Soda Consumption is Not Declining in Berkeley, Despite Hefty Tax

Berkeley’s soda tax ‘should be self-defeating’

By Katy Grimes, April 3, 2019 2:15 am

State lawmakers have introduced a package of bills, seeking a statewide tax on sodas, to target soda and sugary beverages they claim contribute to diabetes, obesity and other health conditions. Assemblyman David Chiu (D-San Francisco) has authored a bill prohibiting selling soda in cups larger than 16 ounces. Assemblywoman Buffy Wicks (D-Oakland) wants displaying sugary drinks at checkout areas prohibited. Assemblyman Rob Bonta (D-Oakland), has a bill to prohibit soda manufacturer discount coupons. Assemblyman Richard Bloom (D-Santa Monica) would impose a fee on sodas. Bloom has proposed two previous bills to impose a fee on sodas, “to help offset the cost to the healthcare system of sugar-related problems, including an increase in diabetes among young people.”

Berkeley and Albany, CA already implemented soda taxes, and while the tax may be generating revenue, soda consumption is not declining.

Michael Barnes, a member of the Albany City Council since 2012, recently analyzed a report from UC Berkeley, on the Sugar-Sweetened Beverage Consumption 3 Years After the Berkeley, California, Sugar-Sweetened Beverage Tax, which concluded, “Reductions in SSB consumption were sustained in demographically diverse Berkeley neighborhoods over the first 3 years of an SSB tax.”

Berkeleyside.com reported the results in a headline which read, “Sugary drink consumption in Berkeley down more than 50% since introduction of soda tax.”

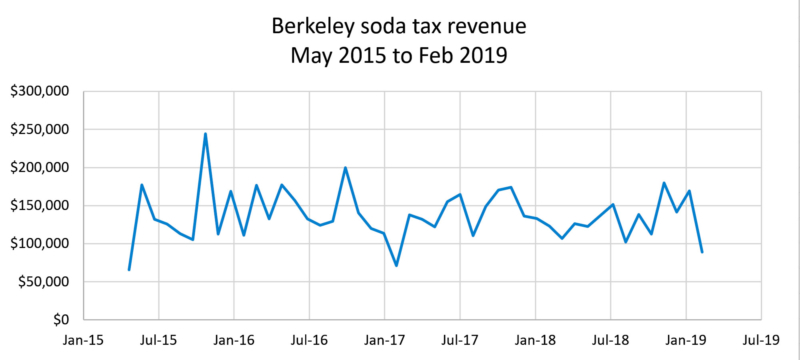

Barnes took umbrage with the report and said, “There is an alternative set of data that, while still imperfect, are far more objective — the history of soda tax revenue in Berkeley. This data tells a very different story. Here is a graph of the Berkeley soda tax revenue:”

The crux of Barnes’ analysis is this: “A quirky feature of Berkeley’s soda tax is that it should be self-defeating. If it leads to lower soda consumption, the tax revenue should decline. So far in Berkeley there is no evidence that is happening. Soda tax revenue, which reflects soda consumption, fluctuates month-to-month, but does not have an obvious downward trend.”

Barnes explains that “there are several confounding factors that could complicate these numbers. First, soda sales nationally have been declining for years. This could lead to a downward trend Berkeley’s soda tax revenues that has nothing to do with Berkeley’s soda tax. Over time, Berkeley residents could shift their soda purchases to Costco outlets or other stores that don’t charge the soda tax.”

Barnes notes “based on self-reported results that relied on the memory of the surveyed subjects. The study did not interview the same residents over time, nor was it based on any diaries of food and drink consumption. ”

Barnes summed it up:

“Perversely enough, the Berkeley and Albany soda taxes are a win-win-win. Cities get more revenue, voters get to feel satisfied they did the right thing, and the soda companies are delighted to learn that soda taxes barely affected their sales. But the reality is that the soda taxes don’t seem to work — at least not yet.”

“I believe we have the obligation to let our legislators in Sacramento know just how well our soda taxes are working. With this information, they can craft more effective policies to reduce the human and social costs of poor nutrition in California. The cities of Berkeley and Albany should also reconsider what they are able to accomplish with their soda taxes.”

This analysis was made possible because Barnes is an economist, and numbers don’t lie.

- Trump Responds, Issues Global 10% Tariff on all Countries - February 21, 2026

- What is Trump’s Plan B After Supreme Court Strikes Down Tariffs? - February 20, 2026

- New BLS Data Shows Union Membership Drives Falling Flat - February 19, 2026

Not surprising.. taxing something is supposed to alter the behavior.. It’s clear that it’s not. The CA government war on guns was supposed to make it harder and discourage gun ownership. After 10 years between 2008-2018 gun ownership has .. doubled

In Seattle, they taxed soda and WalMart posted a sign in-store that pointed to just outside city limits where customers could go and pick up NON-taxed soda in their other stores.