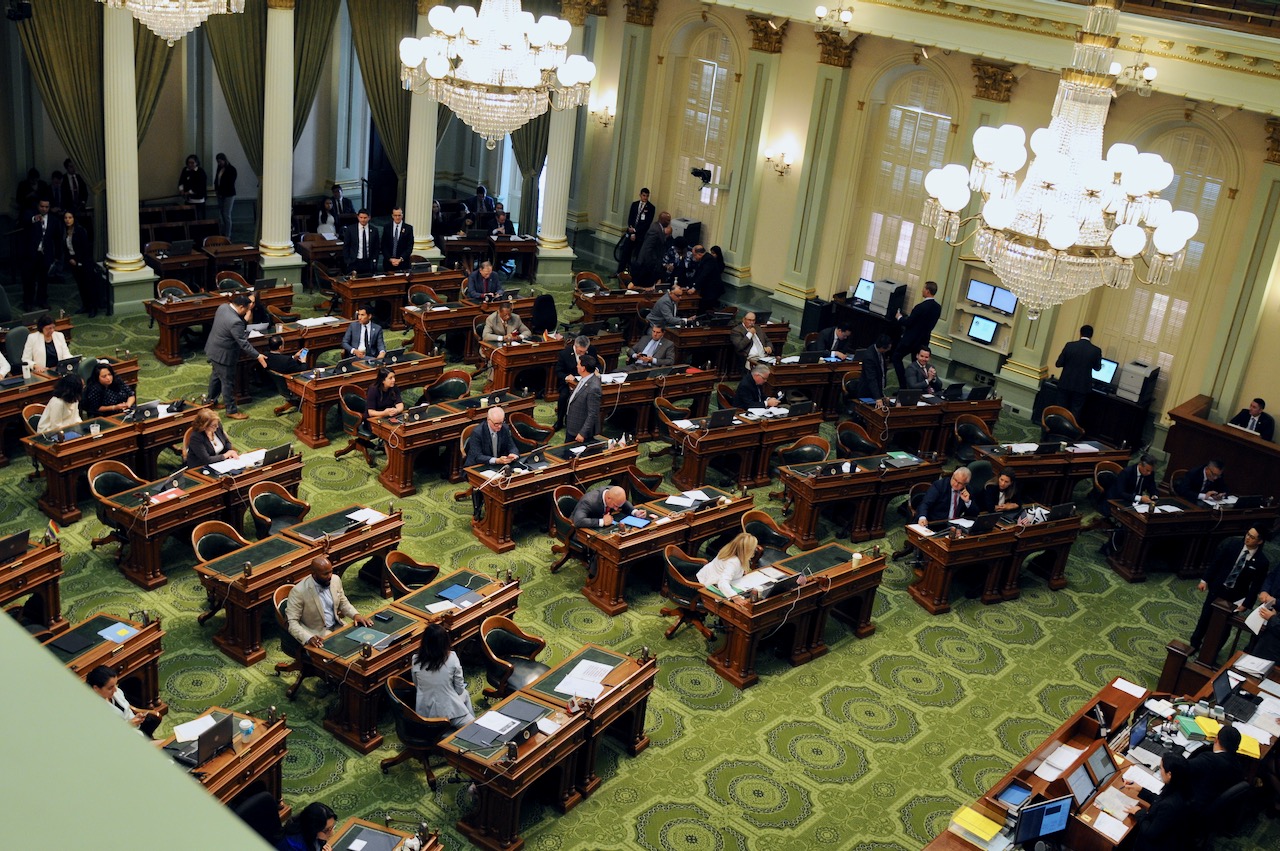

California State Capitol. (Photo: Kevin Sanders for California Globe)

Reports and Statements Required for Withholding Wage Taxes

California’s Unemployment Insurance Code concerns reports, returns, and statements

By Chris Micheli, September 18, 2024 2:30 am

California’s Unemployment Insurance Code, in Division 6, Chapter 4, concerns reports, returns, and statements. Section 13050 provides that every employer or person required to deduct and withhold from an employee a tax, or who would have been required to deduct and withhold a tax if the employee had claimed no more than one withholding exemption, is required to furnish to each employee on or before January 31 of the succeeding year, a written statement showing seven required items. The statement must contain other information, and be in a form, as the department may by authorized regulations prescribe.

In addition, if any person makes a payment of third-party sick pay to an employee, that person is required, on or before January 15 of the succeeding year, furnish a written statement to the employer in respect of whom the payment was made showing three specified items. The Franchise Tax Board is allowed access to the information filed with the department pursuant to this section.

Section 13052 specifies that any person or employer required to furnish a statement to an employee who furnishes a false or fraudulent statement, or who fails to furnish a statement in the manner, at the time, must for each such failure, unless due to reasonable cause, pay a penalty of $50.

Section 13052.5 states that, in addition to the penalty imposed by the Revenue and Taxation Code (relating to failure to file information returns), if any person, or entity fails to report amounts paid as remuneration for personal services as required on the date prescribed, that person or entity may be liable for a penalty. The penalty imposes is assessed against the person or entity required to file a return.

Section 13055 provides that every employee who, in the course of his or her employment by an employer, receives in any calendar month tips which are wages must report all tips in one or more written statements furnished to his or her employer on or before the 10th day following such month.

Section 13056 specifies that, when required by authorized regulations prescribed by the department, any person or employer required under the authority of this division to make a return, report, statement, or other document must include in the return, report, statement, or other document the identifying number as may be prescribed for securing proper identification of the person.

Section 13057 states that, if any person who is required by regulations to provide a required identifying number fails without good cause to comply with that requirement at the time prescribed by the regulations, the person is required to pay a penalty of $5 for each failure to specify four items of required data.

Section 13058 provides that any return, report, statement, or other document required to be made, or be verified by, a written declaration that it is made under the penalty of perjury. The department is required to prepare blank forms for the returns, reports, declarations, statements, or other documents and must distribute them throughout the state and furnish them upon application.

Section 13059 states that, if the Governor declares a state of emergency, the director may extend the time requirements for filing returns, reports, and statements required by this chapter. The extension granted by the director pursuant to this section can only apply to employers prevented by the conditions giving rise to the state of emergency from timely filing their returns, reports, and statements of wages or timely payment of the taxes due.

- A Different Type of Legislative Statement? - December 12, 2024

- Service of Summons in California Civil Actions - December 11, 2024

- Sunset Clause Versus Repeal Clause - December 10, 2024