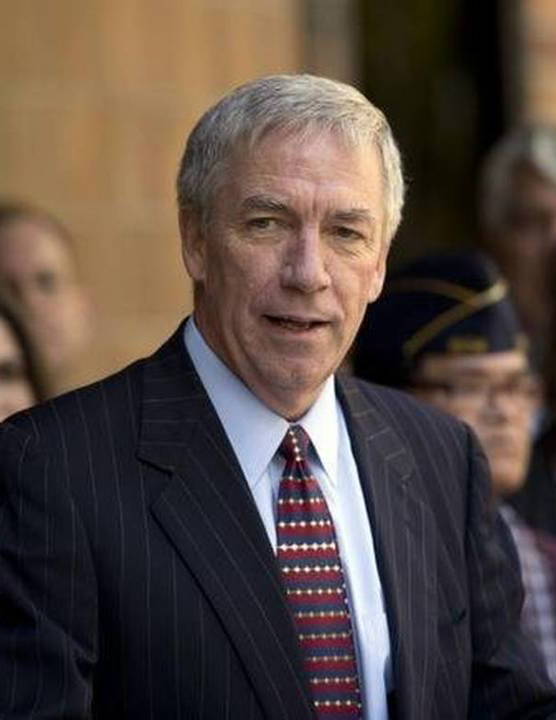

Assemblywoman Lorena Gonzalez. (Photo: Kevin Sanders for California Globe)

California’s Independent Contractors Are About to Become Dependent Employees – or Unemployed

AB5 didn’t just target the ‘gig economy;’ it outlawed all independent contractors with few exceptions

By Katy Grimes, December 17, 2019 5:15 pm

‘AB 5 conflicts with federal law by excessively burdening interstate commerce.’

UPDATE below.

A recent bill signed into law is already changing the employment status of millions of California workers.

Assembly Bill 5, passed mostly on party lines in the California Legislature, and with a vote by Republican Assemblyman Tyler Diep, and signed into law by Gov. Gavin Newsom, will force companies to reclassify independent contractors as employees – except for the industries which managed to secure exemptions from the law.

The stated intent of AB 5 was to force “Gig Economy” rideshare companies to reclassify their drivers as employees, rather than allowing them to work as independent contractors, which could destroy the company’s very business model.

Nearly all other industries which use independent contractors were also caught in the wide net.

“Hundreds of freelance writers at Vox Media, primarily those covering sports for the SB Nation site, will lose their jobs in the coming months as the company prepares for a California law to go into effect that will force companies to reclassify contractors in the state as employees,” CNBC reported Monday.

“SB Nation has chosen to do the easiest thing they can to comply with California law — not work with California-based independent contractors, or any contractors elsewhere writing for California-based teams,” a SB Nation writer said.

AB 5 undermines the principle of equal treatment under the law and deprives many Californians the right to be their own bosses, by exempting some industries over others, Sen. Pat Bates (R-Laguna Niguel) said during Senate debate in September. AB5 is “a prime example of the Legislature picking winners and losers. Why should some people enjoy an exemption while others such as newspaper carriers and language interpreters and translators do not?”

Yet the Internal Revenue Service is the federal agency which regulates independent contractors – not California politicians.

Authored by Assemblywoman Lorena Gonzalez, a former labor union leader, AB 5, which was written by the AFL-CIO, was drafted “to stop the misclassification of nearly a million misclassified California workers so they are provided a minimum wage, benefits and workplace rights.”

However, there were many carve-outs of AB5, done through negotiations with the bill’s author: doctors, lawyers, architects, engineers, accountants, insurance agents, realtors, hairstylists, financial brokers, dentists, podiatrists, psychologists, travel agents, payment processing agents, photographers, editors and commercial fishermen.

As Edward Ring recently reported for California Globe, “Many people working in the gig economy could not possibly work in any other way. They can choose their hours and they have steady work. For people who want to supplement full-time work, or balance their time between family obligations and work, the gig economy is unambiguously good. And since independent contractors still pay for and receive Social Security and Medicare, which are the main benefits they allegedly were going to lose, what’s really going on?”

Assemblyman Kevin Kiley (R-Granite Bay) plans to introduce legislation next year protecting California workers’ right to earn a living, protecting independent contractors and occupational licensing, among other things. It would in effect, nullify AB5, if passed.

What is an Independent Contractor?

The IRS explains what an independent contractor is and is not:

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action. What matters is that the employer has the legal right to control the details of how the services are performed.

As for the legalities and illegalities of AB 5, there are many unanswered questions:

- How will AB 5 impact interstate commerce and the United States Commerce Clause, which regulates trade? And to that extent, how will it impact certain industries which may work in multiple states: trucking, news/reporting, medical, Land surveyors, landscape architects, geologists, Campaign workers, Language interpreters, etc…

- The decision to limit freelance journalists to 35 articles a year for one news outlet was actually a random number chosen by Assemblywoman Lorena Gonzalez. What is the justification for this and can this be removed or expanded? And how can a handful of politicians limit the ability of freelance reporters to cover elected officials? AB5 appears to have First Amendment issues, as well.

- The IRS Independent Contractor formula – how can California legislation override federal agency law?

- What will AB5 do to seasonal workers?

The Commerce Clause is very simple: Congress regulates just the process of goods and services moving from one state to another, and with foreign countries. Some lawyers say California’s AB5 appears to be messing with trade.

California's Music Economy Is About To Crash: https://t.co/vc8ax1DMoq

— Ari's Take (@ArisTake) November 21, 2019

A recent article by Ari Herstand, a Los Angeles based musician who authors the music industry blog “Ari’s Take,” found that AB5 “basically outlawed all independent contractors with few exceptions,” including his music industry.

Herstand said:

“If you want to hire a bass player to play your gig for $100 you have to put that bassist on payroll, pay unemployment taxes, provide benefits, follow labor laws, get workers compensation insurance, deduct taxes, work with a payroll company, W-2 that bassist as they now legally will be designated your employee. FOR ONE F*CKING GIG.”

“Want to hire a violinist to play one song on your record for $150? She’s now your employee. FOR ONE F*CKING GIG.”

He correctly concludes:

“Publishing companies won’t hire producers and won’t be giving songwriters advances anymore in California. Independent record labels can’t pay musicians, producers, engineers or anyone else without designating them as employees.”

Herstand was Tweeting his dismay (below) with Assemblywoman Gonzalez, “and she agreed to meet with me and some other independent musicians to get more educated on our concerns and the music(ian) industry of California.”

“We’re going to get this this amended thanks to your work!” he added.

Legal Challenges on the Horizon

California Globe is tracking down more attorneys to weigh in on AB 5. Ari Herstand also gathered a few legal opinions, some of who expressed their surprise Gov. Gavin Newsom even signed the flawed bill as written.

“I thought for sure that California Governor Gavin Newsom wouldn’t sign the bill in its present form or that the California Legislature would modify it substantially,” one attorney said. “Unfortunately, neither of those things happened. The number of exemptions in the bill is a sign that they didn’t get the language of the underlying law correct. This may have to be decided through the courts or through an amendment to the legislation.”

“As an independent contractor, barring a work for-hire contract or similar language in a services agreement, the work you create is yours and not owned by whoever hired you,” the attorney said. “On the other hand, work done as an employee in the course and scope of your employment is owned by the employer. That should concern artists, songwriters and composers since it jeopardizes their creations.”

Another attorney weighed in: “According to AB5, independent artists who hire a producer or engineer have to abide by minimum wage laws, pay into unemployment, provide benefits and more. Requiring an independent artist working from their home with multiple independent collaborators to abide by minimum wage laws, pay unemployment taxes or provide medical benefits makes absolutely no sense.”

“For that reason (coupled with the fact there is no exemption for the trucking industry) I believe the Bill will be challenged in court and ultimately ruled unconstitutional — because it conflicts with federal law by excessively burdening interstate commerce.”

Do you understand how this will crush independent musicians? We aren’t talking about big corporations. We’re talking about workers scraping by, whom you’re now going to put another massive financial burden on. This hurts us so much and I’m confused why you did it.

— Ari's Take (@ArisTake) November 21, 2019

Assemblywoman Gonzalez played down the impacts of AB5 in her Tweets with Ari Herstand: “It was done by a court decision in April 2018. The law just added clarification. We were very disappointed the music industry and entertainment unions did not get to an agreement. We are confident this will be resolved next year.”

Assemblywoman Gonzalez may resolve the issues with the music industry, but that still leaves many other industries and workers waiting for the hammer to drop.

UPDATE: The Pacific Legal Foundation filed the second legal challenge to AB 5, which they say could put independent journalists out of business.

The lawsuit, filed on behalf of freelance writers and photographers, challenged what it calls an “irrational and arbitrary” limit of 35 submissions each year to each media outlet.

- CAL DOGE Investigation: $1 BILLION California Solar Program Instead Funded Democrat Voter Registration & Activism Efforts - February 27, 2026

- Could President Trump End the Income Tax? - February 26, 2026

- Trump State of the Union: Democrats Showed They’re Not On the Side of The American People - February 25, 2026

What about sports officials. If schools can pick and choose who they want working their games, wouldn’t that make them employees? The term Red Line gives schools options on who they want working their games. Schools AD’s are now telling the independent contractors if the can be paid for mileage stipends, and sometimes withholding their pay.

I have been an independent trucker for 42 years and now some office idiot has decided I’ve been doing it wrong. Well I have a newsflash for Ms. Gonzales….I own my truck…I drive my truck…I pay the insurance and ALL expenses including fuel, and I say who I work for and when. ON WHAT PLANET DOES THIS MAKE ME AN EMPLOYEE?? Ms. Gonzales needs to revisit this bill, maybe this time with her brain turned on. She has no concept of how many people this law is going to kill financially. Maybe we can all come live at her house!!

It’s seems not exactly clear to me who this will and will not affect. If I employ myself as a face painter or service birthday parties for children, just like a photographer, I would be exempt? But if I am doing a gig at the natural history museum in Los Angeles, am I now not exempt? How am I to figure this out?

While I am sure Ms Gonzalez’ intentions were honorable, this bill is definitely a botched mess. Instead of CLARIFYING the Dynamex decision, it made it even more vague than before. I work for a music education non-profit. We hold fundraisers a few times a year and employ musicians to perform. They very likely will only work for us once in a year or even longer. So why should they be classified as employees? And if I hire a combo, do I put just the bandleader on my payroll? Does he then have to be a registered employer with EDD to pay his sidemen?

Something must be done to correct or reverse this legislation, and soon.

I am in a Dixieland jazz club. It is a totally non-profit volunteer organization, no one gets paid a dime. We hire a different jazz band to perform at the local Vets hall once a month. This club has been in existence for 43 years. We charge $10 at the door and all of that money goes to pay the band and the rental of the hall. Once a year we throw “Jubilee by the Sea” where we bring in more than 20 professional jazz bands from across the country and have a 3 day jazz festival that many call the best in the country. Each band negotiates it’s own contract and there is no shortage of bands wanting to perform. This takes a huge amount of work by our 100% non paid volunteer staff. We have no extra money to hire accountants or lawyers. Our club is truly a non-profit because we almost always end up in the red .It would be insane to try to classify the hundreds of musicians as employees and figure out all the red tape involved with each one. This bill will kill our club which has been a labor of love for 43 years.