Senator Patricia Bates. (Kevin Sanders for California Globe)

Gov. Newsom Signs Bill To Eliminate Non-Profit State Filing Fees

SB 934 was costing the state more on manpower, paperwork than what it brought in

By Evan Symon, September 10, 2020 2:20 pm

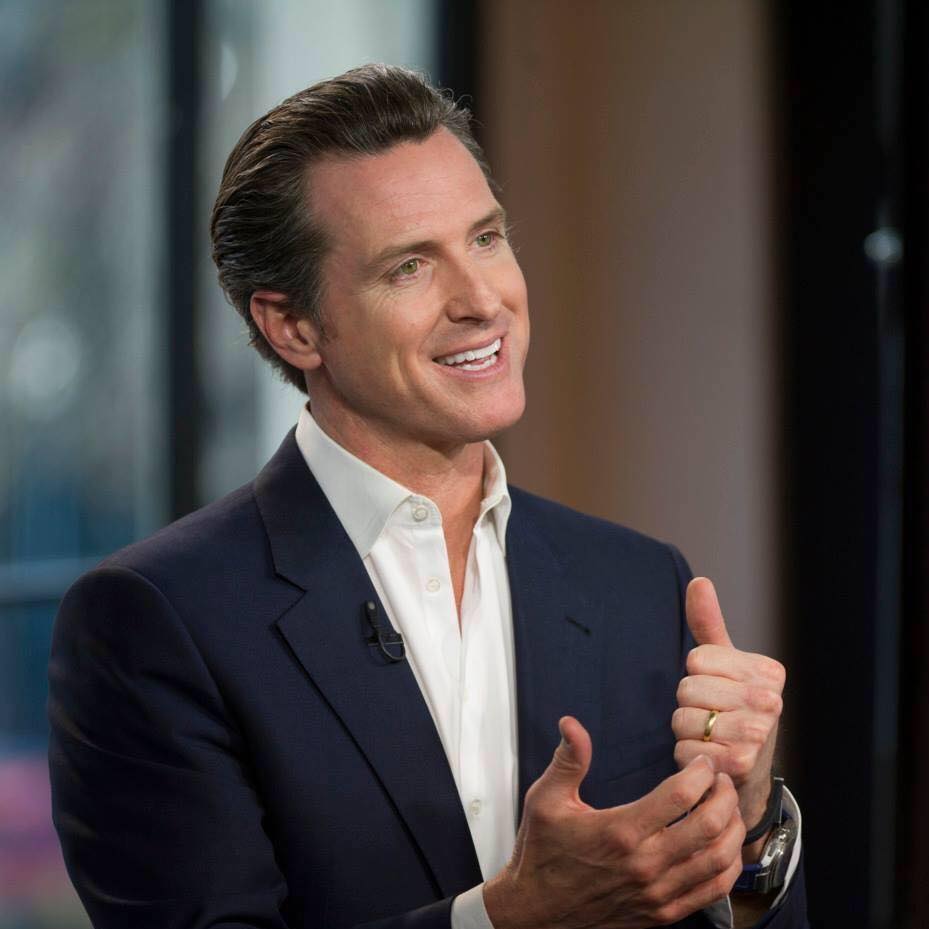

On Thursday, Governor Gavin Newsom signed into a law a bill that will remove California Franchise Tax Board (FTB) filing fees for non-profit organizations applying for state tax exemptions.

Senate Bill 934, authored by Senator Patricia Bates (R-Laguna Niguel), will remove the $25 filing fee tax exemption filing fees, as well as the $10 filing fee for annual informational returns to the FTB and $25 late fees.

While Senator Bates and other supporters pushed for SB 934 to be passed as a way for non-profits to save money and reduce paperwork, the main reason to remove the fees was to remove a large redundancy at the FTB. Non-profit fee collection had been costing the FTB more to collect through manpower and resources than how much they were bringing in. With the signing of the bill on Thursday, both non-profits and the state will now both save money and reduce government waste.

“I thank the Governor for signing my bill to help non-profits save money, reduce paperwork, and make more efficient use of state resources,” said Senator Bates in a statement on Thursday. Special thanks goes to the FTB for partnering with me on this common sense legislation to help make our state government more efficient. When SB 934 becomes effective next year, the FTB will be able to devote additional resources on priorities such as processing tax refunds for families.”

Support for SB 934 had been strong since the bill was introduced earlier this year. It passed every every committee and floor vote unanimously, including a 75-0 vote late last month in the Assembly.

“This is a good thing for everyone,” explained Lucas Wolfe, an accountant to several non-profit companies, to the Globe. “A $25 filing fee may not seem much, but to smaller non-profits, especially those that pride themselves on not having any money go to a staff or administration, it can sting. At least one non-profit I helped out last year had to take the filing money out of an important account, and that means that money could no longer go to someone who could have really used that.”

“Look who was behind it: The government, Republicans, and Democrats. If all three agreed on this, it really must have not been working. And really, it wasn’t. They were spending more on this program than it brought in with no programs or services to help people to justify the loss. There was no real reason to go against it.”

“At least one bill passed this year showed common sense all around.”

SB 934 is due to become law on January 1, 2021 and will be applied to taxes in the coming fiscal year.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

We’re concerned about 25 dollars???

Things are really that BAD for CA non-profits???

Wow….