Prop. 15 Split Roll Will Eventually Cancel Prop. 13

NO on Prop 15 – Stop Tax Hikes

By Wayne Lusvardi, August 7, 2020 7:10 am

It was elderly widows who were being thrown out of their homes for unpaid property taxes in 1975 before Proposition 13. Now with Proposition 15 it will be mom and pop businesses in leased buildings, and Uber drivers who own their homes who are going to be displaced.

Proposition 15 – the so-called split commercial/residential tax roll – on the November ballot is being advertised as solely a commercial property tax. But there is a trojan horse contained in Proposition 15 that will unravel Proposition 13 property tax protections even for residential properties.

Single-family residential homes used for home offices or UBER drivers who park their cars at their owned residences will have their homes reclassified as commercial properties under proposed Proposition 15. Eventually, property taxes will be equalized by the legislature, and the mandates of Proposition 15 will apply to all owners who hold multiple homes and apartments, not just commercial properties. Moreover, small business owners will have the higher property taxes passed through to them in the form of higher rents and will not be able to stay in business after a couple of years. But it will be the consumers who will ultimately pay the so-called higher commercial property taxes.

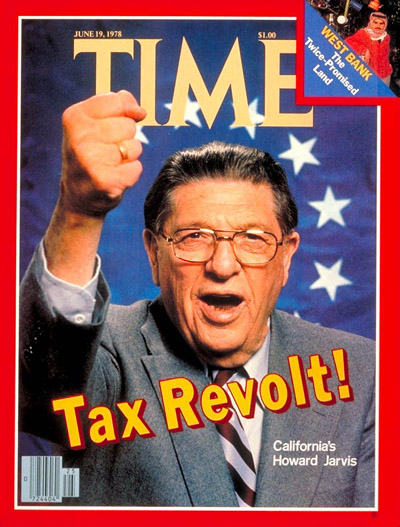

This is why some 2,000 organizations are mounting a $70 million opposition to Proposition 15, including the Commercial Business Property Owners Association, the Howard Jarvis Taxpayers Association, apartment owners associations, the NAACP and senior citizen groups.

Prop 15 Full of Stealth Exceptions

Proposition 15 would require that commercial and industrial properties over $3 million in value would be reassessed every one-to-three years instead of when a property is re-sold (in about 10 years), as is now the rule under Proposition 13. Thus, there would be less lag time until a property is reassessed. Residential properties would initially be exempt, except in the case of the exceptions explained below:

- Immediately after any passage of Proposition 15, a task force shall examine and recommend to the legislature any “statutory and regulatory changes necessary for its equitable implementation.” In other words, the legislature can immediately revise the wording to equalize taxes as it sees fit without voter approval. So, even though Prop. 13 requires a two-thirds vote of the legislature to increase taxes, a simple 50% + 1 vote in the state legislature could amend Proposition 15 to extend to residential properties. As explained below, the process of equalization could extend to reclassifying some residential properties as commercial properties, then to all residential properties under the rationale of tax “equalization.”

- The $3 million minimum for commercial properties to be subject to the tax is cumulative, not based on each singular property. So, if a commercial property owner held, say, two or more commercial properties worth $3.2 million, all those properties would be subject to the higher reassessment. This would, in effect, raise property taxes on smaller commercial properties less than $3 million in value. Affected would be small family-owned commercial business franchises that lease building space from a large commercial landowner. Also included would be small mom and pop restaurants, a Taqueria, a Taco Bell, Popeyes Chicken, a medical or dental office, a laundromat, a non-profit child-care center, or any tenant in a commercial strip center.

Standard commercial-industrial leases provide for pass-through of any expense increases, including property taxes, to the tenant who, in turn, will have to raise prices on customers.

- A commercial-industrial property owner who believes his properties are worth less than $3 million must file for an exemption in the first year. An owner must certify that they have less than 50 employees, that their business is independently owned and the business owns real property in California. If a property owner fails to file the exemption this “shall be deemed a waiver of the exclusion for that year” and any higher tax is automatically due and payable. By requiring owners to file for exemptions in the first year, the state can claim they are protecting small businesses. But this only applies until 2025 and then all bets are off on any exemptions after that.

- If the owner of a residential property has a home office or is, for example, a Uber of Lyft driver who parks the business car at home, this may trigger reassessment of their personal owned residence as a commercial property. There are some 500,000 Uber and Lyft drivers in California. After the governor’s coronavirus emergency order to shut down small businesses and large office buildings, there are countless people working from home.

Commercial properties appreciate at about 5% per year on average, but under Proposition 13 property tax increased are capped at 2% per year. The lower 2% tax increase per year on properties under Proposition 13 was compensated for by higher sales taxes collected from the large number of small businesses in the state. This is why California has a 7.25% sales tax. But that tax won’t be reduced or phased out because of Proposition 15.

The key economic question is how much tax increase will small business tenants be able to absorb when the property tax increase is passed through to tenants each year? When rent increases cumulate each year to about 10% to 20% higher rents, many tenants will default on their leases or declare bankruptcy. So small businesses will initially suffer the most under Proposition 15 as well as owners of single-family residences who work out of their home. But eventually the protections of Proposition 13 will no longer extend to all residential properties.

The California non-partisan and impartial Legislative Analyst’s Office estimates that California will generate $6.5 to $11.5 billion in additional tax revenues based on the existing number of $3 million valued commercial properties in the state. But this does not consider the nearly incalculable rise in property taxes when Proposition 13 protections are lost to commercial properties for property owners owning multiple properties $3 million in value cumulatively. Nor does it consider how many cumulatively-owned residential properties are over $3 million.

In 1975 it was elderly widows on fixed income that were being thrown on the streets by rising property taxes that brought about Proposition 13. In 2020, it would be small business owners who will be filing bankruptcies to escape the high property taxes passed through to them in rent increases.

Rex Hime of the California Business Property Owner’s Association reviewed this article.

- Peter Gleick’s National Water Plan for California - October 12, 2020

- Court Opens Up Big Prop.13 Loophole for ‘Public Franchise Fees’ - October 2, 2020

- New Cal Grid CEO is Ex-Enron Green Power Trader - September 29, 2020

This is a scary proposition. If you have not read it, please do so. It is about 14 pages. And if you have liberal friends have them read it too.

You said it John — very scary.

Glad to see this article that spells out what’s going on here.

Vote NO on Prop 15! It’s even worse than you think.

Liberls don’t care they are too unmotivated or smart enough to even know how to have, start not built a business. Hence why Apple, Tesla and many others bare leaving CA. Plan the people. The people always get the government they vote for.

I thought about investing in commercial real estate and I am glad I did not. If (or should I say when) Dems get rid of prop 13 you will see double or triple property tax bills. Most people will not be able to afford the bills so they will sell but there will be few buyers and property values will collapse. Most people will lose all their equity in their home and those who own their homes outright will lose hundreds of thousands of dollars.

That is what I am scared of. There is already an exodus of taxpayers leaving Ca. If Biden wins and prop 15 passes It will motivate us to sell and move out of Ca. The welfare state of Ca has one of two choices, end the welfare state or go after the last bastion of wealth in Ca, real estate. Given the voters it’s a solid bet the state will go after any wealth it sees in a failed and desperate attempt to maintain the welfare state.

The property doesn’t move out of state I don’t know how an “exodus” would happen.

So if you own a home for personal use, you will see no tax increase? What’s the problem here again? Corporations paying their fair share?

Prop. 15 is a Greek Trojan Horse. Once they get through the gates of the election they will change the wording the assess single family homes at 4% instead of the current 1%. There is a clause in the voter initiative that authorizes the legislature to change the wording any way they please if it passes.

Who pays their fair share? Us consumers after all these businesses raise rates to pay their tripled property tax bill. You must be an idiot if you think corporations are just going to lose money and provide products at the same price. How can one be so stupid?

Did you read the article? This will affect home businesses and small minority owned businesses. Besides, people who don’t own property should pay more taxes, too.

We are a welfare state. Me and my wife worked very hard to buy our home back in 90’s. We had moderate incomes but we were no where close to being privileged or rich. We knew buying a home was a better investment than renting an apartment.? Today, 20+ years later, our income hasn’t increased fast enough to keep up with the high cost of living in California. And now government leaders introduced Prop 15 as the gateway to destroy Prop 13 so the state can squeeze more money out of property owners. Putting us in the same category as big business just because we have a mortgage and property values have soared upwards of 500%. Even though my California tax dollars help pay teachers salaries at Cal State/ UC campuses, for which our kids couldn’t get admitted into. So how does prop 15 help those hard working kids from the inner city whose 3.5 GPA aren’t good enough for tax funded schools like UCBerkeley, UCLA, Cal State Long Beach, UC Irvine, Cal State Fullerton, UCSan Diego or San Diego State. etc. I believe prop 15 revenue will be politicized and distributed amongst the affluent and the low income areas will have to scratch and beg for the leftovers.

Beware people. The next attack on California taxes will be home owners who rent out rooms to college students or to the homeowner who rents out the one bedroom apartment above the garage to a single mom who drive for Uber.

There are two bastions of wealth in California. Real estate is one and Silicon Valley is the other and Sacramento is hell bent to destroy both. The walls are closing in for Californians. This next election is about survival.

It’s crucially important to understand this basic fact: Prop 13 has withstood REPEATED attacks because it’s been defended by an uneasy taxpayer alliance. The CA business community has provided the FUNDING for protecting Prop 13, while CA homeowners (led by HJTA) have provided the activists, legal support and votes to defend Prop 13.

If Prop 15 passes this November — removing any property tax protections for the mid to large size businesses in CA — then the business community will not work with homeowners against a subsequent (2022) proposition to dramatically raise CA home property taxes.

Let me dispel (below) some of the progressive propaganda about commercial property taxes. My article uses reliable sources, showing that commercial property taxes have been paying their fair share along with homeowners.

https://riderrants.blogspot.com/2018/02/commercial-vs-residential-property.html

Before Prop 13, the base California property tax rate was 3% to 4%. Under Prop 13 it is 1%. So taxes would go back to the 3% to 4%, or 3 to 4 times what they are now, without phasing out the 7% base sales tax. It would create financial serfdom – the property serfs would be working for the elites and their government bureaucrats but only the big players could survive 5% per year compounded rent increases.

what prop 13 is missing is a TAX CAP or a maximum of $4,000. annually. There is too much abuse and waste of tax payers money by big brother. Example: credit cards issued to government staff, over estimates of public necessities, high speed rail, millions wasted on homeless projects and blame games. There’s no end to the waste and abuse, but we can cap it.

We must stop Prop 15! We must educate the people of California to vote NO on Prop 15! Renters need to be educated their rents will be unbelievable high, unaffordable as the tax increase will be passed on to them. Renters don’t realize the property owner has no choice but to pass on the incredible massive tax hike !

Oh please, it’s as if the ‘benevolent’ landlords are passing down the tax savings to the tenants. They are not. The greedy landlord’s taxes need to be reassessed to the current market value so they have all the incentives to invite more supply and hence keep property prices down. And rents will come down because guess what, the landlords will finally have to serve their customers (renters). Vote YES on Prop 15.

so if a supplier comes to you and said” sorry, but I have to rise my cost” you would not pass the cost on to me?

It’s too bad that prop 13 was so unfairly written back in the 70s. There are people in my neighborhood who are paying 30 thousand a year for property tax. There is no reason that the tax on any property should rise faster than inflation. The reason that government can get away with this stuff is because there are too many people voting. No one who is collecting a check from any government should be eligible to vote. This would prevent people don’t have skin in the game from voting, eg. Federal, State, and local government employees, people supported by government by being in prison, welfare recipients, and even SS recipients

The strategy of the Democratic Party has been to make people wards of the State and beholden to more “free stuff” from Democrats. This is their base.

Your proposal would destroy the modern Democratic Party.

Perhaps you are on to something…….

You are so correct. Supporters of Prop 15 are indirectly benefiting of passed. Unions, state, county, city employees, all vendors of goods and services, school employees, all public sectors of the California economy are in on the take, especially retired government employees.

Mark Zuckerberg didn’t have the courage to go against Prop 15. NO GUTS! I will support and defend Prop 13 til my last breath. In fact, I am infavor of establishing property tax CAP of $3,000.00 maximum on all property indefinitely. Most government agencies are over budgeted.

Leave prop 13 alone. California can get the money somewhere else. Like cutting back the politicians salaries. Leave the taxpayers alone before there isn’t any left.

I AGREE YES LEAVE IT ALONE!

Vote trump

Wayne, I have a follow up question for you. Your article claims that prop 15 will pass tax increases to renters through higher rent. California currently has a state wide ceiling on annual rent increases. Wouldn’t this prevent these large increases from being passed to renters? Of the 5% + (inflation not to exceed 2.5%) limit on rent increases, what percentage of rentals actually have room (based on historical data) to place their increased tax on renters?

Maybe you could use this on another piece?

Thank you

The rent moratorium is only during the declared virus emergency. Prop. 15 does not kick in until 2025 because it will take 4 years to hire and train assessment staff. Moratorium will be gone by then (but wearing masks is likely going to be permanent because coronavirus is the annual cold.

Wake up Irene! Prop 15 totally excludes residential property, even that Uber driver’s home. A judge already told Prop 15’s backers to stop lying about taxes on homes being increased.

If they are old enough to join the Military, AND be used at “Bounty Bait’ by Putin…I say let them vote.

Many young folks are interested in what is going on in their world today, and especially how it will effect thier lifes when we older folks are long gone. They deserve a say, as do all other citizen of the USA!!

This article is so disingenuous. Prop 15 is not going to reclassify your home as commercial if you are a free lance worker.

The consequences of giving prop 13 benefits to commercial property are obvious: it has shifted the tax burden onto homeowners and encouraged speculation that has lead to high land prices. Companies like IBM are paying less than a penny in tax per square foot while new homeowners are crushed. Watching people argue that taxing commercial property *like every other state does* is going to force businesses out of state is laughable. Prop 15 is not perfect but it is a step in the right direction.

Except the impartial Legislative Analyst’s Office (LAO) study did NOT find the residential property owners are paying a higher proportion of taxes. Here is the link to the LAO study also posted by commenter Richard Rider

https://riderrants.blogspot.com/2018/02/commercial-vs-residential-property.html

Also, I would suggest reading the initiative before making statements.

All legislation that covers property taxes is aimed at undermining prop 13. They will write the law to leave them the loopholes (preplanned) that will enable them to quadruple your tax bill.

If prop 15 had nothing to do with residential taxes this is still a disaster for business owners, employees and consumers.

Irene, I use to be a renter too. If Prop 15 passes, rents and prices of all goods and services will rise. It is a natural progression to pass along increases. Prop 15 will cause more inflation if passed and more homelessness.

You can’t put a fire out with gasoline!

ZERO ACCOUNTABILITY for the spending of this new tax.

Most troubling is that there is no commitment, or even oversight, to where these new tax dollars will be spent.

They are not earmarked for schools or minority communities.

They will most likley be wasted on more proven failed progressive programs such as the endless spending on the homeless industrial complex in San Francisco that has done nothing but draw more homeless to San Francisco’s streets.

NO on Prop 15.

The only thing “unfair” about prop 13 is that liberals can’t tax you out of your home. To a leftist ALL assets and income belong to the state. No one will vote for 4% property taxes so they resort to lies and deception to circumvent the state constitution.

I will put my ranch for sale in Novemberif this passes. I will never earn enough to satisfy the hungry government. This must fail!

In regards to the reassessment of a property if an individual owns more than 3 million in the state what happens if I’m the beneficial owner along with my brother of a property that will be assessed at 4 million but he also owns another property worth 2 million? Will our joint property be reassessed even though I own only 2 million but he owns 4 million? What about REITs holding .CA real estate? Will a portion of the real estate value have to be apportioned to every investor and included as commercial real estate holdings to .CA based investors? And will .CA retired public servants have to include their share of the value of CALPERS real estate holdings since they are the direct beneficiaries of the pension fund?

I will vote NO on 15 . If it passes I will lose my home. I’m retired and live a limited income. So please vote NO on 15.

Wow…Please re-read the article.

Realize this: Corporations and all businesses pass on all their expenses to their customers, or they go out of business.

Prop 13 is the biggest wealth transfer from the young to the old in this state. I have neighbors who pay less than a $1,000 on their $1.5 million home whereas a new buyer would pay 20 times that. This is also a reason why homes cost so much. No incentive to add more supply as that prop 13 beneficiary would fight tooth and nail when it comes to adding more supply as that would decrease their property values. Or will not let it rise as much. Prop 13 needs to go and the tax revenues gained from that should be a dollar for dollar offset against taxes on things like income etc.

Using your logic, young homebuyers who now can get a 3% mortgage should have their interest rates raised because it is unfair to live in an economy where young people have an advantage and older homeowners have higher mortgage rates.

Prop 15 is mainly, but not completely, about how often commercial properties are reassessed. Prop. 13 says they are reassessed when they resell. Prop. 15 wants annual reassessment.

I’m a real estate appraiser. What will happen with commercial income generating properties is that their market values will drop and, thus, the tax base will decline (not increase).

I have proposed a better way to increase property taxes that is counter intuitive – lower tax rates and the property tax base will increase. If the annual inflation adjustment limit under Prop. 13 was changed from 2% to 1.5 percent, property taxes would increase.

Under the proposed Proposition 15 Split Roll Tax, only 30% of the businesses would be subject to the tax. Using your logic, that would be unfair.

I suggest instead of emotionally reacting opposed to those who are against Prop. 15 that you learn something about how taxes and property values work. Then you would understand that raising taxes decreases commercial property values and lowering taxes increases property values and thus increases total collected taxes.

The big win for the Legislature is the 50% plus 1 vote, currently a 2/3 vote is required for a tax increase, think about that. To get a tax increase it requires someone from the minority party to vote along, there will not be any chaos and balances.

Either the author lacks the legal expertise to interpret the measure or is intentionally being misleading. For instance, this myth of the uber driver’s home being subjected to commercial property assessment is NOT TRUE. From the measure itself: “(a). The Legislature shall

also define and provide by statute that limited commercial uses of residential property, such as

home offices, home-based businesses or short-term rentals, shall be classified as residential for

purposes of paragraph (2) of subdivision (a).”

The measure is also written to protect residential mom and pop landlords: “It is the intent of the People of the State of California to do all of the following in this measure:

(a) Preserve in every way Proposition 13’s protections for homeowners and for residential

rental properties. This measure only affects the assessment of taxable commercial and

industrial property. ”

C’mon, Globe, have some integrity and actually fact check this stuff.

At the very bottom of the article it says the statements made in the article were reviewed by Rex Hime of the California Business Owners Association.

Hi Wayne, Thanks for the private message and response here. So you admitted you didn’t fact check it but that a business lobby/special interest group that’s been spreading misinformation to get this proposition to fail said it’s okay. Yeah, that’s not the same as fact checking. Maybe actually read the measure before writing about it? In any case, thanks for confirming your legal and journalistic incompetence on this matter! A retraction would be great.

Thank you for your comment. It not the interpretation of this writer that home offices and Uber drivers will trigger commercial property taxes. It is the governmental affairs representatives and attorneys of the California Business Property Owner’s Association that assert that residential properties will be taxed as commercial properties under Prop. 15. You might contact them if you believe their assertion is incorrect.

Watch this video – LINK https://www.aircre.com/town-hall-on-ca-legislative-issues/

Blake

You are not going to find wording in Prop. 15 that specifically states home offices and Uber drivers properties are subject to a commercial property tax. The original draft of Prop. 15 had such wording but was removed due to opposition. But the existing version has a provision that if passed the legislature can amend Prop. 15 any way they want consistent with its original intent to increase commercial property taxes. Such a wild card would allow the legislature to re-include the provision to tax properties with home offices and Uber drivers. I hope that clarifies the matter. It is not speculative or this writer’s interpretation of the text of Prop. 15, it is based on the original wording of Prop. 15.

Hi Wayne,

Do you understand the difference between being a reporter and being a prop with no integrity? Do you care? My issues here aren’t with the California Business Owners Association, I expect them to lie, the issues are with you and this paper and thus my “effort” as you put it will be directed at you. You’re just a name they can put on their lies so they can undermine small mom and pop businesses. You’re basically admitting that you haven’t read the measure (which is easily available online), or if you did, you certainly didn’t understand the proposition in question. Attaching your most recent email to me so everyone else has context to see you admit to what a sham this article is.

Wayne Lusvardi

9:29 PM (5 minutes ago) to me

It is the position of the Commercial Building Owners Association (CBOA) and that is what was reported. See link to video which I provided. The statements made in the article were reviewed by the CBOA before submittal. Please direct your effort to the CBOA.

I’m sorry I can not respond rationally to your hysteria. Any faults in the article are mine but I relied on phone conversations, videos and an email I sent to the Commercial Building Owners Association to verify accuracy of my statements before submittal. As I emailed you, the original text of Prop. 15 provided for taxing residential properties with home offices and Uber drivers who take their cars home. That language was removed due to opposition. But Prop. 15 has a wild card clause that the legislature can amend it any way they desire if it passes. It is not pure speculation or false interpretation to infer that the same original wording will go back into the proposition if passed.

Do a Google search and you will find I have been defending Prop. 13 for years. Best wishes

Wayne Lusvardi, will you stop privately emailing me with your ridiculous hysterics for calling you out on this. I will not respond to you via email. You can make all those conversations public here. It’s not my fault you think the Commercial Business Owners Association is a legitimate source of information and can be solely relied upon. That’s on you and if you get dragged into a lawsuit for being a part of this misinformation ploy, that has nothing to do with me.

I own a small service company out of my house. If this thing passes it would triple my property taxes. I am looking to retire in a little over a year and the increase would be devastating. I would be better off closing my business and not paying the higher taxes. So there goes all the business taxes I am paying and all the other fees I pay.

The California Democrats continue to run the State into the ground. The time to sell your rental residential real estate is now: that will be the next target because it’s an easy sell to the (not too bright) electorate. Where’s Ronald Reagan when we need him?

This article lies ! Commercial property are often never sold ( the article suggests an average of every 10 years).

Truth is, large commercial properties are usually owned by a corporation or limited liability com. Instead of transfering ownership, many times to sell a building, the corporation that owns it is transfered from one set of shareholders to another, thus avoiding a property tax reassesment. This proposition will close that loophole.

BELOW IS A FAIR ASSESSMENT OF THE CONSEQUENCES OF PROP. 15 PREPARED BY LEE ASSOCIATES, REAL ESTATE APPRAISERS AND BROKERS. BOTTOM LINE, COMMERCIAL PROPERTY VALUES WILL FALL, WIPING OUT ANY INCREASE IN PROPERTY TAXES. A 1% INCREASE IN CAP RATES WILL RESULT IN A 20% DECLINE IN VALUE, MAING PROP 15 AN EXPENSIVE WASH. IN MOST CASES, SMALL BUSINESSES ON LEASES WILL WILL HAVE THEIR RENT INCREASED BY 50% TO PAY THE INCREASED TAX AND WILL HAVE TO CLOSE UP SHOP (E.G., TACO BELL, 99 CENT STORE, ACE HARDWARE, SUBWAY, LAUNDROMATS, USED CLOTHING AND FURNITURE STORES).. MOST BUSINESS WILL HAVE TO BE DONE ONLINE. VAST STRETCHES OF COMMERCIAL CORRIDORS WILL BECOME VACANT AND PRONE TO RE-OCCUPATION BY HOMELESS IN THE SUBURBS – ALREADY OCCURRING DUE TO PLANNED RIOTS IN BIG CITIES.

On November 3, 2020, Californians will decide the fate of Proposition 15. Prop. 15, also known as the Tax on Commercial and Industrial Properties for Educational and Local Government Funding Initiative, asks voters to approve an amendment to the Constitution requiring commercial and industrial businesses to be taxed at market value rather than at purchase price. The market value of properties will be reassessed every three years beginning in fiscal year 2022-2023. This report will identify the historical background of this ballot measure, state who are its backers and detractors, state the likely consequences on the proposition were it to pass, and conclude with an assessment and recommendation regarding the proposition.

INITIATIVE OVERVIEW

Where can I read the text of the initiative?

Because of its length, the exact text of the proposition cannot be reprinted within this report, but it can be accessed and read here.

Who are the supporters of Prop 15?

The Yes on 15 campaign is funded by the California Teachers Association and has the support of the San Jose and San Bernardino Teachers Association, the League of Women Voters, healthcare professionals, other labor organizations, as well as a bevy of city, county and state officials. The full list of its supporters can be read here.

Who are the Opponents of Prop 15?

Opponents to Prop. 15 include California Farm Bureau Federation, California Hispanic Chambers of Commerce, California Small Business Association, Black Business Association, other business groups, as well as a bevy of city, county, and state officials. The full list of its opponents can be read here.

WHAT WILL PROP 15 DO IF PASSED?

To comprehend how Prop 15 will amend California’s tax code, it is important to understand the history and origins of California’s current property tax system.

Between 1974-1978, state property taxes skyrocketed by 120%. Outraged by this, voters in California enacted Proposition 13 in 1978 to check Sacramento’s power to increase property taxes. For both residential and commercial properties, Prop 13 limited one’s annual property tax liability to just one percent of the purchase price of either your residential or commercial asset. Moreover, rather than reassessing the value of either the residential or commercial property at market value, assessors were required to assume that the property annually increased in value by either two percent or the rate of inflation, whichever was lower.

One consequence of the Prop-13-tax-system is that Californians who hold their property for a long time pay far less in taxes than new buyers, with the only exceptions being new construction on a site, which resets the assessed value when a new building delivers or a decline in value associated with 1978’s Proposition 8.

Prop 15 supporters find this consequence irrational since it leaves taxable money on the table, and unfair because the tax burden is not evenly distributed. Proponents of Prop 15, as a result, propose to do three things. First, tax commercial assets at 1 percent of their fair market value, with reassessments occurring every three years. Second, agricultural buildings and owners of commercial and industrial properties with a combined value of $3.0 million or less would be exempt. And third, homeowners will continue to pay the one percent of purchase price with two percent annual caps under the current Prop 13-created-system. Because Prop 15 supporters propose to divide or split how commercial and residential buildings are taxed, it is often called “the split-roll” initiative since it splits California’s property tax roll.

The Prop 15 reform will increase state tax revenue by $8.0 to $12.5 billion per year. Once administrative costs are covered (ranging from $500 million to $800 million), 40.0% of the revenue will go to public schools and community colleges, while local governments will collect the remaining 60%. For the city of San Jose and the county of Santa Clara, for example, Prop 15 would generate an estimated $77 million and $265 million in tax revenue, respectively.

If the measure passes, the tax liability of commercial properties would be assessed at market value starting in the fiscal year 2022-2023. Properties, such as retail centers, whose occupants are 50% or more small businesses would be taxed based on market value beginning in fiscal year 2025- 2026, or at a later date depending on the legislature.

The Yes on 15 campaign uses Walt Disney Studios as an example for how the initiative could level the playing field and restore money to local communities. The Walt Disney property in Burbank spans 43 acres that was assessed in 1975. Disney pays $5 per square foot while Burbank Studios pays $180. If Disney and Burbank Studios were reassessed and taxed at current market value, they would be competing on the same plane and paying $3.5 million more in taxes each year.

WHAT CONSEQUENCE WOULD LIKELY ENSUE FROM PROP 15?

Appraisal Industry: Since Prop 15 mandates assessments every three years, this will create increased-demand for the appraisal industry.

Tenants: Increasing taxes for commercial property owners will lead to higher rents for tenants, which drives up the cost for businesses to operate in California. Small businesses, which employ nearly half of all employees in California, will likely consider out-of-state relocations.

Almost all commercial property leases in all product types contain some kind of clause that requires the tenant to pay all or a portion of property taxes for the space they occupy in addition to base monthly rent. In a net lease, the tenant pays it all from day one. In a typical gross lease, taxes for the “base year” are included in the rental rate with increases for subsequent years passed along to the tenant. But, even in a gross lease the burden is on the tenant because the base rental rate is higher to cover the landlord’s base year levy. As a result, a tenant who occupies a building with a low property tax basis could likely see his or her tax bill double, triple or even quadruple depending on when the landlord acquired the property.

Owner/Users: Because owner/users are both landlord and tenant, it is not possible to avoid a part of the tax increase. In an arms-length transaction, the parties could negotiate who has responsibility for taxes dependent on market conditions. The owner/user cannot.

Typically, owner/users hold a property for much longer than the typical duration of a lease. They do so to fix occupancy cost over the long term by obtaining fixed rate financing and staying in place as long as possible. Generally, those who choose the owner/user route can use the acquired property for 10 years or longer. Thus, imagine the property tax increase for building owners who bought their industrial building for, $50 per square foot back in the mid-1990’s. That property is worth perhaps $270 per square foot today and come 2022, the property would be assessed at current market value and their tax liability would be enormous.

To give a concrete example, consider the following scenario. According to Real Capital Analytics, for office properties in California, the average sold price was $448/SF in 2019, up 109% from 2004. Imagine if Prop 15 were in place in 2019 and a fair-market value assessment occurred, and a hypothetical office building was $25 million in 2004 and the buyer remains the owner to date, then the owner’s tax liability would be 1% of $52,250,000 or $522,500 in 2019. That would be a tax increase of $186,033 or 55.29%.

Investors: Regardless of their value, all commercial property that is not owner-occupied would be subject to the new taxation regime. Thus, even small time investors will face the consequences, and the properties they tend to own are occupied by small tenants who will have to share the tax burden with them one way or another. Institutional investors, the primary target of Proposition 15, should be able to pass most or all of the tax increases to their tenants pursuant to the terms of their leases. So, most of their net operating income should be protected. In short, Fortune-caliber companies are better insulated from higher occupancy costs than smaller and mid-sized entities since their financial reserves are deeper.

A possible consequence of this is that the additional risk associated with potentially higher operating expenses in the future would put upward pressure on cap rates for all commercial properties, which will lower their value across the board. A 1% increase in cap rates (from today’s average of 5%) would wipe out 20% of the current value of commercial properties.

Moreover, for investors weighing multiple state options, such as where to locate a business or where to develop commercial projects, California’s variable tax rates will cause them to think twice before deciding to do business in the Golden State.

EVALUATION

As our foregoing analysis makes clear, Prop 15 would be an extremely burdensome revision of the tax code. It would materially harm tenants, owners, real estate investors, and further undermine the ability of striving entrepreneurs to thrive in California. Contrary to the intentions of its proponents, Prop 15 will only entrench the position of already-powerful companies and undermine the standing of small and midsize firms. Whereas the bigger firms would be able to bear the new tax liability, the smaller firms would not. Although California’s tax code is badly in need of reform, Prop 15 isn’t it. It is neither wise nor sound.

PROP 15 SCAM – NOVEMBER 2020

.

The California November Ballot, Prop 15 Initiative is an attempt to split the assessment roll between commercial and residential property. The objective is to remove the Property Tax Limitations that were established by the Howard Jarvis 13 Prop passed in 1978. It set property tax rates at 1%, and capped yearly increases at 2%. Government has already evaded these limitations to a certain degree by converting certain property “taxes” into “fees”, just by a renaming or by their application. These fees, however, are still on your property tax bill; government officials like to assume these fees fall outside the 1978 Prop 13 limitations. There have been attempts since 1978, to introduce a split roll to break the Howard Jarvis Property Tax Limitations.

,

[[-CA Prop 15, Tax on Commercial and Industrial Properties for Education and Local Government Funding Initiative

. NO – [A “no” vote opposes this constitutional amendment, thus continuing to tax commercial and industrial properties based on a property’s purchase price, with annual increases equal to the rate of inflation or 2 percent, whichever is lower.] -]]

,

Howard Jarvis’s 1978 Prop 13 property tax limitation will be on the chopping block, aka November 2020 Prop 15 ballot initiative.

[California’s Attorney General Xavier Becerra rigs ballot with biased split roll summary” The “split roll” initiative, which would split commercial properties away from Proposition 13’s property-tax protections, is a tax increase. No reasonable observer could come to another conclusion. Yet Becerra’s official title doesn’t mention that point: “Increases funding for public schools, community colleges and local government services by changing tax assessment of commercial and industrial property. – The Orange County Register By THE EDITORIAL BOARD | opinion@scng . com | PUBLISHED: October 21, 2019]

. Something to think about – the State is promoting this initiative, not the property owners.

Also consider what the percentage of voters that were property owners when prop 13 was passed in 1978, compared to the percentage of voters that are property owners today in the 2020’s. With the influx of aliens into California and property owners leaving the State, that percentage is probably significantly diminished.

. The headlines say, “No, there will not be any ballot measures to repeal Prop 13 residential property tax cap in the upcoming election” This is partially true, but it is ignoring the huge impact that removing tax limitation on commercial property will have on all California Citizens, not just on residential Property Owners.

[The California Secretary of State website said there is an initiative called “The California Schools and Local Communities Funding Act of 2020.” It has received at least 25% of required signatures to qualify for the Nov. 2020 ballot. This initiative would undo the property tax caps of Prop 13, but only for commercial and industrial properties. This initiative would not take away the Prop 13 protections for residential properties, California Secretary of State Spokesperson Sam Mahood said. – Author: Monica Coleman (ABC10) Published: 6:59 PM PST January 7, 2020]

. So, if the tax increases are only on the Commercial Properties what could be the problem you might ask?

(1) It is an incursion into the original Howard Jarvis 1978 Prop 13 property tax protections and is just a stepping stone to removing all property tax limitations, commercial and residential.

(2) Who do you think will pay the additional property taxes on businesses? The businesses will just pass on the additional property tax costs to their customers, the consumers.

(3) More businesses will leave California due to the already high taxes, business fees and excessive regulations.

. Additional Prop 13 Comments:

[Leftists and Taxes – Prop 13 – Property Tax Limitations

In California, if they repeal the 1978 Howard Jarvis Prop 13, property tax limitation, in effect you will not own your own land, you will be just renting it from the government. It will get so bad that it will be cheaper to rent than “so called own” your own property. This will especially will be true with governmental rent control to keep the rental prices low to provide for all the homeless and illegal aliens.

At a 5 percent tax rate, it would only take 20 years and you would be paying for your house twice, once from the seller of the property and once from the property taxes. And this valuation would be based on the current value, not your original purchase price; the inflation and market increase in residential values, of your property, in California could literally force you to sell your property in order to just pay the taxes.

. What most people are not aware of is that, originally 100% of the County property taxes went to the County and were used where you lived for projects that were needed in your immediate area. However, over the years the state (of California) has been siphoning off more and more of those funds from the County Property Taxes to the point that a very small percentage of those taxes actually go to the Counties, but yet the Counties are required to pay for all the costs associated with of administering the determinations of values and collections of those taxes. The state then audits the counties to determine if they are correctly collecting the taxes and can make adjustments by taking more taxes.

So when Gavin Newsom cavalierly gives free stuff to illegal aliens like free-health-care just remember where he is getting those free funds from, out of your pocket. And by the way, did not Gavin Newsom promise to give free health care to all; how did that turn into just free healthcare for selective illegal aliens shortly after he obtained the office of Governor?

HR 01-22-2020 revised 03-06-2020 and 10-19-2020]

HR 10-19–2020

[[-Comment: Proposition 15 is an attempt to diminish the Howard Jarvis property tax limitation established by Prop 13 in 1978. While this provision, if passed, would only apply to commercial property, do not kid yourself, the taxes will be passed on by the Businesses to the consumers of their services and products; you, the consumer will be indirectly be paying the taxes.-]]

Prop 13 is unfair to young people.

It’s not fair that my new neighbors have to pay 5 times the property tax I do.

It also artificially raises housing prices (by restricting supply).

A better solution would be have taxes due at time of property transfer. So, if older folks don’t want to (or can’t) pay their property taxes, it would simple be taken from their estate when they pass. This would be more fair to all (including young families).

Better yet, all real properties taxes should be caped at $4,000. annually. Too much waste and abuse of taxpayers money.

The anti prop 15 folks have yet to propose how we are going to fund schools Without property taxes increasing. I personally benefit from prop 13, but recognize, the money to fund our schools has to come from somewhere.