For sale/SOLD sign. (Photo: HUD.gov)

California Loses 300,355 Taxpayers and $12 Billion In Gross Income to Other States Since 2017

Texas and Arizona benefit the most from California ex-pats

By Katy Grimes, June 6, 2021 2:26 am

It’s no secret that Californians are leaving the state in droves. Some are political refugees worn out by the one-party Democrat rule. Others are economic refugees, searching for lower taxes and a more palatable cost of living.

A new report by The Center Square provides details:

“The Internal Revenue Service recently released its latest taxpayer migration figures from tax years 2018 and 2019. They reflect migratory taxpayers who had filed in a different state or county between 2017 and 2018, of which 8 million did in that timespan.”

“California, the nation’s most-populous state, lost more tax filers and dependents on net than any other state.”

“Minus incoming filers, California shed a net 165,355 tax filers and dependents between the two tax years, representing a loss of $8.8 billion in net adjusted gross income.”

“From July 2019 to July 2020, the Census Bureau estimated 135,000 more people left the state than moved in.”

The California Legislative Analyst reported last year that for many years, more Californians have left for other states than move here. According to data from the American Community Survey, from 2007 to 2016, about 5 million people moved to California from other states, while about 6 million left California. On net, the state lost 1 million residents to domestic migration—about 2.5 percent of its total population.

Official U.S. Census figures were unveiled recently showing that California will lose one congressional seat and electoral vote due to a massive slowdown of population growth, the Globe reported in April.

Now we are starting to see outbound migration from California’s big cities to smaller cities and towns, and to the state’s rural counties – if they even choose to stay in California.

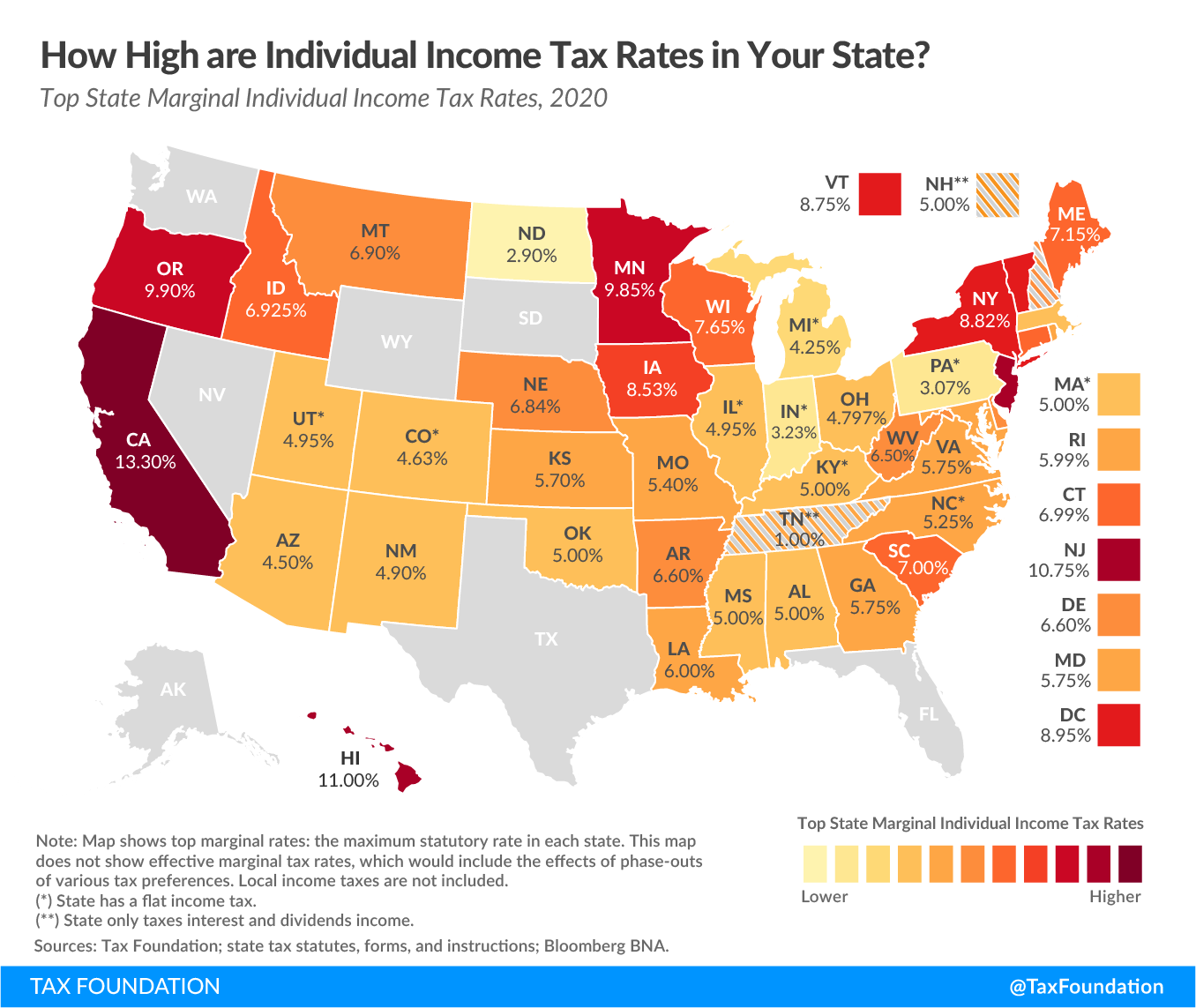

We know why California companies leave for other states: Chief Executive Magazine reports year after year that when CEOs across the country are surveyed, they name California as the worst state in the country in which to have to do business. California has the highest-in-the-nation taxes, one of the highest business tax climates, with the Tax Foundation ranking California at No. 49 – the second worst in the nation, ahead only of New Jersey.

The Center Square continues:

“Texas was the primary destination for California ex-pats, with 72,306 total exemptions leaving to go there. Neighboring Arizona saw 53,476 total filing exemptions come from California. The two states saw a gross income boost of $3.4 billion and $2.2 billion, respectively.”

California’s 13.3% income tax rate is the highest marginal tax rate in the nation. And when you add in up to 37% federal taxes, living in California is expensive right off the top, and especially now that we cannot deduct state taxes against the federal.

With the statewide lockdown still partially in place, with schools closed or partially open, and businesses closed for 15 months, add in the spike in violent crime across the state… expect to see more people reaching a tipping point and making the decision to move to another state.

- Gov. Newsom’s and AG Bonta’s Affordable Housing Shakedown Scheme - April 25, 2024

- 6 California Cities Make the Least Affordable List for Home Buyers - April 24, 2024

- NEW REPORT: California Ranks Among Bottom of 50 States for Financial Transparency - April 23, 2024

Yes, people are fleeing California in droves. The proof is that California lost a seat in the House of Representatives. Incredibly, the media has spun the population loss as related to covid deaths. How creative, diminish an objective verifiable fact by promoting a false one. Thats some chutzpah.

Yes, the HIGHEST marginal rate in California is 13.3%. Imo, a bigger problem with the out-migration from California is that the middle to higher income individuals and families are the ones who are moving to states like Arizona and Florida. That’s because California has a progressive tax. By comparison, middle-class individuals/families pay more on a gradual scale starting with individuals/families who make $34k/$64 year. Therefore, when they leave, California ends up with MORE income inequality. The highest marginal rate in Arizona (4.5%) and Florida (0.0%) is a big incentive to leave. If you are planning to buy/sell a home in the future, it becomes a no-brainer – why stay in California? (https://www.tax-rates.org/taxtables/income-tax-by-state#states)

Dear Ravaged Comrades

What young person or couple can truly afford a domicile? What college graduate makes ends meet while paying student debt forced on them by greedy, corrupt uncompetitive colleges?

Does a thinking responsible resident believe redistribution is proper while being continually insulted or thwarted in many ways because of their skin color?

This is all sick stuff, demoralizing, regrettable, a merciless daily reality…..

Oddly, unemployment is a respite, free money, lottery tickets, loan deferrals or forgiveness, rent forget, tax deferrals or forgiveness, rob a store up to $950.00 and no prosecution, charity bags everywhere, gift certificates, go get em accounts, etc. abound throughout urban communities…why work and pay pay pay pay you hapless, bewildered or puzzled supremacy beast…..

Newsom will backfill the population loss with illegal alien welfare cases. He loses white, law abiding taxpayers and gets dependents that will perpetually vote for more welfare. A win-win in his sick mind.

Eventually all the tax revenue will be as dry as our reservoirs once the decent taxpaying citizens/businesses finish fleeing this state. What will Newsom do when he is left with all welfare recipients, illegals, homeless and extremely low income families? He will be the proud governor of a pig pen!

Newsom already is…

And he WAS, as Mayor of San Franfreakshow…

California lost me 5 years ago after my mom passed away. So this has been happening longer than the years they are reporting. In fact I was the last one in my family to move to another state that lived here. I’m glad to get out since it has only gotten worse with the crime and homeless to name a few problems. Just hoping the Californication doesn’t eventually spread over the whole country because then we are all screwed. I moved to get away from the problems of California and not bring them with me. You can add me to the list as another former taxpayer no longer helping to pay for the overpriced government workers in the state.

Same here in ’17, but then we had to move back for our work in ’19…

God willing, we’ll be out again within the year…

The only two things CA has going for it is some spectacular scenery within 20 miles of the coast, and some of the mildest climate in the world to go along with it…

The downsides are too numerous to rehash, and this site does a great job reporting on the ABSOLUTE LUNACY legislation out of Sacramento…

Nice place to vacation, though…