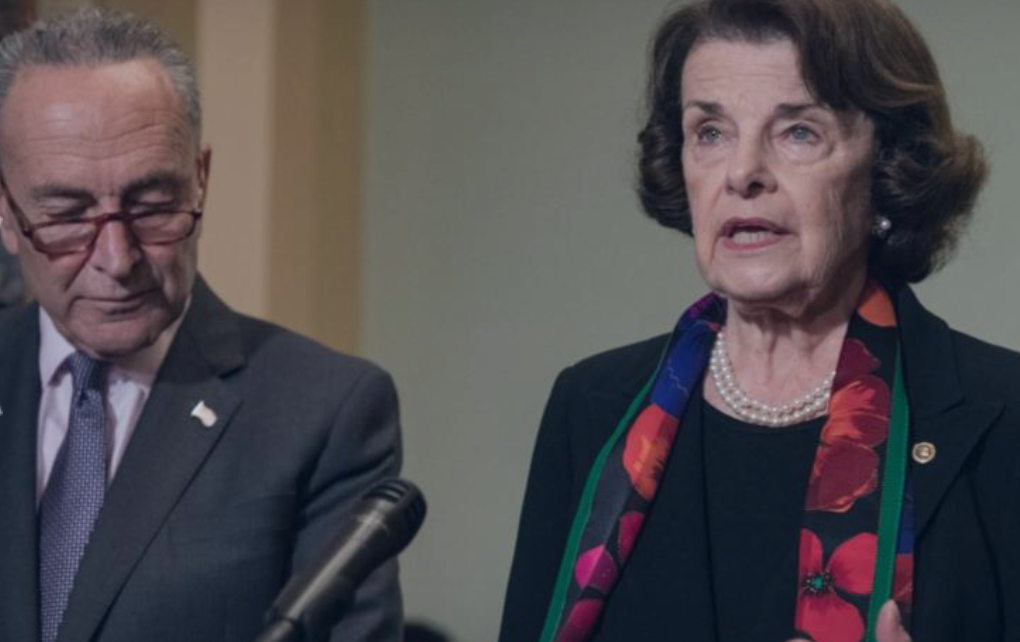

Senator Dianne Feinstein (Photo: Feinstein.senate.gov)

Sen. Dianne Feinstein, 3 Senate Colleagues Sold off Stocks Before Coronavirus Crash

This isn’t Feinstein’s first accusation of insider trading

By Katy Grimes, March 24, 2020 11:02 am

Democratic Sen. Dianne Feinstein of California and three GOP Senate colleagues reported selling off stocks worth millions of dollars in the days before the coronavirus outbreak crashed the market, according to Fox News reports.

Oklahoma Republican Senator Jim Inhofe, Georgia Republican Senator Kelly Loeffler, Republican Senator Richard Burr from North Carolina and Democrat Sen. Feinstein sold their stock holdings after being briefed about the coronavirus and the significant impact the virus was predicted to have on the economy and stock market.

“While telling the American public that there wasn’t much to worry about, they bailed out of their stock holdings to avoid large losses,” Jack Kelly wrote at Forbes.

On March 20, 2020, Common Cause filed complaints with the U.S. Department of Justice, the Securities and Exchange Commission, and the Senate Ethics Committee calling for immediate investigations of Feinstein and Sens. Richard Burr, Kelly Loeffler, and James Inhofe for possible insider trading.

This isn’t Feinstein’s first foray into insider trading.

“In the new blockbuster tell-all Throw Them All Out, investigative reporter and Breitbart editor Peter Schweizer reveals that on November 18, 2009, Sen. Feinstein and her husband invested $1 million into Amyris Biotechnologies, a ‘green’ company focused on plant-based renewable fuels and chemicals,” Breitbart wrote in 2011. “The Feinsteins’ million-dollar investment was their only stock transaction for the entire year.”

Weeks after Feinstein’s million dollar investment in Amyris, the company received a $24 million grant from the Department of Energy to build a pilot plant where altered yeast would turn sugar into hydrocarbons.

And then the following year, the company went public with an IPO that brought in $85 million.

Recently, Feinstein, who serves as ranking member of the Senate Judiciary Committee, and her husband Richard Blum sold between $1.5 million and $6 million in stock in California biotech company Allogene Therapeutics, between Jan. 31 and Feb. 18, The New York Times reported.

This is why Schweizer says in Throw Them All Out, insider trading laws should apply to members of Congress and trigger the kinds of SEC investigations to which ordinary investors must submit,” Breitbart said. Schweizer’s new book, Profiles in Corruption, exposes more abuse of power by elite politicians.

Feinstein’s spokesman said she wasn’t directly involved in the sale. “All of Senator Feinstein’s assets are in a blind trust,” the spokesman, Tom Mentzer, told the New York Times. “She has no involvement in her husband’s financial decisions.”

However, Paul S. Ryan, Common Cause Vice President for Policy and Litigation said, “These Senators appear to have used classified intelligence briefings as stock tips and sold off significant holdings to avoid losses in the markets. These laws are on the books for a good reason, without them the potential to abuse the power of elected office for personal enrichment would be virtually unlimited.”

Karen Hobert Flynn, president of Common Cause said, “These potential violations of insider trading laws and the STOCK Act by these Senators, outlined in widespread media reports, show what appears to be contempt for the law and further a contempt for the American people these Senators have sworn to serve. Situations like these are exactly why Common Cause fought to help pass the STOCK Act, to prevent government officials abusing their power for their personal profit.”

The Stop Trading on Congressional Knowledge Act of 2012, known as the STOCK Act, is a law passed in 2012 that says members of Congress and other government employees, including congressional staffers and members of the executive branch and judiciary, are not allowed to engage in insider trading based off information they learn through their jobs, Fox reported.

However, one year after the STOCK Act’s passage, President Barack Obama “signed a change to the law that had been quietly ushered through Congress. It got rid of a provision that the financial disclosures required by the law be posted online on official websites.”

To read the DOJ complaint, click here. To read the SEC complaint, click here. To read the Senate Ethics Committee complaint, click here.

- ‘Fix Prop. 47’ Ballot Initiative is a Game Changer on Day 1 - April 19, 2024

- California Lawmaker Making the State More Hostile to Business - April 18, 2024

- California Democrats’ Backdoor Reparations Scheme - April 17, 2024

3 thoughts on “Sen. Dianne Feinstein, 3 Senate Colleagues Sold off Stocks Before Coronavirus Crash”