Gov. Gavin Newsom. (Photo: Kevin Sanders for California Globe)

Open the Books Links Gov. Gavin Newsom and Silicon Valley Bank

And Jennifer Newsom’s ‘very close ties to the bank’

By Katy Grimes, March 13, 2023 6:02 pm

Following the Friday Silicon Valley Bank closure, Sunday morning the Globe reported an interesting tie between Silicon Valley Bank and California’s First Partner Jennifer Siebel Newsom – John China, SVB Executive of Capital sits on the board of Jennifer Siebel Newsom’s California Partners Project.

“California Partners Project champions gender equity across the state and ensures our state’s media and technology industries are a force for good in the lives of all children,” the website says.

We detailed calls for Gov. Gavin Newsom to be completely transparent, and especially Ric Grenell’s important questions on California’s First Lady’s relationship to the SVB leadership: “Did she get involved at all? What did they say to her in the lead up to the collapse?”

By Monday, Open the Books, which imposes transparency on those who refuse, “using forensic auditing and open records,” found even deeper ties between Silicon Valley Bank and the Newsom’s: Silicon Valley Bank gave $100,000 “Behested” gift to the Newsom’s nonprofit.

Here are the details Open the Books found of Jennifer Newsom’s “very close ties to the bank:”

In 2021, SVB gave $100,000 in corporate gifts to the Newsom nonprofit. These gifts are so intertwined with the Newsom’s that they are listed as a matter of California ethics law on a state government website, California Fair Political Practices Commission.

All nonprofit donors are listed on the state website if they are “behested” gifts. The term “behested” means “at the request, suggestion, or solicitation of, or made in cooperation, consultation, coordination or concert with the public official.”

In this case, it’s the governor who behested the Silicon Valley Bank $100,000 gift. It’s the governor who requested, suggested, solicitated or cooperated, coordinated or acted in concert to procure the gift. However, the mandatory-state-disclosed conflict-of-interest listing also names his wife, Jennifer Siebel Newsom. That’s because, Mrs. Newsom is also a public official, the first ever “First Partner.”

Siebel Newsom’s public duties including running the Office of First Partner which was created by the governor shortly after inauguration. Since 2019, the governor allocated nine staffers and nearly $5 million in taxpayer funds for his wife’s office.

But Wait! There’s More!

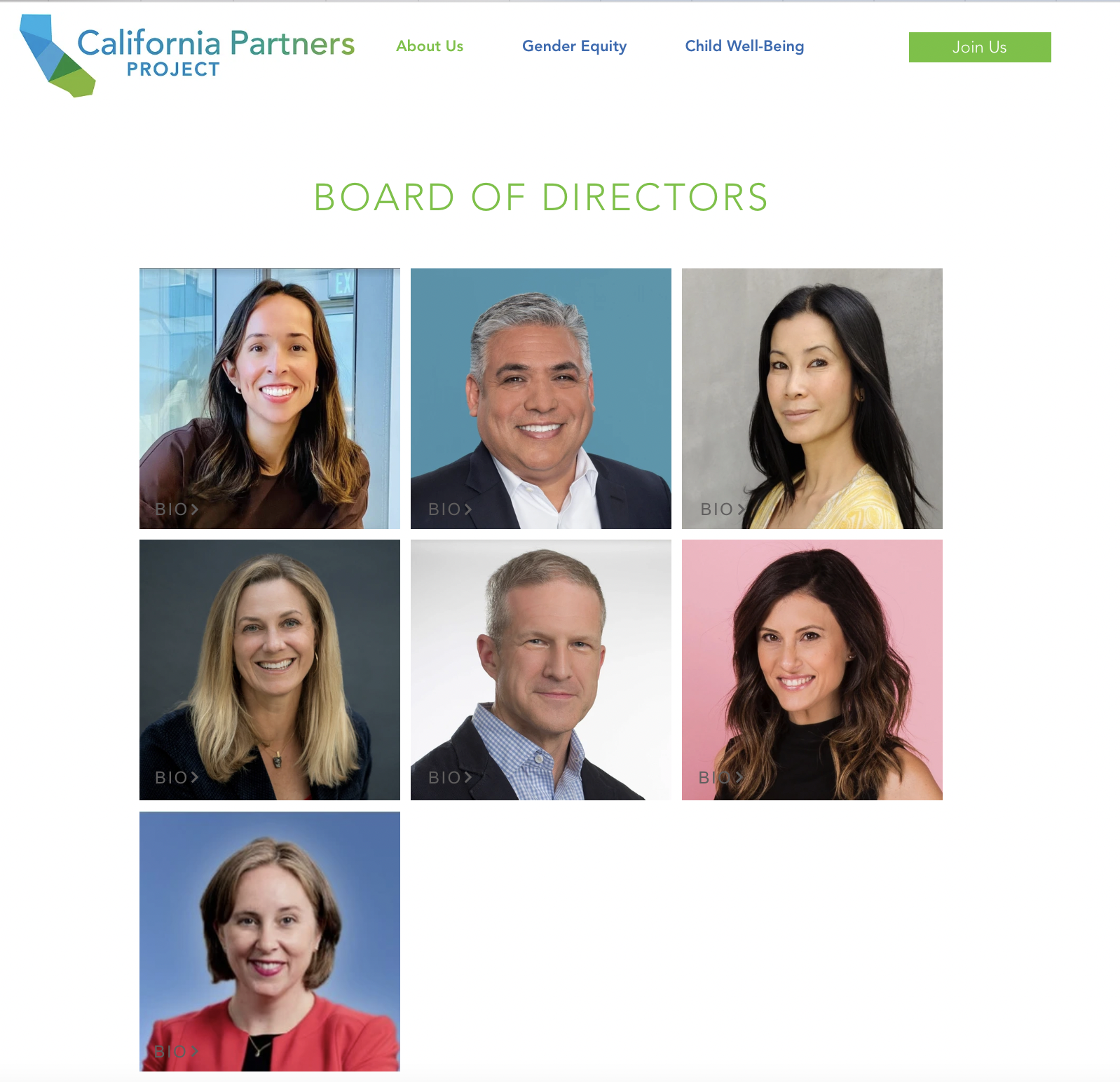

Silicon Valley Bank and its executives played a major role in the Newsom nonprofit, the California Partners Project, since its founding. The President of Silicon Valley Capital – the investment banking arm of the bank – is John China. Mr. China is a 27-year SVB veteran. He’s also a founding board member of the Newsom nonprofit. Even today, China is still listed as a director on the nonprofit’s website.

The California Partners Project’s first board chair, Elizabeth Gore, was also connected to SVB. Her company, Hello Alice, which connects entrepreneurs to resources to grow their companies, received funding from SVB.

John China serves on the board of Hello Alice.

According to China’s LinkedIn profile, SVB Capital managed $5.5 billion in capital funds. China and his group was a primary funder to the tech startups that we are hearing about in the news.

As Open the Books notes, “The California Partners Project was founded to push Jennifer Siebel Newsom’s ‘First Partner’ public policy agenda. As a founding member, the Silicon Valley Bank played a major role. Their executive, John China was on the founding board and the bank gave a $100,000 gift.”

As Open the Books notes, “The California Partners Project was founded to push Jennifer Siebel Newsom’s ‘First Partner’ public policy agenda. As a founding member, the Silicon Valley Bank played a major role. Their executive, John China was on the founding board and the bank gave a $100,000 gift.”

Notably, Ann O’Leary is also on the California Partners Project board. O’Leary was Governor Newsom’s Chief of Staff and co-chair of the Governor’s Task Force on Business and Jobs Recovery.

Open the Books concludes “Further investigations should be conducted into how SVB might have leveraged its funding and influence on behalf of the Newsom administration, and if those decisions put its financial security at risk.”

Indeed.

Please take the time to read the Open the Books entire investigation. There’s a lot more here than meets the eye – and as certain things unravel, others are starting to add up.

- California Elections Code Book Published - July 26, 2024

- California Supreme Court Ends Legal Snafu Over Gig Drivers – Upholds Prop. 22 - July 26, 2024

- Sen. Kamala Harris Claimed Ignorance Over Long-time Employee Sex Abuse Case - July 25, 2024

While SVB founding may have been ‘pure’ (as a bank can be), it ended appearing as scandalous as Newsom admin.

Did they burn it to hide the evidence, phase one to usher in digital currency, or were venture capitalists alerted

to crisis (‘Was SVB Collapse Triggered by a NEWSLETTER?: Well-Regarded Tech Experts Mailer First Flagged

Banks 185:1 Debt to Asset Ratio in February, Spooking VCs’ (dailymail.co.uk). Easy to see why SVB referred

to as ‘Democrats ATM’ – LOL Speaking of Ann O’Leary… ‘CORRECTED: Newsom’s Former Chief (of Staff) is

Repping Walgreens in Abortion Pill Fight’ (politico.com)

Imagine a tech expert flagged the 185:1 ratio!

Where were the fed regulators?

Did Nancy Pelosi encourage them to stand down?

Something smells rotten in San Francisco and this time it is not the streets!

That would be SF Fed Chief Mary Daly, protege of Janet Yellin…busy, busy with DEI, Climate Change, and inequality of inflation. Maybe she relied on SVB CEO Greg Becker who sat on SF Fed Reserve board (quietly

removed Fri) to keep her informed of how he’d like to proceed – The circus is running on all cylinders – LOL

Thanks for that name at the Fed, Mary Daly.

Every piece of the puzzle points that this bank had special consideration from the political elite.

A 185:1 risk to asset ratio was not just a warning sign, it was the Big Las Vegas type neon sign! The bank had reached a boiling point and they tried to keep a lid on it.

Becker served on the Federal Reserve Board, the same board that has the responsibility to monitor bank risk!!

Yes, CG, a $100K “behest” donation (bribe) solicited by Newsom from SVB exec Mr China, but who is actually influencing whom here? So many questions come from what Open the Books has revealed! Starting with all the inappropriate intertwined entangled connections between SVB and the Gov’s office, obviously. Was the Gov ‘nudging’ (or outright directing) who received bank loans, Friends of Gavin who check off the greenie wish list items? Just as one example? A tweet yesterday bemoaning that SVB’s failure was bad news for everything-climate-change (“1500+ climate and energy-tech companies relied on the bank”) received an incredulous response from Ric Grenell, “A small bank giving 1,500 climate related loans?!”

This appears to be only the tip of the iceberg. We definitely need a thorough further investigation of this mess, obviously, and apparently we will be getting one. (knock wood).

Thanks for posting all of this, Marilyn. Found myself caught up in the Ann O’Leary oddity to the exclusion of everything else — for the moment, anyway. How bizarre. Or is it only the usual game of musical chairs these people play as they bop around from position to position around the state?

Overall, it does seem as though the whole rotten picture is finally coming into much better focus now, doesn’t it.

SVB wouldn’t be complete without an Epstein connection…

‘Virginia Islands Subpoenas Multiple Banks for Jeffrey Epstein Financial Records’ (by James Hill, ABC News 7/28/20)

This is explosive, for sure, but is it one crate of TNT or a whole warehouse full? That is the question.

The honorable suggestion of the Open the Books author for the Office of the First Partner to return the behest $100K gift of SVB’s John China to the failed bank for its depositors seems almost delicately understated compared to all the potential Newsom & Newsom skullduggery. Need to let the report and all its rabbit holes sit overnight before commenting more or speculating. There’s a lot there. And none of it is looking good for Newsom & Co., is it.

Just more evidence these progressive, global elites all swim in the same dirty pond together.

Gov Gav solicited “donations” from SVB.

[In this case, it’s the governor who behested the Silicon Valley Bank $100,000 gift. It’s the governor who requested, suggested, solicitated or cooperated, coordinated or acted in concert to procure the gift. However, the mandatory-state-disclosed conflict-of-interest listing also names his wife, Jennifer Siebel Newsom. That’s because, Mrs. Newsom is also a public official, the first ever “First Partner.”]

Take that in! Any client or investor of this bank who had no clue what they did with the SVB deposits, should be livid.

The San Francisco Fed office abdicated their responsibility to monitor the actions of SVB.

Who gets left holding the bag?

Hmmm… lots of “partners” in this grifting sh1tshow of an “administration” dontcha think???

So who wants to take on the BYD deals that this Governor Griftboy undertook back in the early days of their plandemic, and the earlier “train to nowhere” deals?

Who wants to bet SVB was involved with THAT???

Asking for a friend…

While there is a LOT of circumstantial and direct evidence of ethical violations, conflict of interest, etc., in all of this Open Books data, I am still waiting to see if there are any indictable criminal violations that involve the Newsoms. I guess SVB is preparing for this as well since they advertised a job opening for a criminal investigations manager (reported by Fox News).

With you on this, Raymond, that criminal indictments are the bottom line here. Although what was once thought to be criminally indictable may no longer be so, in these terrible times. For instance, we see how a “behest” solicitation funneled to a politician’s wife’s non-profit is, for all intents and purposes, a bribe, but that is now regarded as “legal” (!!!) as I recall from previous coverage here at The Globe. We’ll see what happens, though, with such high-profile skullduggery, and the tip that SVB had advertised an opening for criminal investigations manager is a good sign.

Yes, Showandtell. Bribery, money laundering, dealing in obscene matter and such would be indictable as racketeering (RICO) but the evidentiary requirement is high. Imo, someone like Sam Bankman-Fried (FTX) would have to turn states evidence and, so far, there is no one like SBF being mentioned in relation to SVB and the Newsoms. Although, one can always hope for the “best”. Despite carefully covering their tracks, criminals usually slip up somewhere along the line.

Yes, guess we need to hope for the ‘best’ then.

Showandtell, hope wrt prosecuting “high-profile skullduggery” and “criminality” would not be lost on an ambitious federal prosecutor who is out to make a name for herself/himself. We know how much the governor, in the past, has gone out of his way to make himself as high-profile as possible. In situations like this one involving SVB, by naively(?) doing so, he has placed a giant target on his own back. His own character flaw(s) may portend his doom.

An ambitious Federal prosecutor taking something like this on seems to be a plausible outcome if the fallout from this continues. Which outcome for Newsom would be both Shakespearean (fatal flaw that brings down the king) and Biblical (pride before fall), by the way. Don’t want to get ahead of ourselves though. Ha ha.

Thankful for Katy Grimes and California Globe! We’d never hear about the shenanigans between SVB and California’s First Partner Jennifer Siebel Newsom in the Democrat controlled propaganda media like the Sacramento Bee, LA Times, SF Chronicle, etc.

YES, Samantha, 100%, absolutely agree!

Sure hope everyone who does social media will be sure to keep this huge story alive and in circulation.

SVB is big in the California wine industry. Newsom is a partner in a winery. Other political figures in California have ties as well. Too bad no one is looking at that as well…

Saw a document recently (forget where) that “client” PlumpJack premium wine (Gavin’s co-owned winery) was put on display (!) in SV Bank. Will try to remember where I got that.

Newsom has substantial ties to Silicon Valley Bank through his personal accounts and wineries (Plumpjack) along with his wife Jennifer’s charities, according to a report by The Intercept. California law prohibits officials from influencing a government decision in which he or she has a financial interest, according to the Conflict of Interest Codes. Uh-oh?

(https://theintercept.com/2023/03/14/cheering-silicon-valley-bank-bailout-gavin-newsom-doesnt-mention-hes-a-client/)

Dana, what really offends me is that “political behesting” of $100,000 is considered legal. I had a real estate developer friend in northern California. In order to get projects approved he often had to “compensate” county/city officials by paying for get-togethers (parties). If my friend offered “compensation” to these officials outright, it would have been considered an illegal bribe. But if the official requested (behested) compensation in the form companionship with a particular hostess at a party, for example, it was considered okay to do or, at least, marginally acceptable in doing business. This was years ago. Behesting has apparently become much more sophisticated and lucrative these days.

Well, I guess this is the next “best” thing to criminal litigation – a civil class action lawsuit by shareholders against the SVB holding company and CEO/CFO: https://finance.yahoo.com/news/shareholder-sues-silicon-valley-banks-holding-company-and-ceo-and-cfo-192754498.html

PLEASE listen to columnist and editor Susan Shelley’s take on this at the link below. Turns out Newsom created a new “environment and innovation” regulatory agency in 2020 during the “fog of Covid,” (!!) when the legislature wasn’t meeting in person and the public wasn’t paying attention. This agency came into existence in 2021 and markedly advantaged Silicon Valley Bank, which by the way is a mostly state-regulated bank. Greenies and “innovators” from everywhere flocked to it.

Susan Shelley’s take on what happened here is a bigger-picture view and will fill in some of the blanks:

John Phillips interviews Susan Shelley, 3/14/23 – KABC AM 790:

https://omny.fm/shows/the-drive-home-with-jillian-barberie-and-john-ph-1/susan-shelley-10

The Shelley interview starts around the 5:00 minute mark, if you don’t want to hear about Karen Bass (and I don’t). But anyway, if what Shelley says about this new agency that Newsom created is TRUE, it does smack of RICO to me. In fact Shelley did use the word “Mafia” to describe the operation. Thanks for the link. This is getting more interesting by the minute. 😉

Amazing Polly has good Rumble video on the various shady SVB connections with Epstein, Biden, Thiel, CCP China, Newsom and more. (https://rumble.com/v2d0ntk-boom-silicon-valley-bank-has-epstein-connection-and-more.html)

Tony thank you for this link. Finally had a chance to view the video last night. Interesting stuff.

The NY Post reported that Silicon Valley Bank’s Board of Directors was packed with Democrats and Hillary/Biden/Obama donors. Only one board member had investment banking experience – Tom King, the former CEO of Barclays. One is a Hillary Clinton mega-donor who went to a Shinto shrine to pray after Donald Trump won the White House and donated $50,000 to the Hillary victory fund. Another worked for President Barack Obama before her own political career spectacularly failed. A third is a prolific contributor to Democrats, including Nancy Pelosi — who owns a Napa Valley vineyard just 15 minutes from the former House speaker’s. There’s even an improv performer. LOL!

this whole financial fiasco smells like ten acres of garlic. I would bet, not heavily off course, some well-connected people both in DC & Sacramento are going down.

The SF Bayview Newspaper has been tracking what is now emerging as a pattern of unethical conduct and enterprise corruption promulgated by Gavin Newsom as Mayor of San Francisco when he spearheaded dangerous residential development at the Hunters Point Shipyard federal Superfund site in 2004. His cousin and campaign manager Laurence Pelosi was a VP for the master developer. Nancy Pelosi’s role in the transfer is detailed in a book titled The Truth About Nancy Pelosi. You can read the original article based on a FPPC complaint filed against Newsom that never received a response at: https://SFBayview.com/2009/singing-in-the-rain-hunters-point-shipyard-enriches-sfs-most-powerful-families/

You may also read an up to date investigative piece detailing Newsom’s ongoing role in the enterprise corruption that obstructs state agencies response to endangered residents and workers and his use of state agencies to advance his personal and political interests. It appears in the Westside Observer at:https://westsideobserver.com/23/2-Hunters-Point-development-Newsom’s-Albatross.php#.Y-e5YgQfoNJ.mailto