California Gas Prices Surging Above $4.00. Again.

California’s oil and gas industry is one of the highest taxed industries in the nation

By Katy Grimes, April 16, 2019 10:37 am

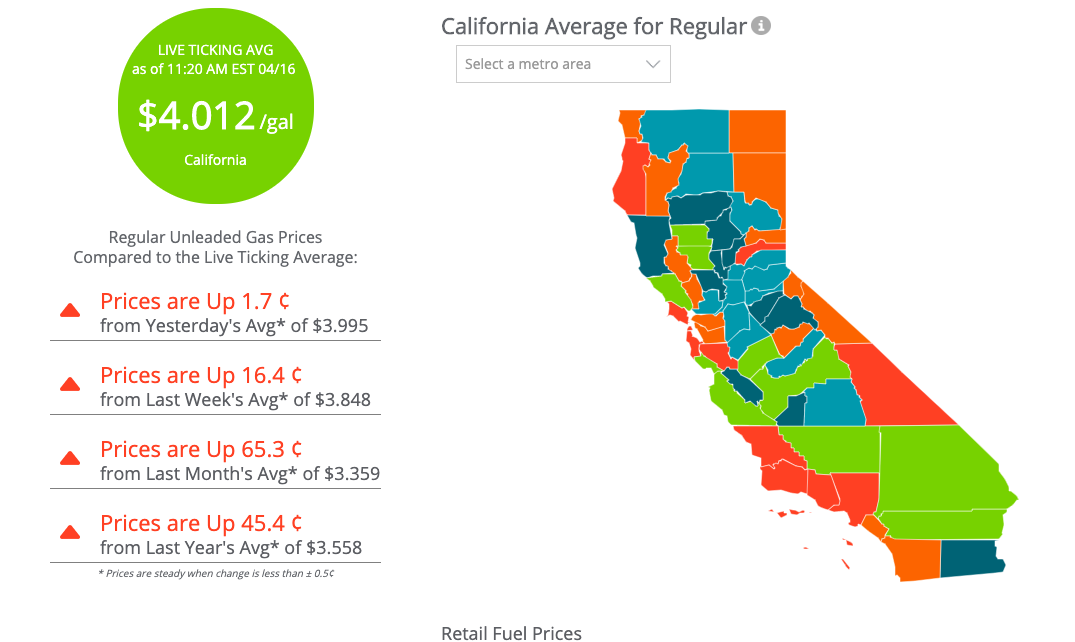

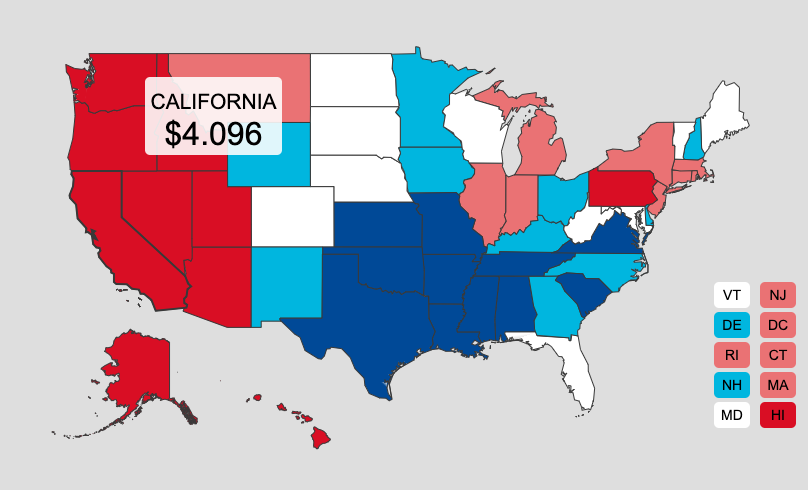

Having just returned from a trip to Virginia, where gas prices ranged from $2.49 to $2.55, it was astounding to see California gas prices surging above $4.00 per gallon. Again.

Now it is being reported that gasoline prices at the pump have climbed for more than eight weeks in a row in California.

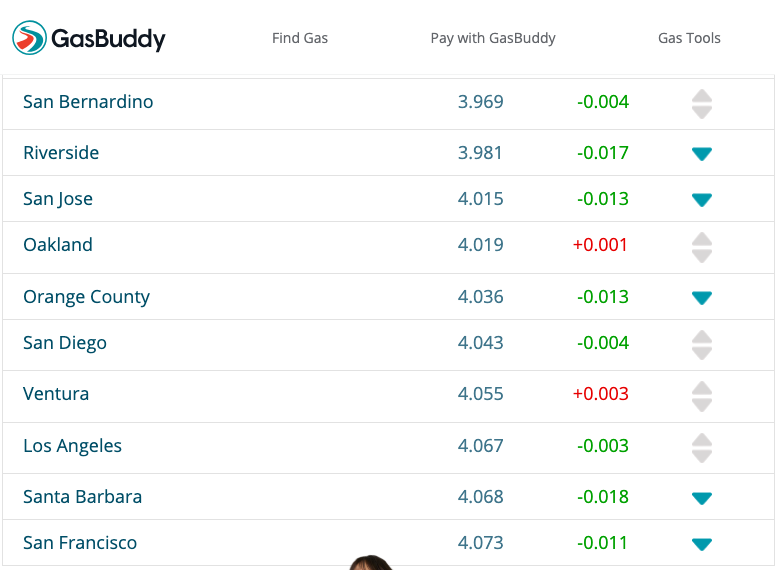

“California will soon be home to something not seen in nearly five years: a statewide average of over $4 per gallon, with some of the largest cities there swelling to averages as high as $4.15 per gallon before any relief arrives,” Patrick DeHaan, head of petroleum analysis for fuel-price tracker GasBuddy said, and MarketWatch.com reported.

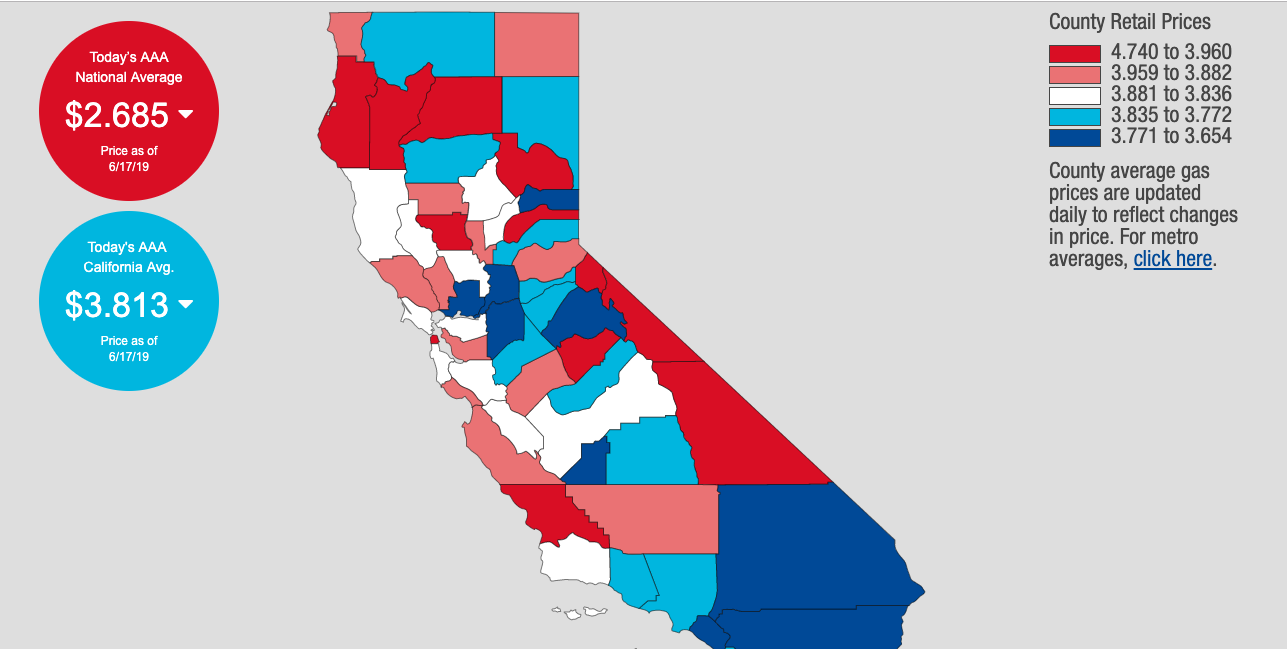

California and the West Coast has been hit particularly hard, after “seeing a surge in unexpected refinery outages, leading to an extremely tight supply of cleaner summer gasoline and causing prices to skyrocket,” said DeHaan.

“Petroleum analysts are blaming maintenance issues at four California refineries,” KGO reported. But that is an erroneous conclusion.

California’s stringent environmental regulations have isolated it from the larger gasoline market. “California’s predicament is largely of its own making and its extra high gasoline prices should not be blamed on Iran, President Trump or even OPEC,” Forbes reported.

But it’s even more complicated.

California requires a special blend of gas, which changes twice a year, from a winter formula to a summer formula. And, when voters voted down Proposition 6 last November 6, they essentially approved more future gas tax increases. A YES vote would have repealed the gas tax imposed by the California Legislature in 2017. A NO vote approved more gas tax increases, including another increase of 5 cents a gallon July 1.

Proposition 6 also would have created voter approval (via ballot propositions), along with legislative passage and the governor’s signature, to impose, increase, or extend fuel taxes or vehicle fees.

The bulk of the high gas prices are a result of the most stringent regulations for its gas in the nation, imposed by the California Air Resources Board under the guise of lowering the state’s greenhouse gas emissions, and explained in recent California Globe articles. This leads to very few refineries willing to produce gasoline for the state, driving gas costs up.

“California contributes less than 1% of the world’s greenhouse gas emissions, so even if we were to reduce all our greenhouse gas emissions, that is not ultimately going to be the answer to climate change,” Tiffany Roberts, Western States Petroleum Association’s Director of Legislative & Regulatory Policy explained in February. “What IS important is that we have policies in place that recognize there needs to be a balance between environmental integrity and economic vitality.”

Legislating more gas tax increases

Senate Bill 246 by Sen. Bob Wieckowski (D-Fremont), listed by the California Chamber of Commerce as one of it’s Job Killer Bills, “would impose a 10 percent oil and gas severance tax onto an oil and gas operator, adding another layer of taxes onto this industry that will significantly increase the costs of doing business, thereby increasing prices paid by consumers for goods and services in this expensive state as well.”

“In the midst of California’s large budget surplus, this is an unnecessary tax that will impact businesses and consumers and harm our state’s economy,” WSPA President Catherine Reheis-Boyd said about SB 246. “California voters have already rejected this bad idea because they understand it would increase costs, devastate jobs, local services, and compromise our state’s sustainable energy future.”

Reheis-Boyd said: “California’s oil and gas industry is already one of the highest taxed industries in the nation, contributing $42 billion in federal, state and local taxes.”

- VP JD Vance to Lead Anti-Fraud Task Force in Newsom’s California - February 4, 2026

- Steve Hilton Stands Out in CA Gubernatorial Debate - February 4, 2026

- Gov. Gavin Newsom: How to Destroy California in Two Terms - February 4, 2026

I suspect that the reason for ANY tax in our state is the need to fund the health care and pension funds of our present and past state/city employees.

California’s perpetual money grab – anything related to petroleum is taxed far and wide. From the asinine winter/summer blend BS, to Becerra purposely obfuscating the title and summery of Prop 6, it never ends and never will. Keep it up and California will assure its own bankruptcy when no one but non-business wealthy will live here. Then who will build their mansions? Who is John Galt? I see it coming.

Unfortunately, when the gas taxes goes up, it is not used for what it is intended!