Ellen and Elly offshore oil platforms nearby Long Beach (Photo: www.bsee.gov)

Ringside: What’s Behind Newsom’s ‘Special Session’ on Gasoline Prices

Much of the high price for gasoline in California is caused by higher taxes

By Edward Ring, September 25, 2024 5:11 pm

By now most of the mega-majority Democrats in our state legislature understand basic facts about energy in California: We still derive 50 percent of our total energy from petroleum, and another 30 percent of our energy from natural gas. This makes them understandably reluctant to kill California’s oil and gas industry, and gives them pause before they outlaw every device – from automobiles and locomotives to electricity generating plants – that consume oil and gas.

By now most of the mega-majority Democrats in our state legislature understand basic facts about energy in California: We still derive 50 percent of our total energy from petroleum, and another 30 percent of our energy from natural gas. This makes them understandably reluctant to kill California’s oil and gas industry, and gives them pause before they outlaw every device – from automobiles and locomotives to electricity generating plants – that consume oil and gas.

What they may not realize is that to-date, despite mandating what amounts to hundreds of billions in higher energy prices on California’s households and businesses, California’s reliance on fossil fuel for 80 percent of its energy is only two percent better than the global average of 82 percent.

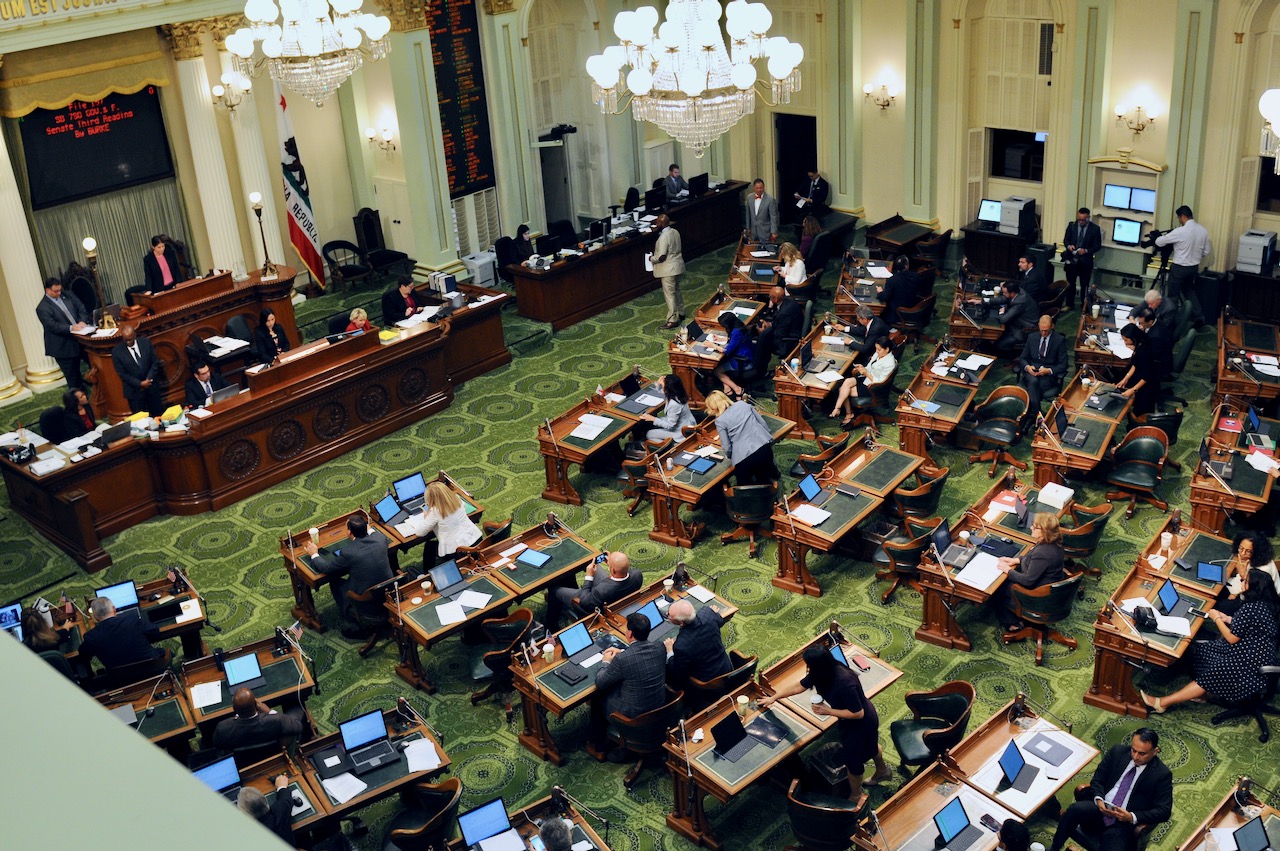

None of this, however, is stopping Governor Gavin Newsom, who has dragged a handful of legislators back to the Capitol for a special session on alleged price gouging by California’s oil refineries. In a press release on September 3, the governor claimed that “Gas price spikes on consumers are profit spikes for oil companies, and they’re overwhelmingly caused by refiners not backfilling supplies when they go down for maintenance.”

To prevent these alleged misdeeds, the governor proposes to require California’s refineries to stockpile reserves of gasoline to meet demand whenever refineries are not operating. In addition to mandatory storage, the law would require refineries to report how much refined gasoline they have stored at all times.

It’s hard to know what additional motivation may be behind the governor’s urgency. A report presented on September 18 by the legislature’s Utilities and Energy Committee discusses the need for more stored gasoline to buffer supply disruptions in future years when (as they predict) Californians go electric and demand for gasoline drops. And it’s fair to wonder if another underlying motivation is to build up the state’s reserves of gasoline to counter possible supply disruptions since the state now imports 75 percent of its crude oil. Perhaps the answer to that would be to produce more, here, instead of shutting it all down.

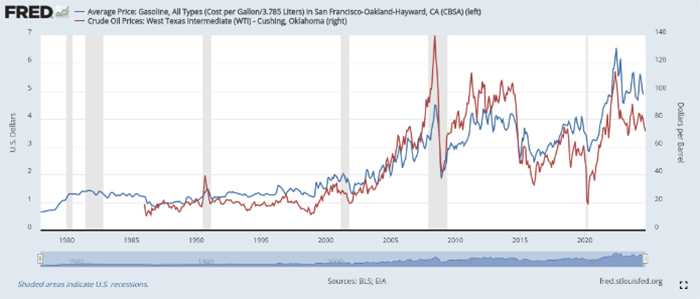

But the least credible motivation for these hearings, and this proposed legislation, is alleged price gouging, because the data doesn’t support the allegation. Using data compiled by the St. Louis Federal Reserve Bank based on figures from the Bureau of Labor Statistics and the U.S. Energy Information Agency, it is possible to plot historical price trends for barrels of crude oil versus the cost per gallon of gasoline. When comparing the price for barrels of West Texas Crude to the price for a gallon of gasoline in San Francisco, over time the respective plots rise and fall in almost perfect lockstep. The price of crude oil is the primary driver of gasoline price fluctuations, not temporary refinery shutdowns for maintenance.

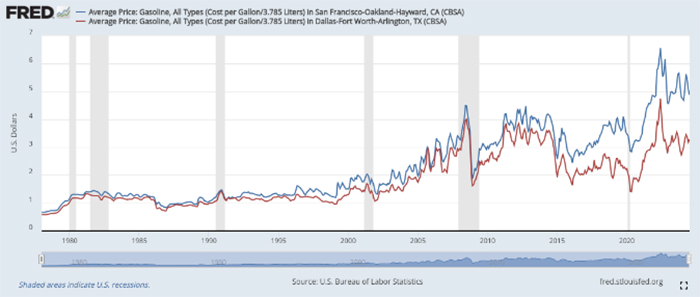

Further evidence is found when viewing, over time, the price for a gallon of gasoline in San Francisco compared to the price per gallon in Dallas. Here again, the plots move in lockstep, despite Texas refineries following an operations and maintenance schedule that has nothing in common with the schedules that apply at California refineries.

It’s impossible to not notice the difference in price, of course, between a gallon of gasoline in Dallas compared to a gallon in California. Some of that is justifiable. We refine our gasoline to higher standards in California because we have high elevation mountains surrounding our largest coastal cities, trapping emissions from millions of vehicles. But much of the high price for gasoline in California is caused by higher taxes. In July 2024, when the average price per gallon in California was $4.49, state taxes, fees, and programs added $1.23 to the price, along with another $0.18 of federal excise tax. The cost of crude oil added $2.04 and “industry costs and profits” added $1.04. Included in that last number are not only refinery operating costs, but also distribution and marketing costs.

California’s state government collects corporate income tax on oil company profits, which adds to the $1.23 they collect in direct taxes and fees on a gallon of gas. So one may ask, since our governor is so concerned about California’s consumers getting gouged at the pump, why the amount the state collects on every gallon of gasoline is grossly in excess of not only industry profits (before taxes), but profits plus total operating costs. Who, then, is gouging who?

Joining Newsom in a war on “big oil” is Attorney General Bonta, who in September 2023 sued Exxon Mobil, Shell, Chevron, ConocoPhillips, and BP for allegedly causing climate change-related damages and deceiving the public. Now Bonta has filed another lawsuit, this time against ExxonMobil for “deceiving the public on recyclability of plastic products.” This new lawsuit invites many questions. Why did Bonta, and every other concerned public official and legislator, fail to provide any oversight over the recycling industry which they regulated into existence? Why now? And has Bonta, in his zeal to harass the petrochemical industry at large, failed to recognize that almost everything in the civilized world is made out of plastic? It’s not just shopping bags. It’s everything.

And so California continues its state sanctioned war on energy, jobs, materials, and affordability. “Price gouging” confronts Californians everywhere. It is a completely unnecessary consequence of a state government that is out of control. It has little or nothing to do with “oil company profits.”

- Ringside: Can California’s Oil Industry Survive? - February 5, 2026

- Ringside: California’s Drought is Over, But We Still Must Invest in Water Supply Projects - January 29, 2026

- Ringside: Why Fossil Fuel Use Must Increase – The Numerical Reality - January 22, 2026

It’s embarrassing on top of everything else because the Newsom administration lies badly and are otherwise implausible in everything they do. Sorta looks like AG Bonta’s self-righteous law suit, apparently at Newsom’s direction, is motivated by “big oil’s” deep pockets, where a law suit might help to fill in some of that $73 billion dollar budget hole, you know? Or am I missing something?

Let us cut to the chase. Newsom wants to build his own Strategic Oil Reserve, so he can use it to drop prices at election time just like Biden did. He and his cronies will stockpile expensive oil, paid for by taxpayers, then lose his (and taxpayers) asses when a Republican comes in and brings more oil to market and the value of his oil reserve crashes.

Newsom has no clue how big a tank farm of this size needs to be. But he does not care. He has been captured by feelings of grandeur, greater than market forces can supply. Meanwhile, Newsom is sending his strategic water supply to the ocean instead of letting farmers grow crops with it. Go figure.

Spot on analysis Chuckie, on another insightful article….

Thank you both for publishing this publicly, so people can see and read what a dumbass Gavin Newsom is about fuel sources and energy policy…

Newsom and the criminal Democrat mafia in the legislature are completely out of control as they continue their state sanctioned war on energy, jobs, materials, and affordability.

Would be interesting to see statistics on the dollar amount and percentage rise in gas related taxes (direct and sales) and regulatory cost impositions over the past 30 years.

Newsome had a coccaine problem that fried his brain but he’s pretty boy whose friend was a Getty.

California gets hosed on just about everything because of his kind of corrupt leadership. BTW did he return the hundreds of thousand dollars he got from PGE was in trouble for not maintaing electricity transmission tower parts that caused massive fires?

He’s hoping for KH to become President so he can get a cushy Federal do nothing job

It’s all bs people!