Senator Scott Wilk. (Photo: Kevin Sanders for California Globe)

Bill to Make Wildfire Settlements Exempt From State Income Tax Approved By Senate

SB 1004 would cover all wildfire settlements for fires between 2020 and 2034

By Evan Symon, May 25, 2024 2:45 am

A bill to make all wildfire settlement payments tax free was approved by the Senate on Thursday, moving the bill to the Assembly.

Senate Bill 1004, authored by Senator Scott Wilk (R-Santa Clarita), would specifically, for all taxable years beginning on or after January 1, 2020, and before January 1, 2034, provide an exclusion from gross income for any qualified taxpayer for amounts received for costs and losses associated with wildfires.

Senator Wilk originally wrote the bill back in February as a way to help wildfire victims retain all settlement money to help better build their lives back up. While a previous bill in 2022, SB 1246, also exempted wildfire victims from state income taxes on wildfire settlements, it only covered the 2017 Thomas Fire and the 2018 Woolsey Fire, leaving all others not covered. Wilk was especially incensed to create this bill as the 2020 Bobcat Fire, which burned over 115,000 acres and destroyed homes in Juniper Hills in his district, left many there struggling to get back on their feet partially because of the state income tax taking a chunk of their settlement money away.

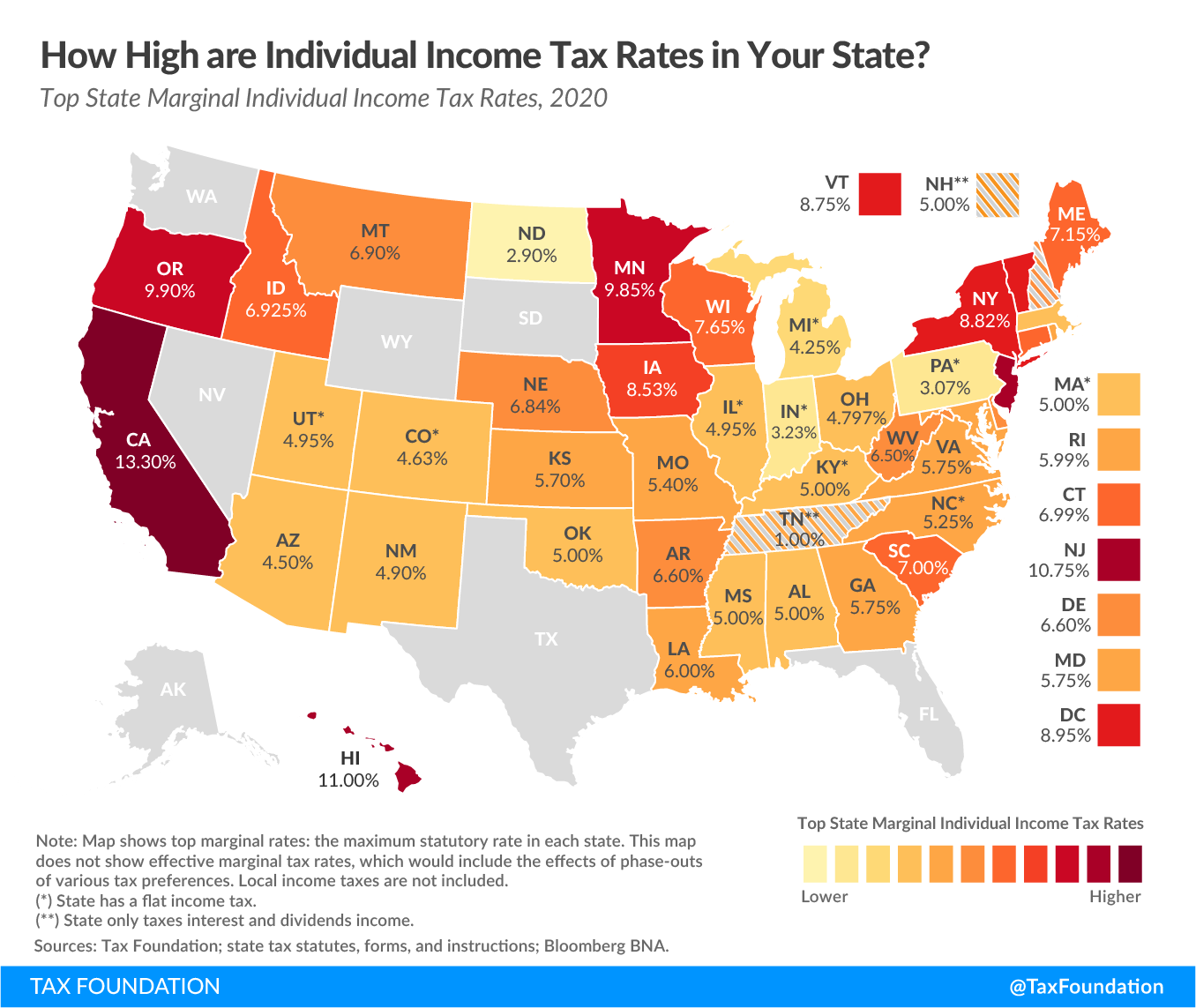

As single filer Californians face paying 6% income tax if they make around $50,000 a year, 9.3% if they make over $100,000 a year and 11.3% if they make over $500,000 a year, paying such a large percentage can be daunting, especially if they are looking to buy a new home or rebuild. For joint filers, paying the income tax on a settlement can prove hard as well, as 6% is taxed for $100,000 joint income, 9.3% is taxed for above $500,000, and 11.3% is taxed for over $1,000,000.

“When you’ve lost everything, the last thing you need is a tax hit on the settlement money meant to help restart your life,” said Senator Wilk earlier this year. “The legislature has already decided that certain wildfire settlements shouldn’t be taxed. So instead of cherry picking who gets a break, this bill makes it standard across the board. I feel deeply for those who lost their homes, memories, and livelihoods to wildfire. My goal with this bill is to ensure that they have one less thing to worry about, so they can focus on rebuilding and move forward.”

While Democratic legislators are usually opposed to such a tax exemption, Senators found no fault in SB 1004 as it meant that wildfire victims from any class would have all the more funds to find someplace to live. SB 1004 unanimously passed both of the Senate committees it went through, easily survived Suspense Day last week and, on Thursday, passed the Senate in a 37-0 vote. Only 3 Senators, all Democrats, abstained from voting.

Very pleased to announce SB 1004 is on its way to the Assembly! Wildfire victims, who have lost everything through no fault of their own, deserve every cent of any settlements they may receive. 1/ pic.twitter.com/FTo7uuDHMQ

— Scott Wilk (@ScottWilkCA) May 24, 2024

“Wildfire victims, who have lost everything through no fault of their own, deserve every cent of any settlements they may receive. The legislature already recognizes this, and has granted tax-free status to numerous wildfire settlements,” said Senator Wilk in a statement on Thursday. “This bill creates consistency and will help alleviate an unnecessary burden on those working to rebuild their lives. Unfortunately, any settlements my constituents may receive will not be tax free because the Bobcat Fire was not included in past legislative efforts. SB 1004 would ensure that they, and all California wildfire victims, get the same treatment.”

Wildfire victims and victim groups also applauded the bill moving forward, saying that the bill would help Californians going well into the 2030s.

“The income tax really did hurt us when the settlement came in,” explained Burt Taylor, who lost his home to a wildfire in 2018. “This bill rectifies that. It’s too late for me, but it gives a 14 year window, going back to 2020 and forward to 2034, for the exemptions. You cannot believe how much an extra $10, $20 grand can help out. With insurance companies leaving a lot of homeowners high and dry nowadays because of wildfire risk in their area, and living costs out of control, it’s good to see some compassion coming from Sacramento. Even a little bit means a lot for us.”

SB 1004 is to be heard next in the Assembly.

Is the interest earned on the settlement amount also tax free or does it depend on the property value?