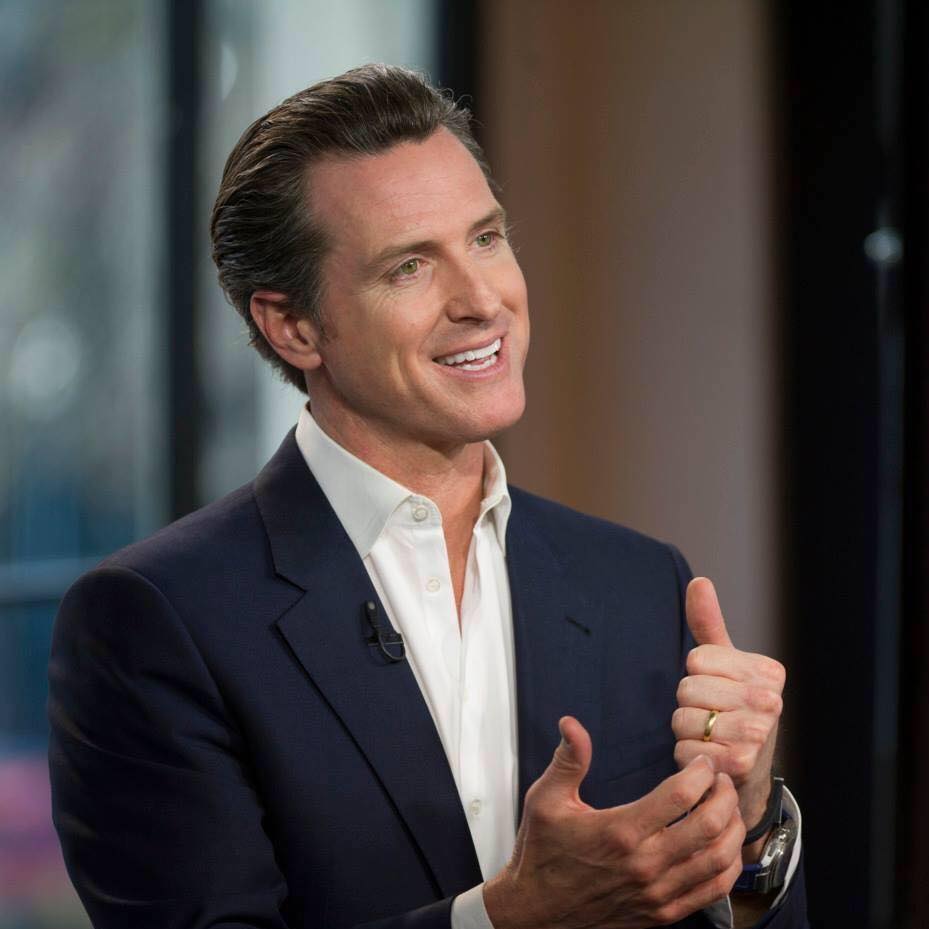

California Governor Gavin Newsom speaking at the State of the State address in Sacramento, CA, Mar 8, 2022. (Photo: Sheila Fitzgerald/Shutterstock)

Latest Claim by Gov. Newsom: Highbrow Hubris or Desultory Delusion?

‘California is not a high tax state’

By Martin Marks, May 12, 2023 3:05 am

Let’s give credit where credit is due. At least he was able to say it with a straight face.

Last week in a conversation with Stephanie Ruhle, NBC Senior Business analyst and host of MSNBC’s The Eleventh Hour, California Governor Gavin Newsome commented that despite the “lazy punditry” that perpetuates such claims, California is not a high tax state. The dialogue took place at the Milken Institute’s Global Conference held in Los Angeles.

When confronted by Ms. Ruhle with the proposition that among other things, Californians pay high taxes, and then proffered a pointed question, “Why should people be in this state?” Newsome responded, “I respectfully submit that I do not accept the premise.”

He continued, “California is not a high tax state, and I know y’all are gonna roll your eyes.” (as if he knew he had just uttered something incredibly outrageous). “It is for you,” pointing to what he assumed to be a wealthy audience— “….but not 99% of the others……..I am not a tax and spend liberal.”

Wow. Just, WOW.

Newsom then cited a study that reported California as the 9th best tax-friendly state for the middle class. It is likely that the governor was referencing a 2022 report by Kiplinger that indeed rated California as the 9th best tax friendly state for the middle class. Yet, the Kiplinger report defined a typical middle class family as a married couple with two children making $77,000 in yearly income.

Can we really categorize such a family as “middle class”—especially one living in California? Hardly.

Let’s take a look at another report done by Pew Research using 2020 U.S. Census Bureau figures. They report that the middle-class income range for a family of four in the U.S. is from $67,100 to $201,270 with the median figure at $97,650. That’s a 27% jump from the figure that Kiplinger chose. Additionally, when one factors in the obvious cost of living and corresponding income variations across the country, can we really assign that $77,000 figure from Kiplinger as “middle-class” in California? Can we even ascribe the Pew figure of $97,650 as “middle-class” for a Golden State family?

The bottom line here is we simply cannot accept the premise that somehow California is a tax-friendly state for the middle class, either from Kiplinger or from Governor Newsom. By his own admission in the Milken interview, Newsom acknowledges that the California income tax is highly progressive in nature. By definition, those families earning north of the $77,000 yearly income figure—and there are quite a few of them in California, no?—are being taxed at much higher rates than those at that $77,00 figure or below. In fact, California, at 13.3% has the highest in the land state income tax at its upper “progressive” margin. More on that in a moment.

But, really Governor. When you pointed at that Milken audience to acknowledge that they may in fact pay high taxes in California, but 99% of the rest do not, was this hyperbole or delusion?—because it was certainly not the truth. The fact remains, that those 99% do pay some of the highest state income taxes, sales taxes, gasoline taxes, and other assorted taxes and fees in the nation. The only California tax that might be seen as comparably reasonable and tolerable compared to other states is the property tax as the voter-enacted Proposition 13 of 1978 has kept a lid on that tax spiraling out of control. And do we believe for a second if the inconvenience of Prop 13 didn’t stand in the way, that progressive California politicians wouldn’t be ravenously feeding at that trough as well?

Yet, there is another facet of this Milken Institute conversation with the Governor that needs to be examined. When Newsom averred that California is not a high tax state and then pointed to what he perceived to be a wealthy audience to acknowledge, “It is for you,” his interviewer interjected, also pointing to the audience, and asked:

“Do you not want these people to live here?”

Newsom of course responded in lighting round speed that he did want his audience that day to remain in California before quickly launching into a litany of reasons why California is a wonderful place to live. What he chose to gloss over is that California’s blue-state progressive policies that he and other left-wing politicians are responsible for are causing those upper income earners and job-providing businesses to leave the state in droves and it is mainly due to California high tax policies.

For a while now, California has been hemorrhaging residents—and this outbound migration spans the income spectrum. Since 2020 California has had a net decrease in population of 500,000 residents and that trend is predicted to continue. Reasons cited for leaving the Golden State have been high housing costs, crime, long commutes to work, the effects of the Covid-19 pandemic, taxes, and just a high cost of living in general.

Just recently, the Public Policy Institute of California (PPIC) released a study that showed in detail to which states this Cal-exit was taking place and cross-referencing it with the income levels of the residents seeking a better life elsewhere. According to PPIC, generally the net loss/gain of residents was to neighboring states such as Utah, Nevada, Arizona, Oregon and Idaho. One fairly notable exception was the net outflow of residents to Texas where that net loss was the greatest by far. Texas is known for many things including but not limited to lower taxes, lower housing costs, and something less than progressive politicians at the helm of state government.

And then the PPIC study highlighted a truly enlightening fact. They noted which states in the union that do not have a state income tax – Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming – and then indicated that it was the high-income California emigrants who were leaving predominantly for these states. On the contrary, it was the lower income residents that were leaving for states irrespective of the state’s income tax. Middle income residents left for states with or without a state income tax in equal proportions.

In avian terms, as these trends continue and the golden geese continue to flee California, the chickens will eventually come home to roost as tax and spend liberals in Sacramento led by Newsom see their revenue sources needed to fund their lefty largesse disappear.

What Governor Newsom did not admit to, nor can he avoid is that the top 20% of income earners pay more than 90 % of the state’s income taxes. Newsom was way, WAY off when he pointed to the roomful of Milken Institute attendees to insinuate that it is just the upper 1% of California income earners that bear the burden of California’s onerous taxation. California is indeed a high-tax state, and no amount of glib talking points can circumvent that fact.

Governor Gavin Newsom is in fact a tax and spend liberal despite his protestation to the contrary.

- Time to Take The Human Touch Out Of Redistricting - January 20, 2026

- Vice President Vance Visits The Golden State - February 22, 2025

- Is DEI Ready To DIE? - January 4, 2025

Guess it comes down to what the meaning of “is” is. Is it a tax or is it a fee.

There’s middle class in California?

Didn’t see this interview, but wonder why Ms. Ruhle didn’t refute Newsom’s claim with some of the data that is so readily supplied here?

Like most what’s out there these days, not good journalism.

Gas Lighting on steroids. I thought leftists were trying to outlaw natural gas? 😉