Prop 13 Split-Roll Tax Increase Would Hurt Business, and Affordable Housing Efforts

No longer the ‘Golden State,’ California is the ‘tax-me’ state

By Katy Grimes, February 11, 2019 1:05 am

California Gov. Gavin Newsom announced during his budget press conference he is on a mission to force cities across the state to build more affordable housing, or risk losing state transportation dollars. But with a Constitutional Amendment initiative on the 2020 ballot threatening to remove tax protections on commercial and industrial properties, Newsom’s affordable housing construction boon may end up being a bust.

In the past eight years, local governments across the state have enacted more than 800 general and special taxes on businesses and residents – perhaps incentivizing cities and developers could be more effective.

The liberal dream to undo Proposition 13

“It has been a liberal dream for decades to undo parts or all of Proposition 13, the seminal California initiative limiting the property tax rate,” the Sacramento Bee reported last year.

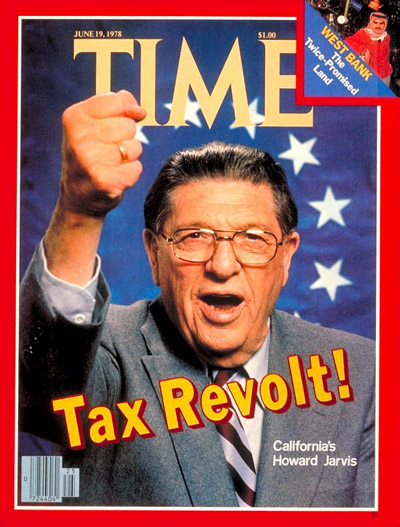

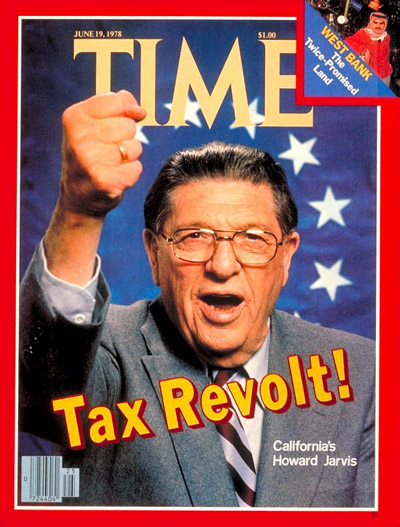

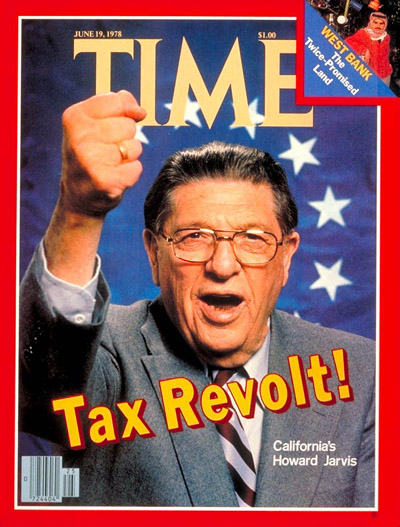

Proposition 13 was passed by voters in 1978 because as property values rose rapidly through the 1970s, property taxes also skyrocketed, driving many families and retired couples out of their longtime homes.

Prop. 13 was so effective when it was passed, within two years, 43 states implemented some kind of property-tax limitation or relief, 15 states lowered their income-tax rates, and 10 states indexed their state income taxes for inflation, the Hoover Institute reported.

With passage of Prop. 13, property tax increases were limited to no more than 2 percent per year as long as the property was not sold. Once the property is sold, it is reassessed at 1 percent of the sale price, and the 2 percent yearly cap becomes applicable to future years, allowing property owners to be able to estimate the amount of future property taxes.

Yet opponents of tax limits continually say publicly that big corporations get away without paying their “fair share” of property taxes. It’s a common theme in California politics.

However, since 1978, all legal challenges to this have been overturned by higher courts of law, according to Jon Coupal, president of the Howard Jarvis Taxpayers Association, named for the author of Prop. 13. Coupal said that Prop. 13 has been one of the most adjudicated laws in the history of the state, yet continues to hold fast.

Opponents of Prop 13 Seek to Split The Tax Protections, Target Businesses

A coalition of organizations supportive of higher taxes qualified a constitutional amendment for the 2020 ballot, to gut one of California’s only remaining taxpayer protections: Proposition 13.

Proposition 13 was a landmark decision by California’s voters to limit property taxes.

However, if the “split roll” is passed by voters, this would tax commercial and industrial properties at market value, rather than when the property is reassessed because of a sale. It’s already a constant challenge for commercial property owners because counties annually attempt to reassess a property’s value without a sale occurring, forcing property owners to appeal the tax amount. And counties are not justifying or quantifying the increase in commercial property values for cing owners to appeal.

Proposition 13 protections for homeowners will remain in place.

Yet, Proposition 13 has stabilized the flow of property tax revenue to local government. It has served as a conduit to stop the volatility of market values from affecting the flow of property tax revenues to cities.

According to Coupal, split-roll proposals will adversely impact the cost of doing business in the state, result in higher prices and reduced employment. Coupal also said that a split roll could have unintended consequences for small businesses, many of which lease property from large business owners.

The state’s politicians have long claimed that Prop. 13 is behind California’s volatile reliance on taxes. And there is a well-worn myth that property taxes disproportionately fall on homeowners instead of commercial property owners. But studies consistently find that commercial and industrial property is being assessed for tax purposes at values that are closer to market values than is the case for owner-occupied residential property.

“Not only did Prop. 13 not slow down the tax burden” on California landowners, Coupal said, “we’re not a low-tax property tax state. We’re in the middle.” Coupal said efforts to rework Prop. 13 would be exactly the wrong message to business and job-creators.

- California Elections Code Book Published - July 26, 2024

- California Supreme Court Ends Legal Snafu Over Gig Drivers – Upholds Prop. 22 - July 26, 2024

- Sen. Kamala Harris Claimed Ignorance Over Long-time Employee Sex Abuse Case - July 25, 2024

Saying this would effect low income housing is a incorrect!!!!

Single family, condos, and apartments buildings are not going to see their property taxes go up!!!

Only retail, Industrial, and commercial buildings that do not provide housing will see property tax increase on a rolling three year period.

Small businesses that run their business on their own land or buildings are protected too! They will see no tax increase!!!

THIS WILL NOT EFFECT LOW INCOME HOUSING.

This will affect all renters of all income levels.

I own 4 rental properties and as such, they are considered commercial properties.

Two are in lower income areas and two are not.

Any tax increase I get will be 100% passed on to the renters.

I am no different than any other commercial property owner.

If I owned a commercial storefront business, any tax increase would be 100% passed on to the consumer.

Every gas station in the state will raise gas prices to offset 100% of the tax.

The plan to soak the “rich” with increased taxes will simply be passed on to the end consumer.

The Math really isn’t that hard to understand.