TRICK or TREAT: California Ranks Among 10 Worst in U.S. for High Taxes

No TREAT: Gavin Newsom’s state ranks in the bottom three for worst for individual taxes

By Katy Grimes, October 31, 2023 3:29 pm

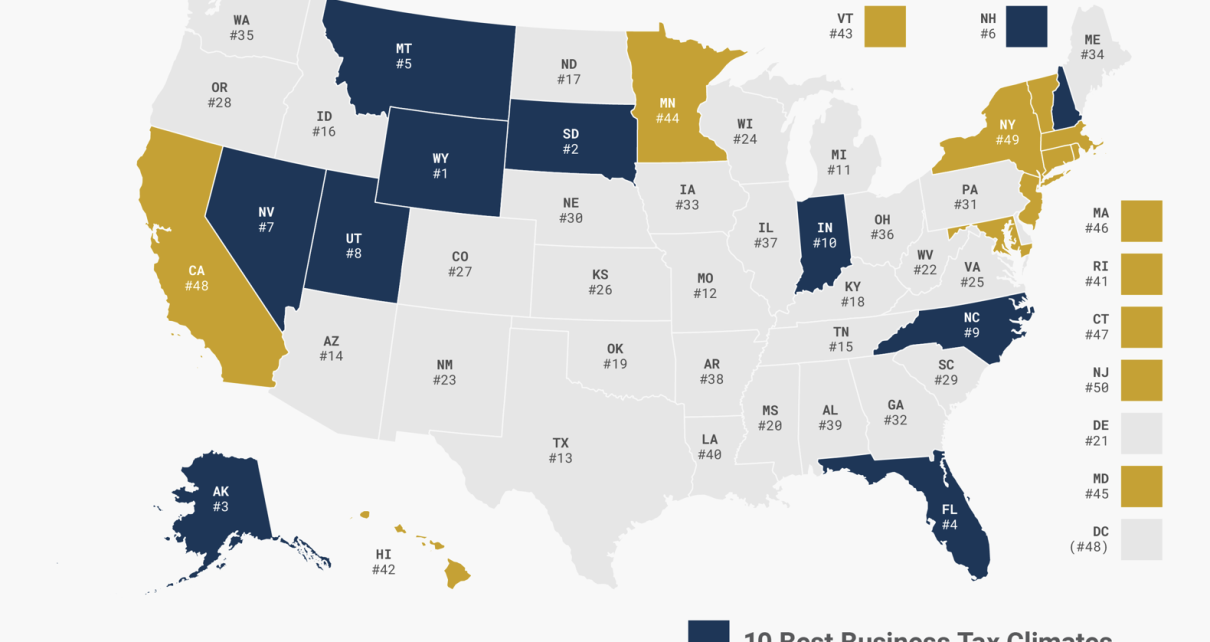

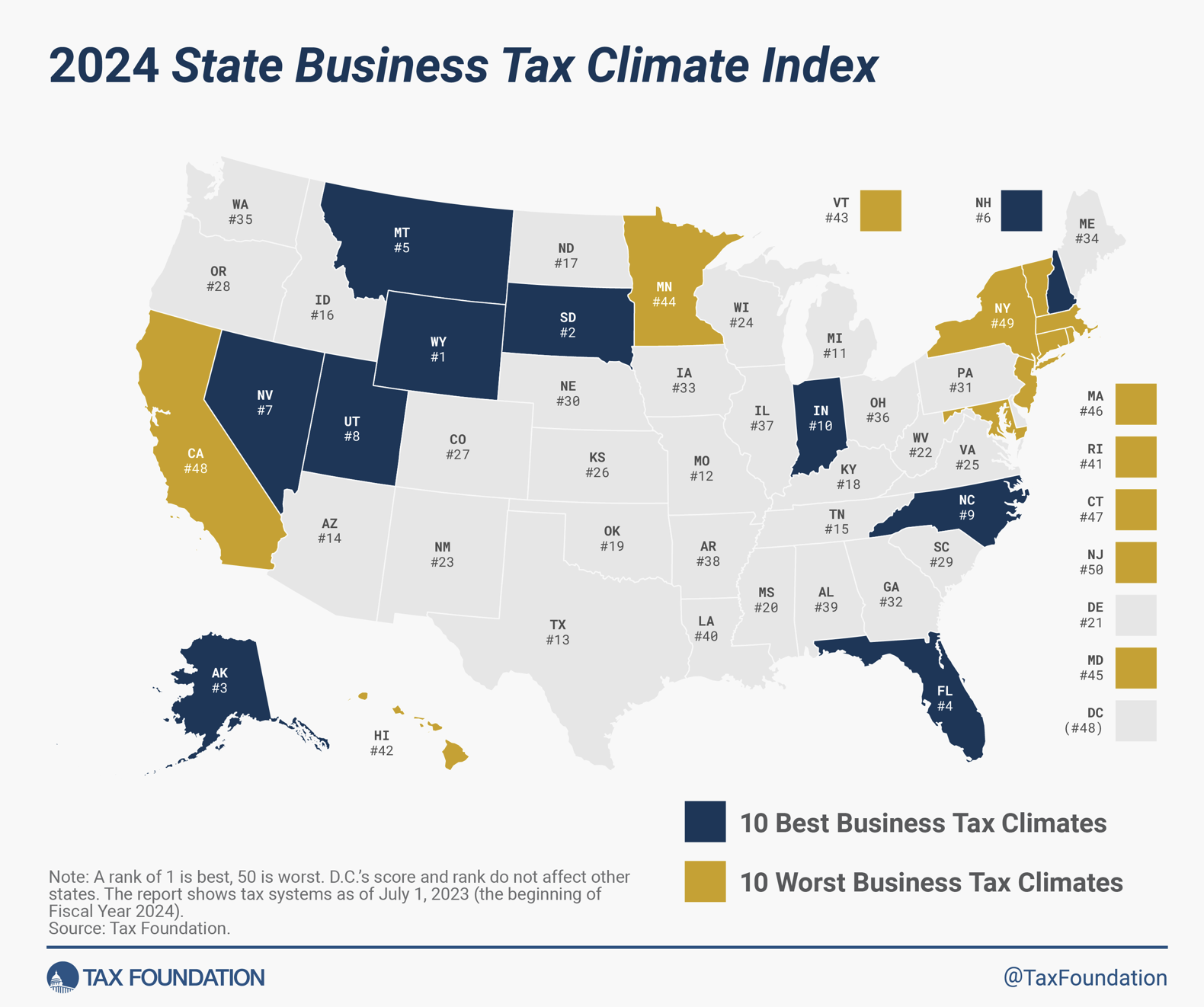

The Tax Foundation’s State Business Tax Climate Index 2023 finds California has maintained its position as number #48 for the worst taxes in the country, in a near three-way tie with New York and New Jersey.

California still ranks in the bottom three for worst for individual taxes.

The Tax Foundation has released its annual State Business Tax Climate Index enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare. While there are many ways to show how much is collected in taxes by state governments, the Index is designed to show how well states structure their tax systems and provides a road map for improvement.

What do high tax states have in common? “Complex, nonneutral taxes with comparatively high rates.”

What do low-tax states have in common? “The absence of a major tax is a common factor among many of the top 10 states,” the tax Foundation reported. “Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax. Nevada, South Dakota, and Wyoming have no corporate or individual income tax (though Nevada imposes gross receipts taxes); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire and Montana have no sales tax.”

The Tax Foundation offers New Jersey, for example, which “is hampered by some of the highest property tax burdens in the country, has the highest-rate corporate income taxes in the country, and has one of the highest-rate individual income taxes. Additionally, the state has a particularly aggressive treatment of international income, levies an inheritance tax, and maintains some of the nation’s worst-structured individual income taxes.”

Ouch New Jersey. That hurts. But California has most of the same taxes. Only Proposition 13 keeps our property taxes somewhat in check.

California has the highest gas tax, personal income income tax, and state sales tax in the country. Ouch again – especially right now with such high inflation.

The 10 lowest-ranked, or worst, states in this year’s Index are:

- Rhode Island

- Hawaii

- Vermont

- Minnesota

- Maryland

- Massachusetts

- Connecticut

- California

- New York

- New Jersey

Here are California’s individual tax rates from the Tax Foundation:

Top Individual Income Tax Rate

13.3%See Full Study

State Local Individual Income Tax Collections per Capita

$3729 Rank: 1

State and Local Tax Burden

11.5% Rank: 43See Full Study

Top Corporate Income Tax Rate

8.84% See Full Study

State Business Tax Climate Index Ranking

State Sales Tax Rate

7.25% Rank: 1See Full Study

Average Local Sales Tax Rate

1.57% See Full Study

Combined State and Average Local Sales Tax Rate

8.82% Rank: 7See Full Study

State and Local General Sales Tax Collections per Capita

$1498 Rank: 15

State Gasoline Tax Rate (cents per gallon)

68.15¢ Rank: 1

State Cigarette Tax Rate (dollars per 20-pack)

$2.87 Rank: 12

The 10 best states in this year’s Index are:

“The absence of a major tax is a common factor among many of the top 10 states.”

As for California’s death tax, as Jon Coupal reported, “for 35 years we haven’t had a death tax, until the narrow passage of Prop. 19 in 2020.”

“Proposition 19 resurrected the Death Tax on hard-working families and put their homes, businesses, and legacy at risk. While it was cleverly disguised as a benefit for the elderly and disabled communities, Prop. 19 caused more harm than good.”

“Prop. 19’s Death Tax unleashed a callous tax increase on Californians who are grieving the death of a loved one. The passing of Prop. 19 eliminated the taxpayer protections of Prop. 58 and Prop. 193 from the state constitution. These protections guaranteed properties wouldn’t be reassessed upon the passing of parents and grandparents — enabling children and grandchildren to keep their family home or business.”

Senator Kelly Seyarto (R-Murrieta) held a press conference in May 2023 introducing Senate Constitutional Amendment 4, to restore taxpayers’ property rights by reversing the state’s “death tax” written into in Proposition 19. Deviously titled “the Property Tax Transfers, Exemptions, and Revenue for Wildfire Agencies and Counties Amendment,” Prop 19 passed in 2020 by voters who were deceived.

SCA 4 would reverse one of the largest property tax increases in state history, a little-noticed provision of Proposition 19 that revoked the ability of families and parents to pass property to their children without any change to the property tax bill, according to the Howard Jarvis Taxpayers Association.

Sen. Seyarto said SCA 4 will allow Californians to keep their childhood homes and family businesses when their parents or grandparents pass away.

Except Democrats killed SCA 4 only days after Senator Seyarto’s press conference, and I anticipate they will again in 2024.

But you must consider what California taxpayers get for the exorbitant taxes they pay:

Wonderful public schools

Little homelessness

Little crime

Hardly any drug addiction

Little government intervention

Wonderful roads

Caring politicians

Secure borders

Very few welfare recipients

Functional big cities

No censorship

Perfect business climate

Lowest gas and energy prices

Anyone can get home insurance

Colleges and universities whose sole objective is teaching critical thinking

The Oakland Raiders

C’mon people, show a little gratitude

Ha ha! So funny, Fed Up.

Yeah, where’s the appreciation, people? 🙂

Prop 19 was such a deliberate deception. Multi generation property will have forced sales due to property taxes.

With high income taxes California has driven out some very high tax paying individuals like Musk. They will want even more taxes increased. Stop supporting the homeless by choice and the “homeless industry”. I am fine with housing vouchers for those truly in need such as the disabled and single parents of young children. Too many homeless by their own choices destroy rentals within months.