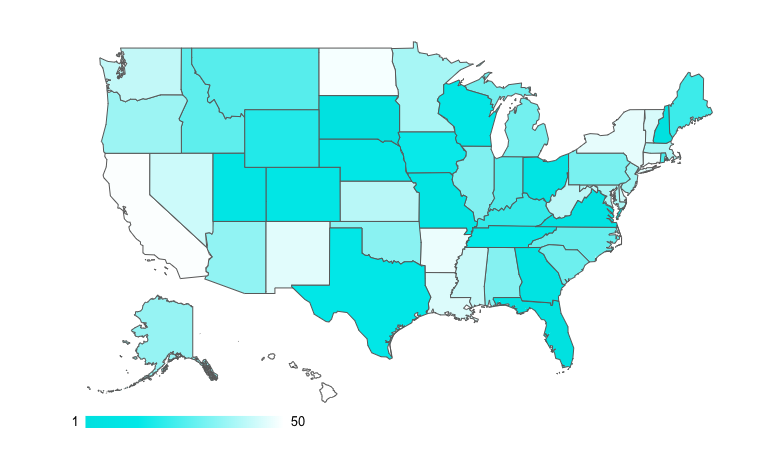

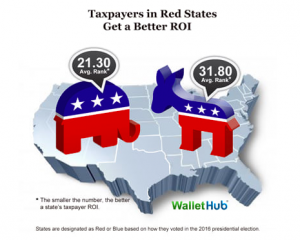

WalletHub state rankings taxpayer ROI. (Photo: screen capture, WalletHub)

California Has 2nd Worst Taxpayer ROI WalletHub Study Reports

Coming in at 49th in state and local taxes paid vs. spending received by state

By Katy Grimes, March 24, 2020 7:20 am

With Tax Day on Americans minds, even with the federal government allowing taxpayers to defer payment without penalty due to the coronavirus pandemic, California just placed 49th – second to last – in Wallet Hub’s Return on Investment study of states.

WalletHub’s latest analysis of the U.S. tax landscape is an in-depth look at the states with the Best & Worst Taxpayer Return on Investment in 2020.

WalletHub used 30 metrics to compare the quality and efficiency of state-government services across five categories — Education, Health, Safety, Economy, and Infrastructure & Pollution — taking into account the drastically different rates at which citizens are taxed in each state.

They also note that taxpayers in red states get a better return on investment than those in blue states.

- 49th – Overall ROI

- 45th – Total Taxes per Capita (Population Aged 18+)

- 11th – Education

- 18th – Health

- 34th – Safety

- 40th – Economy

- 48th – Infrastructure & Pollution

Notably, California’s 13.3% rate is the highest marginal income tax rate in the nation. When you add in up to 37% federal taxes, living in California is expensive right off the top, and especially now that we cannot deduct state taxes against the federal.

California ranked 34th in overall government services, broken down by Education (11th), Health (18th), Safety (34th) and Economy (40th).

WalletHub asked three economists:

Do states with high tax burdens provide better government services?

Kimberly Gaither, Vice President for Enrollment Management, Culver-Stockton College said, “there doesn’t seem to be a good correlation between high state tax burdens and quality of life rankings for their citizens.”

How can state and local governments use tax revenue more efficiently?

Doug Stives, CPA, MBA – Specialist Professor of Accounting, Monmouth University, said, “The states must face the unions representing public workers including teachers. Most teachers in New Jersey will collect more during retirement than they made during their entire career. They are depending on unfunded pensions. States such as Wisconsin have faced reality and eliminated benefits including inflation proof retirement plans and lifetime medical insurance to save their states from financial disaster like New York, New Jersey and California face.”

For the full report, go to the Wallet Hub website.

- Data Forecasts Drastic Job Losses from San Diego $25 Wage - September 19, 2025

- George Soros Gives Massive Donation to Gov. Newsom for Mid-Decade Redistricting Effort - September 19, 2025

- Rep Ilhan Omar Saved From Censure By Four Republican Congressman - September 18, 2025

On the federal level, blue states heavily subsidize red states. They are effectively welfare states kept afloat by the wealthier blue states. How about discussing that for a less biased picture?

^^^ Typical liberal talking point, completely opinion driven and false…