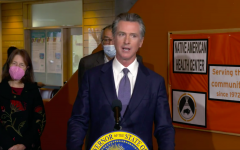

Governor Gavin Newsom signs paid sick leave extension and COVID relief for small businesses on February 9, 2022. (Photo: gov.ca.gov)

Gov. Newsom Signs Paid COVID-19 Sick Leave, $6.1 Billion in Small Business Relief Bills

‘It could force businesses to bring in temps, and that costs additional money too’

By Evan Symon, February 9, 2022 4:36 pm

Governor Gavin Newsom signed two bills into law while in Oakland on Wednesday, both bringing back COVID-19 paid sick leave through September and $6.1 billion in tax credits to small businesses.

One of the bills, Senate Bill 114, which was introduced by the Committee on Budget and Fiscal Review, will mirror last year’s SB 95 and allow all workers at businesses with 26 or more employees to have another 80 hours, or two standard working weeks, of paid sick time off. Like SB 95, SB 114 would retroactively extend from January 1st to September 30th, only this time in 2022.

Business interest changes in SB 114 will only allow 3 days, or 24 work hours, to attend a vaccine appointment or recover from COVID-19 side effects, with employers only needing to give 40 hours of paid leave for COVID without question, with the other 40 hours requiring a positive COVID test. In addition, part-time workers will go from receiving two weeks to getting an equivalent amount based on the number of hours worked each week.

The other bill, Senate Bill 113, also introduced by the introduced by the Committee on Budget and Fiscal Review, will provide $6.1 billion in relief to businesses hit hard by the pandemic. $500 million will go towards tax cuts for restaurants and other venues by changing state tax policy more in line with the federal Restaurant Revitalization Fund and Shuttered Venue Operators grant programs. As both grants are not considered taxable, the taxed savings will go directly to businesses.

The largest chunk of SB 113 is the restoration of $5.5 billion in tax credits and deductions. Finally $150 million will be put into COVID-19 relief grants for small businesses through the Small Business COVID-19 Relief Grant Program, which gives up to $25,000 in grants per affected business.

At the signing in NIDO’s BackYard in Oakland on Wednesday, Governor Newsom noted that the bills support both workers and businesses alike.

“As California continues to lead the nation’s economic recovery, today’s action deepens our commitment to supporting the workers and businesses that have sustained us all during this unprecedented pandemic and are driving our economy,” explained Governor Newsom. “We’re ensuring that workers have the time they need to take care of themselves and their loved ones, expanding our nation-leading small business relief grant program and supporting the businesses whose innovation and entrepreneurial spirit help make California the 5th largest economy in the world.”

Newsom signs two bills in Oakland

Both labor and business leaders praised the signing on Wednesday, with many happy at least one of the bills was signed into law by the Governor.

“Paid sick leave is key to ensuring workers don’t have to make the impossible choice between going to work sick or losing wages needed to pay rent and keep food on the table,” said California Labor Federation Executive Secretary-Treasurer Art Pulaski. “By signing COVID paid sick leave into law today, Gov. Newsom provided critical protection to frontline workers and families across the state, and underscored California’s commitment to the essential workers that have given so much to help our communities weather this devastating pandemic.”

California Chamber of Commerce CEO Jennifer Barrera, meanwhile, voiced support for the passage of SB 113, saying, “This business relief package of more than $6 billion will help to offset losses employers have incurred, help create good paying jobs, and will speed up our economic recovery from the pandemic. While we have more work to do, this sends the right message that California is investing in the success of our business community.”

Business experts noted on Wednesday that the two bills are actually working in tandem, with SB 113 and new business concessions in SB 114 off setting the fact that many businesses will now have to automatically give employees an additional two days off.

“I don’t know who calculated it all, but even with a bunch of grants and tax cuts, employees just being given straight paid time off still leads to a loss,” explained Lincoln Taylor, a payroll advisor for multiple small businesses in California, to the Globe on Wednesday. “Because it isn’t just about the pay. We’re talking about the work itself. With even one less person, less work gets done overall. In a retail business, that’s one less person at the register, one less person stocking shelves, one less person helping customers. With out them, fewer people are helped and less product makes the floor in time. So that generates lost sales.”

“It could also force businesses to bring in temps, and that costs additional money too. Or you force employees to double up on duties, which can leave them exhausted. And during the Great Resignation happening now, that can bring less job satisfaction and cause them to leave. Every action has consequences, and the legislature and Governor failed to see the big picture and simply threw money at it and assume everything will work itself out. That isn’t how labor works in the real world. Businesses were hurt a lot by SB 95 last year, and it’s going to now happen again, with or without those added incentives and grants.”

Following the signing on Wednesday, California became the fourth state this year to require COVID-19 paid time off, joining Colorado, Massachusetts and New York.

- Oracle Moving Headquarters Out Of Austin Only 4 Years After Moving Out Of California - April 26, 2024

- Congressman Adam Schiff Robbed of his Luggage in San Francisco Car Break In - April 26, 2024

- U.S. Senate Candidate Steve Garvey Denounces Protestors On Campuses Across California, Nation - April 25, 2024

Gruesome learned a big lesson from the recall: Start the vote-buying as early as possible.

That should REALLY tick you off.

More proof that California and Colorado are dysfunctional legislative twin-cesspools….

Welcome to being #50 in terms of business-friendliness for yet ANOTHER year…