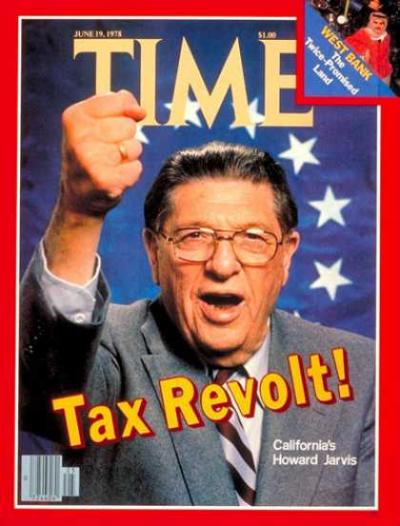

Prop 13 author Howard Jarvis on the cover of Time Magazine in 1978 (Photo: Twitter)

Prop 15 Officially Defeated, 1978 ‘Tax Revolt’ Law Preserved

1978 Prop 13 Property taxation law will not be amended

By Evan Symon, November 12, 2020 6:13 pm

Late on Wednesday, Proposition 15, which would have allowed tax reassessments on commercial and industrial properties every 3 years rather than being based on the purchase price plus 2% each year, was defeated after a final statewide vote tally.

After over a week of close vote counting, votes against Prop. 15 finally became insurmountable on Wednesday, with the office of the California Secretary of State announcing that the proposition had been defeated with 8,217,352 NO votes and 7,618,635 votes in favor of the proposition. In total, it was a 4 point victory for those against Prop. 15, 52% to 48%.

Had Prop. 15 passed, it would have heavily amended the 1978-passed Prop. 13. Widely known as the “Tax Revolt Proposition,” Prop. 13 changed many tax laws and required a two-thirds majority in both the Senate and Assembly to approve of tax increases, with local municipalities following suit for special taxes. The ensuing tax revolt swept across much of the country and proved to be instrumental for the election of Ronald Reagan in 1980.

Prop. 15 would have specifically amended the part of Prop. 13 that prohibited tax reassessment of commercial properties except in cases of changed ownership or construction, and limited annual assessed value of property to no more than 2%. Prop. 15 would have allowed new assessments every 3 years on commercial properties and focused more on the market value, rather than the purchased value. Taxes would have gone significantly up on many properties with supporters saying that as much as $12.5 billion would have been raised each year.

Supporters of the proposition said that communities would benefit greatly from the extra revenue, and that commercial and industrial property owners were benefitting from a system that taxed them inadequately based on their property value. Supporters, which included such prominent politicians such as media-named probable President-Elect Joe Biden, Governor Gavin Newsom, Los Angeles Mayor Eric Garcetti, and dozens of others of state and national level politicians both in and outside of California, noted that the new tax money would be reinvested back into schools and other public projects.

“When I look at our dire budget deficits over the next couple of years, and then I see these revenue estimates showing how much we can invest in our community without having to raise any taxes on residents, it makes it more important for me to give my full support on this initiative,” said San Francisco Mayor London Breed in support of Prop. 15 earlier this year.

The failure of Proposition 15

However, those opposed to the proposition said that the cap helped attract many businesses and companies, and that communities already benefitted from the jobs and economic impact they made. Many also said that a “no” vote would help protect taxpayers, with others saying that a “yes” vote would only scare away companies from California for not being tax-friendly, and hurt small businesses.

A wide variety of Republicans and Democrats, as well as a mixture of both conservative and liberal organizations, opposed Prop. 15, including the California GOP, Former LA Mayor Antonio Villaraigosa, the NAACP, and the Howard Jarvis Taxpayers Association (HJTA).

“This is yet another attack on the longstanding taxpayer protections in Prop. 13,” said the HJTA earlier this year. “Special interests continue to push for new and higher taxes to pay for their out-of-control pensions, which have already directed existing tax revenue away from classrooms and other state priorities.”

While the final vote was close, the opposition was ultimately victorious on Wednesday due to high-tax fatigue from Californian voters, concern over the possibility of California losing more businesses and industries due to higher taxes, and potential permanent harm to the California economy at a fragile time.

“From day one, we knew that if voters understood the harm this deeply flawed tax hike would impose on California’s economy and its families, farmers and small businesses, voters would reject this ill-advised effort,” said No of Prop. 15 Co-chair Ron Lapsley on Wednesday.

“It was close, but Californians realize that, if we tax companies even more, then few will want to stay,” noted tax analyst Richie Kincaid to the Globe. “California is safe, for now, and many companies are willing to give them a second chance. And this came during an election where other states that Californians and Californian companies are looking at, like Arizona, have been raising taxes like crazy. California still has a horse in the race because of this.”

Final results for all the propositions in the 2020 election are expected in the next few days.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

Thank GOD!!

One of the few bright spots of this election.

However is was close enough not to discourage them from trying again.