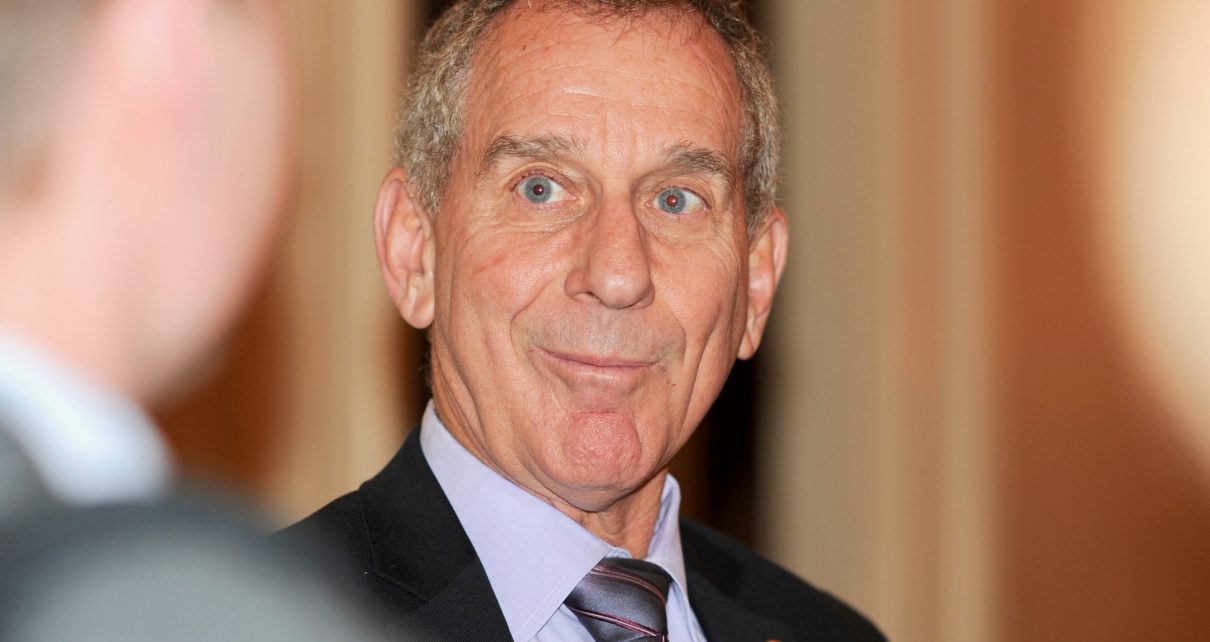

Senator Bob Wieckowski. (Kevin Sanders for California Globe)

Debt Collector Licensing Bill Passes Assembly Banking and Finance Committee

SB 908 would regulate the debt collection industry in California

By Evan Symon, August 13, 2020 4:11 pm

On Wednesday, a bill that would require the licensing of debt collectors and debt buyers passed the Assembly Banking and Finance Committee.

SB 908 moves up through the Assembly

Senate Bill 908, authored by Senator Bob Wieckowski (D-Fremont), would have the licencing be mandatory by January of 2022. The name and license number of debt collectors on the phone with debtors would also need to be legally given out during calls, emails, and other communication. Also under the bill, the California Department of Business Oversight (DBO) would be in charge of licensees, regulations, and rule enforcement. Licensing fees would cover the costs of the DBO expansion.

New amendments since June have fine tuned SB 908, such as not letting county or cities have their own debt collector licensing. License revocation proceeding details and other additions and clarifications wanted by legislators before voting were also added.

As noted by the Globe in June, SB 908 was written as a consumer protection measure during a time where an economic downturn is increasing many people’s debts across the country. Senator Wieckowski noted that he wants to end abusive debt collection tactics and hold debt collectors responsible for any laws broken during collection calls.

“I have worked with a broad array of California’s top consumer organizations and the debt collectors and debt buyers on this legislation, and I am pleased to say the industry now supports SB 908 and the bill’s important consumer protections,” said Senator Wieckowski on Thursday. “Consumer debt is at an all-time high and families living paycheck-to-paycheck need increased protection from unscrupulous players. This is especially true now that we are in a pandemic with high unemployment.”

In a previous interview, the Senator also clarified his backing of SB 908 in more detail, saying “Without SB 908, more Californians will fall prey to the often abusive tactics of debt collectors. We license all sorts of professions in California that do not have the power to do the financial harm to individuals that debt collectors can do by garnishing wages and seizing people’s assets. It is a gaping loophole that needs to be closed to protect California consumers, especially when so many are struggling through this pandemic.”

In addition to many consumer groups, a majority of legislators support the bill, as evidenced by SB 908 passing in the Senate 29-4 and the Assembly Banking and Finance Committee 9-3.

Debt collection industry support torn by SB 908

Despite much of the debt collection industry now behind the bill, there remains some opposition against the bill, with many pointing to privacy laws and the reduction of power that debt collectors would have against collecting from debtors.

“This will just encourage more people to not pay their debts,” said former debt collector Malcolm Friesling in an interview with the Globe. “Leniency often gets dragged out. If you have licenses for this and have to give your name, those in debt may try and ‘kill the messenger’ and look up info on you and threaten you back more directly. It can put us in danger. And it would limit who we can pick as a debt collector too due to the proposed regulations.

“We can say that their credit score will go down and subpoena them for collection from the court, but many don’t want to pay and want to ignore it as long as possible.We’re there to keep the heat on and remind them of their obligation. This bill would destroy that.”

SB 908 is expected to go to the Assembly Appropriations Committee.If passed there and in the Assembly, SB 908 would likely become law as Governor Gavin Newsom has signaled that he would sign the bill.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

One thought on “Debt Collector Licensing Bill Passes Assembly Banking and Finance Committee”