Governor Newsom and West Coast Leaders Sign Climate Agreement. (Photo: ca.gov.ca)

Failed Silicon Valley Bank, the Newsoms, and Connected Friends

Gov. Newsom thanks President Biden for the bailout; omits that he is a SVB client

By Katy Grimes, March 14, 2023 5:27 pm

The Silicon Valley Bank failure and shutdown is because of “idiot bank management under an incompetent board,” according to Shark Tank star Kevin O’Leary.

“O’Leary joined Fox News hosts Bill Hemmer and Dana Perino on Tuesday to discuss the Silicon Valley Bank failure and the announcement that deposits would be protected,” Mediaite reported. “President Joe Biden announced this week that people’s ‘deposits are safe.’”

“O’Leary blasted the plan, arguing it will simply provide a safety net for mismanagement. The Shark Tank star argued Silicon Valley Bank collapsed because of ‘idiot management,’ as opposed to a regulatory issue. ‘Idiot’ managers, he said, are now free to behave more irresponsibly.”

It appears there are plenty of idiots and incompetents involved in the bank, focused on Diversity, Equity and Inclusion loan and investment goals, rather than responsible financial outcomes.

But the bailout/cover up may be more of the story in the long run – as in Why did Janet Yellen, Secretary of the Treasury in the the Biden administration state last Friday that there would be no bailouts, and by Sunday, the President effectively said there would in fact be a bailout and depositors would be made whole.

What changed in 48 hours?

For one thing, pure panic in the Silicon Valley Democrat donor base. And as likely is pure panic from California’s governor and the “First Partner.”

As the Globe reported Sunday:

“California Governor Gavin Newsom issued a statement Saturday morning in response to the appointment of the Federal Deposit Insurance Corporation (FDIC) as receiver of Silicon Valley Bank:

“Over the last 48 hours, I have been in touch with the highest levels of leadership at the White House and Treasury. Everyone is working with FDIC to stabilize the situation as quickly as possible, to protect jobs, people’s livelihoods, and the entire innovation ecosystem that has served as a tent pole for our economy.”

The Intercept just reported Tuesday Gov. Gavin Newsom failed to mention that President Biden’s announcement also protected his own businesses in Silicon Valley Bank.”CADE, Odette, and PlumpJack, three wineries owned by Newsom, are listed as clients of SVB on the bank’s website. Newsom also maintained personal accounts at SVB for years, according to a longtime former employee of Newsom’s who handled his finances, and who requested anonymity to avoid professional reprisal.”

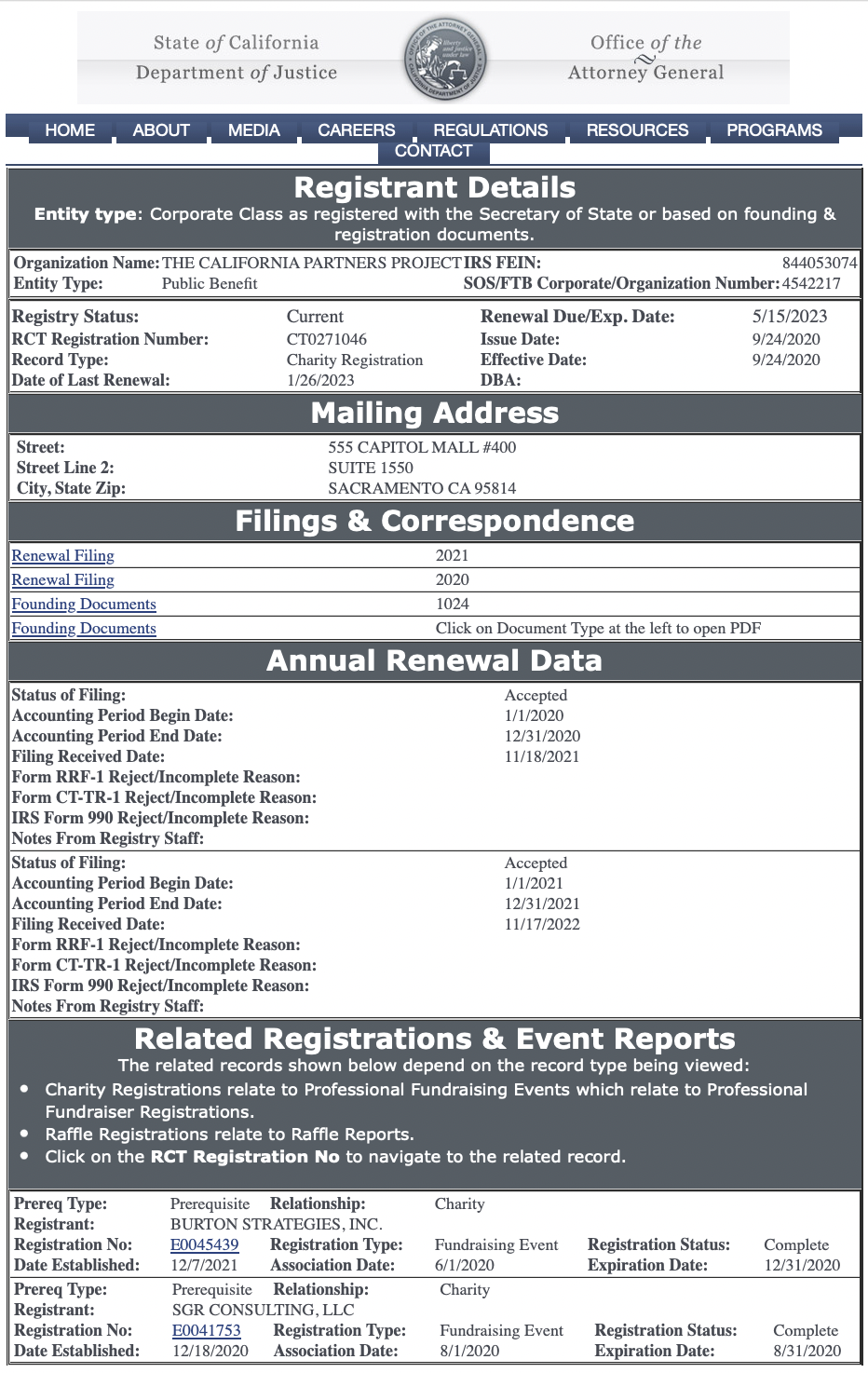

Newsom also neglected to say that he and the First Partner have even deeper ties with Silicon Valley Bank – Silicon Valley Bank President of Capital John China gave $100,000 “Behested” gift to the Newsom’s nonprofit, California Partners Project, Open the Books discovered, the Globe reported.

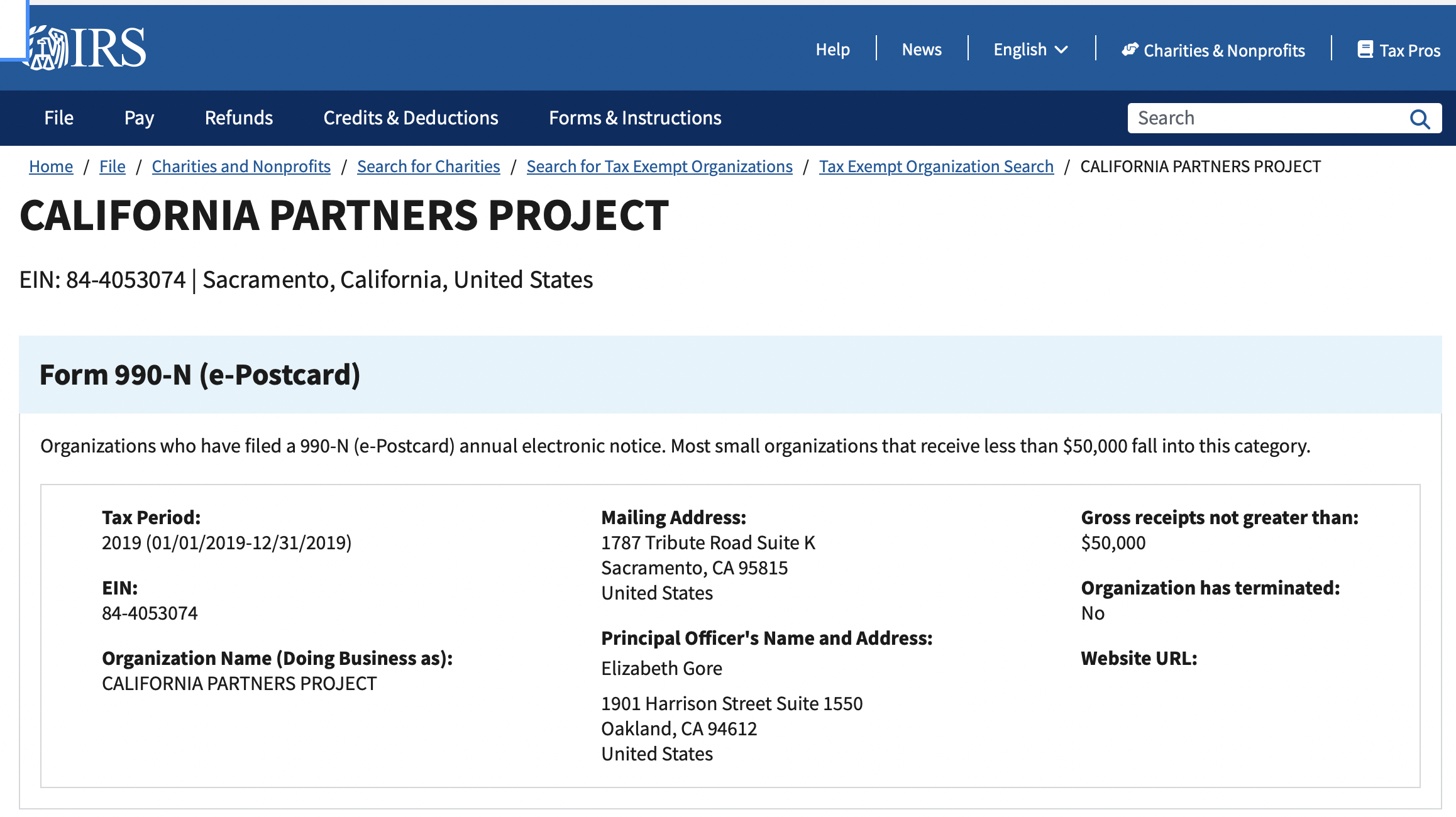

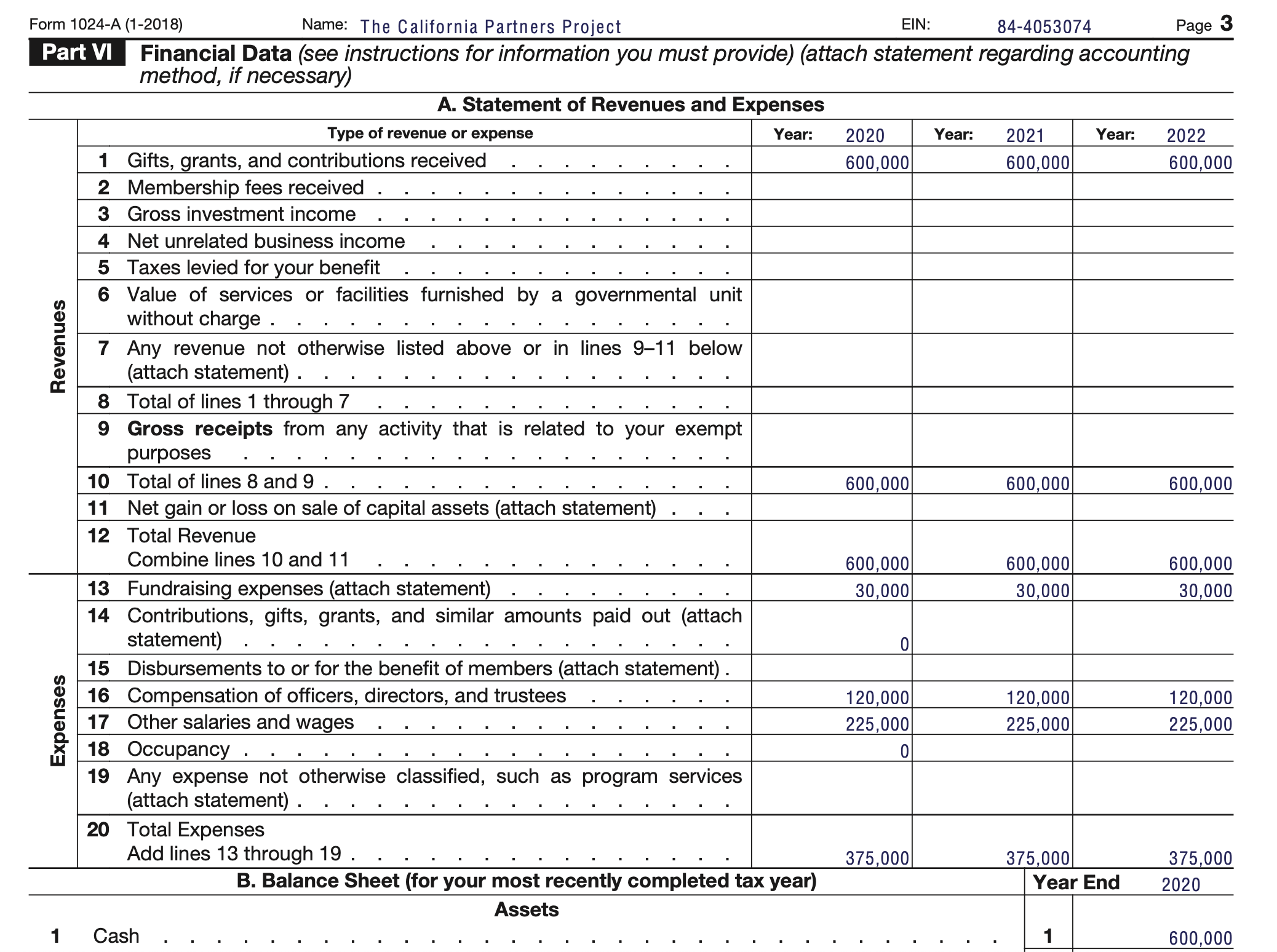

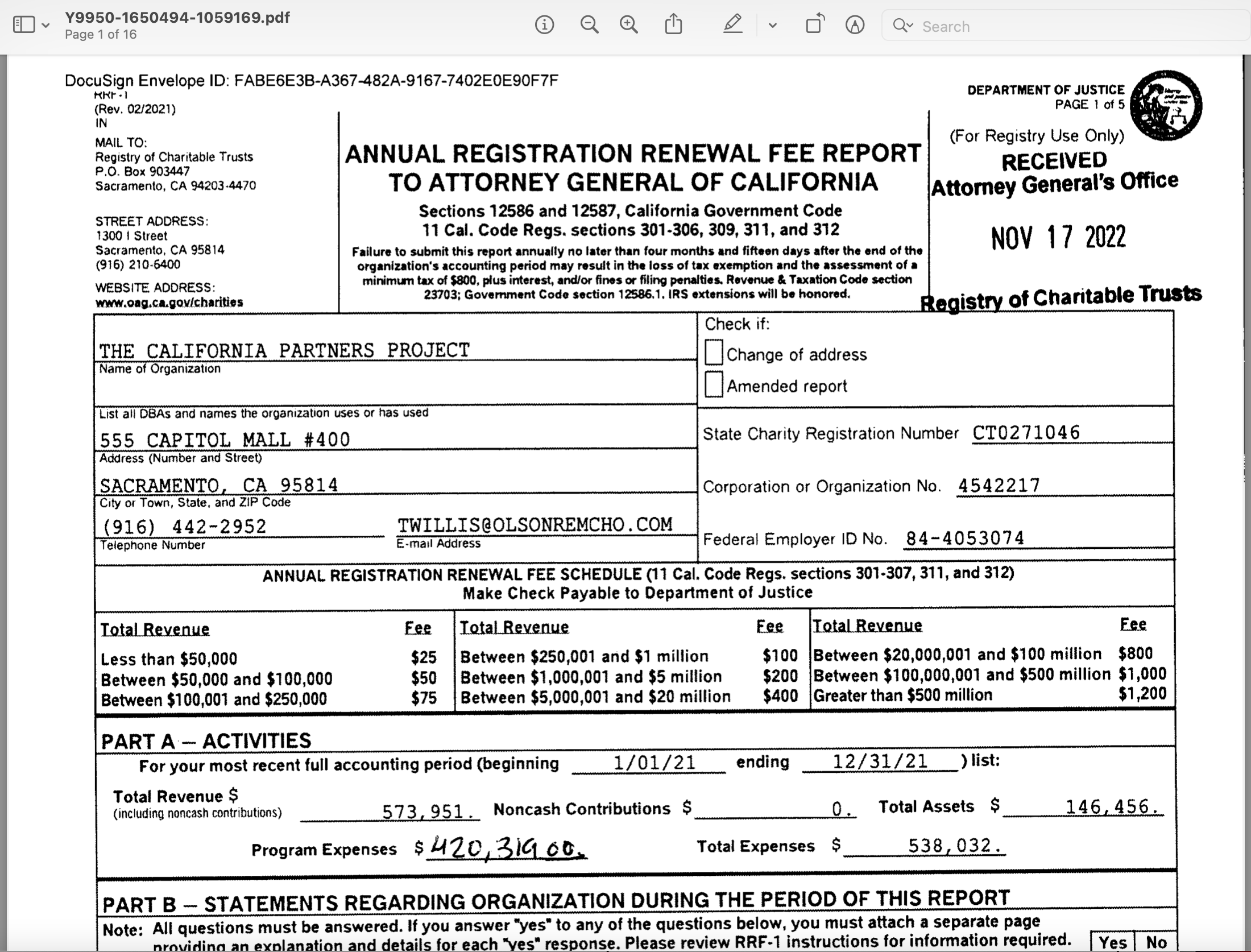

Notably, a 2019 IRS Form 990 for Newsom’s California Partner Project reports only $50k in total gross receipts (image below). This seems inaccurate given the new information of Newsom’s behested payments. The Globe did not find any record of 2020-2021 IRS Form 990 filings on the IRS website, but did find IRS Form 990 filings with the California Office of the Attorney General Charities registry.

Those filings show grants and contributions to the Newsom’s California Partners Project of $573,951, $596,321 to $600,000 in 2020, 2021, and 2022, including supplemental filings. There is no information on who or what made those grants or contributions.

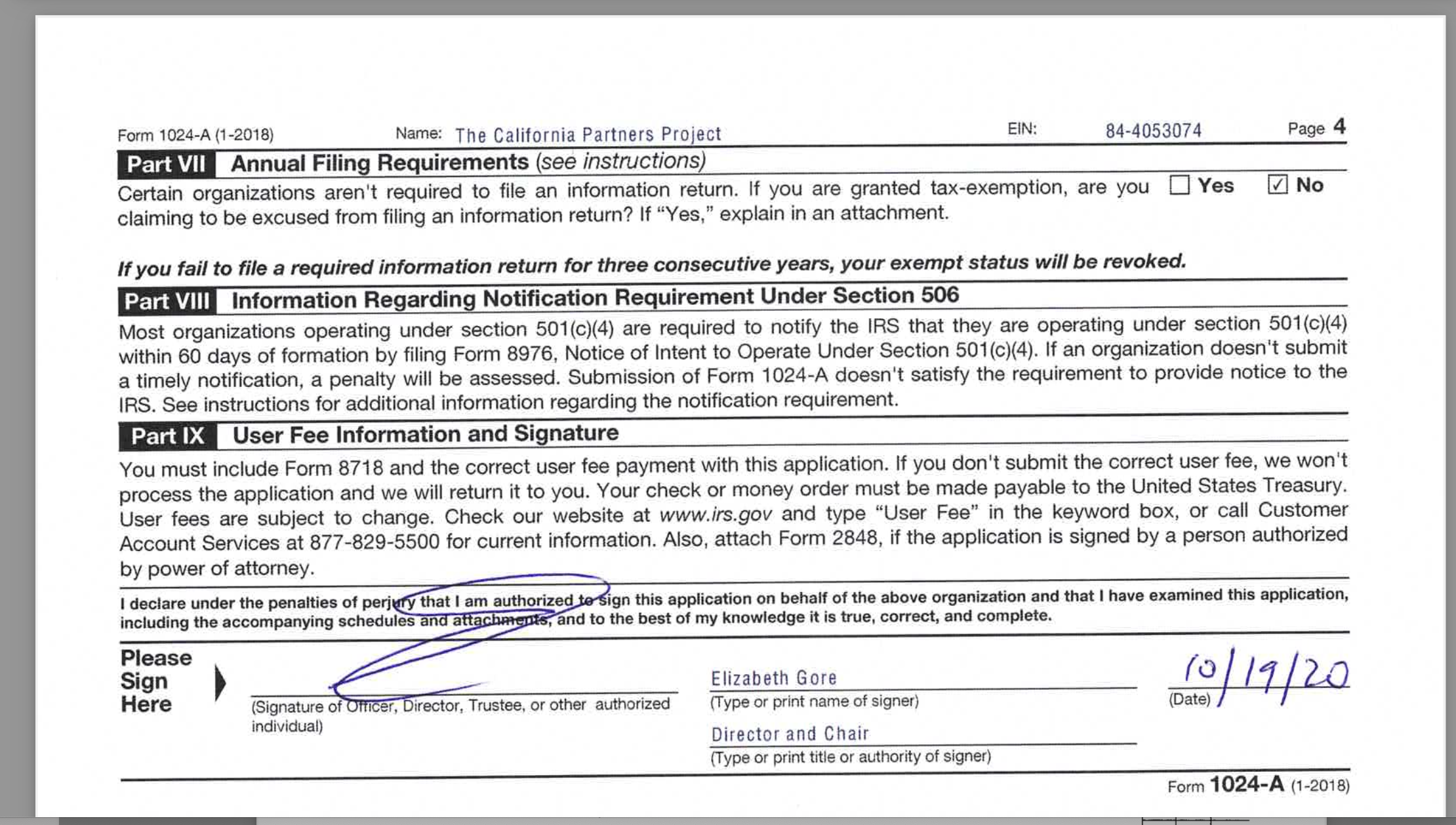

Elizabeth Gore was previously the CEO to the Newsom’s California Partners Project as indicated in the original articles of corporation and the above IRS Form 990 filing, as well as signing the tax filings.

Elizabeth Gore founded “Hello Alice,” which also received funding from Silicon Valley Bank, and SVB President John China is on the Board of Directors at Hello Alice, in addition to California Partners Project, Open the Books reported. Hello Alice “helps businesses launch and grow. A multi-channel platform powered by machine learning technology, Hello Alice guides business owners by providing access to funding, networks and services,” according to her Linkedin bio.

And from a from Healdsberg Rotary posting: “Elizabeth Gore is the Resident Entrepreneur at the UN Foundation’s Global Entrepreneur’s Council and spoke of the three strategic grassroots efforts she has founded: Nothing But Nets, Girl Up and the Shot@Life global vaccines campaign.”

“Shot@Life “connects and empowers Americans to champion vaccines as one of the most cost-effective ways to save the lives of children in developing countries…..By encouraging Americans to learn about, advocate for, and donate to vaccines, Shot@Life aims to decrease vaccine-preventable childhood deaths and give every child a shop at a healthy life.”

Open the Books reported that Elizabeth Gore told them she doesn’t work with Jennifer Seibel Newsom today, but had volunteered for the California Partners Board for two years.

There is more to come…

O’Leary was against the bailout, but his colleague on Shark Tank, Mark Cuban, supported it because some of Cuban’s business partners have accounts at SVB and he wanted those partners protected. For investors, this SVB failure is what they call a “Black Swan” event. Something that is unexpected and causes turmoil in the investment world – like Covid19. Yes, Ms. Grimes. I am sure that there IS more to come.

Oh lookie there…. the “First Partner” is a grifter of the first order … surprise, surprise, surprise….

The Intercept reported that although California law stringently regulates campaign contributions and gifts to elected officials, there are no limits on behested payments like the $100,000 donation that Newsom requested from SVB for his wife’s charity. Newsom had reported at least $23.7 million in payments last year to such groups at his behest. The behest payment shenanigans that Newsom has been involved in is highly unethical and should not be legal?

Oh my goodness, look real close to his hair…

All these years, I thought it was hair gel but nope it is pure SLIME that drips off his slimy, scummy shell of a person.

His wife, “The First Partner” reference makes sense to me now, as they are partners in crime!

They will laugh all the way to the new bank, “ behests in hand”.

Katy, I have no doubt there is more to come! The grift is not over.

OpenTheBooks has done some great work on Newsom: they only filed with the Attorney General because OpenTheBooks found Jennifer had not filed, and the AG’s website was updated in one hour: https://openthebooks.substack.com/p/newsom-twosome-jennifer-siebel-newsoms

The Epoch Times reported that the audit firm KPMG signed its audit of SVB on Feb. 24, two weeks before the bank failed with no findings. KPMG did not issue a “going concern” warning, which would be a requirement if the audit firm had substantial doubt as to whether the banks could survive over the next 12 months. KPMG as the auditing firm has an obligation to evaluate the company’s system of internal control and risk management is part of internal control. On 2/24/23 the auditors should have seen the current numbers and realized they were upside down. Liabilities exceeded assets. They should have noted a going concern issue. The KPMG auditors received big fees from SVB and it appears that they did what their client wanted instead of issuing an honest audit? (https://www.theepochtimes.com/top-audit-firm-defends-giving-clean-bill-of-health-to-svb-signature-bank-weeks-before-failure_5124466.html?utm_source=partner&utm_campaign=ZeroHedge)

@TJ, SVB did not initiate their bond sale which resulted in a loss until March 8. So, the KPMG audit of February 24 would not have been able to see this coming. If they had, I am pretty sure they would have warned management.

P.S. Analysts are saying that even with taking a loss on the bond sale, SVB would have had enough assets to continue operating. However, a few large depositors learned of the sale (through Peter Thiel?) and they pulled their deposits out. This started the run on the bank.

Silicon Valley Bank execs may have failed to hedge against interest rate risk, they did signal $73.45 million in virtue donating to Black Lives Matter and related entities, according to a database maintained by the Claremont Institute. Maybe just focus on running a bank? BLM = Bank Lies Matter.

This is an important point I’ve not seen bandied about but makes a lot of sense: “According to the bank’s annual financial statements from December 31 of last year, SVB had $173 billion in customer deposits, yet only $74 billion in loans.” So where did the money go? Hickman said, “SVB failed because they parked the majority of their depositors’ money ($99 billion) in U.S. government bonds. Biden, He made government bonds worth less which has banks dropping like cockroaches in a Raid commercial. Hickman said, “SVB failed because they parked the majority of their depositors’ money ($99 billion) in U.S. government bonds. Hickman said the bank noted in December that it had $15 billion in unrealized losses on government bonds. On Friday, those losses were realized. You see, to cure inflation, the Federal Reserve must raise interest rates, which pushes the value of the existing bonds down. Well that is just one bank and . . .

This is from some analysis from Don Surber, a retired Journalist and I think he has a solid point few are discussing. Offered up in the spirit of getting to the facts.

I know we have Brandon in the White House, now we have Brandon Jr,running the State.