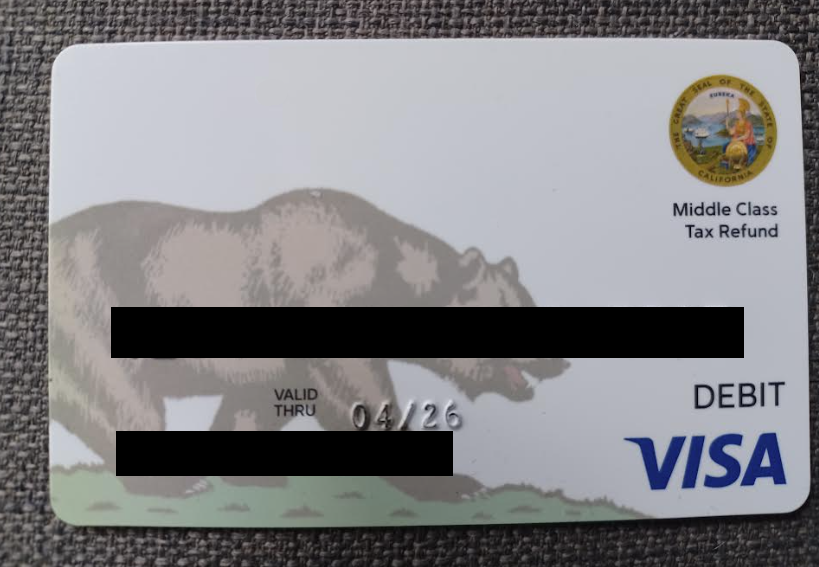

California Franchise Tax Board (Photo: FTB.CA.Gov)

Franchise Tax Board To Take Back $360 Million In Unclaimed Middle Class Tax Refund Money Next Week

Californians have until the end of the month to claim funds.

By Evan Symon, May 25, 2024 2:55 am

The California Franchise Tax Board (FTB) prepared for over $360 million dollars to be reverted back to the State General Fund from the Better For Families Tax Refund Fund this week as much of the Middle Class Tax Refund money sent to Californians in late 2022 and early 2023 has gone unspent.

High inflation, as well as linger effects of COVID-19, caused the state to roll out another statewide relief program. Unlike the previous Golden State Stimulus program the year prior which sent payments largely by check, the Middle Class Tax Refund aimed at either direct deposits or through a debit card. In June 2022, a $17 billion package was agreed to. According to the agreed-upon package, those making up to $75,000 a year, or joint filers who make up to $150,000, would get $350 each. Those who make up to $125,000 a year, or joint filers making up to $250,000, would get $250 each. Those who make up to $250,000 a year, or $500,000 filing jointly, get $200 each. One dependent could also be added at each tier for the same amount as each filer, meaning that Californians would see as much $1,050, $750, or $600 coming in per household depending on tier level.

This package, later renamed the Middle Class Tax Refund, was refined by the FTB. According to the FTB, those who filed taxes electronically and received a direct deposit refund would receive a relief check direct deposit. But, for everyone else, they were to get a debit card, including those who filed a paper tax return in 2020, those who received a 2020 tax refund by check, those who received their 2020 tax refund by direct deposit, but have since changed banks or account numbers, those who received a tax refund by check regardless of filing method, those who received an advance payment from a tax service provider, or paid their tax preparer fees using their 2020 tax refund, and those who received a Golden State Stimulus payment by check.

Payments subsequently went out in late 2022 and early 2023. Those receiving cards saw an expiration of funds occurring sometime in 2026. The exact month was when the card was issued, with the card making note of the expirations date like a regular debit or credit card:

However, around $360 million has gone completely unclaimed, with many Californians not receiving a card or direct deposit for a variety of reasons. While the FTB has a website for Californians to check to see if they are due any money, the FTB has not exactly sent out notices either. Thus, the state of California is due to receive that money on the June 1st deadline, only a week away. While there is a larger amount of unspent debit card funds in a separate account, the state cannot get those funds until late 2026 after all cards expire.

“Despite everything, the Middle Class Tax Refund missed a lot of people,” explained former lobbyist Harry Schultz to the Globe on Friday. “First you have $360 million going back to the state next month. It won’t exactly make a dent in the $73 billion deficit the state has, and that money would have been better spent by people in the economy.”

“Then you have the unspent debit funds. No exact number has been given out on that, but it is probably going to be larger based on the fact of how many went out. Again, not that big of an effect on the budget overall, but we’ll see where the budget is in 2026 during Newsom’s last year in office.”

“The FTB is really just operating normally, taking back money by the end date. They are just doing their job on that front. But they should have also done a better job making sure everyone got their due funds as well. A lot of people didn’t even want the refund program. Money Network, which did the cards, did prove themselves and actually replaced Bank of America for things like EDD payments after that whole billions in fraud fiasco. So some good came out of it.”

“But that doesn’t make up for the state taking back $360 million on June 1st, and who knows how much in 2026. If there is any Californian who was in state in the 2020 tax year, look up to see if you are owed money now. Especially if you didn’t get this stimulus.”

The FTB is to shift funds to the General Fund on June 1, 2024.

The “lord” giveth, and the “lord” taketh away.