pay their bills? Consider that they may feel fortunate to be able to pay their bills and make a valuable contribution to society as well.

This is an opinion piece. No more then opinion. Read the actual language of this proposal. And look at what other states do (even your beloved Texas). MOST have split roles. This proposal has an exemption for small businesses, an exemption for agriculture. Agricultural land stays at the old formula (1% of purchase price, maximum 2% increase annually) OR on the Williamson Act (which is almost no property taxes paid). Small businesses with real estate of less then $3 million purchase price, and less then $500k of personal property (aka equipment) are exempted.

As for the comment above about people over 55 who move – under CURRENT law, it is up to the county as to whether they can keep their old base or not – most counties don’t allow them to keep the old base, and those who DO allow it, ONLY allow it if you stay within the county (so if a 60 year old woman wants to move 2 counties away to be closer to her children, under the current law, she’s screwed). So this is an attempt to make it BETTER for retirees and disabled to move – move closer to family, move into a smaller home, etc.

Property taxes DO support schools – there is a formula that mandates that schools get a portion of local property taxes. Property taxes also support your LOCAL government – POLICE AND FIRE. The State doesn’t take property taxes, they stay in your community.

No one is going to try to change the protection for individual homes – that would be political suicide. This is simply an effort to go to split role, as most states do. It won’t hurt small businesses. It won’t hurt family farms. It won’t even hurt corporate farms. It is designed to make companies like Google, Walmart, Facebook pay their share to support the community they operate in.

Michele,

Do you really believe that if this passes it won’t affect residential homeowners and renters? For one, apartments larger than a fourplex are considered commercial property. So rent there will go up to cover higher taxes. Followed by single family home rent prices raising because it’s subjective. Now the commercial property rents will increase, the small business’ that rent those storefronts will struggle and cut jobs and or raise prices for goods and services to try and stay solvent. On top of all of this the large corporations that this is targeted at will be better served paying their $2,000/hr lawyers to file appeals on the reassessments rather than pay the increase in tax. Reassessments that will already burden every county in this state which will then burden the court system. Inevitably rents raise, prices on goods and service go up, lawyers get paid, very few dollars go to what it was meant for. Sounds familiar huh. So tell me what this sounds like? You keep voting to raise taxes for a specific item, trusting politicians to make sure that money gets spent on what was put forth. How’s that worked out so far? Sounds like you keep doing the same thing expecting a different outcome. That sounds like the definition of… ????

If it is not broken you do not need to fix it and it is working just fine. BTW some of them were also doing remove Newsome from office.

To withdraw your signature, the HJTA website has a flashing red button at the top of their website which takes you to a page: https://www.hjta.org/

https://www.hjta.org/withdraw-your-signature-forms/

California collects more tax revenue than most other states due to it’s population and economy, taxes aren’t the problem, population is. Over the last couple of decades California has enticed people to move here, a majority of them low income/no income by providing “free” benefits. Problem is NOTHING IS FREE, these benefits cost tax payers and the more people receiving them the less tax money there is for other programs like education, road repair, etc. This tax and spend mentality has caught up with California politicians and now they need a new stream of income. This wouldn’t be such a big deal for businesses or individuals except that these same politicians have caused the real estate market to become so inflated that instead of a modest tax increase taxes for most commercial owners will increase by 4x or more. As the article states these expenses will be passed down to consumers, example if a grocery’s taxes increase $40,000 they will pass that on as higher food prices, worse is if the store is in a poor neighborhood where they have very low margins they may just close the store leaving the area without a grocery. While the system is flawed I agree, the answer isn’t more taxes it’s less spending by the politicians, less spending to buy votes and protect their jobs.

As Edison said, “5% of the people think, 15% of the people think they think, and 85% of the people don’t bother to think” I would suggest that this is just about right for the people in California. In Texas,it is probably closer to 100% who don’t bother to think. After all, they were indoctrinated by the age of 5 no they don’t need to think anymore. That is is why Trump was so popular in Texas. The Democrats are no bargain, especially the likes of Bernie Sanders and Elizabeth Warren, but I would rather have a moderate Democrat in office than a corrupt, incompetent, pathological liar who no more a Republican than Mussolini was. In fact I would say Trump is is rather like a replica of Mussolini. I can’t say like Hitler’s replica, because Trump is less intelligent than Hitler, but every bit as Dangerous..Com on California, start thinking. Don’t be like Texas.

Your comparison of Trump to Mussolini or Hitler is ridiculous….they were dictators….

I suggest you read up on history!

Comparing Trump to Hitler is nit only inaccurate, ineffective, dishonest and dangerous, it also trivializes the tragedy of the Holocaust in the name of scoring political points.

We need to remove this governor. Bait and Switch should be illegal, they did it with the mis-titled gas tax which passed. I think it’s time to leave this state and move. This gov is destroying California.

So, signing a petition requires more ID, and verification than voting in California. What’s wrong with that system? Everything!

There are only 2 ways to go California turn out in record numbers to bote these people out or from a well regulated malitcha and remove them from office

It seems hard for people to understand that businesses do not pay taxes – they collect them.

Taxes are collected by businesses by including the amount of those taxes in what businesses charge for their products and then sending that amount to the federal, state, and local governments.

I do not know why this is hard for anyone to understand.