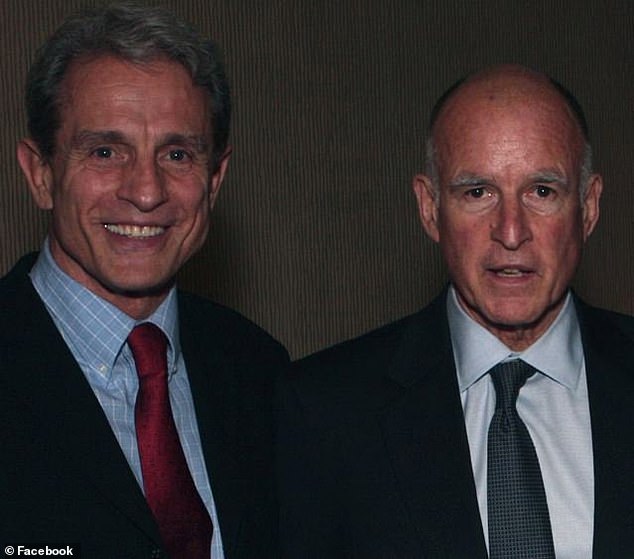

Former Governor Jerry Brown (Photo: ca.gov)

Former Gov. Brown Joins Newsom and Dems In Opposition to Voter Approval on Tax Increases

Democrats are throwing everything they have to stop the Taxpayer Protection and Government Accountability Act

By Evan Symon, February 2, 2024 12:32 pm

Former Governor Jerry Brown joined current Governor Gavin Newsom in opposition to the Taxpayer Protection and Government Accountability Act ballot measure in November that, if approved by voters, would give voters final approval on future taxes and fees imposed by state and local governments.

The Taxpayer Protection and Government Accountability Act, also known as “the Taxpayer Protection Act,” was developed as a ballot measure in 2021 by a group of California homeowners, taxpayers, and businesses. According to the Howard Jarvis Taxpayers Association (HJTA), the measure would amend the state constitution do the following if passed:

- Require all new taxes passed by the Legislature to be approved by voters

- Restore two-thirds voter approval for all new local special tax increases

- Clearly define what is a tax or fee

- Require truthful descriptions of new tax proposals

- Hold politicians accountable by requiring them to clearly identify how revenue will be spent before any tax or fee is enacted

- New taxes and fees imposed starting in 2022 unless approved by voters will be canceled within a year of the act going into effect

Throughout late 2021, signature gathering commenced, with the goal of getting at least 1.4 million signatures to have enough be valid for the just under 1 million needed to go on the ballot. Many California officials, initially unconcerned and doubtful that such a measure would get enough signatures were shocked when the Secretary of State’s office announced in early 2022 that 1,075,585 valid signatures had been gathered, more than enough to qualify for the 2024 ballot.

State and local officials and lawmakers quickly went on the offensive, labeling the Act as “threatening voter rights” and “going against local services.” Some, including the League of California Cities, even tried to paint the measure as nothing more as a way for corporations and businesses to get out of paying some taxes.

“This deceptive initiative would undermine the rights of local voters and their elected officials to make decisions on critical local services that residents rely upon,” said California State Association of Counties Executive Director Graham Knaus. “It creates major new tax loopholes at the expense of residents and will weaken our local services and communities.”

However, polls found that a majority of Californian voters actually liked the measure, with many saying that the Taxpayer Protection Act would do as the name of the act said and would give them more say in what taxes are moved forward.

“The Taxpayer Protection Act was written to restore a series of voter-approved ballot measures that gave taxpayers, not politicians, more say over when and how new tax revenue is raised,” explained HJTA President Jon Coupal. “Over the past decade, the California courts have created massive loopholes and confusion in long-established tax law and policy. The Taxpayer Protection Act closes those loopholes and provides new safeguards to increase accountability and transparency over how politicians spend our tax dollars.”

A California Supreme Court petition

Faced with the Act actually passing, opponents switched to a new tactic in 2023: Going to the state Supreme Court and having it removed from the ballot. Governor Gavin Newsom and Democratic state legislators sent a petition to the California Supreme Court, urging them to remove the measure from the November 2024 ballot because of it infringing on the rights of lawmakers to institute taxes and it being an unlawful California constitution revision.

The initiative’s changes would infringe on lawmakers’ constitutional powers to impose state taxes. It would also illegally shift power from the governor to lawmakers by requiring charges now considered fees to be approved as taxes by the Legislature,” said the petition. “Such far-reaching changes to the foundational powers of the government would amount to an unlawful constitutional revision. Pre-election review is therefore necessary because the measure cannot lawfully be enacted through the initiative process.”

In December, the Court agreed to hear the case, with a final decision if the measure will go on the 2024 ballot likely to come in the next several months.

“As we said when the case was filed, this radical effort led by wealthy business interests impermissibly seeks to completely restructure our system of government in a way that will hobble the state’s ability to respond to future crises,” Gov. Gavin Newsom’s office added in a statement. “We are pleased the Court decided to hear this important case.”

Despite the matter now being in the State Supreme Court, popularity of the measure amongst voters only grew. Large groups, such as the Los Angeles Taxpayers Association came out in support of the measure, putting lawmakers in Sacramento even more on edge.

“Over and over again, California taxpayers have made it abundantly clear they want control over their government and how much they are taxed,” said Coupal in December. “I think all of these attacks are reflective of one thing and one thing only, is that if the Taxpayer Protection Act is on the ballot, it will pass. It’s extraordinarily popular.”

This led to this week when opponents of the measure decided to add more big names this week. Governor Jerry Brown, who led the state from 1975 to 1983 and again from 2011 to 2019, joined Newsom and Democratic state legislators, with he and his team petitioning against the measure. While most of the reasons given were the same, Brown also added in climate change worries into the reasons against the measure from appearing on the ballot.

The proposed ballot measure would deprive the Legislature of its power to tax by requiring a majority of voters to approve any tax increase,” said Brown’s lawyer David Goodwin to the court. “And by requiring every tax increase to identify the programs on which the money would be spent, the initiative would make it much harder to raise funds for general state needs or emergencies.”

Brown specifically warned that the passage of the measure would decimate the Cap and Trade program set up during his 2010’s term as Governor.

“The ballot measure would largely eliminate the ability of state agencies to regulate environmental pollution by imposing charges or cap-and-trade requirements on polluters and would remove the power of the Legislature to enforce state climate change policy,” Brown said. “Cap-and-trade funds have been used to restore wetlands and watersheds, fund light rail and the state’s bullet train and promote zero-emission motor vehicles.”

“Under the initiative, Oakland would be forced to stop collecting money on behalf of the libraries unless Oakland holds another election in which the voters re-approve the library tax. In the meantime, library funding would be interrupted, libraries would close, and one of the most important civic services provided to the children of Oakland would be disrupted if not eliminated.”

Brown out against the measure

However, even with Brown now on board, many experts are unsure if it will be enough to convince the Supreme Court to pull the measure from the ballot only nine months out from the election.

“Democrats are throwing everything they have to stop this, because they know that if it passes, people will likely not want money going towards what they are trying to push,” Dana, a Capitol staffer told the Globe on Friday. “This measure has been in the background for a long time, but slowly becoming more and more into focus. Look at how much Newsom and everyone have been slowly ratcheting up their pushes against it. You don’t petition the California Supreme Court unless you are worried. And if they are bringing in high profile people like Brown, then yeah, they know that this is likely going to be voted on in November.”

“But, on the other side, this is the California Supreme Court we’re talking about. How they rule on things can be pretty wild sometimes. Both people for and against the measure will really need to prove their points. And Newsom and co. know what is at stake, all that tax money and people deciding on it instead of officials.”

“What they don’t like to hear is that most voters are smart enough to know if something does or doesn’t need a tax hike. Like the library thing Brown mentioned. Yeah, things may be interrupted for a bit, but people will know if that tax is needed and there won’t be closures like Brown is prophesizing. They’ll see where libraries are now, and then weigh it against what libraries will say what will happen if the voters don’t approve it, and then the voters can decide. It’s quite simple when you stop for a minute and think. But they also do have a point with the constitution issue, which could be the wrench in the gears that throws all this off. We’ll get a decision soon.”

A decision by the Supreme Court is expected soon.

- San Diego Country Supervisor Jim Desmond Calls San Diego New Epicenter Of Illegal Crossings By Migrants - April 27, 2024

- Oracle Moving Headquarters Out Of Austin Only 4 Years After Moving Out Of California - April 26, 2024

- Congressman Adam Schiff Robbed of his Luggage in San Francisco Car Break In - April 26, 2024

You will own nothing and be miserable. (Paraphrase of the WEF)

Endless taxes are one way they plan on enforcing this dictate. These rapacious monsters will stop at nothing to take it all from use. Vote like your life depends on it because it does.

The first sign of a bad idea is anything that gives the government more money. I will be voting yes on “the Taxpayer Protection Act”. The Dems are scared and that is good.

We need the Taxpayer Protection Act. Now.

Former Gov. Jerry Brown and Democrat Gov. Gavin Newsom are both pampered deep-state Democrats stooges for their WEF globalist and CCP masters? The criminal Democrat mafia are all about stealing from taxpayers and they’ll do everything they can to stop the Taxpayer Protection and Government Accountability Act ballot measure?

The Sacramento swamp is apparently incapable of understanding that this initiative is a direct result of their abuse of the power to tax. This is not surprising, as most of them regard the general public with contempt, and think of themselves as our betters. It offends them that we would dare challenge their authority. I don’t think they have a clue about what the likely reaction will be, should they succeed in getting this measure pulled from the ballot.

Governor Moonbean and Galloping Gaff Gavin wanting to “give away what little the working class has left” to some ineffective NGOs who will recycle a hefty cut back to the party. Chicago has nothing on California !

Let go of my wallet!

Democrats say “Democracy dies in darkness” – but that is what they are doing from WH to CA gov. They want to HIDE things from the people, to aggressively and ruthlessly take as much control over the people and as fast as possible now.

The way to crush the bourgeoisie is to grind them between the millstones of taxation and inflation.

Vladimir Lenin

The Democrats think we forget about previous taxes (mostly we do) The ozone layer, the ice age, global warming, now climate change. Do they still collect those taxes? What are they doing with it? THIS is just a small reason we need to vote yes on this if it doesnt get pulled.

It’s highly ironic that the DEMOCRATS are so opposed to a DEMOCRATIC initiative that they are appealing to the State Supreme court to find that the initiative violates our REPUBLICAN form of government. But we all know anyway that the Democrats only care about democracy in as far as it can be used to keep them in power.

jerry you ruined this state twice and now you got your protege in there to finish it off. go away

A perfect picture of Jesuit Jerry shilling for his globalist masters…

And anything Jesuit Jerry and current Governor Period Fullstop are against, we are FOR 100%

Where do we donate for the legal defense fund???

These stupid Democrats don’t even reconcile their personal checking accounts, so trusting them blindly without adult, taxpayer oversight is foolish insanity…

Time to take California BACK AND AWAY from the corrupt, evil Democrats!!!

Where is John Moorlach when we need him???

Retiring to the Midwest state where I grew up, I was amazed at the lack of swooping off-ramps, and the plethora of new schools with many newer amenities (like roofs that don’t leak and working plumbing).

So at the first County and city elections I saw ballots renewing sometimes years long taxes for infrastructure and rare increases.

At the City and County meetings (we have Villages here too Hillary) they cannot vote for taxes and fees. They put them to the voters.

Ever heard “we can’t afford that” from the millionaires who decide what is best for you?

I hear that all the time here, and they persuade instead of dictate what they receive. Most of the elected pols don’t get paid..

Jerry Brown set the table for destroying California and Gavin Newsom is feasting on the state’s destruction. Both of them are evil Demoncrats who have been feeding off of beleaguered taxpayers for years!

The only difference between California politicians and the Roman Empire that the Romans would have first attempted to poison or knife their opponents.

Jerry Brown, Gavin Newsom and the rest of the thug Democrats consider the ballot measure a threat to “their democracy!”

The Orwellian saying “save our democracy” is correctly translated into common English as “save our totalitarian regime”.

Get out of California.

“We must prevent the voters from interfering with ‘Our Democracy.'”