Hospital hallway, emergency room. (Photo: VILevi, Shutterstock)

Tax Increase on Medi-Cal Managed Care Plans Really for Governor’s $73 Billion Budget Deficit?

This is money being taken out of your pockets to pay the governor’s bad debts

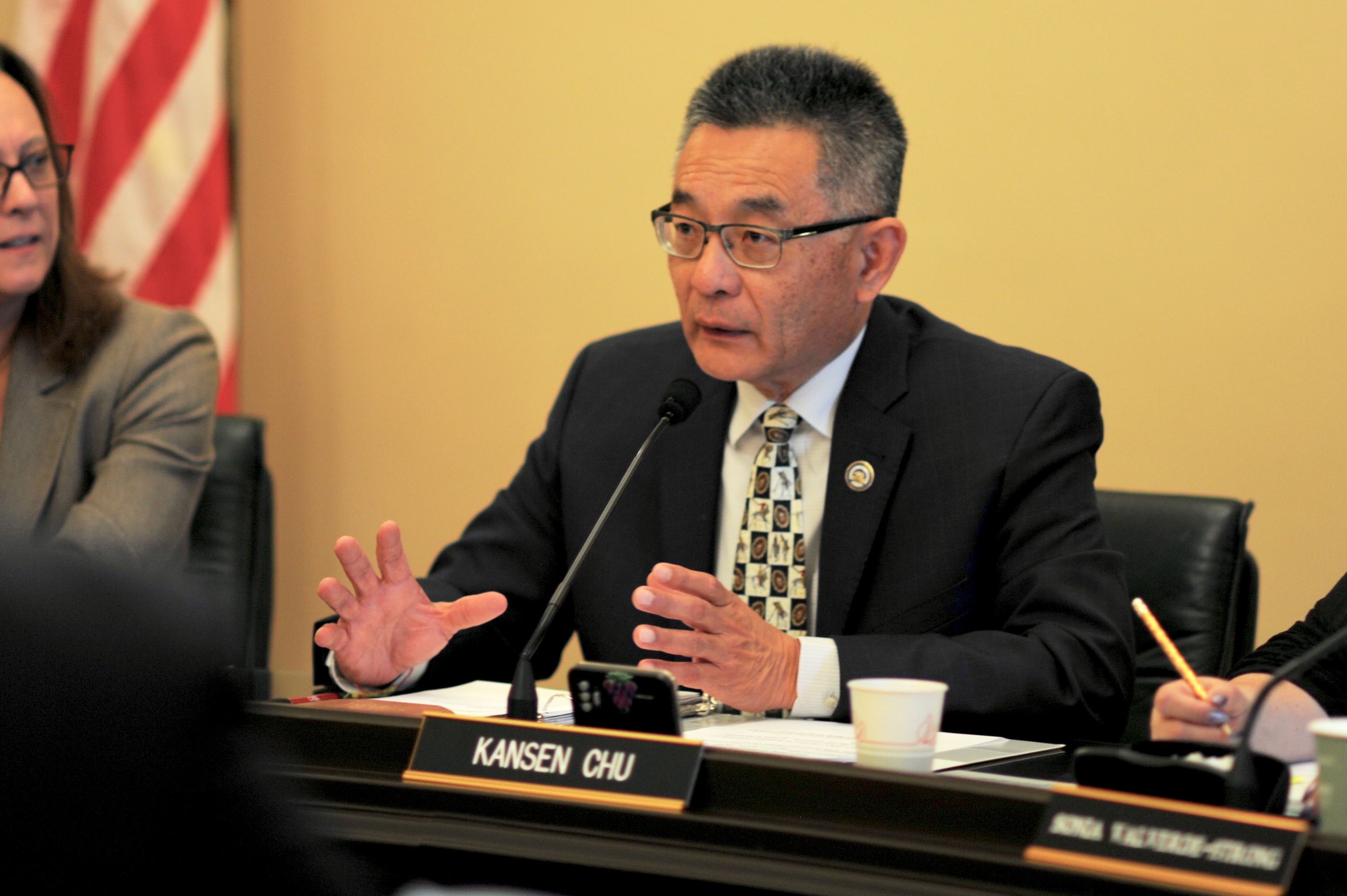

By Katy Grimes, March 19, 2024 9:15 am

California Democrat lawmakers are pushing a bill to increase the tax on Medi-Cal managed care plans by another $1.5 billion, to fund the state share of cost in the Medi-Cal program. Or so we are told. While this appears to be in-the-weeds legislative lingo, it also appears to be a money grab to help Gov. Newsom shore up his $73 billion budget deficit… on the backs of the state’s poorest people, and physicians who can’t get full reimbursement for treating Medi-Cal patients.

This is what third world countries do when the results of Socialism or Communism come home to roost. All you need to know is this is money being taken out of your pockets to pay the governor’s bad debts.

Assembly Bill 119 in 2023 authorized amendments to the Medi-Cal Managed Care Organization Provider Tax (MCO tax), affecting the budget of the Department of Health Care Services, according to bill analysis.

Last year, the MCO tax was to expire.

2024’s Senate Bill 136 increases that tax, as the bill language shows:

Existing law sets forth certain taxing tiers and tax amounts for purposes of the tax periods of April 1, 2023, to December 31, 2023, inclusive, and the 2024, 2025, and 2026 calendar years. Under existing law, the Medi-Cal per enrollee tax amount for Medi-Cal taxing tier II, as defined, is $182.50 for the 2024 calendar year, $187.50 for the 2025 calendar year, and $192.50 for the 2026 calendar year.

This bill would raise that tax amount for that tier to $205 for all 3 of those calendar years. (emphasis the Globe)

SB 136 seeks to impose another $1.5 billion General Fund tax increase, which will be matched by federal funds to give the governor $3.1 billion.

Last year’s MCO Tax (Assembly Bill 119) also taxed health plans, however, those revenues were intended to fund Medi-Cal providers with much-needed rate increases to Medi-Cal physicians.

This MCO Tax will not fund rate increases, but will instead be used to backfill the Governor’s massive budget shortfall.

The bottom line is that AB 119 was a bad bill and was passed and signed into law by Gov. Gavin Newsom in June 2023. And Democrats are back with another bad bill to help provide cover for additional funding for Newsom’s budget deficit.

I wonder what federal auditors would say about this scheme…

The governor will be able to “shift” $3.1 billion from the MediCal Provider Payment Reserve Fund to the general fund to help shore up his $73 billion budget deficit. How many other state agency budgets are facing such a scheme?

Republican lawmakers warned in Assembly floor debate Monday that the “shift” and additional tax affects the long-term stability of the Medi-Cal Managed Care Organization Provider Tax-funded provider rate increases by creating a fiscal cliff when the MCO Tax expires.

Or the governor will just get another bill passed to extend the tax…

Assemblyman Vince Fong (R-Bakersfield) called this another “tax,” and reminded lawmakers that promises were made last year of no increases on the MCO tax. Fong said the governor was “diverting funds to cover state mismanagement.”

The vote on SB 136 was telling, almost entirely along party lines, but with a few curious abstentions on such a blatant tax increase:

This budget scheme does nothing to improve California’s healthcare system, which is why it is curious that Republicans, including the Minority Floor Leader, Assemblyman Heath Flora (R-Ripon), who is the policy leader, did not vote against the tax bill (his second questionable vote in one legislative session).

Republican Leader Assemblyman James Gallagher (R-Yuba City) voted an affirmative “no” on AB 136 (the second vote in one legislative session his number 2 guy did not vote with him).

And it is just a tax being used as a bait-and-switch funding mechanism to provide relief to the General Fund.

“Historically, these taxes on managed care plans — the MCO tax — have been swept into the state’s general fund, used to balance the budget whenever times got tough,” Politico reported in June when AB 119 was passed. “But this year, nearly every health care advocate and elected official in the state was demanding the money stay in the health care system.”

Until the Governor needed $3.1 billion for his deficit.

Notably, California has added millions more people to Medi-Cal in recent years, including illegal immigrants, so asking for the additional tax last year made sense – which is really where the costs are going.

“For the coming year, the deal hews closely to what Newsom proposed in May,” Politico reported. “Some of the money will be used to balance the budget, with $3.5 billion going into the general fund. Three specialties will get a boost to their reimbursement rates: Primary care, OBGYN and some mental health care services will start being paid 87.5 percent of what the federal government pays them through Medicare.”

Hi Katy. A tax increase of $(205-187) for 15.7 Medi-Cal eligible/recipients is $1B for the three year period, not $1.5B. What am I missing? Thanks.

More absolutely INFURIATING stuff from this pinhead of a governor, Gavin Newsom. How can this be legal? We’re seeing this additional TAX —– and all because of Newsom and his reckless spending sprees, which of course adds insult to injury —- to dump into the General Fund toward a whopping $73 BILLION budget deficit (really $80 BILLION?… or more, we’re hearing?). Katy Grimes: “I wonder what federal auditors would say about this scheme…” No kidding! Welcome, welcome, federal auditors, come on in please, have a seat and have a look.

And apparently this outrage is only the beginning of many many many more to come. Katy Grimes: “How many other state agency budgets are facing such a scheme?” It would have to be A LOT, wouldn’t it, to even begin to fill in that $73 BILLION hole? You know, like a couple of DOZEN? Or many more, depending on what they would be able to get away with?

By the way, Gavin has been so panicked about Prop 1 not passing (and it might not), that in addition to running away from Sac reporter Ashley Zavala in the halls of the capitol, he has been out there supposedly barking orders to “cure as many ballots as you can” in order to drag that ailing thing (Prop 1) across the finish line. Suspicious me, but I keep hearing “curing ballots” as a euphemism for SEIU filled-in vote-by-mail ballots to add to the Prop 1 Victory Pile. Of course I don’t know but obviously wouldn’t be shocked if it would eventually be shown to be true. The question is, was Newsom also banking on much of the Prop 1 $6.4 BILLION bond cash to help cover the future continuing budget hole?

Trump is currently being prosecuted for saying something equivalent to Newsom’s “cure as many ballots as possible.”

Good point.

When they grind the counting of the March 5th election to a halt, they are looking for more yes votes in other areas that they would deem as “disenfranchised” voters. They goofed and did not manufacture enough “Yes” votes upfront because there was not any organized opposition. This causes reason for hope with the upcoming recall of Newsom. The people are past fed up with him.

Newsom and the criminal Democrat mafia in the legislature are at it again and as Katy Grimes pointed out this is probably just another money grab to help Newsom shore up his $73 billion budget deficit on the backs of the state’s poorest people, and physicians who can’t get full reimbursement for treating Medi-Cal patients. When will Californians ever be free of Newsom and the criminal Democrat mafia?

Time to cut the budget there, Gov Gav!

He will go down as the worst Governor California has elected or selected depending on your viewpoint. It makes Grey Davis look like a fiscal hawk.

I would think squeezing blood from a turnip, (the California Taxpayer) will no where near fix the problems these progressives have cooked up in the name of Climate Change and social welfare experiments.

So how much money could we save by ditching the train to nowhere, I ask for myself, my family, neighbors and every living Californian!

Time to redline the proposed budget! Now!

Give a Democrat a fish and he’ll eat for a day. Teach a Democrat to fish and he’ll steal your rod, take your wallet, sexually assault the fish, stuff the ballot box and then blame President Trump. Later he’ll sue you for assault.

HA!

I’m struggling to understand the headline. I can’t even get in to the body of the article. The word “really” doesn’t seem to fit. Help!