Cal Pension Systems are Headed to BK but Not Due to C-19 Losses?

Budget crisis could have been avoided if Gov. Newsom had pursued a triage virus health policy instead of martial law and business shutdowns

By Wayne Lusvardi, May 11, 2020 6:35 am

‘In 1999, most government pension plans were 100% funded. With a 50% increase in liabilities, they instantly became two-thirds funded. And, for the last 20 years they are still two-thirds funded!’ – Sen. John Moorlach

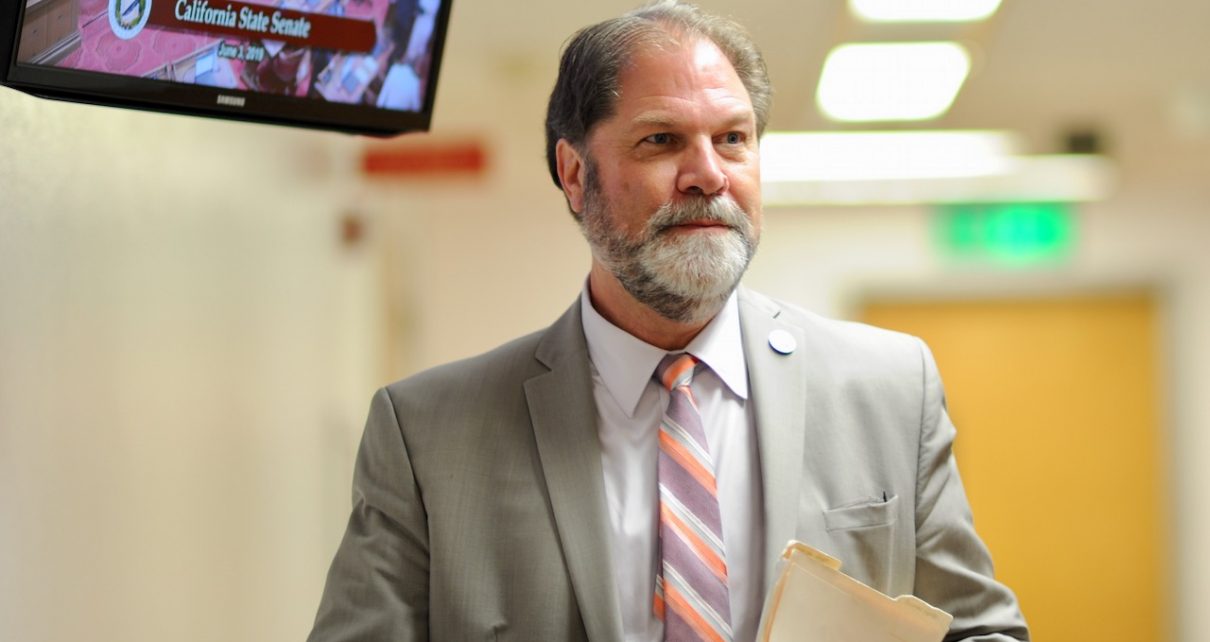

State Senator John Moorlach (R-Costa Mesa) knows a lot about municipal budgeting. While campaigning for Orange County Tax Collector-Treasurer in 1994, he accurately predicted the largest municipal bond loss and bankruptcy in history. Moorlach recently wrote in the Bond Buyer: “Put California Pensions on a Ventilator”, alluding to the use of mechanical ventilators to assist patients with life-threatening coronavirus to breathe.

Moorlach describes the current situation created by Gov. Newsom’s economic shutdown policies in response to the coronavirus outbreak:

“The coronavirus has massively impacted the necessary revenues our cities are relying on to meet their already stretched budgets. Anaheim is losing some $500,000 per day as their hotels and Disneyland are closed. Costa Mesa is likely to be losing massive sums in sales tax revenues as South Coast Plaza sits empty and car sales have dissipated.”

Moorlach is skeptical that budget reductions, issuing pension bonds that double the true pension costs to taxpayers, huge spikes in sales taxes, increased commercial property taxes by a split-roll property tax or more ballot initiatives will prevent eventual Chapter 9 municipal bankruptcies.

But Moorlach says the current self-created state and local government budget crisis only worsens the underfunded public pension system that goes back to 1999 when California government pensions were increased by 50 percent:

“In 1999, most government pension plans were 100% funded. With a 50% increase in liabilities, they instantly became two-thirds funded. And, for the last 20 years they are still two-thirds funded!”

State Pension System is a “Scam” – Moorlach

Moorlach believes that the state pension system is a Ponzi-like “scam” as it is currently structured and points to the state of Wisconsin, which has a 100 percent pension system, as a model.

A double check of Moorlach’s forecast of pension system and municipal bankruptcies by this writer indicates that Moorlach is right. Cal-PERS’ huge investment fund has only kept up with money inflation in the 20 years since SB 400 was signed by then Governor Gray Davis.

The online US Bureau of Labor Statistics Inflation Calculator indicates that a dollar has inflated to $1.57 (by 57 percent) over that same time period. Pension benefits went up by 50 percent but pension fund levels have only gone up 7 percent after adjusting for inflation. There has been little-to-no investment magic gained by Cal-PERS to grow state and local pension funding beyond the actual contributions by taxpayers.

In comparison, the Compound Annual Growth Rate in the Standard and Poors 500 stock index from 1999 to 2019 is $2.48 adjusted for inflation and including stock dividends (+148 percent). This means that stocks have outgained the Cal-PERS investment fund by 91 percent (148% – 57% = 91%).

Current Cal-PERS asset allocations are 50 percent stocks, 28 percent bonds, 15 percent factor-weighted stocks (aka index funds), 13 percent real estate, 8 percent private stocks and 1 percent cash.

State Budget Reserves May Cover Losses?

Likewise, Gov. Newsom announced a $54.3 billion budget deficit reportedly due to shutting the state down over the coronavirus public health crisis. The State Legislative Analyst’s Office, however, forecasts a more modest deficit of $18 to $31 billion through 2022. California has $16 billion in reserves. Thus, it is conceivable California could absorb its losses with reserves and modest budget reductions. But this will do nothing to alleviate the coming shock wave of underfunded pension systems. State and federal elected representatives are seeking a federal bailout for these self-caused budget reductions including its pension systems.

The cause of these enormous budget reductions is being mostly blamed on tax revenue losses from hotels, businesses and tourism as a result of ironically self-imposed coronavirus restrictions. Arguably, these budget reductions could have been avoided if Gov. Newsom had pursued a triage virus epidemic public health policy instead of martial law and business shutdowns. But the reality behind the coronavirus headlines is that gold-plated pension benefits have hit the wall. The coronavirus crisis only serves as a cover for bloated pension programs, which remain untouchable unless forced into bankruptcy.

- Peter Gleick’s National Water Plan for California - October 12, 2020

- Court Opens Up Big Prop.13 Loophole for ‘Public Franchise Fees’ - October 2, 2020

- New Cal Grid CEO is Ex-Enron Green Power Trader - September 29, 2020

For all Safety workers and many other CA Public Sector workers, their DB pension are 5 to 10 TIMES greater in VALUE (and hence COST) than the retirement security that Private Sector workers typically get (almost always via 401k DC Plans) in retirement security contributions from their employers.

And if that were not sufficiently outrageous, while it’s very rare to get employer-sponsored retiree healthcare benefits in the Private Sector today, EVERYONE get it …… with Taxpayers paying for a large share of the cost ….. in the Public Sector.

Boy, have we (Private Sector Taxpayers) been treated as suckers to be financially abused.

And just imagine, most of these people make well above their basic salary, they get to combine all of their overtime, vacation time, and sick time. And that’s how they base their retirement.

So many are receiving 20 and 30% more than their base pay, and it’s amazing that most safety personne. Retire on disability so there’s no state or federal tax taken out of it

Safety worker disability pensions are one of the worst abuses of Taxpayers because is WAY WAY WAY too easy to be approved for a disability pension. One transit cop in NYC is retired on a disability pension for stapling her trigger finger.

As to inclusion of overtime, vacation time, and sick time in “pensionable compensation” in CA, CalPERS-administered Plans do NOT allow that while some non-CalPERS County Plans do.

Please don’t put out information, with out attaching the facts. It is not a solution to the problem at hand.

“Thank You Sir May I Have Another” comes to mind.

I have to wonder why we in the private sector are still here in California paying for such abuse!

I have one foot out the door, but I was born into this one lovely beautiful state but how much abuse can one take?

Could it be I am a masochist? ????

Be careful where you move to. According to the Institute on Taxation and Economic Policy, if you are middle-income ($39k-62k) in California, your total state plus local tax burden is below the national average.

If you are in the top 1 percent (over $714k), your state taxes are among the highest. But you can afford it. Congratulations.

I’d heed the warning, if Mr. Lusvardi is saying it. Judging from past experience, while working along his side the man understands the issue. All the beat Wayne.

” With a 50% increase in liabilities, they instantly became two-thirds funded. And, for the last 20 years they are still two-thirds funded!”

I don’t think so, Tim.

SB400 changed the typical safety formula from 2%@50 to 3%@50. That is not a 50% increase. (Except for those who actually retired at age 50.) The 2%@50 “formula” incrementally increased to 2.7%@55, and the average retirement age for safety workers is 54 or higher.

Most non safety workers received a pension increase of about 3-4 percent.

‘And, for the last 20 years they are still two-thirds funded!’ – Sen. John Moorlach

Actually the funding had returned to 100 percent by 2007, when it was hit again by the 2008 crash and the “greatest recession. ”

And as of 2013, all new employee pensions, safety or miscellaneous, have been reduced to below 1999 levels.

Stephen you should look up the numbers before you state incorrect information which you do again and again.

The previous formulas for Safety employees were 1.426, 1.52 and 1.628 per year of service for people who retired ages 50, 51, and 52 respectively. After the retroactive increase they all went to 3% meaning they were increased by 110%, 97% and 84% respectively. And if you look at the average retirement age for Safety people it is around 52.

That’s the 2%@55 formula. Who had that? Nobody I know.

Y’all can argue about the average retirement age till the cows come home. I recall several sources saying 54*. Generally speaking it’s higher for local LEO than for CHP, also higher for firefighters than for police. And increasing for most in the years since 2008.

And there are a number of different formulas throughout California for safety or miscellaneous employees, one can only speak in generalities, but one can safely say that a “fifty percent increase” overall is a blatant bulls hit talking point.

* https://www.latimes.com/projects/la-me-pension-crisis-davis-deal/

It’s funny how people who don’t work for the state and/or have a CalPers pension think they know more about the actual terms/benefits than the people who do… Smh If the pension is so good why don’t you get a govt job? Oh yeah, cuz you would make about 10-15% less than you do in the private sector. Just like everything in life, there are tradeoffs.

lol ………… SMH is a retired CA employee, and supporting everything “Union” for years on this and other Blogs.

Your Dad Chris H,

In SOME Public Sector jobs, “Base wages” are less than what is paid in the Private Sector, but when you add in the VERY VERY rich pension and VERY VERY generous benefits (BOTH while active AND retried), the Public Sector worker’s Total Compensation package is (with very few exceptions) MATERIALLY greater than that of comparable Private Sector workers.

” lol ………… SMH”

Is an Internet acronym for Shaking My Head.

Stephen Douglas, OTOH, is a retired California state worker and skeptic who uses his spare time to fact check exaggerated, misleading, and outright false claims on so-called “pension reform”.

Por ejemplo…

1. “In 1999, most government pension plans were 100% funded. With a 50% increase in liabilities, they instantly became two-thirds funded. …”

2. “… the Public Sector worker’s Total Compensation package is (with very few exceptions) MATERIALLY greater than that of comparable Private Sector workers.”

a. The 50% increase in California pensions never happened. And if John Moorlach is not aware of that, he should educate himself.

b. MATERIALLY greater (with very few exceptions) than that of comparable Private Sector workers…. is false, and Tough Love is aware of that.

—————————

” Moorlach believes that the state pension system is a Ponzi-like “scam” as it is currently structured and points to the state of Wisconsin, which has a 100 percent pension system, as a model.”

Or point to New York State, which is also 100 percent funded and has among the most generous pay and pensions in the nation.