California Attorney General Xavier Becerra. (Photo: Katy Grimes for California Globe)

UPDATE: Court Rules on ‘Misleading if Not Outright False’ Voter Guide for Property Tax Measure

HJTA appeals decision allowing deceptive ballot information to remain on the ballot

By Katy Grimes, August 6, 2020 7:25 am

UPDATE 2:10pm: The Howard Jarvis Taxpayers Association just announced Thursday afternoon, they are appealing the decision a lower court made, which found the ballot title “misleading” in Proposition 15’s title and summary, but failed to take corrective action, allowing deceptive ballot information to remain on the ballot, according to HJTA.

The HJTA filed a writ of mandate directly to the California Court of Appeal for the Third Appellate District seeking reversal of a trial court decision handed down on Tuesday that failed to correct false and misleading ballot material submitted by California Attorney General Xavier Becerra to Proposition 15, the largest property tax hike in state history, HJTA reported.

Superior Court Judge James P. Arguelles ruled Wednesday that the partisan slanting of ballot language in Proposition 15 was biased and misleading.

California Attorney General Xavier Becerra once again wrote a biased ballot Title and Summary, which deliberately misleads voters about Prop. 15, the initiative that will remove Prop. 13’s property tax protections for commercial property and institute the largest property tax increase in California history.

Judge Arguelles said that the paragraph “is misleading if not outright false,” saying the proposal exempts the operation of a home-based business from reassessment. He also ruled other language deleted that said there is “no accountability how the money is spent.” However, it does not appear that just because he “ruled” the language was biased and misleading, that there is an order to do so.

California Globe recently reported:

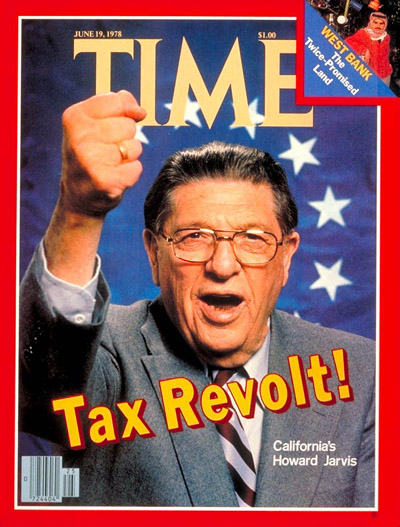

Currently, under the 1978 Proposition 13, property tax rates could not exceed 1 percent of the property’s market value and valuations couldn’t grow by more than 2% per annum unless the property was sold, according to the Howard Jarvis Taxpayers Association.

While claiming the anticipated $12 billion annually from Prop. 15 will go to schools and California cities desperate for bailouts, proponents are not addressing the snowball effect the initiative will have on property owners, small businesses, and consumers.

Property taxes will double and even triple for many commercial property owners, and those costs will be passed on to the small businesses renting space, and eventually to consumers.

“The attorney general contorts the English language to avoid using the word ‘tax.’ Unfortunately, he can’t call Prop 15 a revenue increase, since, as the nonpartisan Legislative Analyst’s Office says, some rural governments could lose money if Prop 15 passes.

The initiative should have been called: “The largest property tax increase in California history.”

At issue is the very serious problem in California of confusion at the ballot box. This is why the original lawsuit was filed, and what was expected to be addressed by the Superior Court Judge. But that did not happen, so the Howard Jarvis Taxpayers Association took the battle directly to the California Court of Appeal for the Third Appellate District.

Here is how this new “revenue stream” is expected to be dispersed:

1) About $1 billion comes right off the top and goes to counties to pay for administrative costs and paying back the state for loss of income tax revenue, according to the LAO analysis.

2) About 60% goes to unspecified local government services. The legislature can divert the new local government revenues for other purposes, just like they did with the gas tax, the lottery and other revenue streams intended for local government.

3) Lastly, 40% goes to schools with no guarantee that the money makes it to the classroom. There are no reforms and no requirements that the money be spent in the classroom.

Many in the state have called for the writing of ballot titles and summaries to be done by the Legislative Analyst’s Office.

According to the Howard Jarvis Taxpayers Association:

“The courts should act as a check and balance, ensuring that the Attorney General is doing his job in presenting a ‘true and impartial statement’ to voters. While the judge agreed with us that his description of Prop 15 is ‘somewhat misleading,’ she did not take corrective action. Our only remedy is seeking an appeal to ensure voters are told the truth—Prop 15 is a tax increase we will all pay for,” said Jon Coupal, President of Howard Jarvis Taxpayers Association. “While the Elections Code requires an impartial statement to voters, the appellate court, in previous rulings, has allowed the Attorney General to have ‘broad discretion’ over his or her writing of a ballot title and summary. This legal standard has been repeatedly abused by the Attorney General, who has been sued on 6 of the 12 titles and summaries he drafted this year alone. Our lawsuit seeks to not only ensure voters understand the true impact of Prop 15, but also remedy this previous ruling by the appellate court that has given the Attorney General unfettered ability to deceive voters.”

Thank you for reporting this! Changes need to be made to cost in the state’s bloated government, not revenue.

The dishonest Democrats have hated Prop 13 since it became law to enable people to keep their family homes and property from reassessment and huge automatic tax increases if the property next door sold for a lot of money. Now they put Prop 15 on the ballot hoping to destroy Prop 15 by claiming its for the schools baloney even though I have a couple of school taxes and others on my property…because there’s never enough. California’s corrupt democrats fooled people into allowing our once protected Transportation Fund to be used in the General Fund promising no increased taxes lie. Because of this there’s never enough money for what it was intended requiring continual tax and fee increases. If they pass Prop 15 you may not be able to afford the taxes and live on your own property. ..and doubt that the children’s education will improve during this continual scam. It shouldn’t even be on the ballot because it’s been proven that big time paper ballot voting fraud has been going on but nothing done about it.

Comrades

Reimagine what else is being groomed/soothed/ lathered to intro the Utopian solution….

Investia would be proud.

A tax increase on businesses will drive costs up meaning higher prices at the store, lost jobs due to increased business costs plus businesses will leave the state at a higher rate than they already are. Democrats would call this a win because it will increase the welfare roles, crime and poverty.

A FREE people always get the government they deserve.

These people are criminals who wear ties, dresses, and pants suits. Disgusting.

This is what happens with one-party rule. Have been here for 35 years (loved it when I came in 1985). I have owned homes, businesses, raised kids here, employed many, and have paid hundreds of thousands in taxes. As soon as our youngest graduates high school in three years we are gone. Plenty of other states just as nice, more friendly, and half the price.

Oh, and they don’t have crooked AGs, and Pelosi’s nephew as governor.

We’re out of here in December for a fiscally solid red state far, far away. But not before casting my ballot in person for whatever the Jarvis organization recommends.

Just because property value increases doesn’t mean your income increases along with it. In fact, repealing prop 13 and allowing property taxes to jump will put many fixed income elderly people out of their homes.

How many more times can Californians fall for “for the schools”?

Every new tax that has passed in CA in the last thirty years has been “for the schools”. The Lottery was “for the schools”.

Let’s tell the truth, it’s for unfunded liabilities, illegal aliens, and bloated pensions.

The fourth paragraph of this update reads: ”

Judge Arguelles said that the paragraph “is misleading if not outright false,” saying the proposal exempts the operation of a home-based business from reassessment. He also ruled other language deleted that said there is “no accountability how the money is spent.” However, it does not appear that just because he “ruled” the language was biased and misleading, that there is an order to do so.

Pay heed to the final phrase of the final sentence. The reporter has the best of intentions, but what she literally seems to be saying is that there is no order to make the language biased and misleading!! Did she mean – or maybe not – to say instead that there is no order to correct the language to be unbiased and not misleading??

Good intentions do not always add up to clear reporting. We don’t need media for good intentions or agreeable fantasies. We need media for correctly clearly reported facts.

CA is setting the seniors up for a “Land Grab” … we struggle now to make ends meet.

At what point does government return to the very basic of services? Law Enforcement, Roads, Kindergarten thru 12th, fire protection, disaster preparedness, Mental Health (State Hospitals) and Medi-CAL. Everything else has been a program designed to make Californians dependent on hand-outs.