Assembly Constitutional Amendment 1 to Weaken Prop. 13 Fails to Pass Assembly

California’s Democrat supermajority decries two-thirds voter threshold as ‘ undemocratic supermajority’

By Katy Grimes, August 20, 2019 2:05 am

“While all voters are able to vote on this debt, only property owners pay it.”

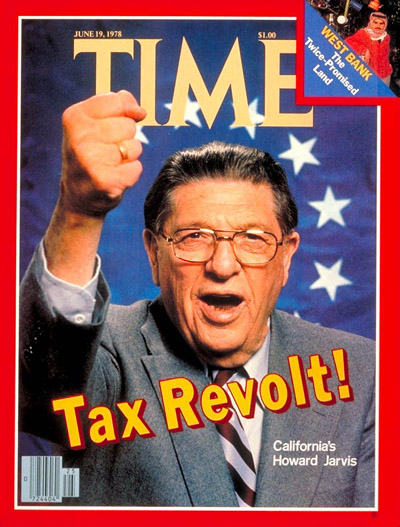

One of the only remaining taxpayer protections left in California is Proposition 13, a landmark 1978 decision by California’s voters to limit property taxes. But opponents of Prop. 13 would like to split the measure, exempting commercial property from the tax limitations. They claim the additional revenue will be used to fund public infrastructure, homelessness, and subsidized housing.

Under the proposed initiative, county assessors would split their tax rolls into individually-owned residential properties, and commercial properties. This is being sold to voters as extracting more taxes from “corporations.”

To do this, the Legislature needs to pass ACA 1 by Assemblywoman Cecilia Aguiar-Curry (D—Yolo County), a proposal to amend the California Constitution, via approval of a ballot initiative by voters, to weaken Prop. 13’s taxpayer protections by lowering the voter approval threshold for local tax increases from two-thirds to 55 percent. This would allow a city, county, or special district, with 55 percent voter approval, to incur bonded indebtedness or impose specified special taxes to fund projects for affordable housing, permanent supportive housing, or public infrastructure, bill analysis states.

“ACA 1 also lowers the vote threshold from two-thirds to 55% to approve bonds, as has already been done for local school bonds (by Proposition 39 in 2000),” the Howard Jarvis Taxpayers Association explains. “While all voters are able to vote on this debt, only property owners pay it. Lowering the threshold for local school bonds has added billions of dollars of new debt on property tax bills since 2000. Considering that this debt is often on property tax bills for at least 30 years, maintaining a higher voter approval threshold is crucial to protecting current and future taxpayers.”

ACA 1 Floor Debate

During floor debate in the Assembly Monday, Assemblyman Jay Obernolte (R-Big Bear Lake) noted, “California doesn’t have a revenue problem, California has a revenue allocation problem.” Obernolte, questioning why the voter threshold needs to be lowered, said 80 percent of the bonds on ballots across the state passed last election.

Several Assembly Democrats ironically called the two-thirds voter requirement a “supermajority.”

Assemblyman Rob Bonta (D-Oakland), a member of the Democrat supermajority, said the requirement of a “two-thirds super majority is undemocratic.”

“Something is wrong with this country when Donald Trump can get elected with 46 percent of the vote but California can’t get something built with 58 percent,” Assemblyman Todd Gloria (D-San Diego) said referencing to a San Diego bond that failed to pass with only 58 percent of the vote.

Assemblywoman Lorena Gonzalez (D-San Diego) called the two-thirds voter threshold requirement “outdated.”

Assemblyman Ken Cooley (D-Sacramento) said he opposes ACA 1, and encourages “an engaged community” to have to debate issues as important as tax and bond increases. “This is an example of Democracy.”

“As you reduce the voter threshold, you reduce the accountability,” Assemblyman Jim Patterson (R-Fresno) said. Patterson, the former Fresno Mayor, said the higher threshold requires the proponents to be specific with voters about the promises and commitment.

What is Proposition 13?

Proposition 13 was a landmark decision by California’s voters to limit property taxes. Prop. 13 was passed by voters in 1978 because as property values rose rapidly through the 1970s, property taxes also skyrocketed, driving many families and retired couples out of their longtime homes.

Prop. 13 was so effective when it was passed, within two years, 43 states implemented some kind of property-tax limitation or relief, 15 states lowered their income-tax rates, and 10 states indexed their state income taxes for inflation, the Hoover Institute reported.

Prop. 13 stabilized the flow of property tax revenue to local government. It has served as a conduit to stop the volatility of market values from affecting the flow of property tax revenues to cities.

With passage of Prop. 13, property tax increases were limited to no more than 2 percent per year as long as the property was not sold. Once the property is sold, it is reassessed at 1 percent of the sale price, and the 2 percent yearly cap becomes applicable to future years, allowing property owners to be able to estimate the amount of future property taxes.

Yet opponents of tax limits continually say publicly that big corporations get away without paying their “fair share” of property taxes. It’s a common theme in California politics.

However, if the “split roll” is passed by voters, this would tax commercial and industrial properties at market value, rather than when the property is reassessed because of a sale. It’s already a constant challenge for commercial property owners because counties annually attempt to reassess a property’s value without a sale occurring, forcing property owners to appeal the tax amount. And counties are not justifying or quantifying the increase in commercial property values forcing owners to appeal.

While commercial and industrial property owners’ tax rates wouldn’t change, beginning in 2022 the levy would be based on the current market value of the real estate. Business property values would have to be updated by county assessors at least every three years.

“ACA 1 reinforces the false idea that every problem can be solved with more government spending,” said Assemblyman Kevin Kiley (R-Rocklin). “Today’s vote was a win for California taxpayers and families.”

“This was a victory for taxpayers struggling to afford life in California, but the fight isn’t over,” said Assemblyman Tom Lackey (R-Palmdale). “The middle class is being driven out of our state because of the high cost of living. I’ll continue to oppose legislation like ACA 1 that will make the affordability crisis even worse.”

“ACA 1 also does nothing to address California’s affordable housing crisis,” HJTA said. “Right now, one-third of renters spend half of their take-home pay on rent, only 30 percent of Californians can afford a median-priced home, and only 53 percent of Californians are homeowners statewide, well below the national average. Adding hundreds of dollars a year to individual property tax bills won’t make home ownership more affordable.”

This Assembly vote rejecting this Prop 13 bogus reform is great news! But don’t think this is over. Not by a long shot!

For one thing, the Assembly DID pass the measure with a 2/3 vote — 73%, actually (46 to 17). See the voting tally graphic.

But 16 of the elected Assembly members did not cast a vote. They either abstained, or were not present to vote. Hence the vote fell short of the 2/3 requirement — in this case 53 votes were necessary for passage. So the measure fell only six vote short of passing.

More important, this vote was REALLY about saving the state’s public employee labor unions $3 million. That’s roughly the cost the unions will have to pay to get this initiative on the 2020 ballot via the signature process.

$3 million is CHUMP CHANGE for our all-powerful labor unions, who annually spend well over $100 million on CA elections and political lobbying. IF the unions want it on the ballot, it will happen. it will be a decision based solely on the LIKELIHOOD of the prop passing — a political calculation that has nothing to do with “need.”

For the legislature, this vote gives those state lawmakers in the remaining competitive districts “plausible deniability” in that they didn’t vote for this multi-billion dollar tax increase. For instance, Brian Maienschein (my local rep) is in a somewhat competitive district. In 2019 he switched his party affiliation from GOP to Democrat, as the district’s voter registration changed. He waited until after he was reelected in 2018 as a Republican before announcing his switch (he callously noted the leftward drift of voter preferences). But he is savvy enough to know an anti-Prop 13 vote would make his political future in this area less certain. So he wisely abstained. It’s easy to do when you have no principles to contend with.

But I digress.

Keep your powder dry. They’ll be back.

Thank god this BS did not pass! Protect Prop 13 and keep the state from sucking all the money out of hardworking people’s pockets. Less taxes is better.

We do not have free daycare, healthcare or schools to show for the unbelievable amount of property taxes already collected in Cali. Public schools beg every household to donate each year because they do not receive enough funding? So, where does the money go???? Wake up. Vote.

The extra money will not do anything to further help the homeless problem, only create more homeless as California is already full of scam taxes and it works completely against keeping families in their homes.

Think about it.