CA State Auditor Finds State Agencies Overpaying Millions for Workers’ Compensation Insurance

Agencies could have saved the State more than $20 million in 2017-18

By Katy Grimes, December 9, 2019 9:38 am

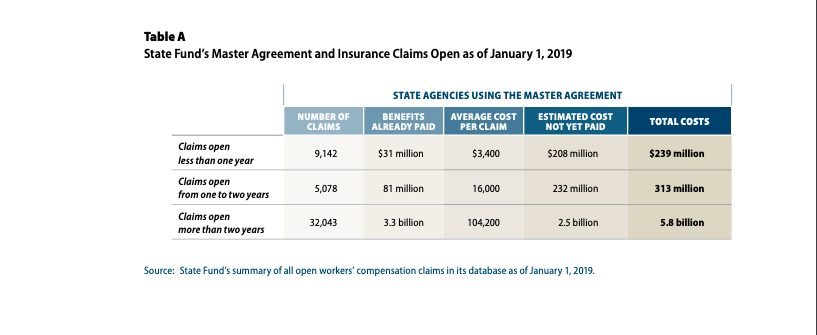

The State Auditor reported total costs of $5.8 billion for 32,043 claims open more than two years.

The California State Auditor just released an audit finding at least 10 state agencies purchasing Workers’ Compensation Insurance from State Compensation Insurance Fund (State Fund), a nonprofit enterprise established by the California Legislature in 1914, are paying millions of dollars more than necessary to provide benefits to their employees.

Authorized by the Joint Legislative Audit Committee to perform the audit, State Auditor Elaine Howle’s assessment focused on insurance used by state agencies, and which agencies are paying millions more than they should to provide benefits to employees.

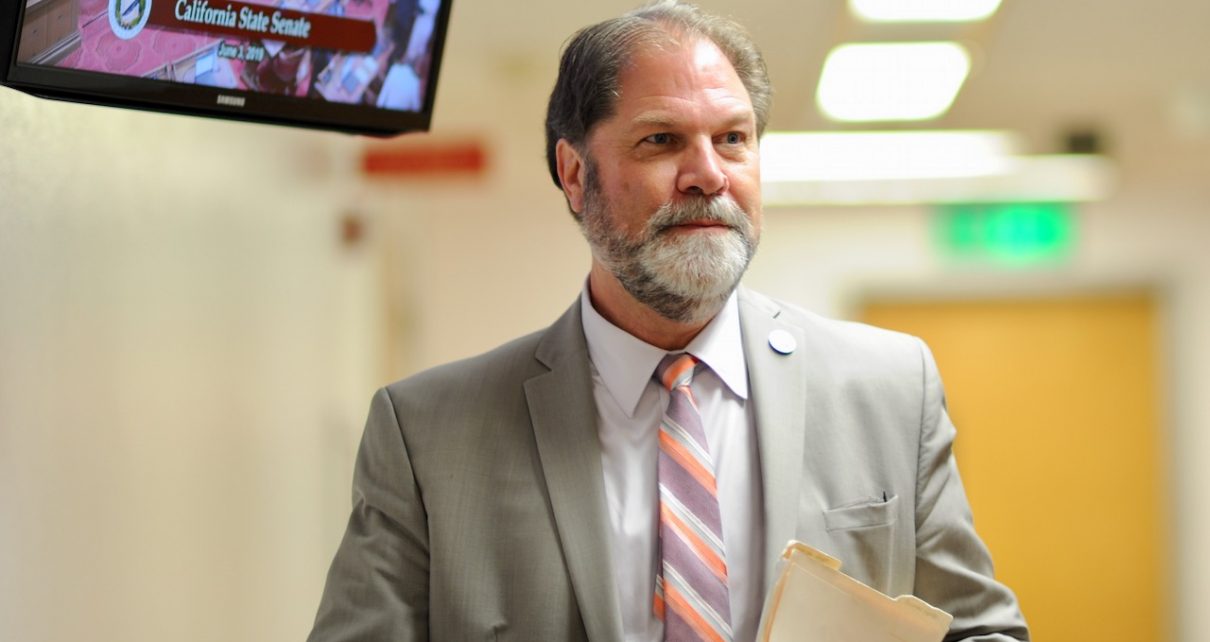

Sen. John Moorlach (R-Costa Mesa), the only CPA in the California Legislature, requested the audit based on a Workers’ Compensation Closing Project he conducted in Orange County while he was a County Supervisor. The goal was to close as many lingering open workers’ comp claims. As evidenced by the findings of state audit, Sen. Moorlach was spot on to address open claims.

Sen. Moorlach had recommendations regarding the stunning state findings:

“First, the California Department of Human Resources (CalHR) should provide a benefit analysis comparing the cost of obtaining workers’ compensation insurance through the Master Agreement vs purchasing directly from State Fund. I commend CalHR for agreeing to implement the Auditor’s recommendation.”

“Second, the California Legislature should grant CalHR the authority to obtain the necessary data to compare insurance versus master agreement costs,” Moorlach said.

“Third, State Fund needs to create a policy for ‘to provide settlement authorization requests to agencies at least 30 days before settlement conferences.’ State Fund failed to achieve this for eight of the 15 claims the auditor reviewed. I call on State Fund to reconsider this request and implement the policy.”

“Lastly, a review of rates paid to qualified medical evaluators should be considered.”

State law allows state agencies to decide how to provide workers’ compensation benefits to their employees. According to the Auditor, almost 90 percent of them choose to do so using a master agreement that the California Department of Human Resources negotiated on their behalf with the State Compensation Insurance Fund. Under the master agreement, State Fund administers, processes, and pays employee benefits for participating state agencies, and the agencies reimburse State Fund for the actual costs of services rendered. However, 32 agencies opted to purchase insurance directly from State Fund. That is where the overspending occurred.

The State Auditor found each of 10 of the 32 agencies that purchased insurance directly from State Fund in 2017–18 consistently paid more in insurance premiums than it would have if it had provided benefits by using the master agreement. “We estimate that from fiscal years 2013–14 through 2017–18, these 10 agencies collectively paid an average of $5.7 million per year in premiums but they could have saved the State more than $20 million during the period we reviewed if they had used the negotiated master agreement.”

The Auditor also found “that State Fund does not always provide state agencies with enough time to review settlement authorization requests (settlement requests) before the mandatory settlement conferences (settlement conferences) in which State Fund and injured employees attempt to come to agreement to avoid seeking a trial. State Fund should provide 30 days to review settlement requests before the settlement conferences. However, for eight of the 15 claims we reviewed, State Fund did not do so. When State Fund does not make settlement requests available for agencies to adequately review before settlement conferences, it may delay the settlement authorization process and may lead to agencies’ having to pay additional expenses if the cases go to trial.”

The Auditor made several recommendations including:

- Cal HR should provide a cost‑benefit analysis every five years that compares the cost of purchasing this insurance through State Fund with the cost of obtaining coverage through the master agreement.

- the Legislature should give CalHR the authority to obtain that information.

- State Fund should create and follow a policy by May 2020 to provide settlement authorization requests to agencies at least 30 days before settlement conferences.

Notably, the Auditor reported 32,043 claims open more than two years, $3.3 billion benefits already paid, $104,200 was the average claim paid, $2.5 billion is the estimated cost not yet paid, and the total is $5.8 billion.

The Auditor’s review of 15 claims at CAL FIRE, Social Services, and Caltrans “found that in many cases, State Fund did not provide agencies with at least 30 days to respond to the settlement requests before the settlement conferences, which may have limited the agencies’ ability to effectively resolve the claims through stipulations or compromise and release agreements in some instances.6 State Fund provided less than 30 days for eight, or 53 percent, of the 15 claims that we selected.”

At the end of the audit, State Fund provided a response to the audit which the Auditor found “misleading.”

“Although State Fund is correct that the guidelines it mentions establish a time frame for completing settlement requests, State Fund has consistently failed to comply with these guidelines,” the Auditor said. “We reviewed 15 settlement requests and found only one instance in which State Fund sent the settlement request within 30 days of receiving the maximum medical improvement (MMI) report.”

The agencies overpaying workers’ comp insurance claims are: California Department of Food and Agriculture, California Department of Pesticide Regulation, California Department of Transportation, California Department of Veterans Affairs, California Military Department, Commission on Peace Officer Standards and Training, Governor’s Office of Business and Economic Development, Secretary of State’s Office, State Council on Developmental Disabilities, and the State Treasurer’s Office.

You can READ the entire audit here.

- ‘Fix Prop. 47’ Ballot Initiative is a Game Changer on Day 1 - April 19, 2024

- California Lawmaker Making the State More Hostile to Business - April 18, 2024

- California Democrats’ Backdoor Reparations Scheme - April 17, 2024

The fact that no outraged comments here is damning evidence against CA voters, who elect morons that ENCOURAGE this fraud, waste & abuse in exchange for votes….

Excellent article. I am dealing with a few of these issues as well..