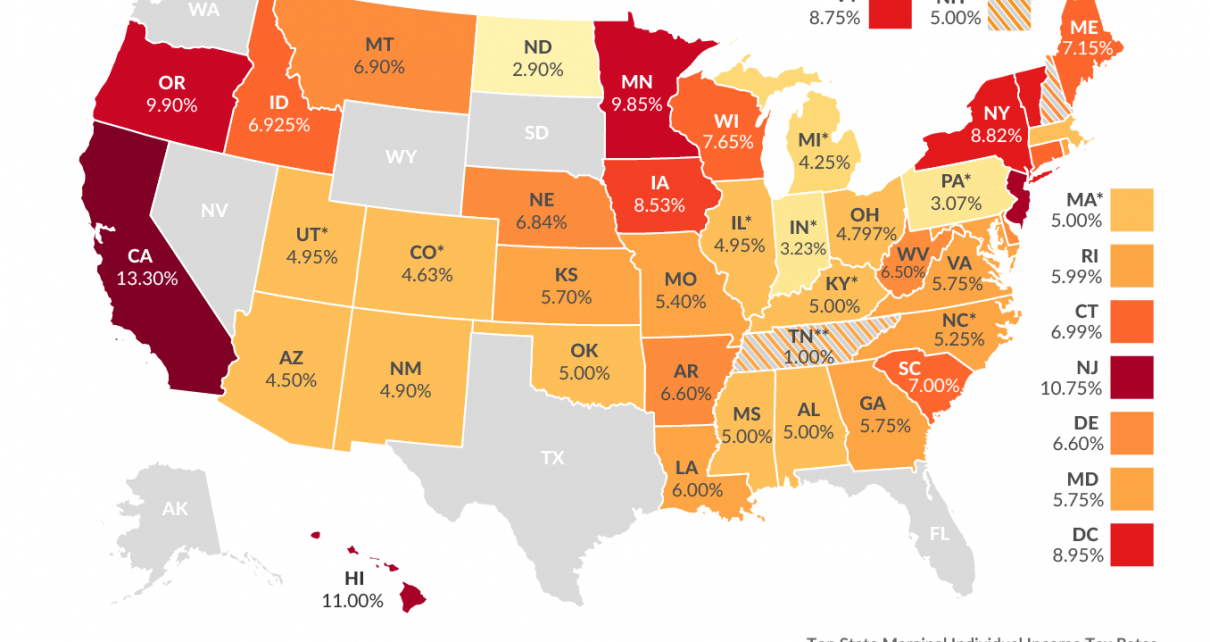

Personal Income Taxes by state. (Tax Foundation)

With Tax Day Around the Corner, California Still Has Highest In the Nation Individual Income Tax Rates

More is never enough

By Katy Grimes, February 10, 2020 7:38 am

With Californians preparing their state and federal taxes, it’s a challenge knowing that California’s 13.3% rate is the highest marginal tax rate in the nation.

When you add in up to 37% federal taxes, living in California is expensive right off the top, and especially now that we cannot deduct state taxes against the federal.

California’s taxes were always high, but voters were somehow convinced to extend the 2012 Proposition 30 tax increase, through Proposition 55 until 2030.

Prop. 30 was then-Gov. Jerry Brown’s personal income tax increase on high-income earners of more than $250,000 passed in 2012. California lawmakers and governors rely on California’s wealthiest for state income, but this is prone to boom-and-bust cycles.

Prop. 30 created four high-income tax brackets for taxpayers with taxable incomes exceeding $250,000, $300,000, $500,000 and $1,000,000. This increased tax was “temporary,” set to be in effect for seven years, until Brown pushed Prop. 55, which extended this temporary tax by twelve years.

Prop. 30 also raised California’s sales tax to 7.5 percent from 7.25 percent.

When Californians think of moving to a low tax or no tax state, one consideration is because of the high income taxes.

As the Tax Foundation explains, “Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two states—New Hampshire and Tennessee—exclusively tax dividend and interest income. Seven states levy no income tax at all. Tennessee is currently phasing out its Hall Tax (an income tax applied only to dividends and interest income), with complete repeal scheduled for tax years beginning January 1, 2021.”

“Of those states taxing wages, nine have single-rate tax structures, with one rate applying to all taxable income. Conversely, 32 states levy graduated-rate income taxes, with the number of brackets varying widely by state. Kansas, for example, imposes a three-bracket income tax system. At the other end of the spectrum, Hawaii has 12 brackets. Top marginal rates range from North Dakota’s 2.9 percent to California’s 13.3 percent.”

Tennessee has been phasing out its tax on investment income, with the rate dropping from 2 to 1 percent for 2020. By 2021, Tennessee will be among the states with no individual income tax.

“The state with the highest combined corporate income tax rate is Iowa, at 29.5 percent. Corporations in Alaska, California, Illinois, Maine, Minnesota, New Jersey, and Pennsylvania face combined corporate income tax rates at or above 28 percent. Six states—Ohio, Nevada, South Dakota, Texas, Washington, and Wyoming—face no state corporate income tax and only the federal tax rate of 21 percent,” Tax Foundation reported.

- California Lawmaker Making the State More Hostile to Business - April 18, 2024

- California Democrats’ Backdoor Reparations Scheme - April 17, 2024

- California’s Senate Democrats Reject Bill to Make Purchasing a Child for Sex a Felony - April 16, 2024

I’m a Tennessee resident! We don’t pay an individual INCOME TAX!

Americans shouldn’t choose ignorance.

Exempt income is already defined in US tax regulations. Read it so you’re not an ignoramus.

Google “the term exempt income means any income”

WhatisTaxed c o m

Computer scientist data mines tax code… Finds government run tax fraud.

It’s true. But as Irwin Schiff how that worked out for him. And watch America: Freedom to Fascism

https://youtu.be/uNNeVu8wUak

California is number 1. Yay!

Now all we gotta do is stop those fleeing CA from voting the same way in their new state as they did in CA. They’re apparently too stupid to see that all they do is turn their new state into mini-Californias

I know I see them coming here to New Hampshire… don’t come to the “live free or die” state to live tax free then vote for taxes—- fools

As a native New Hampshire (ite), I agree with you, but you can probably see the writing on the wall. We’re considered a blue state and the primary results showed more dems than Republicans. Thank God for Governor Sununu.

California is a giant pile of AIDS

Listen to Jack Hibbs at Calvary Chapel Chino Hills, that is if you want to listen to something worth listening to.

Agree Kevin!

Jack Hibbs is awesome, he sees the whole picture!

Pray up and look up my friends. There is something so much better waiting for us at the end of our journey. Jack Hibbs will let you in on the secret, all you have to do is accept Jesus Christ as your savior. What a glorious proposition..

☆ IMPORTANT RECOMMENDATION ☆

please share with your friends.

CALIFORNIANS… vote NO on PROP 13

For “RENTERS,”

just because you are a “RENTER” . . . DO NOT think you won’t be affected by this. Your landlord will be hit with the INCREASED prop tax, and WILL pass along the increase to you with HIGHER RENT.

This WILL AFFECT EVERYONE.

Renters and homeowners.

Important … ☆ VOTE “NO” ☆

(please share with your friends)

I lived in California from 1985-2002, now retired elsewhere. What happened with Proposition 13 is that rents are (were?) frozen at a certain level, or allowed to increase only a small/nominal percentage on occasion. The landlords figured out ways around this by renting to people they like, and they seemed to like people who fronted them with a big wad of cash that is unreported to the authorities, thereby circumventing the intent of the law. I had friends in Santa Monica living in apartments roughly equivalent to my $800K condo, even though they were paying well below $1000/month. They had to make the big up-front payment, but were happy with that arrangement. It became a game of who you know and who could be trusted to play the game. I think a better way is to allow market forces determine the price. But the state should build some housing for qualified low-income people, because otherwise how can people such as teachers, firefighters, or nurses who earn less than $75K/year afford to live in/near places like San Francisco or Santa Monica?

California is not the highest by just a small amount. The second highest is New Jersey at 10.75%. At 13.3% California is almost 25% higher than number 2. We owe this burden to the unionized public employees with their salaries and pensions that the people who have to pay these taxes can only envy. We certainly do not have the best government services in the nation as one should expect if paying the highest taxes.